The Kentucky Amended and Restated Principal Underwriting Agreement is a legal document that outlines the terms and conditions surrounding the issuance of variable annuity contracts and life insurance in the state of Kentucky. This agreement serves as a contract between the insurance company and the underwriters who are responsible for distributing and selling these financial products to the public. This comprehensive agreement covers various aspects related to the underwriting process, including the responsibilities and obligations of both parties involved. It sets forth the guidelines for the issuance and distribution of variable annuity contracts and life insurance policies, ensuring compliance with the laws and regulations specific to the state of Kentucky. Here are some relevant keywords associated with the Kentucky Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance: 1. Variable Annuity Contracts: The agreement outlines the procedures and requirements for the issuance of variable annuity contracts, which are investment products that provide individuals with income during retirement based on the performance of underlying investment options. 2. Life Insurance: The agreement addresses the issuance of life insurance policies, which are contracts between the policyholder and the insurance company that provide financial protection to beneficiaries upon the insured's death. 3. Underwriters: The underwriting agreement defines the roles, responsibilities, and compensation arrangements for the underwriters involved in the distribution of variable annuity contracts and life insurance policies. 4. Issuance Process: The agreement outlines the necessary steps and documentation required for the issuance of variable annuities and life insurance policies. It may include procedures for application submission, policy approval, and policy delivery. 5. Compliance: The agreement emphasizes the need for compliance with applicable laws, regulations, and guidelines set forth by the state of Kentucky's insurance regulatory authority. It ensures that all parties involved adhere to ethical and professional standards. 6. Amendments and Restatements: As indicated by its name, the agreement may undergo amendments or restatements to reflect changes in applicable laws or to address specific provisions unique to a particular situation. It's important to note that while there may be variations in different versions or amendments of the Kentucky Amended and Restated Principal Underwriting Agreement, the core purpose and key elements typically revolve around the issuance of variable annuity contracts and life insurance policies in compliance with Kentucky's regulations.

Kentucky Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance

Description

How to fill out Kentucky Amended And Restated Principal Underwriting Agreement Regarding Issuance Of Variable Annuity Contracts And Life Insurance?

If you want to complete, obtain, or produce legitimate document themes, use US Legal Forms, the most important assortment of legitimate forms, that can be found online. Take advantage of the site`s easy and hassle-free research to discover the paperwork you want. A variety of themes for company and personal uses are sorted by groups and claims, or keywords and phrases. Use US Legal Forms to discover the Kentucky Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance within a few click throughs.

In case you are already a US Legal Forms consumer, log in in your bank account and then click the Acquire key to obtain the Kentucky Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance. You can even gain access to forms you in the past delivered electronically inside the My Forms tab of your own bank account.

If you use US Legal Forms initially, refer to the instructions beneath:

