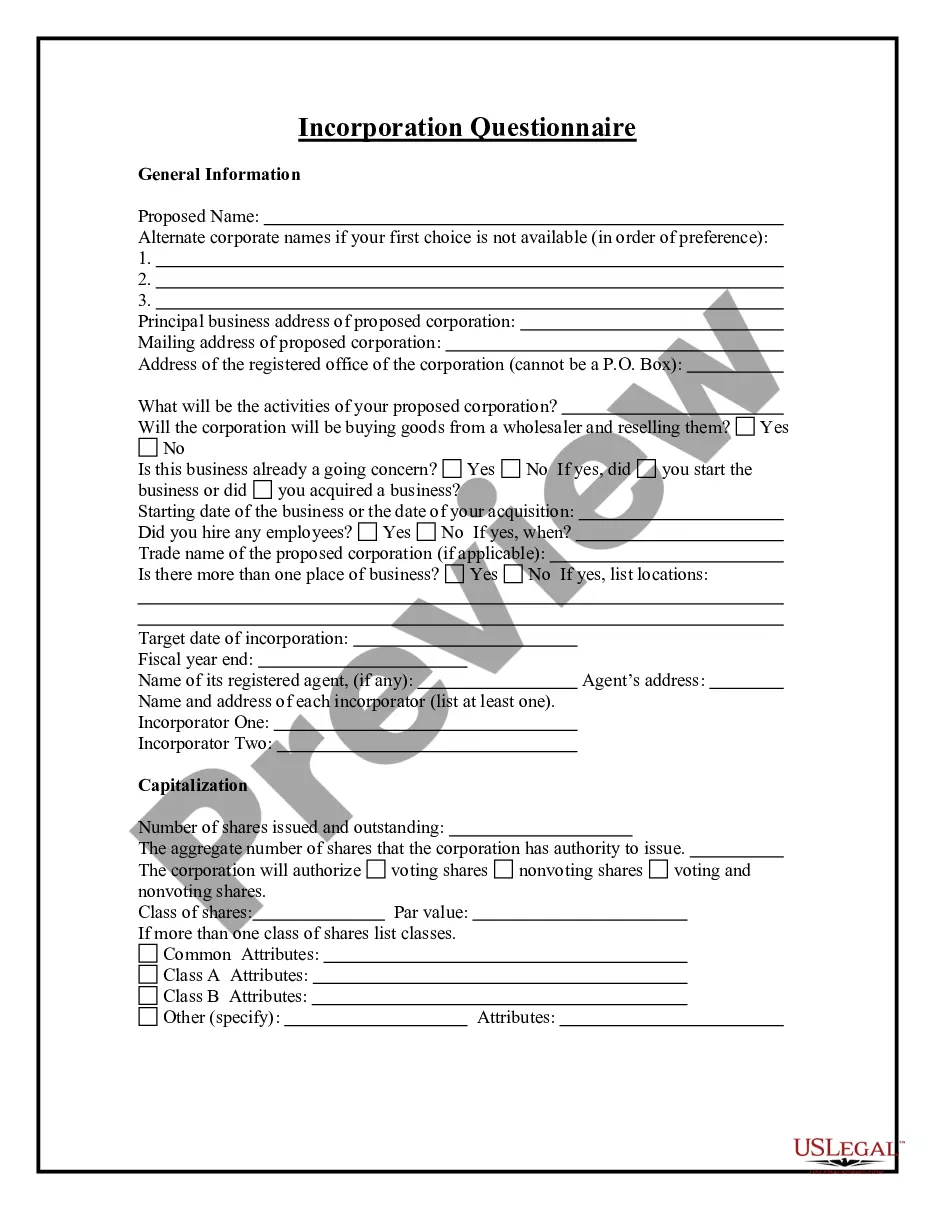

Kentucky Incorporation Questionnaire

Description

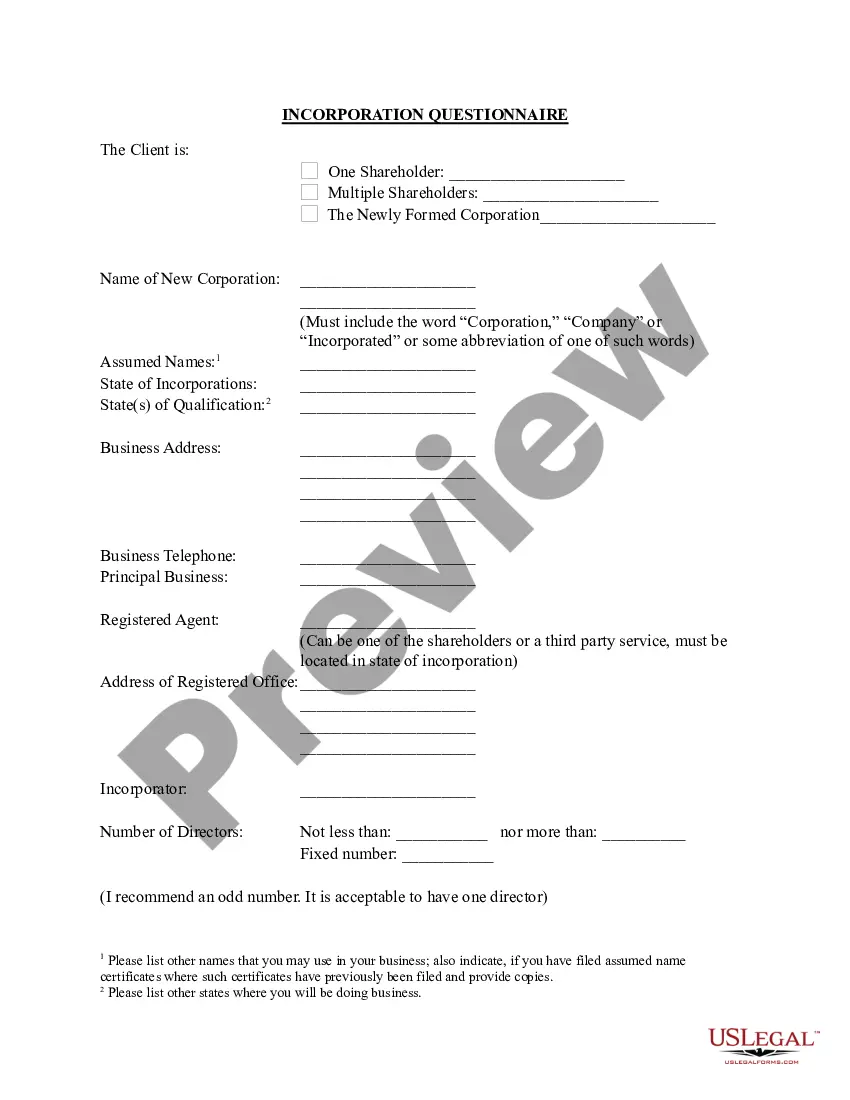

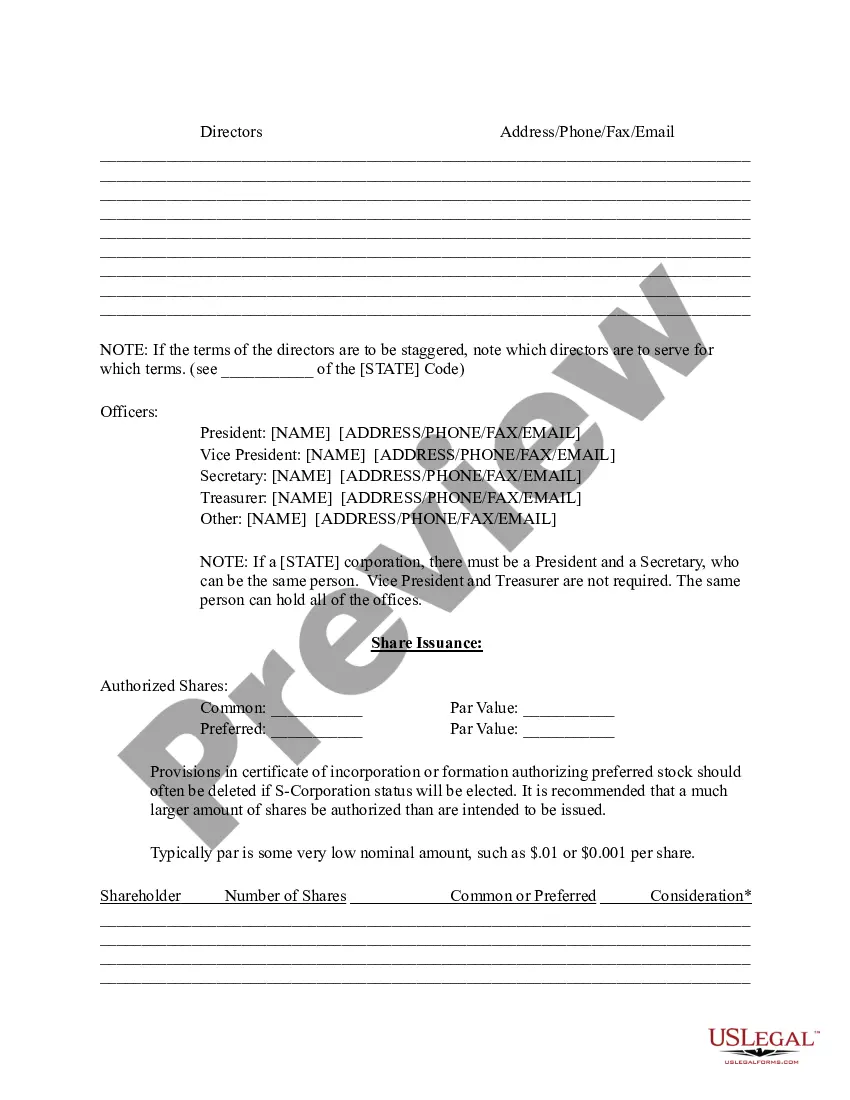

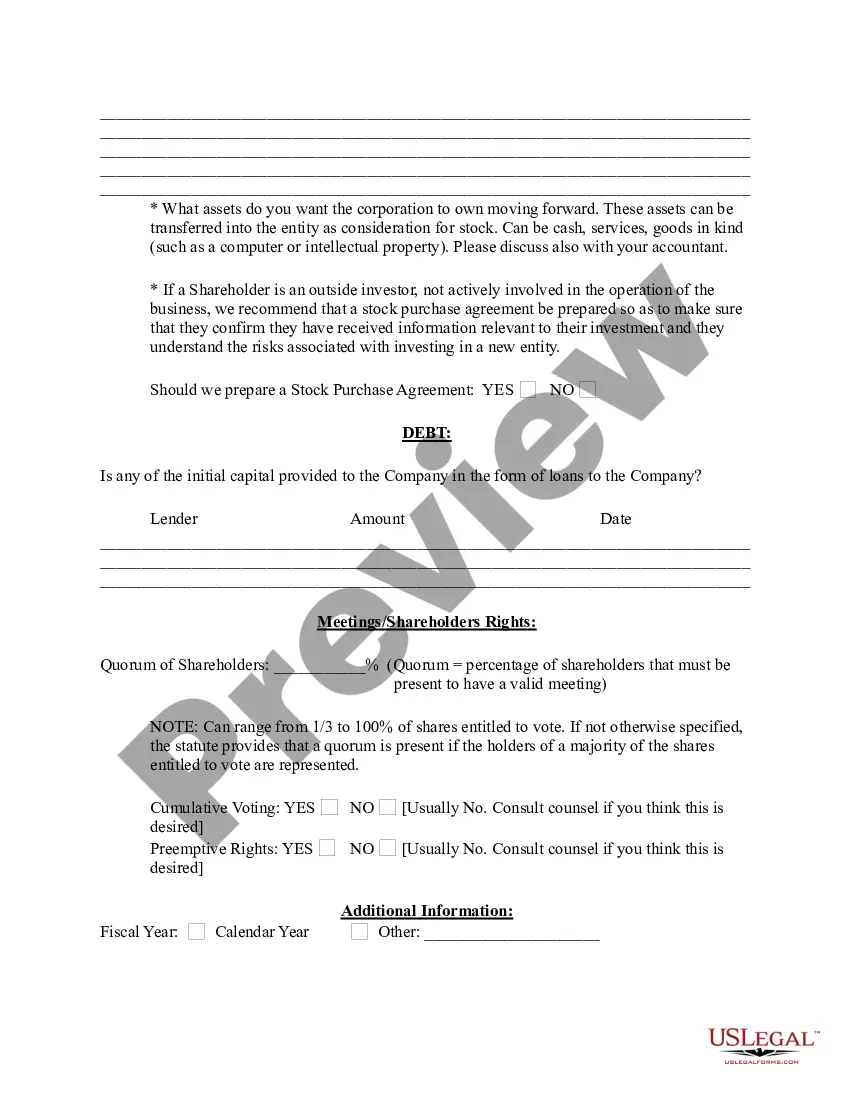

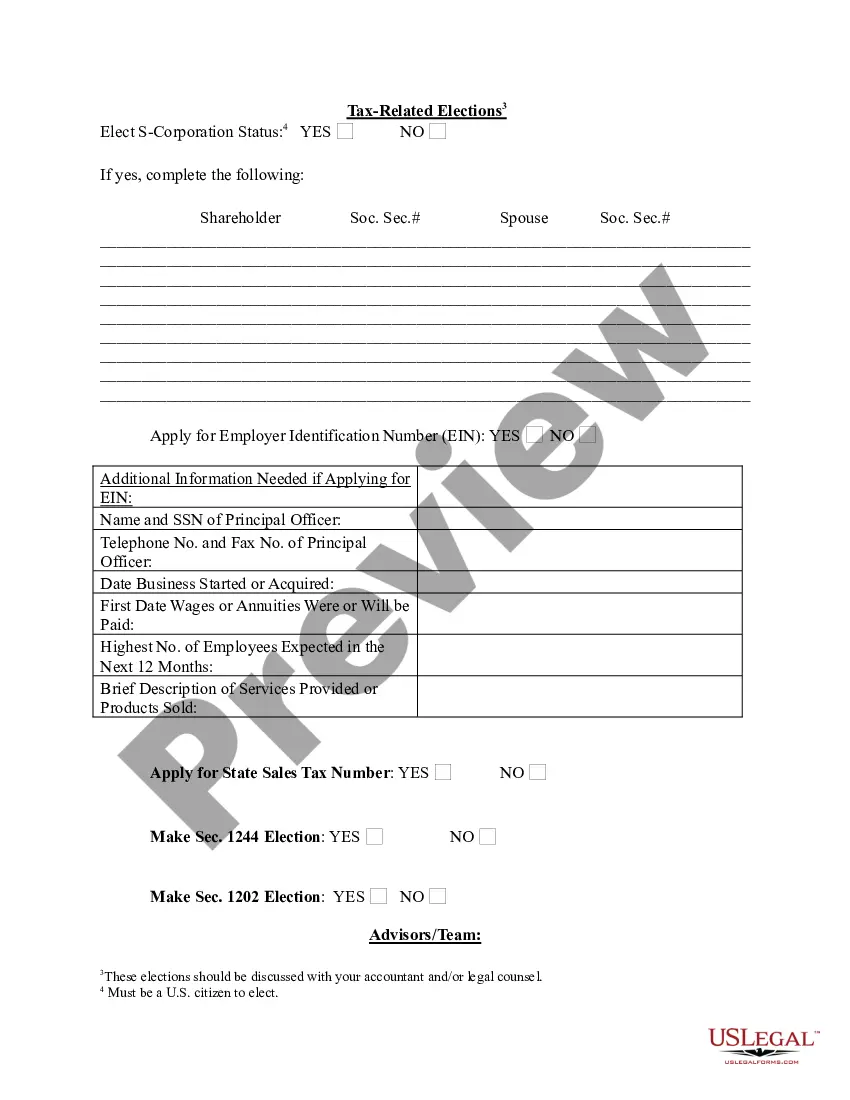

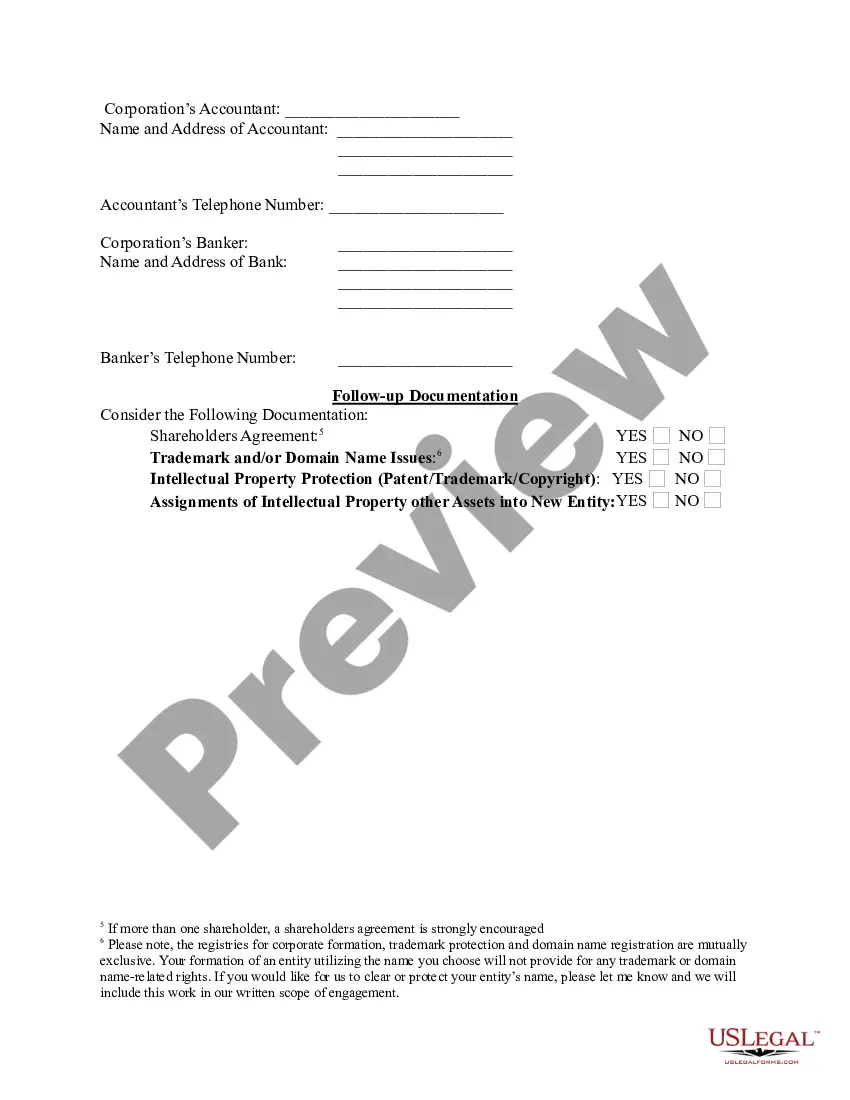

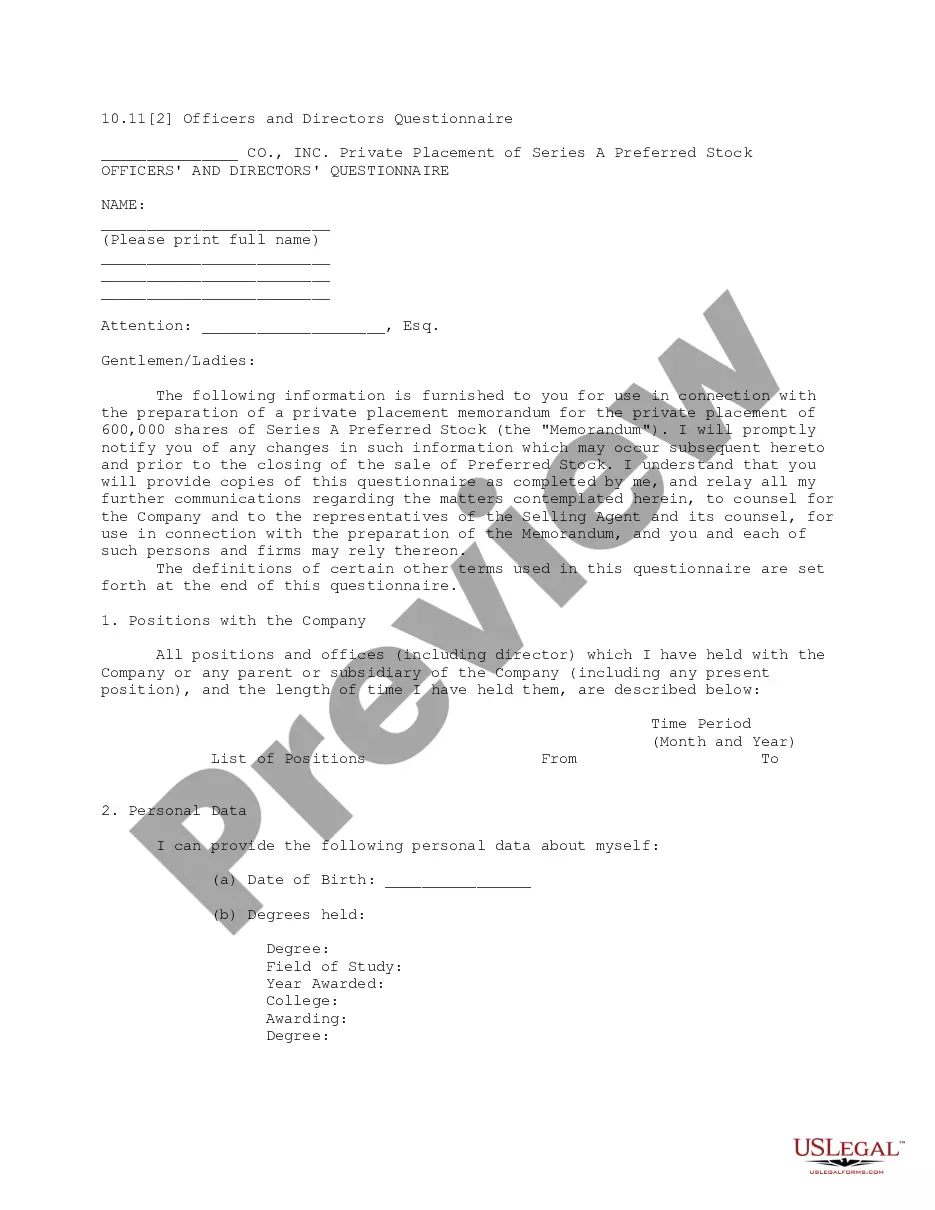

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client's needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews."

How to fill out Incorporation Questionnaire?

