Kentucky Investment-Grade Bond Optional Redemption (without a Par Call) refers to a type of bond issued by the state of Kentucky that offers optional redemption to the bondholder, without a par call provision. Keywords: Kentucky Investment-Grade Bond, Optional Redemption, Par Call. When it comes to Kentucky Investment-Grade Bond Optional Redemption (without a Par Call), there are two primary types: 1. Kentucky Investment-Grade Bond: A Kentucky investment-grade bond refers to a bond issued by the state of Kentucky, typically with a high credit rating, indicating low default risk. These bonds are considered a relatively safe investment option. 2. Optional Redemption: In the context of Kentucky investment-grade bonds without a par call provision, optional redemption refers to the bond issuer's ability to redeem the bonds before their maturity date, at their discretion. This means that the state of Kentucky has the flexibility to redeem the bonds early, providing an advantage to the issuer. Par Call: It is worth noting that Kentucky Investment-Grade Bond Optional Redemption (without a Par Call) differentiates itself by not having a par call provision. A par call provision would allow the issuer to redeem the bonds at a predetermined price or par value before their maturity date. Without this provision, the issuer is not obligated to redeem the bond at its par value, giving them more flexibility in managing their debt. Investors interested in Kentucky Investment-Grade Bond Optional Redemption (without a Par Call) should consider these factors while evaluating their investment options. The absence of a par call provision offers additional flexibility to the issuer, potentially impacting the redemption value an investor receives. Additionally, investors should carefully analyze the credit rating and financial stability of the state of Kentucky before investing in these bonds. In conclusion, Kentucky Investment-Grade Bond Optional Redemption (without a Par Call) refers to a type of bond issued by the state of Kentucky, offering optional redemption without a par call provision. This investment option provides flexibility to both the issuer and the investor, making it essential to understand the associated risks and benefits.

Kentucky Investment - Grade Bond Optional Redemption (without a Par Call)

