Kentucky Pre-Incorp Checklist

Description

How to fill out Pre-Incorp Checklist?

US Legal Forms - one of many biggest libraries of legal kinds in America - provides a wide array of legal document themes you may obtain or produce. Making use of the website, you can find thousands of kinds for organization and person uses, sorted by types, says, or key phrases.You can get the newest versions of kinds like the Kentucky Pre-Incorp Checklist in seconds.

If you already have a membership, log in and obtain Kentucky Pre-Incorp Checklist through the US Legal Forms collection. The Acquire option will show up on each develop you look at. You get access to all previously saved kinds from the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, here are basic directions to get you began:

- Make sure you have selected the proper develop for your personal city/area. Click on the Review option to check the form`s articles. See the develop description to actually have selected the right develop.

- When the develop does not fit your specifications, make use of the Look for field near the top of the screen to find the one who does.

- If you are satisfied with the form, validate your option by visiting the Get now option. Then, opt for the prices plan you prefer and give your qualifications to register for an profile.

- Procedure the deal. Make use of Visa or Mastercard or PayPal profile to accomplish the deal.

- Select the file format and obtain the form on the system.

- Make adjustments. Fill up, change and produce and indicator the saved Kentucky Pre-Incorp Checklist.

Each and every template you put into your money does not have an expiration time and it is yours for a long time. So, if you wish to obtain or produce another version, just go to the My Forms area and click on around the develop you need.

Obtain access to the Kentucky Pre-Incorp Checklist with US Legal Forms, by far the most comprehensive collection of legal document themes. Use thousands of professional and status-distinct themes that satisfy your company or person needs and specifications.

Form popularity

FAQ

Kentucky Tax Rates, Collections, and Burdens Kentucky has a flat 4.50 percent individual income tax rate. There are also jurisdictions that collect local income taxes. Kentucky has a 5.00 percent corporate income tax rate. Kentucky has a 6.00 percent state sales tax rate and does not levy any local sales taxes.