Are you in a situation the place you need to have files for either company or specific reasons just about every time? There are tons of legitimate file templates available on the net, but locating kinds you can depend on is not easy. US Legal Forms gives a large number of kind templates, such as the Kentucky Incorporation Questionnaire, which are composed in order to meet federal and state specifications.

Should you be already acquainted with US Legal Forms website and have a free account, basically log in. Following that, you are able to acquire the Kentucky Incorporation Questionnaire web template.

If you do not come with an accounts and need to start using US Legal Forms, abide by these steps:

- Get the kind you will need and ensure it is to the proper metropolis/area.

- Take advantage of the Preview key to examine the form.

- Browse the information to ensure that you have chosen the right kind.

- When the kind is not what you are seeking, use the Lookup industry to get the kind that suits you and specifications.

- When you get the proper kind, simply click Acquire now.

- Pick the pricing strategy you want, fill out the desired information to create your account, and pay money for your order using your PayPal or bank card.

- Pick a handy file structure and acquire your copy.

Find every one of the file templates you might have purchased in the My Forms menus. You can obtain a further copy of Kentucky Incorporation Questionnaire anytime, if required. Just go through the required kind to acquire or produce the file web template.

Use US Legal Forms, one of the most extensive assortment of legitimate forms, to save time and prevent blunders. The services gives professionally manufactured legitimate file templates that you can use for a selection of reasons. Create a free account on US Legal Forms and commence making your lifestyle easier.

Form popularity

FAQ

Withholding (income) tax account number from the Department of Revenue. Your KY DOR account number will be 6 digits and can be found on any return (K-1, K-1E, K-3 and K-3E) sent from the Kentucky Department of Revenue. If you have a 9-digit number with 3 leading zeroes, leave the zeroes off.

Form a Kentucky Corporation: Name Your Corporation. Designate a Registered Agent. Submit Articles of Incorporation. Get an EIN. Write Corporate Bylaws. Hold an Organizational Meeting. Open a Corporate Bank Account. File State Reports & Taxes.

To make payments, the FEIN is required along with the Kentucky Corporate/LLET 6-digit account number.

What are the requirements to form an LLC in Kentucky? You must file articles of organization, appoint a registered agent, and pay a filing fee of $40 (or $60 for expedited service). An operating agreement is recommended but not required.