Description

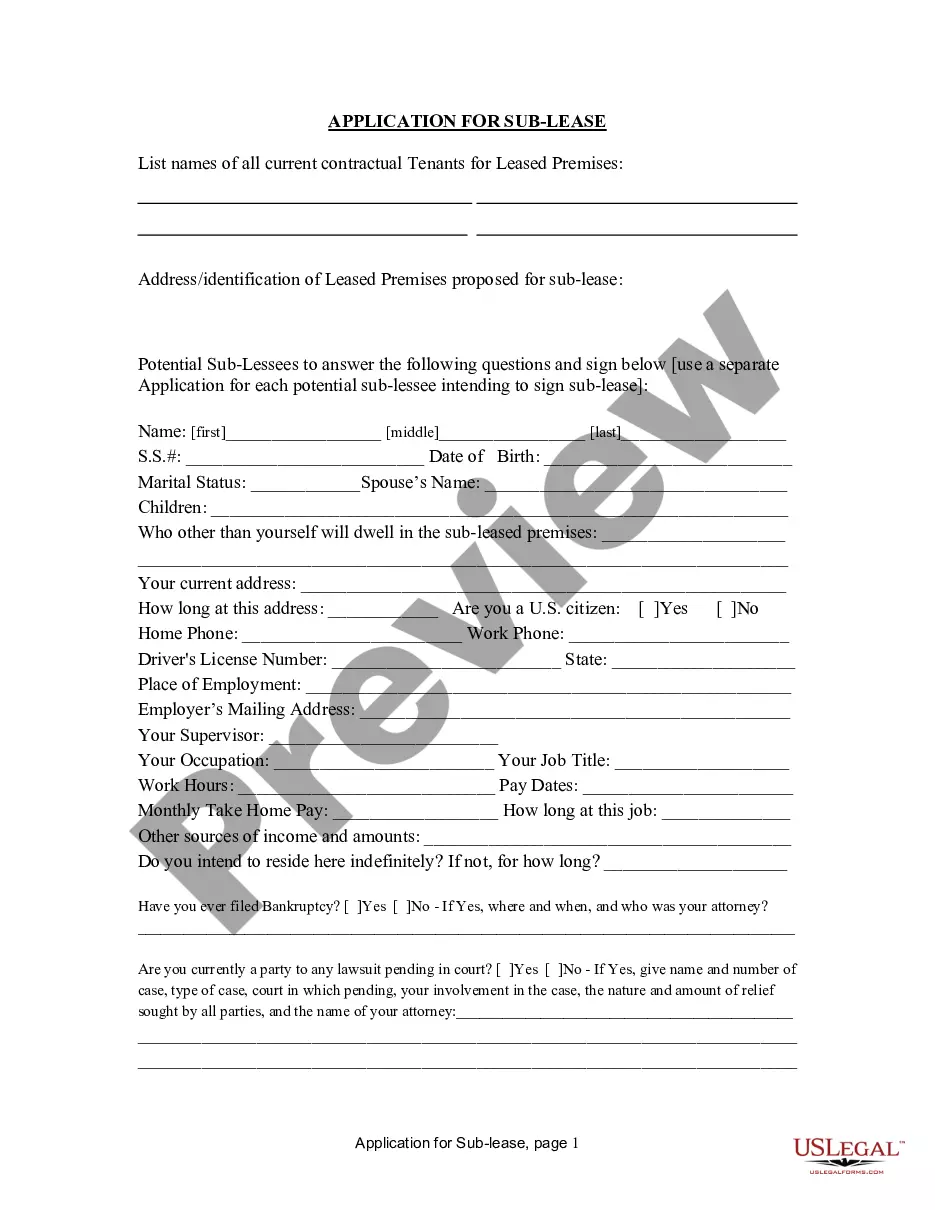

How to fill out Kentucky Investment - Grade Bond Optional Redemption (without A Par Call)?

Have you been within a situation that you need paperwork for either enterprise or individual reasons almost every day? There are a variety of lawful file templates available on the net, but locating kinds you can rely on is not straightforward. US Legal Forms gives 1000s of kind templates, such as the Kentucky Investment - Grade Bond Optional Redemption (without a Par Call), which are composed to fulfill state and federal requirements.

Should you be previously familiar with US Legal Forms site and get an account, basically log in. Afterward, you are able to acquire the Kentucky Investment - Grade Bond Optional Redemption (without a Par Call) format.

If you do not offer an bank account and want to begin using US Legal Forms, abide by these steps:

- Get the kind you want and ensure it is for that proper area/region.

- Take advantage of the Preview switch to analyze the shape.

- Look at the information to actually have selected the correct kind.

- When the kind is not what you`re trying to find, take advantage of the Search area to obtain the kind that meets your needs and requirements.

- Once you discover the proper kind, simply click Acquire now.

- Opt for the rates program you want, complete the required information and facts to produce your account, and purchase the order making use of your PayPal or charge card.

- Choose a convenient data file format and acquire your backup.

Get all of the file templates you might have bought in the My Forms food selection. You can aquire a further backup of Kentucky Investment - Grade Bond Optional Redemption (without a Par Call) at any time, if needed. Just select the needed kind to acquire or produce the file format.

Use US Legal Forms, by far the most substantial collection of lawful types, to save efforts and stay away from blunders. The assistance gives expertly manufactured lawful file templates that you can use for a selection of reasons. Generate an account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

Redemption value is the price at which the issuing company may choose to repurchase a security before its maturity date. A bond is purchased "at a discount" if its redemption value exceeds its purchase price. It is purchased "at a premium" if its purchase price exceeds its redemption value.

In return for buying the bonds, the investor ? or bondholder? receives periodic interest payments known as coupons. The coupon payments, which may be made quarterly, twice yearly or annually, are expected to provide regular, predictable income to the investor..

Over the long term, high-quality bond funds have tended to offer better diversification against stock volatility and higher yield potential than cash. While the road ahead may be a bit bumpy, sticking to your investment plan is an important step toward keeping your long-term goals on track.

Most bonds are issued in $1,000 denominations, so typically the face value of a bond will be just that ? $1,000. You might also see bonds with face values of $100, $5,000 and $10,000.

An investor who buys a government bond is lending the government money. If an investor buys a corporate bond, the investor is lending the corporation money. Like a loan, a bond pays interest periodically and repays the principal at a stated time, known as maturity.

Optional Redemption On or after the Par Call Date, the Company may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to the redemption date.

An investor who buys a government bond is lending the government money. If an investor buys a corporate bond, the investor is lending the corporation money. Like a loan, a bond pays interest periodically and repays the principal at a stated time, known as maturity.

Bond Redemption Date means, with respect to any Bond, the date on which such Bond is redeemed pursuant to the applicable Bond Documents. Bond Redemption Date means any date, other than an Interest Payment Date, upon which Bonds shall be redeemed pursuant to the Indenture.