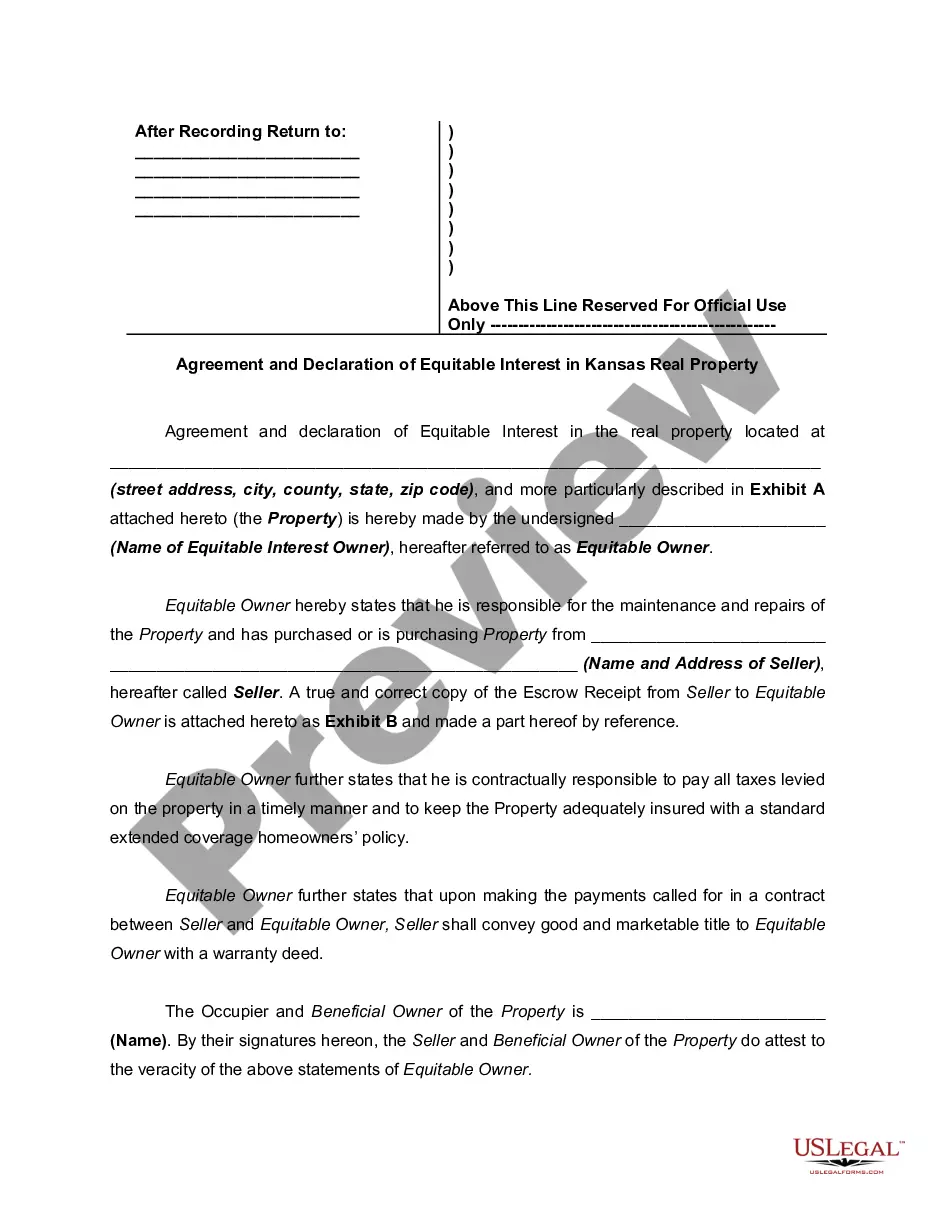

Kentucky Self-Employed Bathroom Remodeling Services Contract

Description

How to fill out Kentucky Self-Employed Bathroom Remodeling Services Contract?

It is possible to invest hrs on-line looking for the lawful record template that fits the state and federal needs you require. US Legal Forms provides thousands of lawful forms which are evaluated by experts. It is simple to down load or printing the Kentucky Self-Employed Bathroom Remodeling Services Contract from your support.

If you already have a US Legal Forms accounts, you can log in and click on the Acquire button. Next, you can comprehensive, change, printing, or indicator the Kentucky Self-Employed Bathroom Remodeling Services Contract. Every lawful record template you buy is your own permanently. To obtain yet another backup associated with a bought kind, proceed to the My Forms tab and click on the related button.

If you use the US Legal Forms internet site for the first time, keep to the straightforward instructions beneath:

- Initial, be sure that you have chosen the proper record template for the state/metropolis of your choice. Look at the kind description to make sure you have picked out the right kind. If accessible, make use of the Preview button to search from the record template as well.

- In order to discover yet another edition of your kind, make use of the Search discipline to get the template that meets your requirements and needs.

- Once you have discovered the template you would like, click on Buy now to carry on.

- Choose the rates program you would like, type your qualifications, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You can use your charge card or PayPal accounts to purchase the lawful kind.

