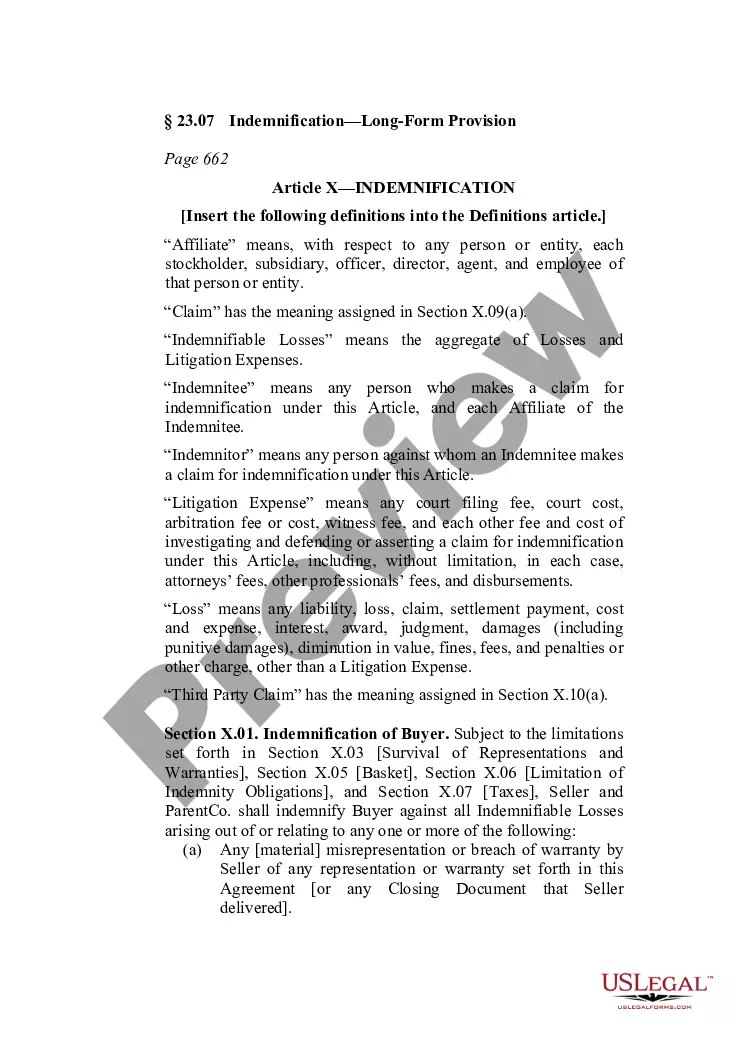

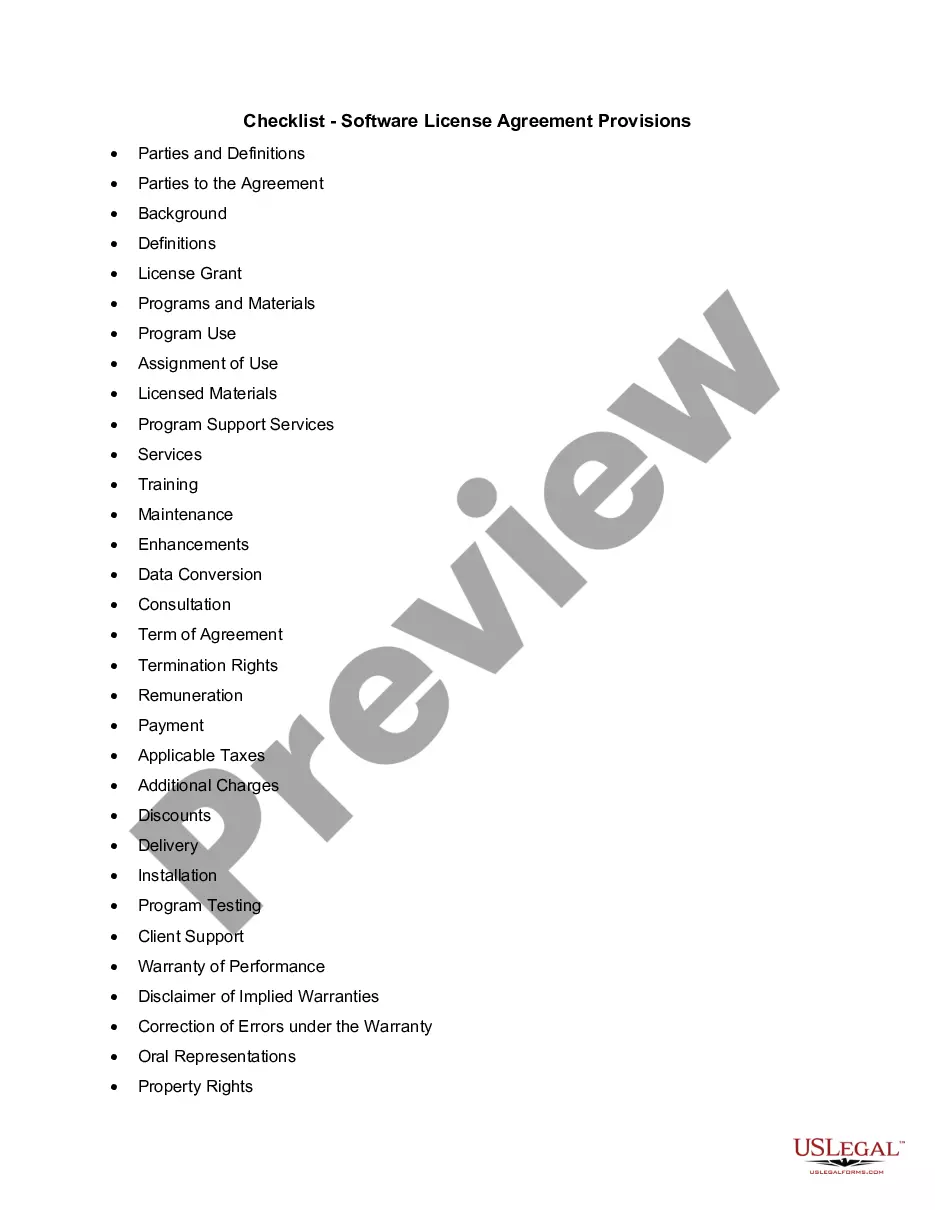

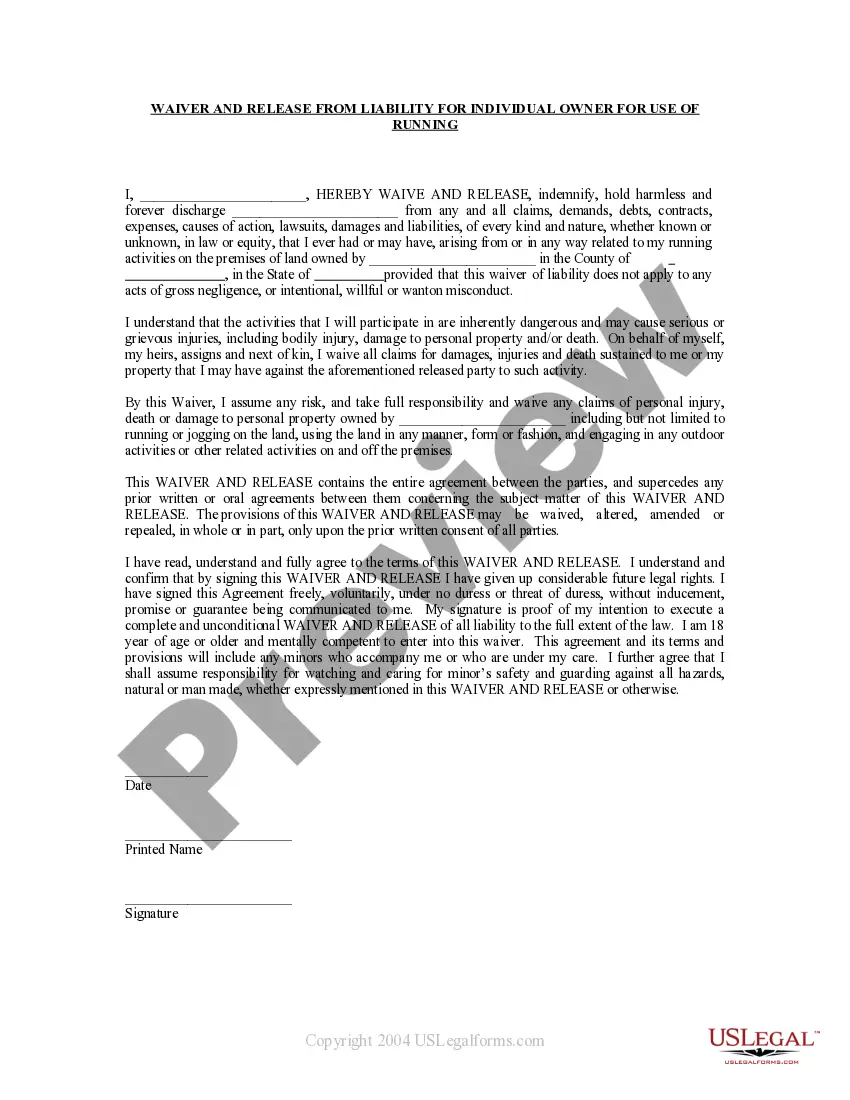

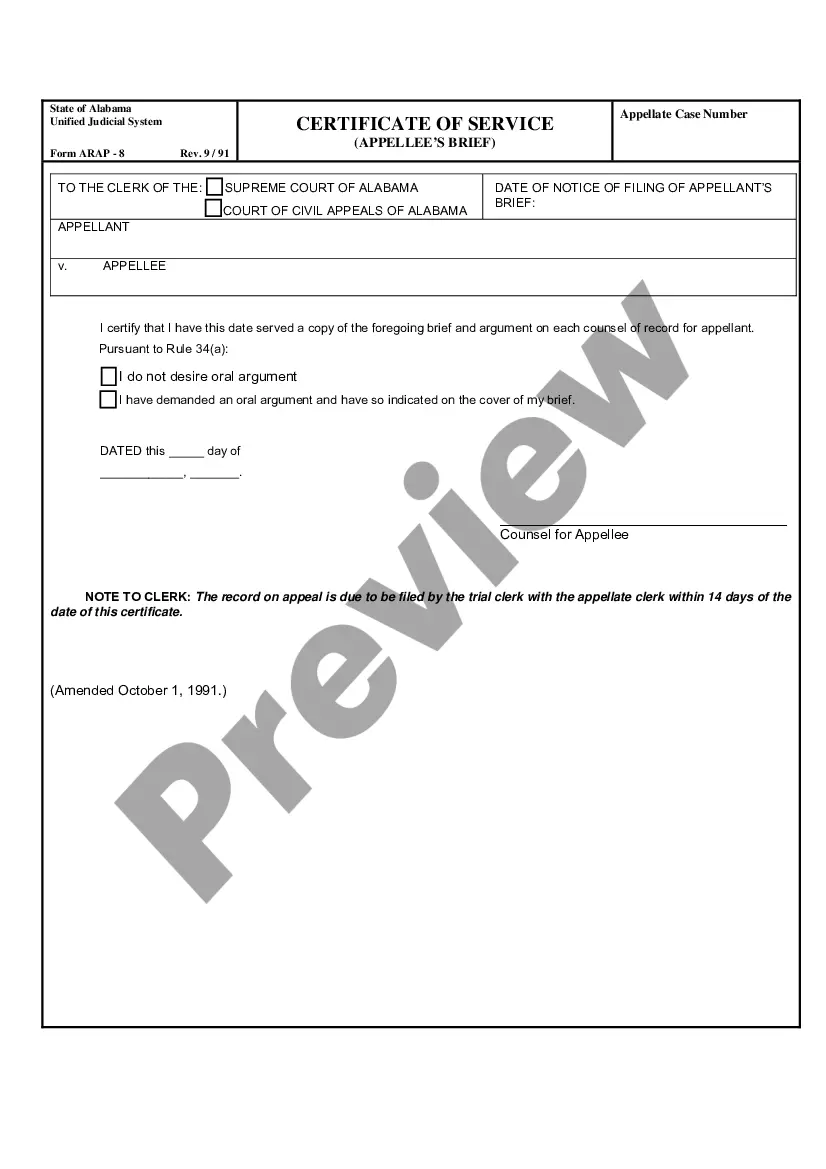

This form provides boilerplate contract clauses that outline the duration of any indemnity under the contract agreement, particularly for tax or environmental claims.

Kentucky Indemnity Provisions - Duration of the Indemnity

Description

How to fill out Indemnity Provisions - Duration Of The Indemnity?

You may devote hours on the web attempting to find the legitimate document format which fits the state and federal requirements you will need. US Legal Forms offers thousands of legitimate forms which can be analyzed by specialists. You can easily acquire or print the Kentucky Indemnity Provisions - Duration of the Indemnity from your services.

If you already possess a US Legal Forms profile, you are able to log in and click the Acquire button. Following that, you are able to comprehensive, revise, print, or signal the Kentucky Indemnity Provisions - Duration of the Indemnity. Every legitimate document format you acquire is your own forever. To acquire one more version of any bought develop, go to the My Forms tab and click the corresponding button.

If you work with the US Legal Forms site for the first time, adhere to the easy directions listed below:

- First, ensure that you have chosen the right document format for that region/metropolis of your choice. See the develop description to ensure you have picked the right develop. If accessible, use the Review button to look through the document format also.

- If you want to discover one more model from the develop, use the Lookup area to discover the format that fits your needs and requirements.

- Once you have found the format you want, click Get now to move forward.

- Pick the prices program you want, enter your references, and register for a merchant account on US Legal Forms.

- Total the deal. You can utilize your Visa or Mastercard or PayPal profile to purchase the legitimate develop.

- Pick the structure from the document and acquire it for your gadget.

- Make changes for your document if needed. You may comprehensive, revise and signal and print Kentucky Indemnity Provisions - Duration of the Indemnity.

Acquire and print thousands of document web templates while using US Legal Forms web site, that provides the greatest assortment of legitimate forms. Use professional and status-distinct web templates to tackle your business or specific needs.