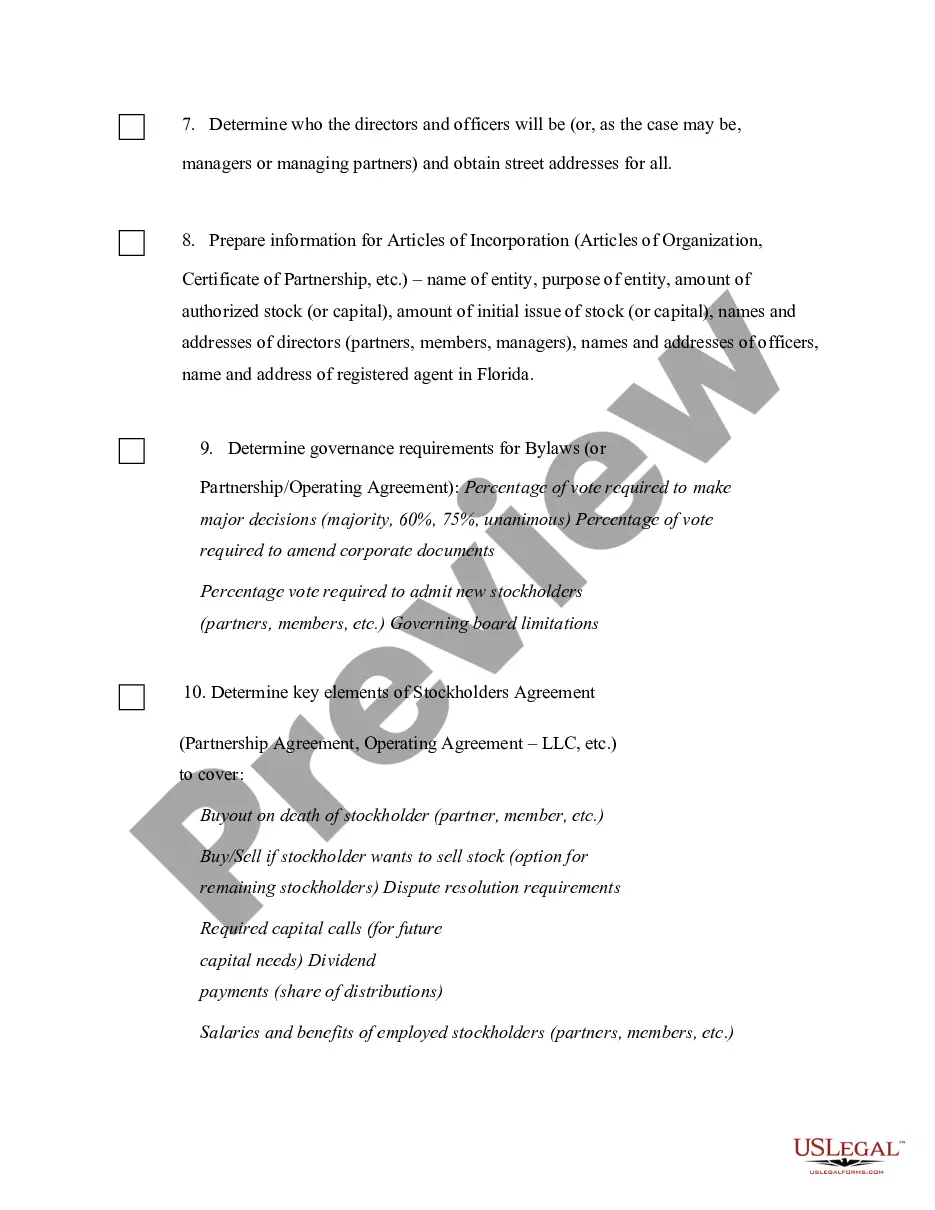

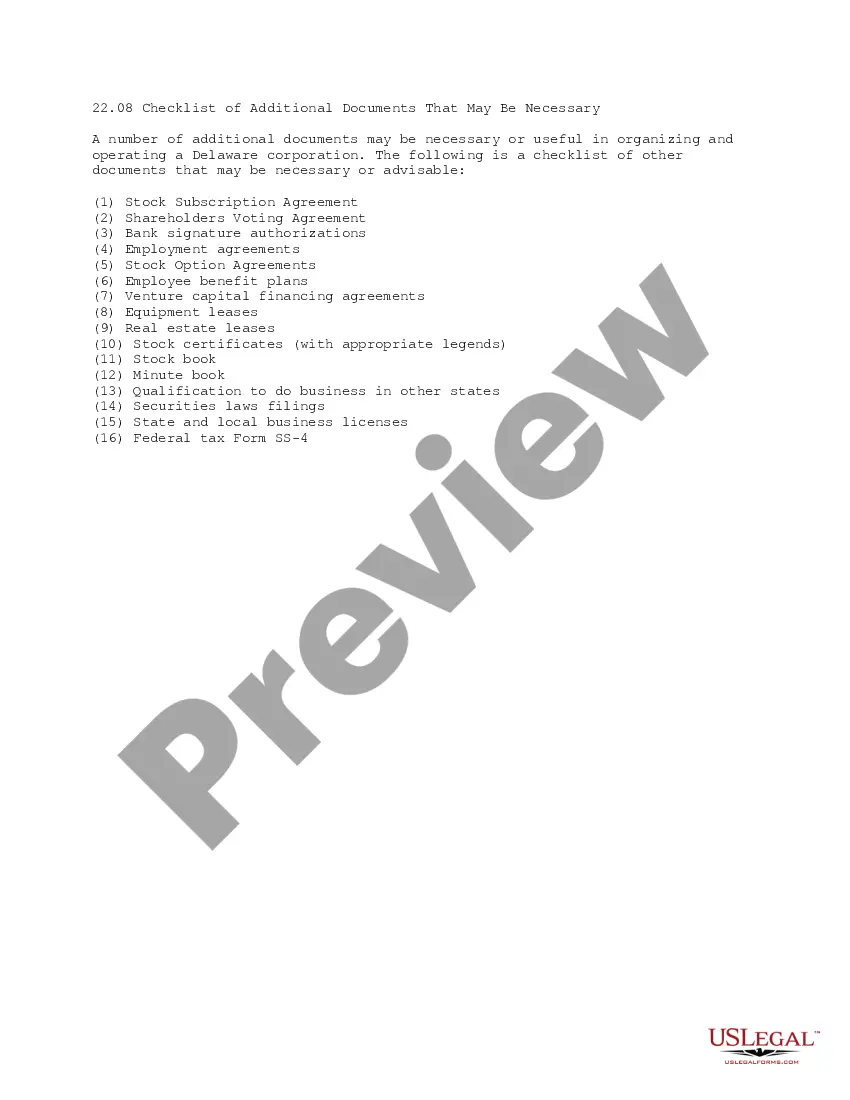

Form a Kentucky Corporation: Name Your Corporation. Designate a Registered Agent. Submit Articles of Incorporation. Get an EIN. Write Corporate Bylaws. Hold an Organizational Meeting. Open a Corporate Bank Account. File State Reports & Taxes.

How to Start an LLC in Kentucky (Step-by-Step Guide) #1: Name Your Kentucky LLC. #2: Find a Kentucky Registered Agent. #3: File Articles of Organization. #4: Create an Operating Agreement. #5: Register With the Necessary Tax Authorities. #6:Fulfill Your Ongoing Obligations.

The LLET may be calculated using the lesser of $0.095/$100 of Kentucky gross receipts or $0.75/$100 of Kentucky gross profits. A minimum tax of $175 applies regardless of the method used. Sole proprietorships and pass-through entities are exempt from state corporate income taxes.

The Kentucky interest rate on tax underpayments was 5% in 2022 but has now increased to 8% for 2023. These increased interest rates can be a significant cost to taxpayers who have historically delayed making payments throughout the year.

Annual wages minus the Kentucky standard deduction equals annual Kentucky wages. Compute tax on wages using the 5% Kentucky flat tax rate to determine gross annual Kentucky tax. Divide the gross annual Kentucky tax by the number of annual pay periods to determine the Kentucky withholding tax for the pay period.

To obtain your valid Kentucky Corporation/LLET account number, please contact the Department of Revenue at (502) 564-3306. To submit payment online, visit .

The Secretary of State shall file the original of the certificate and advise the entity of that determination. (3) An entity administratively dissolved continues its existence but shall not carry on any business except that necessary to wind up and liquidate its business and affairs.