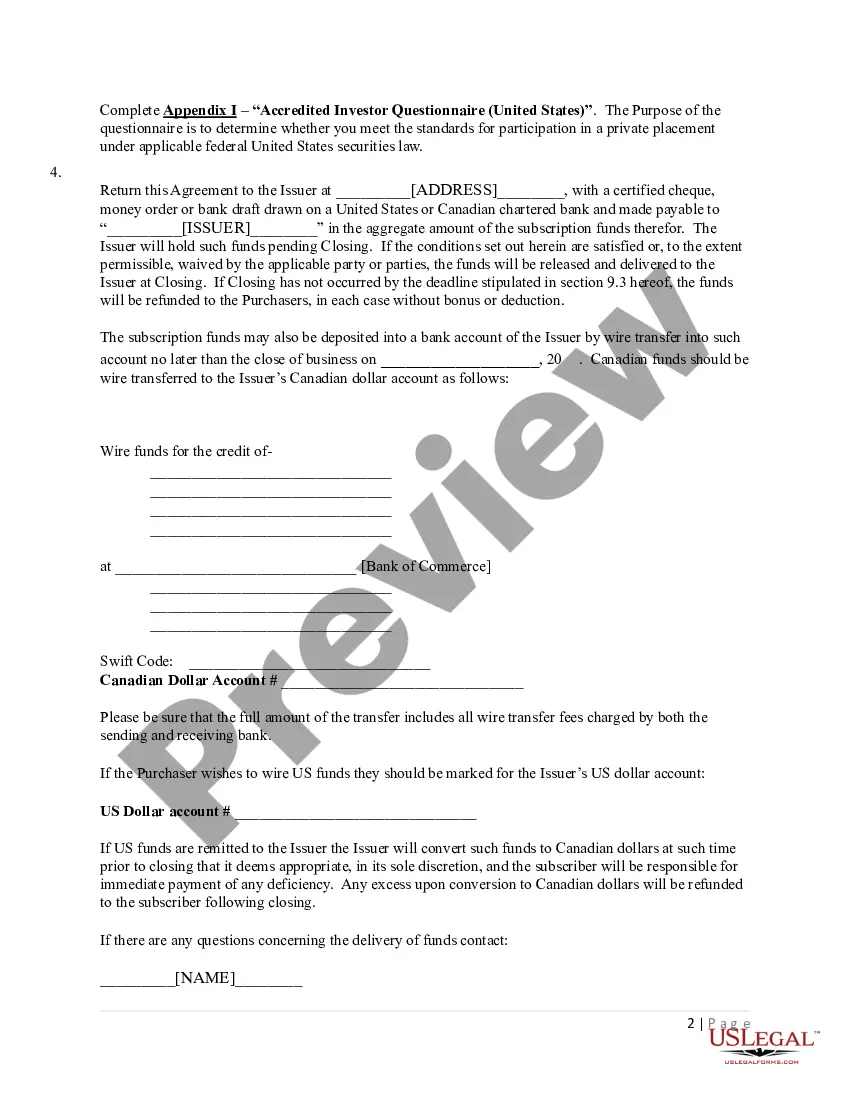

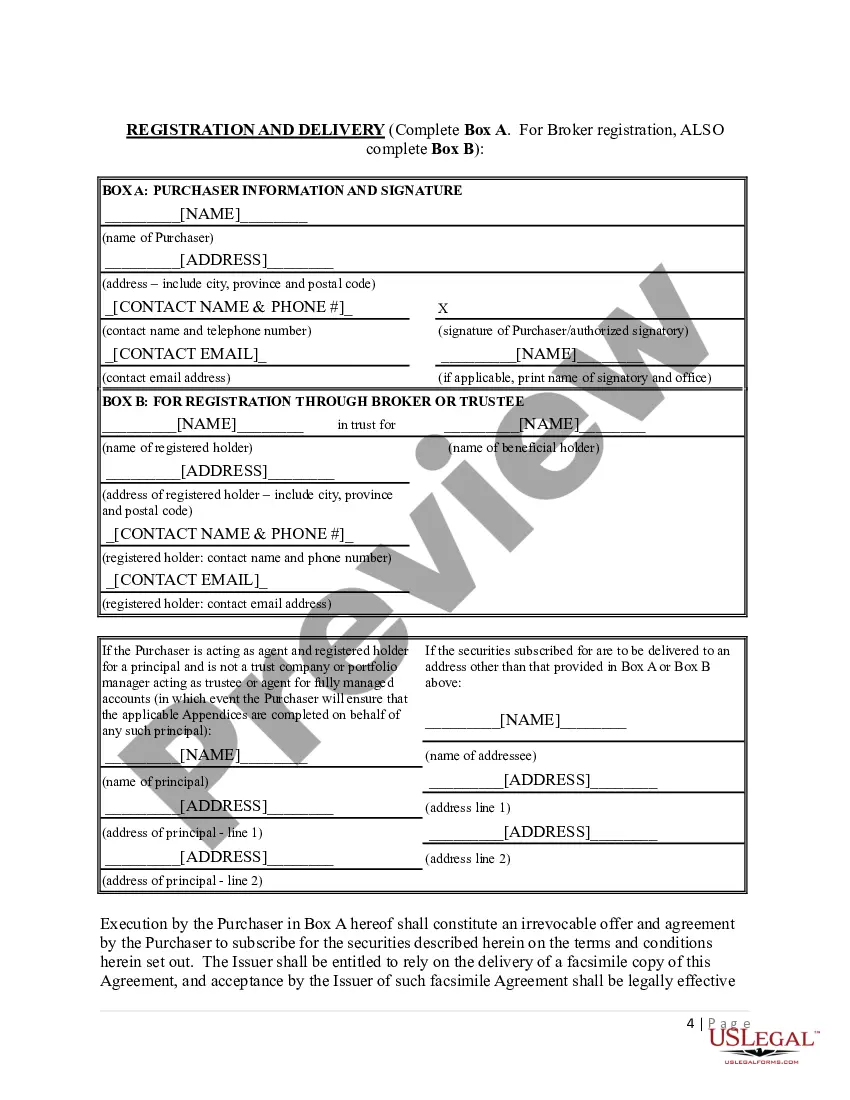

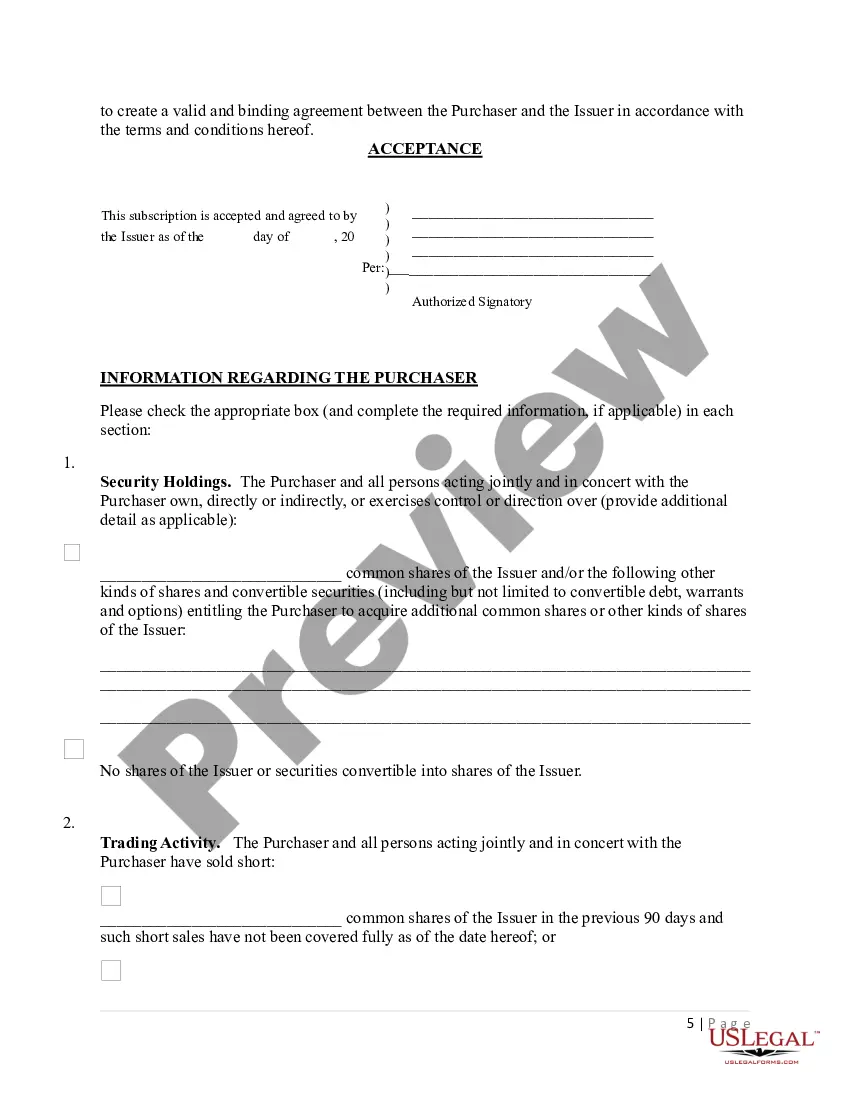

The Kentucky Subscription Agreement is an important legal document that outlines the terms and conditions of a subscription for securities offered by a company or investment. This agreement serves as a formal agreement between the issuer of the securities and the investor who wishes to purchase them. One type of Kentucky Subscription Agreement is the Equity Subscription Agreement. This type of agreement is commonly used by startups and early-stage companies to raise capital by issuing equity securities, such as common or preferred stock. The Equity Subscription Agreement specifies the number of shares being offered, the price per share, and any additional terms or conditions that the investor must meet before the shares are issued. Another type of Kentucky Subscription Agreement is the Convertible Note Subscription Agreement. This agreement is used when a company offers convertible notes, which are debt instruments that can be converted into equity at a later date. The agreement defines the terms of the convertible note, such as the interest rate, maturity date, and the conversion terms. A third type of Kentucky Subscription Agreement is the Limited Partnership Subscription Agreement. This agreement is commonly used in the formation of a limited partnership, where