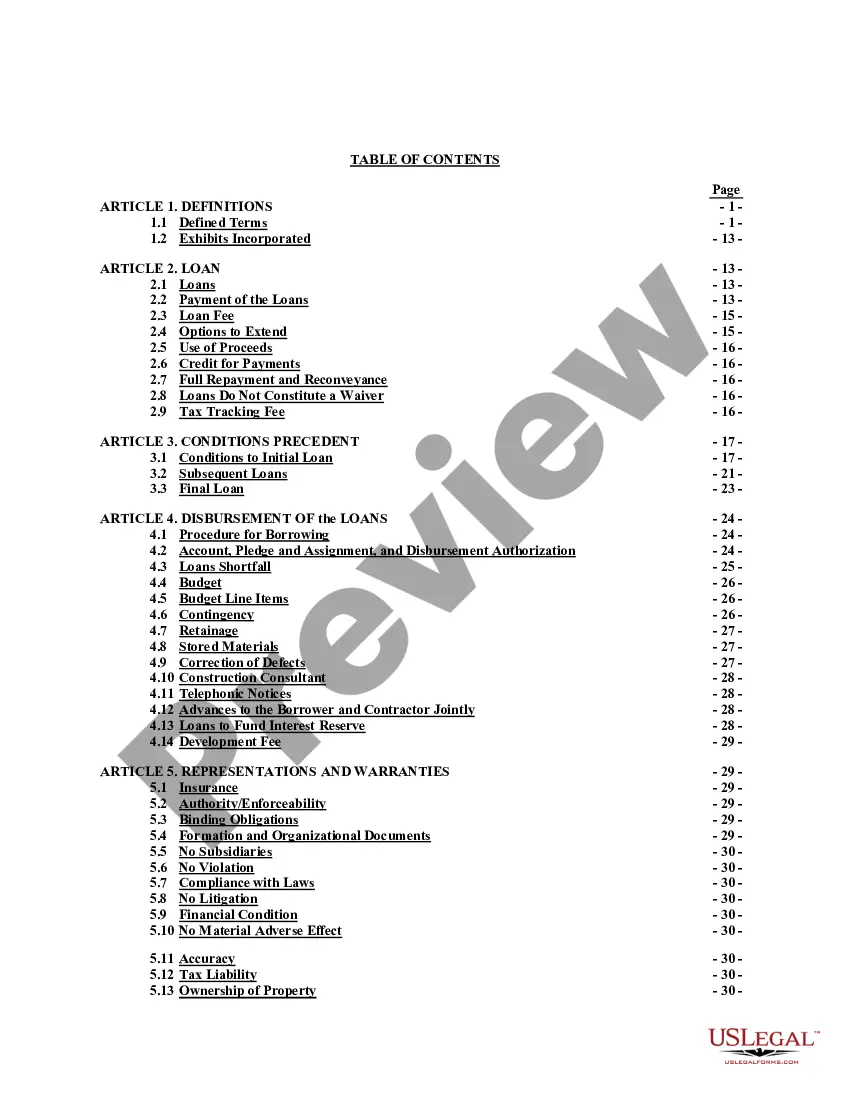

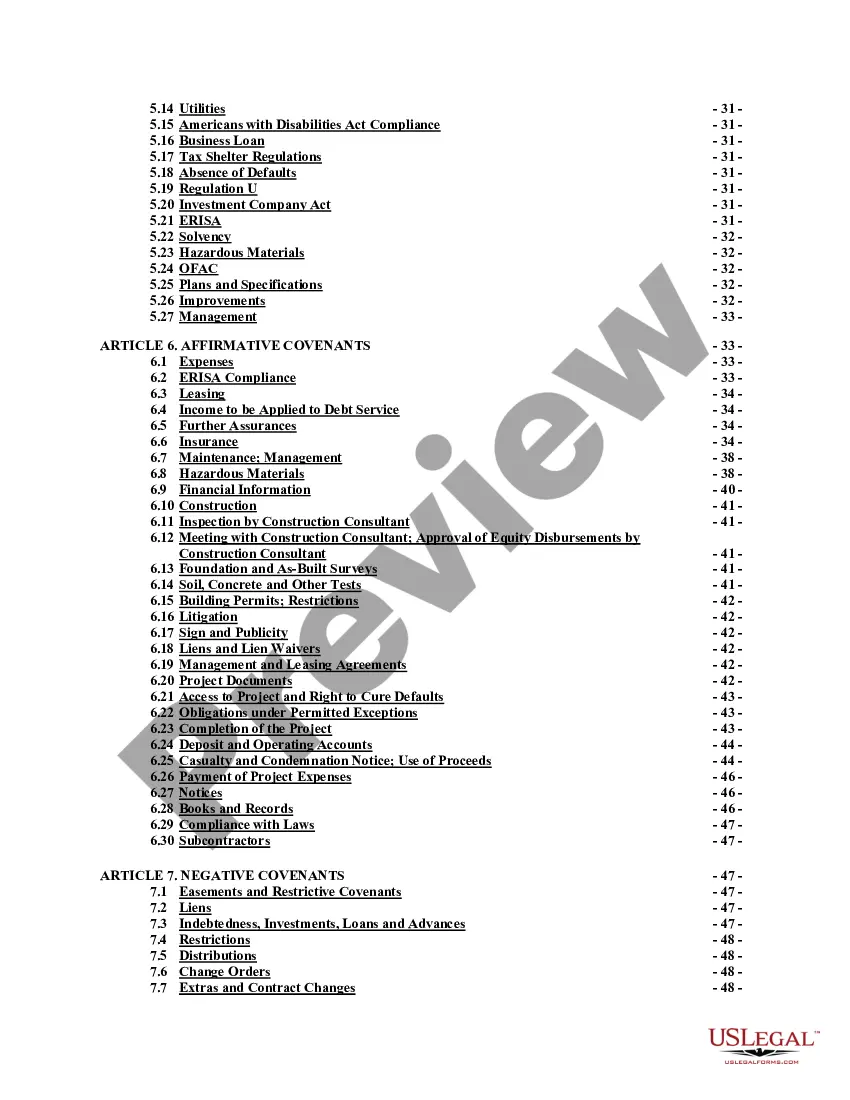

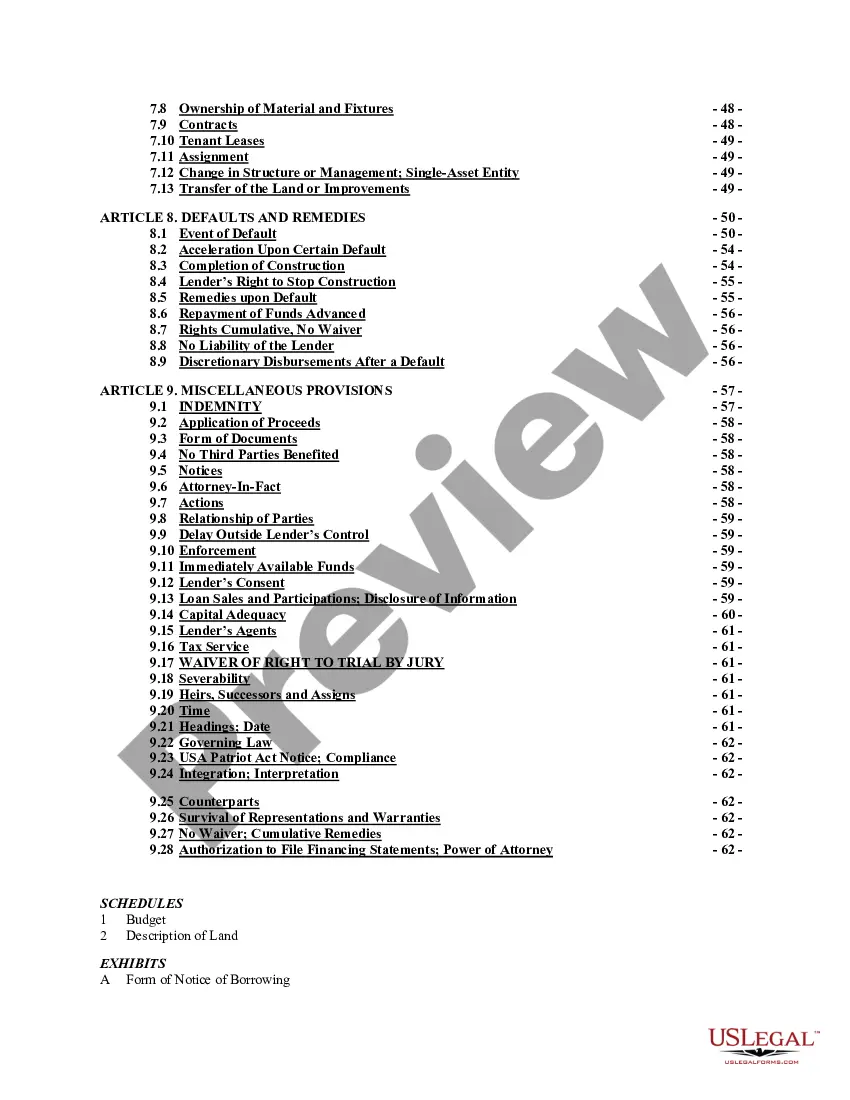

Kentucky Construction Loan Agreement

Description

A Loan Agreement is a document between a borrower and lender that details the loan repayment schedule.

The Loan Agreement protects the lender by enforcing the borrower's pledge to repay the loan; payment via regular payments or lump sums. The borrower may also find the loan contract useful because it records the details of the loan for their records and helps keep track of payments.

Loan agreements generally include information about:

* The location.

* The loan amount.

* Interest and late fees.

* Repayment method.

* Collateral and insurance."

How to fill out Construction Loan Agreement?

US Legal Forms - one of the greatest libraries of lawful kinds in the USA - offers a wide array of lawful file web templates you may download or produce. Making use of the website, you can find a large number of kinds for organization and personal purposes, categorized by categories, claims, or keywords.You will discover the latest types of kinds such as the Kentucky Construction Loan Agreement within minutes.

If you currently have a monthly subscription, log in and download Kentucky Construction Loan Agreement from the US Legal Forms library. The Down load key will show up on each develop you see. You have accessibility to all formerly acquired kinds from the My Forms tab of your own accounts.

If you would like use US Legal Forms initially, allow me to share simple guidelines to obtain started out:

