Kentucky Bill of Sale Issued Shares

Description

How to fill out Bill Of Sale Issued Shares?

US Legal Forms - one of the largest libraries of legal types in the USA - delivers a wide range of legal file templates you may obtain or printing. Using the web site, you can find a huge number of types for company and person functions, sorted by categories, claims, or keywords.You can find the most recent versions of types such as the Kentucky Bill of Sale Issued Shares in seconds.

If you have a membership, log in and obtain Kentucky Bill of Sale Issued Shares from your US Legal Forms library. The Download switch will show up on every single form you view. You gain access to all earlier acquired types in the My Forms tab of your own profile.

In order to use US Legal Forms initially, allow me to share easy instructions to obtain started out:

- Be sure you have picked out the best form to your city/region. Select the Preview switch to examine the form`s information. Look at the form information to actually have chosen the right form.

- In case the form doesn`t match your demands, take advantage of the Research industry at the top of the screen to find the the one that does.

- In case you are happy with the shape, verify your option by visiting the Get now switch. Then, choose the rates program you like and provide your qualifications to register for the profile.

- Approach the deal. Make use of Visa or Mastercard or PayPal profile to complete the deal.

- Pick the file format and obtain the shape on your own gadget.

- Make alterations. Fill out, modify and printing and indicator the acquired Kentucky Bill of Sale Issued Shares.

Every single design you added to your money does not have an expiry date and it is the one you have forever. So, if you would like obtain or printing one more copy, just visit the My Forms area and click on around the form you require.

Gain access to the Kentucky Bill of Sale Issued Shares with US Legal Forms, the most considerable library of legal file templates. Use a huge number of skilled and condition-certain templates that satisfy your organization or person requirements and demands.