investors become limited partners by subscribing to the partnership interests. The agreement details the rights, obligations, and capital contributions of the limited partners. In all types of Kentucky Subscription Agreements, certain key elements are typically included. These elements may include the name and address of the issuer and investor, the total subscription amount, payment terms, representations and warranties made by both parties, conditions precedent for closing the subscription, and any applicable governing law or dispute resolution provisions. It is crucial for both the issuer and investor to thoroughly review and understand the Kentucky Subscription Agreement before signing it. Seeking professional legal advice is highly recommended ensuring compliance with the state's laws and regulations governing securities offerings.

Kentucky Subscription Agreement

Description

How to fill out Kentucky Subscription Agreement?

Choosing the best authorized document format can be quite a struggle. Needless to say, there are plenty of templates available on the Internet, but how do you get the authorized develop you require? Utilize the US Legal Forms web site. The support offers 1000s of templates, such as the Kentucky Subscription Agreement, that can be used for business and private demands. All the types are inspected by experts and meet federal and state requirements.

When you are presently signed up, log in to the account and click on the Acquire key to obtain the Kentucky Subscription Agreement. Utilize your account to check throughout the authorized types you possess bought earlier. Proceed to the My Forms tab of your own account and get another copy in the document you require.

When you are a fresh customer of US Legal Forms, allow me to share basic instructions so that you can adhere to:

- Initial, make certain you have selected the correct develop for your personal city/area. You may examine the form utilizing the Review key and study the form description to ensure this is the best for you.

- When the develop does not meet your needs, utilize the Seach area to obtain the appropriate develop.

- Once you are sure that the form is proper, click the Get now key to obtain the develop.

- Select the pricing strategy you would like and enter the required info. Create your account and buy an order with your PayPal account or bank card.

- Choose the document structure and download the authorized document format to the device.

- Full, revise and print out and signal the attained Kentucky Subscription Agreement.

US Legal Forms may be the most significant collection of authorized types in which you can find various document templates. Utilize the service to download professionally-manufactured files that adhere to condition requirements.