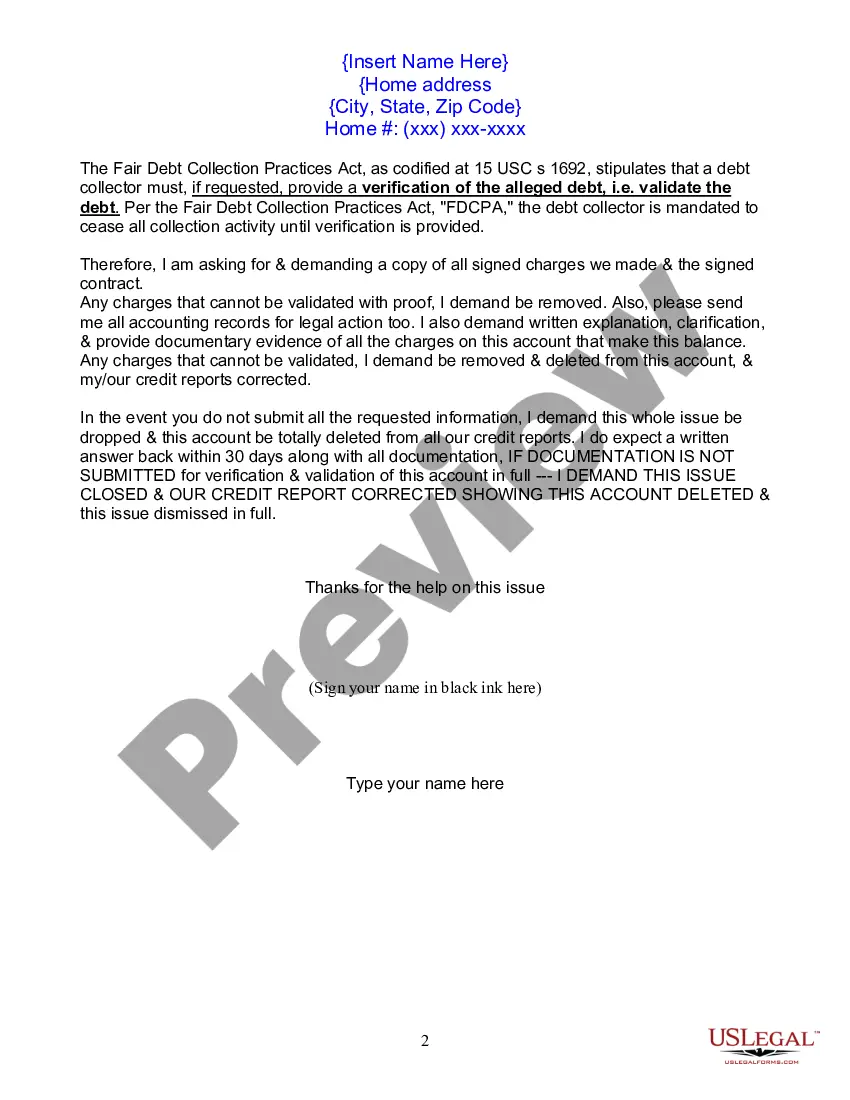

This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

623 Dispute Letter Sample

Description

How to fill out Kentucky Letter Of Dispute - Complete Balance?

Are you presently in a placement in which you will need papers for either business or personal uses virtually every day time? There are tons of lawful record templates accessible on the Internet, but discovering ones you can rely on isn`t simple. US Legal Forms gives a large number of kind templates, like the Kentucky Letter of Dispute - Complete Balance, that happen to be written in order to meet state and federal requirements.

When you are presently informed about US Legal Forms website and possess your account, merely log in. After that, you may down load the Kentucky Letter of Dispute - Complete Balance design.

Unless you provide an account and would like to begin using US Legal Forms, adopt these measures:

- Find the kind you will need and ensure it is for your proper metropolis/area.

- Use the Preview key to check the shape.

- Browse the explanation to actually have selected the proper kind.

- If the kind isn`t what you are searching for, make use of the Search area to find the kind that fits your needs and requirements.

- When you find the proper kind, click Acquire now.

- Opt for the prices program you want, submit the required details to generate your account, and buy an order with your PayPal or Visa or Mastercard.

- Pick a hassle-free document file format and down load your copy.

Discover each of the record templates you possess purchased in the My Forms food selection. You can obtain a further copy of Kentucky Letter of Dispute - Complete Balance any time, if needed. Just click on the essential kind to down load or produce the record design.

Use US Legal Forms, by far the most comprehensive assortment of lawful types, to save time and stay away from errors. The support gives appropriately produced lawful record templates that you can use for a range of uses. Generate your account on US Legal Forms and start generating your lifestyle a little easier.

Form popularity

FAQ

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit reportit's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices. Written by Natasha Wiebusch, J.D..

Section 604(g) of the FCRA prohibits consumer reporting agencies from providing consumer reports that contain medical information for employment purposes, or in connection with credit or insurance transactions, without the specific prior consent of the consumer who is the subject of the report.

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices. Written by Natasha Wiebusch, J.D..

Get the free 604 act letter form Instructions 1 Write the name and account number of the creditor in question under the Item in Dispute section 2 Write in the reason for your dispute in the Reason for Dispute section 3 Sign and mail to the appropriate credit... Easy to use and adds a lot of efficiency to my workflow!

A 611 credit dispute letter references Section 611 of the FCRA. It requests that the credit bureau provide the method of verification they used to verify a disputed item. It is sent after a credit bureau has responded to a dispute that a negative item has been verified.

The name 623 dispute method refers to section 623 of the Fair Credit Reporting Act (FCRA). The method allows you to dispute a debt directly with the creditor in question as long as you have already filed your complaint with the credit bureau and completed their process.

A 611 credit dispute letter references Section 611 of the FCRA. It requests that the credit bureau provide the method of verification they used to verify a disputed item. It is sent after a credit bureau has responded to a dispute that a negative item has been verified.

A 604 dispute letter asks credit bureaus to remove errors from your report that fall under section 604 of the Fair Credit Reporting Act (FCRA). While it might take some time, it's a viable option to protect your credit and improve your score.