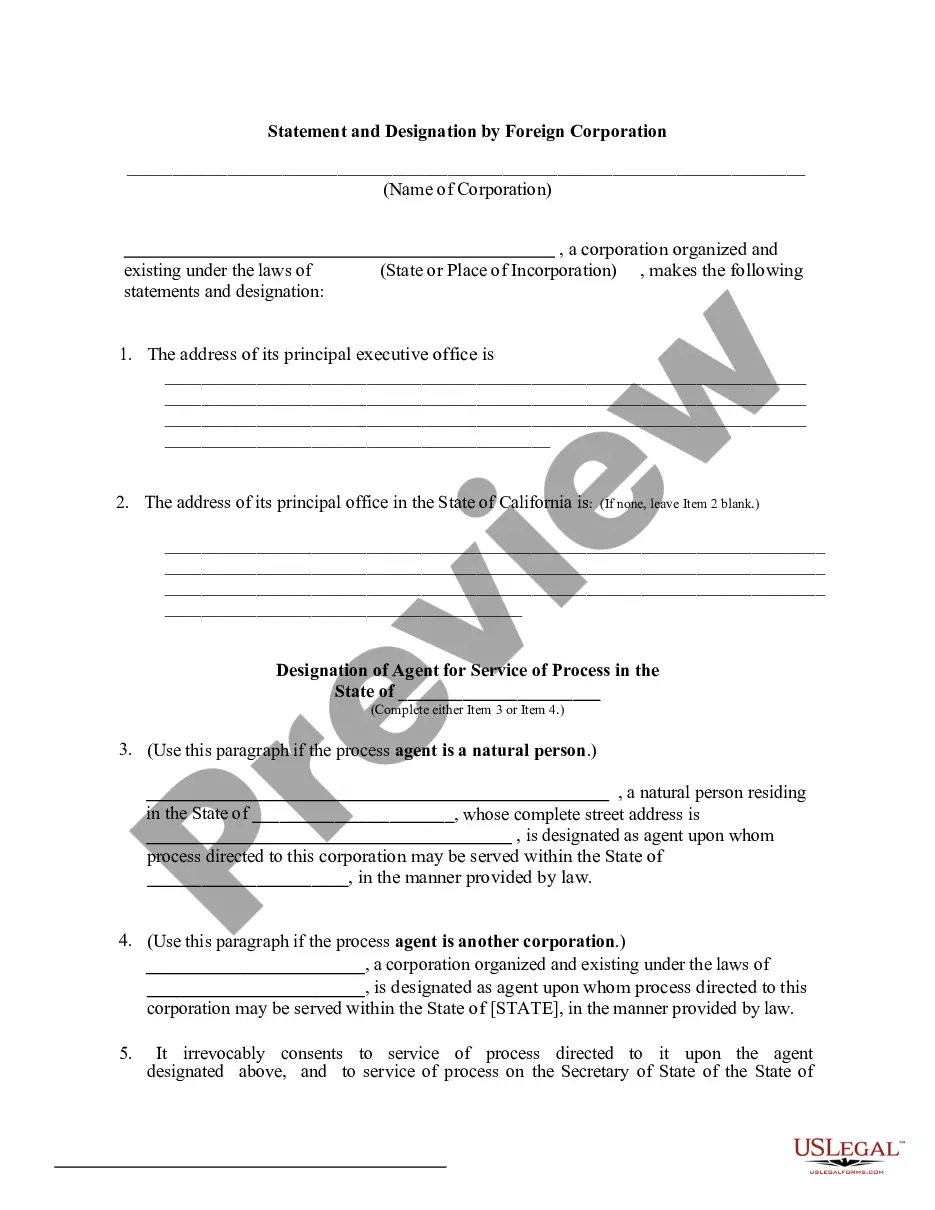

Foreign Limited Liability Company: A foreign limited liability company transacting business in Kentucky does not file Articles of Incorporation, but must obtain a Certificate of Authority from the Secretary of State by filing an Application for Certificate of Authority with a filing fee.

Kentucky Tax Account Numbers If you already have a KY Withholding Tax Account Number and an assigned deposit frequency, you can find this online, or on any previous Form K-1 or K-3, or on correspondence from the KY Department of Revenue.

To obtain your valid Kentucky Corporation/LLET account number, please contact the Department of Revenue at (502) 564-3306.

A Limited Liability Entity Tax (LLET) applies to both C corporations and Limited Liability Pass-Through Entities (LLPTEs) and is not an alternative to another tax. However, corporations paying the LLET are allowed to apply that amount as a credit towards its regular corporate income tax.