- Choose the formatting of your record and down load it to your gadget.

- Make modifications to your record if necessary. It is possible to comprehensive, change and indicator and printing Kentucky Self-Employed Bathroom Remodeling Services Contract.

Acquire and printing thousands of record templates while using US Legal Forms web site, which offers the largest collection of lawful forms. Use skilled and status-certain templates to take on your company or individual requirements.

Form popularity

FAQ

Nevertheless, independent contractors are usually responsible for paying the Self-Employment Tax and income tax. With that in mind, it's best practice to save about 2530% of your self-employed income to pay for taxes. (If you're looking to automate this, check out Tax Vault!)

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

What percent do independent contractors pay in taxes? The self-employment tax rate is 15.3%, of which 12.4% goes to Social Security and 2.9% goes to Medicare. Income tax obligations vary based on net business profits and losses, among other factors.

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

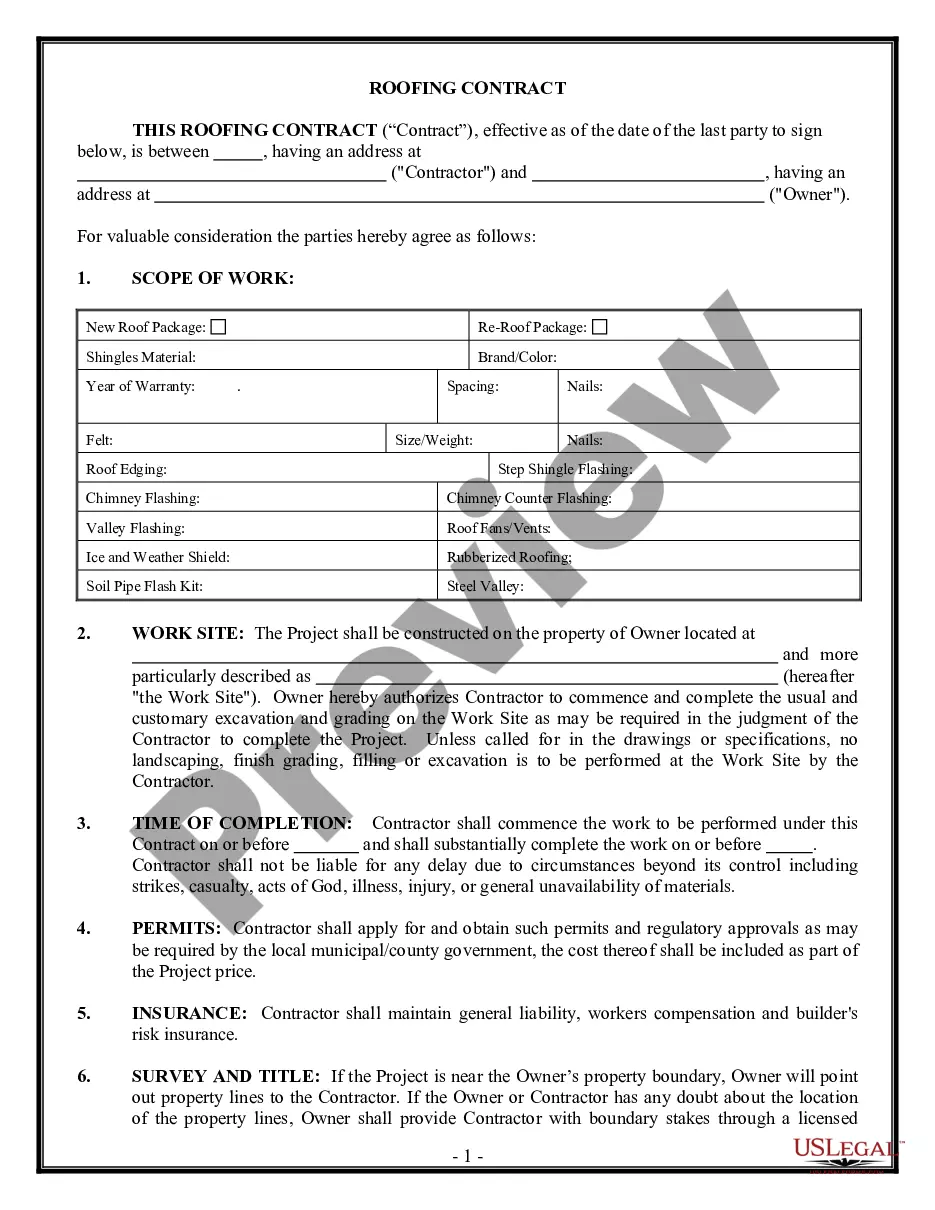

8 Things Every Remodeling Contract Should HaveScope of Work, Selection Sheet and Drawings.License Number and Insurance.Description of Change Orders.Warranty information.Subcontractor Agreements.Payment schedule.Completion Schedule / Timeline.Clauses Required by Law.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

While being an independent contractor means you have to pay more in self-employment taxes, there is an upside: You can take business deductions. These business deductions reduce the amount of profit you pay income taxes on. You'll report these deductions along with your income on Schedule C.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.