Form popularity

FAQ

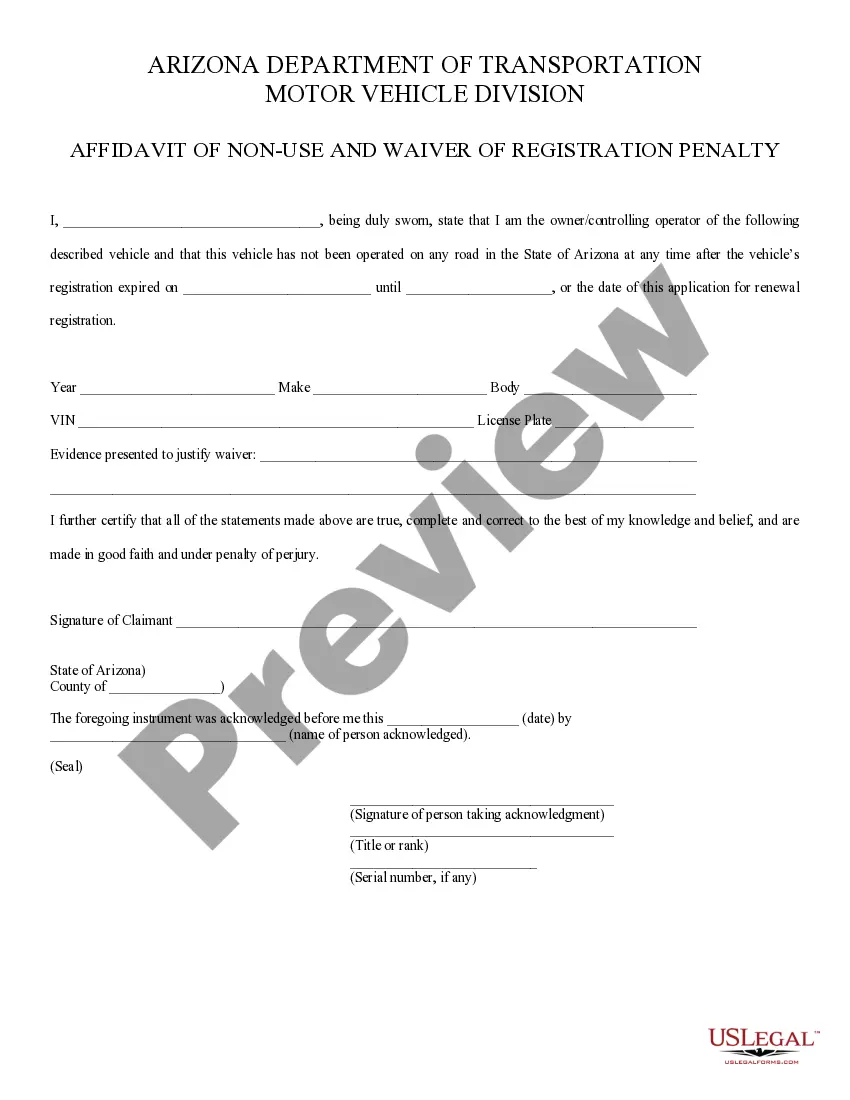

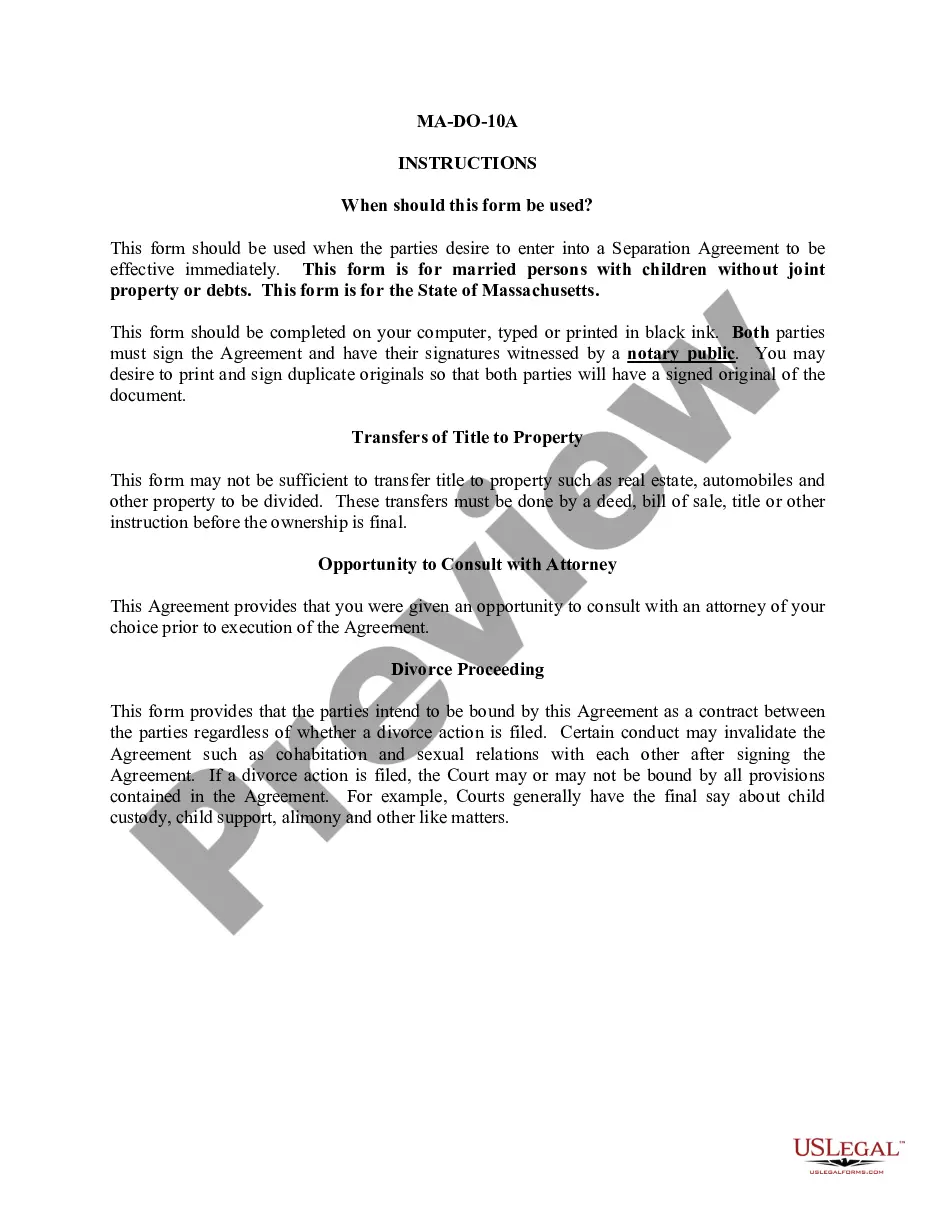

To fill out a stock certificate, you fill in the name of the shareholder, the name of the corporation, the number of shares represented by the certificate, the date, and possibly an identification number. There is also a space for a corporate officer to sign on behalf of the corporation and to affix the corporate seal.

In some sort of written document?it could be a bill of sale or stock certificate?the issuer establishes a price for each share and documents the amount of shares being bought, along with the name of the shareholder and the corporation. A director or officer approves the sale with a signature.

Stock ledgers require the following for every transaction: The number of company shares transferred. The amount paid for the shares. A description of the share type. The names, addresses, and contact information of each shareholder. The updated number of shares for each shareholder.

Issuing new shares typically requires approval from the company's shareholders. This may involve holding a vote at a shareholder meeting or obtaining written consent from a majority of shareholders. The approval process will depend on the company's bylaws and state laws governing the issuance of new shares.

If you hold stocks in physical certificate form and want to sell them, you will have to send the certificate to your broker or the company's transfer agent to execute the sale. You probably will need to get your signature guaranteed. Once the brokerage firm has the stock certificates, the sell order can be executed.

Does a Bill of Sale Have to Be Notarized in Kentucky? In most cases, no. If you are applying for a title on an out-of-state vehicle and your state only issues bills of sale to prove ownership, the signatures on the bill of sale must be notarized.

A share certificate should be signed by two company directors or one director and the company secretary. For companies with a single director and no company secretary, the company director should sign in the presence of a witness who attests to his or her signature.

To sell a security for which you hold a physical certificate: check with your broker-dealer to see if they accept delivery of physical certificates, and if so, deliver the certificate to your broker-dealer ing to the firm's instructions and with your instructions to sell; or.