- Make sure you have selected the best develop for your personal city/area. Click the Preview key to review the form`s content material. See the develop description to actually have chosen the proper develop.

- In case the develop doesn`t satisfy your demands, take advantage of the Lookup field on top of the monitor to get the one which does.

- If you are pleased with the form, confirm your selection by clicking the Get now key. Then, opt for the pricing strategy you want and supply your qualifications to sign up for the accounts.

- Process the transaction. Make use of your credit card or PayPal accounts to complete the transaction.

- Select the structure and download the form on the system.

- Make changes. Load, change and produce and signal the acquired Kentucky Construction Loan Agreement.

Every single web template you put into your bank account does not have an expiration time and is also your own property forever. So, if you wish to download or produce another backup, just check out the My Forms section and click about the develop you want.

Get access to the Kentucky Construction Loan Agreement with US Legal Forms, the most comprehensive library of lawful file web templates. Use a large number of expert and condition-distinct web templates that meet up with your organization or personal demands and demands.

Form popularity

FAQ

Construction Loans Compared Type of loanBest forConstruction-to-permanent loanHomeowners who want to save on closing costs and lock in mortgage financingConstruction-only loanThose who have a large amount of cash on hand or who intend to pay off the construction loan with the sale of their previous home2 more rows ?

Assuming that you're making the standard FHA down payment of 3.5 percent, the minimum credit score for a construction loan is 580. Otherwise, you can apply for a new construction FHA loan with a credit score as low as 500, but in that case, you'll need to make a 10 percent down payment.

Construction loans typically have higher financial requirements and interest rates than conventional mortgages for existing homes.

What should be included in a loan agreement? The amount of money to be loaned. The timeframe in which the money is to be repaid. The agreed method of repayment. What the ramifications are of late or non-payment. The amount of interest (if any) to be repaid. Details of any security required to protect the lender.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

Construction Loan Requirements Credit score: Most lenders will require you to have a minimum credit score of 620 or higher in order to qualify for a construction loan. Debt-to-income (DTI) ratio: Your lender will also look at your DTI ratio, which compares your recurring monthly debts to your gross monthly income.

Credit score: Most lenders will require you to have a minimum credit score of 620 or higher in order to qualify for a construction loan. Debt-to-income (DTI) ratio: Your lender will also look at your DTI ratio, which compares your recurring monthly debts to your gross monthly income.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.