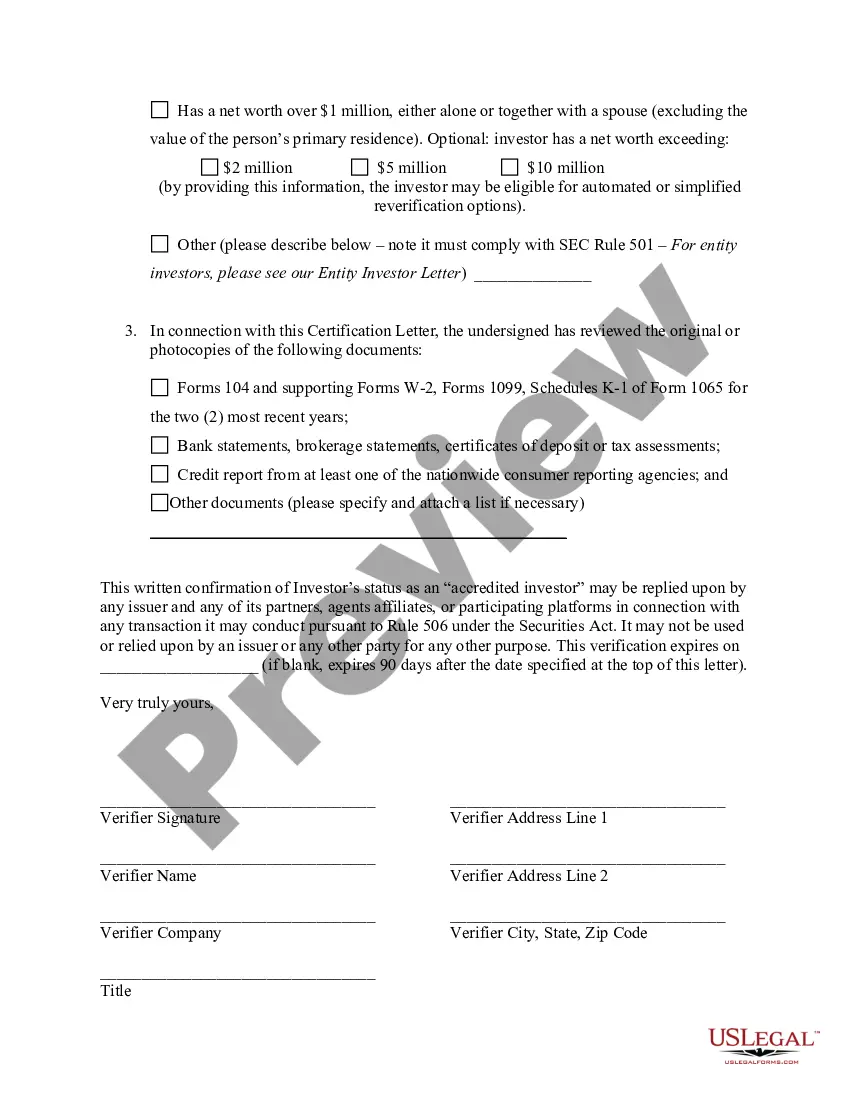

Kentucky Accredited Investor Verification Letter — Individual Investor is a comprehensive document utilized in the state of Kentucky to verify an individual's status as an accredited investor. This letter serves as evidence that an investor meets the criteria set forth by the Kentucky Department of Financial Institutions (DFI) and the Securities and Exchange Commission (SEC) to participate in certain investment opportunities limited to accredited investors. The Kentucky Accredited Investor Verification Letter — Individual Investor contains essential details regarding the individual's qualifications and financial standing, affirming their eligibility to participate in private placements, venture capital funds, hedge funds, and other investment vehicles that are generally restricted to accredited investors. Keywords: Kentucky, accredited investor, verification letter, individual investor, qualifications, financial standing, private placements, venture capital funds, hedge funds, investment vehicles, restricted, eligibility. Types of Kentucky Accredited Investor Verification Letters for Individual Investors: 1. Net Worth-Based Verification Letter: This type of letter confirms an individual's accredited investor status based on their net worth. In accordance with the SEC guidelines, an accredited investor must have a net worth exceeding $1 million, excluding the value of their primary residence. 2. Income-Based Verification Letter: This letter validates an individual's eligibility as an accredited investor based on their annual income. To qualify, an investor must have an individual income exceeding $200,000 in the most recent two years, or a joint income with their spouse exceeding $300,000, with a reasonable expectation of reaching the same income level in the current year. 3. Combination Net Worth and Income Verification Letter: This type of verification letter provides confirmation of an individual's accredited investor status by combining both their net worth and income. For instance, an investor may not meet the income threshold but surpasses the net worth requirement, enabling them to qualify as an accredited individual investor. 4. Qualified Institutional Buyer (RIB) Verification Letter: In rare cases, a Kentucky Accredited Investor Verification Letter may be specifically required for qualified institutional buyers under Rule 144A of the Securities Act. These institutional buyers typically meet the criteria established by the SEC, including having at least $100 million in securities owned and invested under their management. Note that the specific terminology and requirements may vary slightly depending on the Kentucky DFI and SEC regulations. It is important to consult the relevant authorities or legal experts to ensure compliance and accuracy when using the Kentucky Accredited Investor Verification Letter — Individual Investor.

Kentucky Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out Kentucky Accredited Investor Veri?cation Letter - Individual Investor?

Discovering the right authorized papers web template can be quite a battle. Needless to say, there are tons of themes available online, but how will you discover the authorized develop you will need? Take advantage of the US Legal Forms website. The support provides a huge number of themes, for example the Kentucky Accredited Investor Veri?cation Letter - Individual Investor, that can be used for enterprise and private requires. Each of the kinds are checked out by professionals and fulfill federal and state needs.

In case you are presently listed, log in to your accounts and then click the Obtain key to obtain the Kentucky Accredited Investor Veri?cation Letter - Individual Investor. Make use of accounts to look through the authorized kinds you possess ordered previously. Check out the My Forms tab of your accounts and acquire an additional duplicate in the papers you will need.

In case you are a brand new user of US Legal Forms, listed below are easy instructions for you to comply with:

- Initially, ensure you have chosen the appropriate develop to your town/region. You can examine the shape utilizing the Preview key and browse the shape explanation to make certain it will be the best for you.

- In case the develop is not going to fulfill your preferences, utilize the Seach industry to obtain the proper develop.

- When you are sure that the shape would work, click on the Get now key to obtain the develop.

- Choose the costs program you desire and enter the necessary info. Design your accounts and purchase an order with your PayPal accounts or bank card.

- Choose the document formatting and download the authorized papers web template to your product.

- Total, revise and print out and sign the obtained Kentucky Accredited Investor Veri?cation Letter - Individual Investor.

US Legal Forms is the biggest collection of authorized kinds that you can find various papers themes. Take advantage of the company to download appropriately-produced paperwork that comply with express needs.