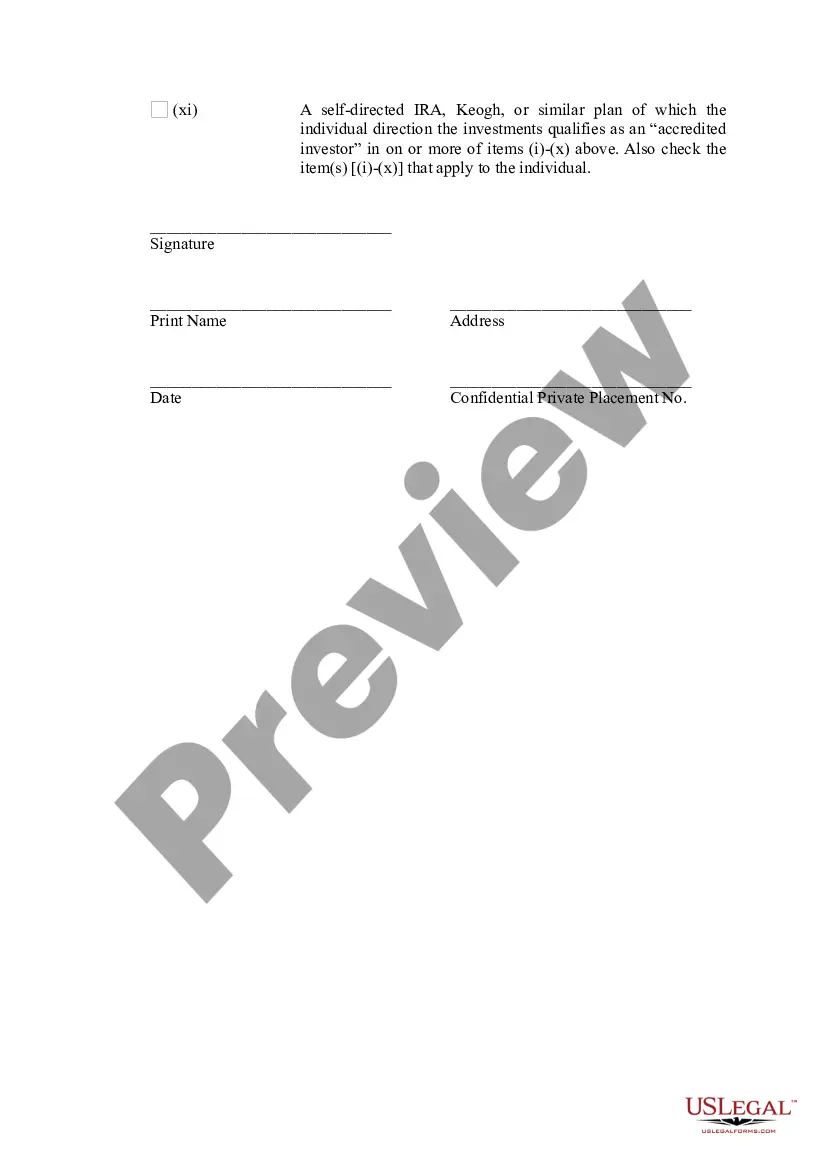

The Kentucky Checklist — Certificate of Status as an Accredited Investor is a vital document that pertains to individuals or entities seeking to establish their status as accredited investors within the state of Kentucky. This certificate serves as proof of eligibility for participation in various investment opportunities that are exclusively available to accredited investors. Keywords: Kentucky, Checklist, Certificate of Status, Accredited Investor An accredited investor, as defined by the U.S. Securities and Exchange Commission (SEC), is an individual or entity that meets specific financial and experience criteria, enabling them to invest in certain types of securities that are not registered with regulatory authorities such as the SEC. This status allows investors greater access to private placements, hedge funds, venture capital, and other investment opportunities that may offer higher potential returns but are accompanied by increased risk. The Kentucky Checklist — Certificate of Status as an Accredited Investor helps streamline the accreditation verification process and ensures compliance with state regulations. By obtaining this certificate, individuals or entities can prove their eligibility as accredited investors when engaging in investment activities within the state of Kentucky. Different types of Kentucky Checklist — Certificate of Status as an Accredited Investor include: 1. Individual Accredited Investor: This type refers to an individual who meets the SEC's criteria for accreditation based on specific income or net worth thresholds. Typically, an individual must have an annual income of at least $200,000 or a net worth exceeding $1 million, excluding their primary residence. 2. Entity Accredited Investor: This type includes entities like corporations, limited liability companies (LCS), partnerships, and trusts that meet certain financial criteria. Entities may qualify as accredited investors based on their total assets, such as having more than $5 million in investments or being entirely owned by accredited investors. 3. Institutional Accredited Investor: Institutional investors, including banks, insurance companies, registered investment companies, and employee benefit plans, fall under this category. These entities have significant financial resources and expertise necessary for engaging in high-risk and complex investments. To obtain the Kentucky Checklist — Certificate of Status as an Accredited Investor, individuals or entities are required to provide supporting documentation and complete various sections of the checklist. This may include submitting financial statements, tax returns, investment portfolios, and other relevant documents to verify their accredited investor status. By possessing a valid Kentucky Checklist — Certificate of Status as an Accredited Investor, individuals and entities can establish credibility and gain access to exclusive investment opportunities within Kentucky. It streamlines the process of verifying accreditation eligibility, providing a standardized and recognized proof of status for investment purposes. In conclusion, the Kentucky Checklist — Certificate of Status as an Accredited Investor is a crucial document for individuals and entities seeking to demonstrate their eligibility and take advantage of investment opportunities within the state. By meeting the relevant criteria and obtaining this certificate, investors can position themselves to access restricted investment opportunities and potentially enhance their investment portfolios.

Kentucky Checklist - Certificate of Status as an Accredited Investor

Description

How to fill out Kentucky Checklist - Certificate Of Status As An Accredited Investor?

If you want to complete, acquire, or print out lawful record layouts, use US Legal Forms, the largest selection of lawful types, which can be found on the Internet. Take advantage of the site`s easy and convenient lookup to get the documents you need. Various layouts for company and personal functions are sorted by categories and suggests, or key phrases. Use US Legal Forms to get the Kentucky Checklist - Certificate of Status as an Accredited Investor within a few clicks.

If you are presently a US Legal Forms consumer, log in for your profile and click on the Acquire switch to obtain the Kentucky Checklist - Certificate of Status as an Accredited Investor. You can even gain access to types you earlier downloaded in the My Forms tab of the profile.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the shape for that right town/region.

- Step 2. Use the Review solution to look through the form`s content material. Don`t forget about to read through the description.

- Step 3. If you are unsatisfied with all the type, use the Research industry towards the top of the monitor to discover other variations from the lawful type template.

- Step 4. Once you have located the shape you need, go through the Get now switch. Pick the rates program you prefer and add your qualifications to register for the profile.

- Step 5. Process the financial transaction. You can utilize your credit card or PayPal profile to accomplish the financial transaction.

- Step 6. Find the formatting from the lawful type and acquire it on the product.

- Step 7. Full, modify and print out or signal the Kentucky Checklist - Certificate of Status as an Accredited Investor.

Every single lawful record template you acquire is your own eternally. You have acces to every type you downloaded with your acccount. Go through the My Forms segment and select a type to print out or acquire yet again.

Remain competitive and acquire, and print out the Kentucky Checklist - Certificate of Status as an Accredited Investor with US Legal Forms. There are thousands of expert and state-specific types you can utilize for the company or personal demands.