Kentucky Geologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Kentucky Geologist Agreement - Self-Employed Independent Contractor?

Are you presently within a placement where you need paperwork for possibly enterprise or person uses almost every time? There are tons of legal record layouts accessible on the Internet, but locating versions you can rely isn`t straightforward. US Legal Forms gives a large number of form layouts, such as the Kentucky Geologist Agreement - Self-Employed Independent Contractor, that happen to be composed to meet state and federal specifications.

In case you are already acquainted with US Legal Forms website and possess a free account, merely log in. Following that, you can down load the Kentucky Geologist Agreement - Self-Employed Independent Contractor format.

If you do not provide an accounts and would like to start using US Legal Forms, follow these steps:

- Discover the form you need and ensure it is to the proper metropolis/state.

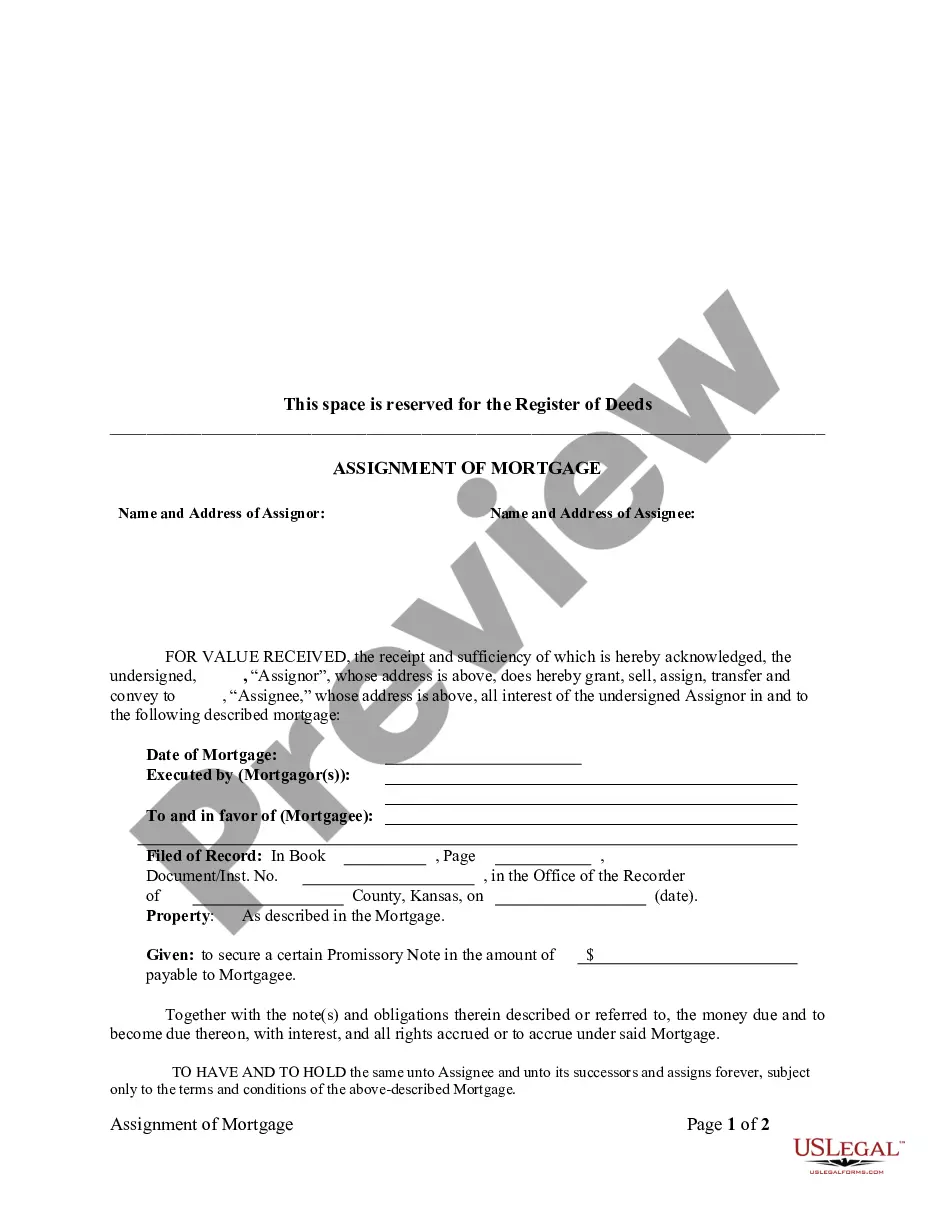

- Take advantage of the Review key to analyze the form.

- See the information to ensure that you have selected the proper form.

- When the form isn`t what you are seeking, make use of the Look for discipline to get the form that fits your needs and specifications.

- If you find the proper form, simply click Buy now.

- Select the costs program you desire, fill in the desired details to make your money, and pay money for the transaction making use of your PayPal or credit card.

- Pick a practical file structure and down load your version.

Find each of the record layouts you have bought in the My Forms menus. You may get a more version of Kentucky Geologist Agreement - Self-Employed Independent Contractor any time, if needed. Just click the required form to down load or print the record format.

Use US Legal Forms, the most considerable variety of legal varieties, to conserve efforts and steer clear of blunders. The service gives professionally manufactured legal record layouts that can be used for a selection of uses. Create a free account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Paying yourself as an independent contractor Independent contractor pay allows your business the opportunity to stay on budget for projects rather than hire via a third party. As an independent contractor, you will need to pay self-employment taxes on your wages. You will file a W-9 with the LLC.