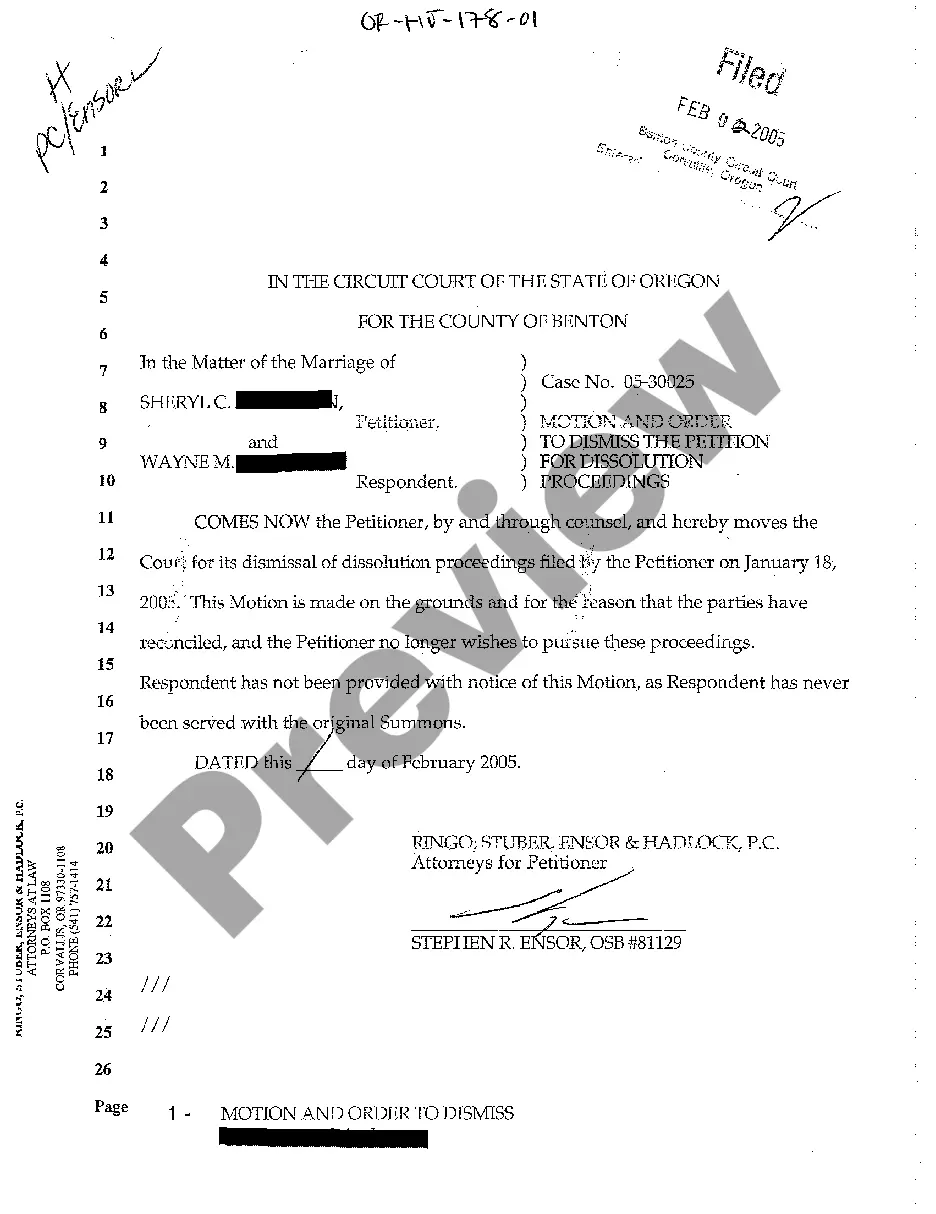

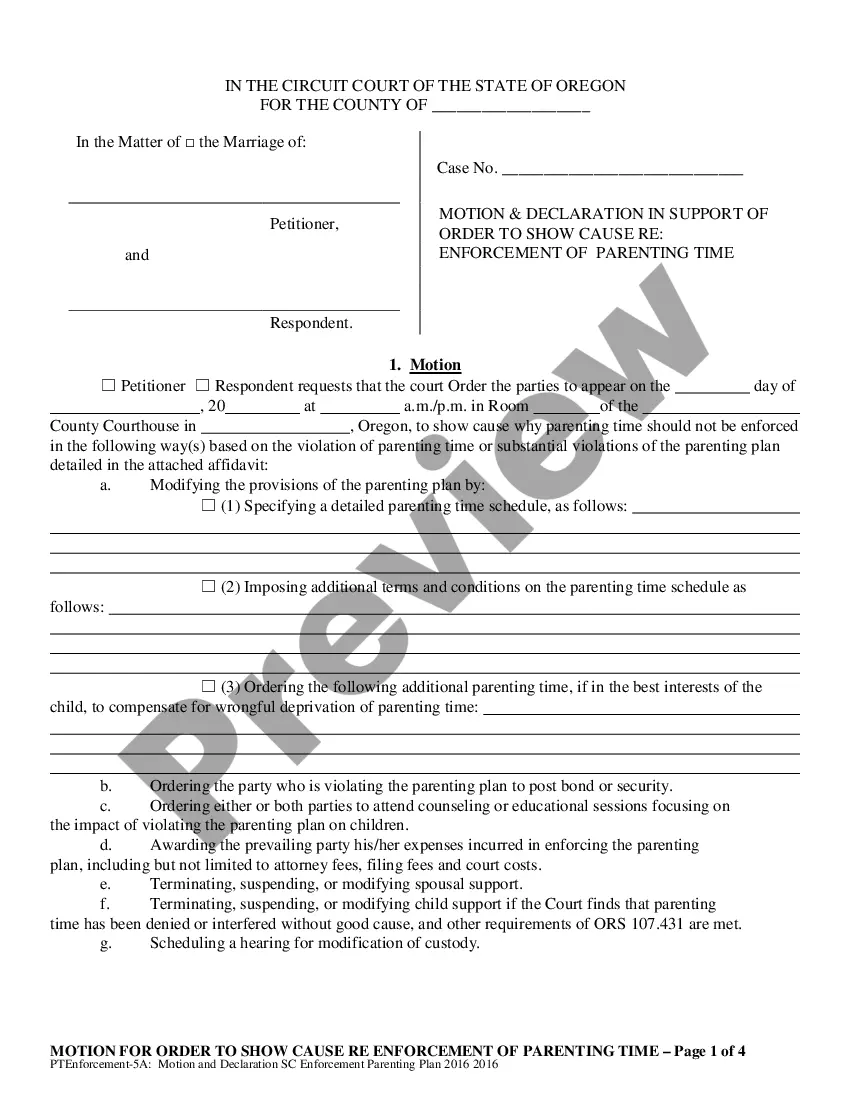

- Step 1. Make sure you have chosen the form for that proper metropolis/country.

- Step 2. Make use of the Review solution to look through the form`s information. Do not forget to read the explanation.

- Step 3. In case you are not happy with all the develop, utilize the Look for field at the top of the screen to get other models from the legitimate develop template.

- Step 4. Upon having identified the form you want, select the Acquire now key. Select the costs prepare you choose and add your credentials to register to have an bank account.

- Step 5. Method the purchase. You can use your credit card or PayPal bank account to perform the purchase.

- Step 6. Select the format from the legitimate develop and obtain it on your own product.

- Step 7. Total, edit and produce or indicator the Kentucky Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance.

Every legitimate document template you acquire is your own forever. You have acces to each and every develop you delivered electronically within your acccount. Select the My Forms section and select a develop to produce or obtain once again.

Contend and obtain, and produce the Kentucky Amended and Restated Principal Underwriting Agreement regarding Issuance of variable annuity contracts and life insurance with US Legal Forms. There are many professional and status-specific forms you can utilize to your company or personal requires.

Form popularity

FAQ

Deferred variable annuities are hybrid investments containing securities and insurance features. Their sales are regulated both by FINRA and the Securities and Exchange Commission (SEC).

If an insurance agent offers products that are considered securities?such as variable annuity contracts or variable life insurance policies?the agent must also be licensed as a registered financial professional and comply with FINRA rules.

Fixed annuities are not securities and are not regulated by the SEC.

FINRA Rule 2330 (Members' Responsibilities Regarding Deferred Variable Annuities) establishes sales practice standards regarding recommended purchases and exchanges of deferred variable annuities, including requiring a reasonable belief that the customer has been informed of the various features of annuities (such as ...

To have Variable Life and Variable Annuity authority added to your license you must be registered with the Financial Industry Regulatory Authority (FINRA) and approved for California.

A fixed annuity's value will not decline due to market losses?it's consistent and stable. On the other hand, variable annuity values will fluctuate with the performance of the subaccounts you elect as the markets rise and fall.

Section 3(a)(8) generally exempts from the Securities Act any security that is an ?insurance or endowment policy or annuity contract or optional annuity contract, issued by a corporation subject to the supervision of the insurance commissioner, bank commissioner, or any agency or officer performing like functions, of ...

The reviewing and approval process must be done within seven days after the application has been submitted to the office of the supervisory jurisdiction. On the same note, registered representatives must inform their clients of vital information concerning deferred variable annuities.