"Summary of High Technology Developments Affecting Real Estate Financing" is a American Lawyer Media form. This form is a summary booklet of High Technology affecting real estate financing.

Kentucky Summary of High Technology Developments Affecting Real Estate Financing

Description

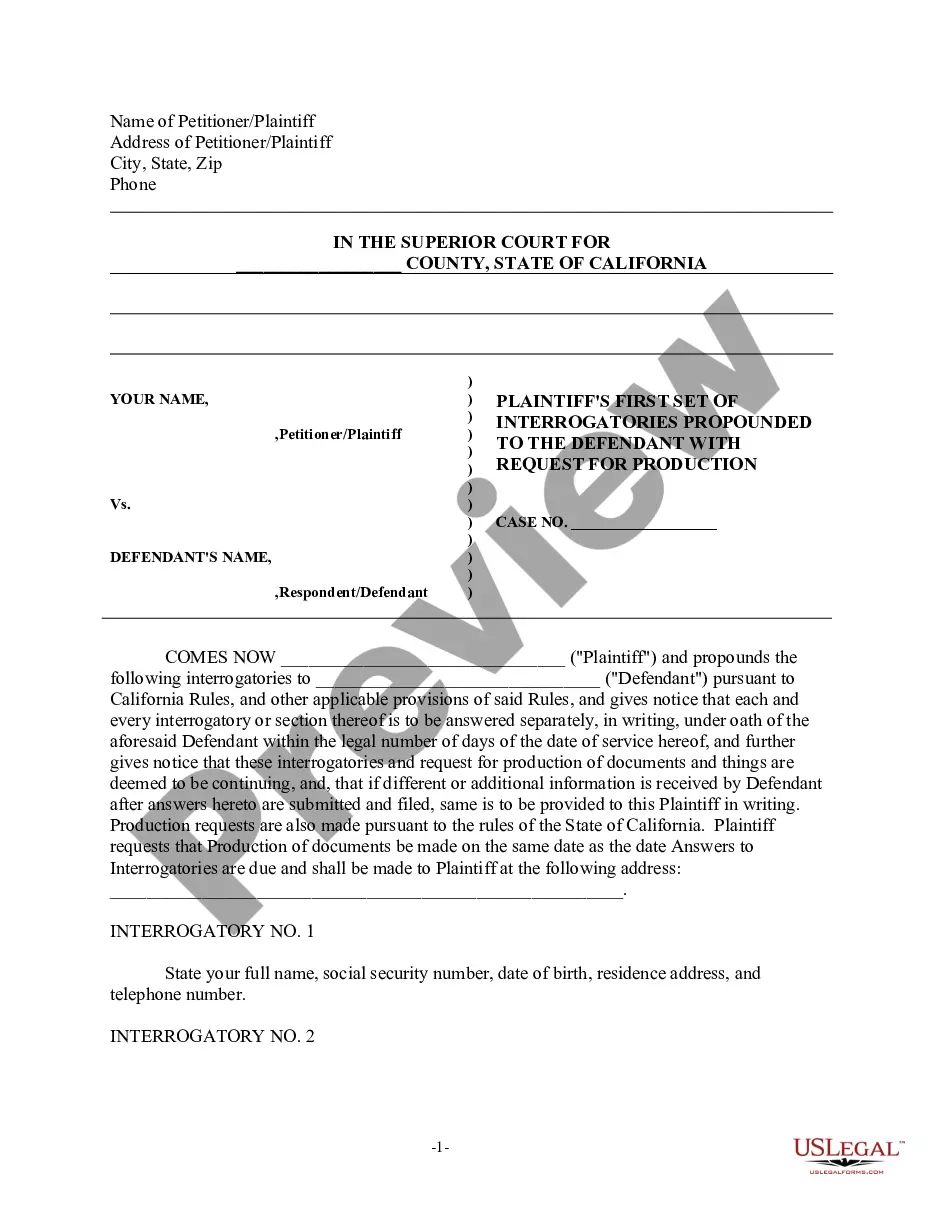

How to fill out Summary Of High Technology Developments Affecting Real Estate Financing?

US Legal Forms - one of several biggest libraries of lawful kinds in the USA - provides a wide range of lawful file templates you are able to download or print. Using the website, you can find 1000s of kinds for business and person reasons, sorted by types, states, or keywords and phrases.You will find the latest types of kinds just like the Kentucky Summary of High Technology Developments Affecting Real Estate Financing in seconds.

If you have a subscription, log in and download Kentucky Summary of High Technology Developments Affecting Real Estate Financing through the US Legal Forms catalogue. The Acquire option will show up on each kind you look at. You have accessibility to all formerly downloaded kinds from the My Forms tab of your bank account.

If you would like use US Legal Forms the very first time, here are straightforward guidelines to get you began:

- Be sure to have chosen the proper kind for your personal metropolis/area. Click the Preview option to review the form`s articles. Browse the kind information to ensure that you have selected the right kind.

- If the kind doesn`t satisfy your requirements, make use of the Search field at the top of the screen to obtain the one which does.

- In case you are pleased with the shape, verify your decision by clicking the Acquire now option. Then, pick the costs program you like and supply your references to register on an bank account.

- Process the transaction. Make use of Visa or Mastercard or PayPal bank account to complete the transaction.

- Select the formatting and download the shape on your system.

- Make modifications. Complete, modify and print and sign the downloaded Kentucky Summary of High Technology Developments Affecting Real Estate Financing.

Each and every template you added to your money lacks an expiry time and is also your own eternally. So, if you wish to download or print an additional version, just visit the My Forms area and click in the kind you require.

Gain access to the Kentucky Summary of High Technology Developments Affecting Real Estate Financing with US Legal Forms, by far the most extensive catalogue of lawful file templates. Use 1000s of skilled and condition-certain templates that fulfill your small business or person needs and requirements.

Form popularity

FAQ

Lesson Summary Listing contract: an agreement between a property owner and a real estate broker. Offer to purchase: a contract between a buyer and seller that outlines the sale of a property. Purchase contract: an agreement that binds two parties to the terms and conditions of a real estate transfer.

The future technology trends in the real estate industry include smart homes, temperature control, smart lighting systems, security systems, data-driven property management systems, business process automation, and virtual property tours.

Seller Disclosure Laws A seller of a single family home must supply buyers with a completed property condition disclosure form. The law in Kentucky states that sellers must reveal any known material defects of a property that may affect its value or desirability.

Property Management and Maintenance: Technology has greatly improved property management processes. Internet of Things (IoT) devices allow for remote monitoring and control of various aspects of a property, including security systems, temperature control, and energy management.

The contract must be in writing and there must be an offer and an acceptance of said offer. In order for a real estate contract to be enforceable by law, it is required to be in writing. 2. The contract must have mutual assent and legal purpose.

To be legally binding as a contract, a promise must be exchanged for adequate consideration. Adequate consideration is a benefit or detriment which a party receives which reasonably and fairly induces them to make the promise/contract.

Kentucky requires that all real estate contracts include a seller's disclosure and a lead-based paint disclosure. such as whether it is free from defects or liens. Addition terms. Terms and conditions agreed upon by both parties like the inclusion of fixtures, appliances, or furniture.

In Kentucky, a seller can get out of a real estate contract if the buyer's contingencies are not met?these include financial, appraisal, inspection, insurance, or home sale contingencies agreed to in the contract. Sellers might have additional exit opportunities with unique situations also such as an estate sale.