This form brings together several boilerplate contract clauses that work together to outline the procedures, restrictions, exclusivity and other aspects of an indemnity provided for under the terms of the contract agreement. Both short and detailed examples are provided to suit individual needs and circumstances.

Kentucky Putting It All Together - Indemnification Provisions

Description

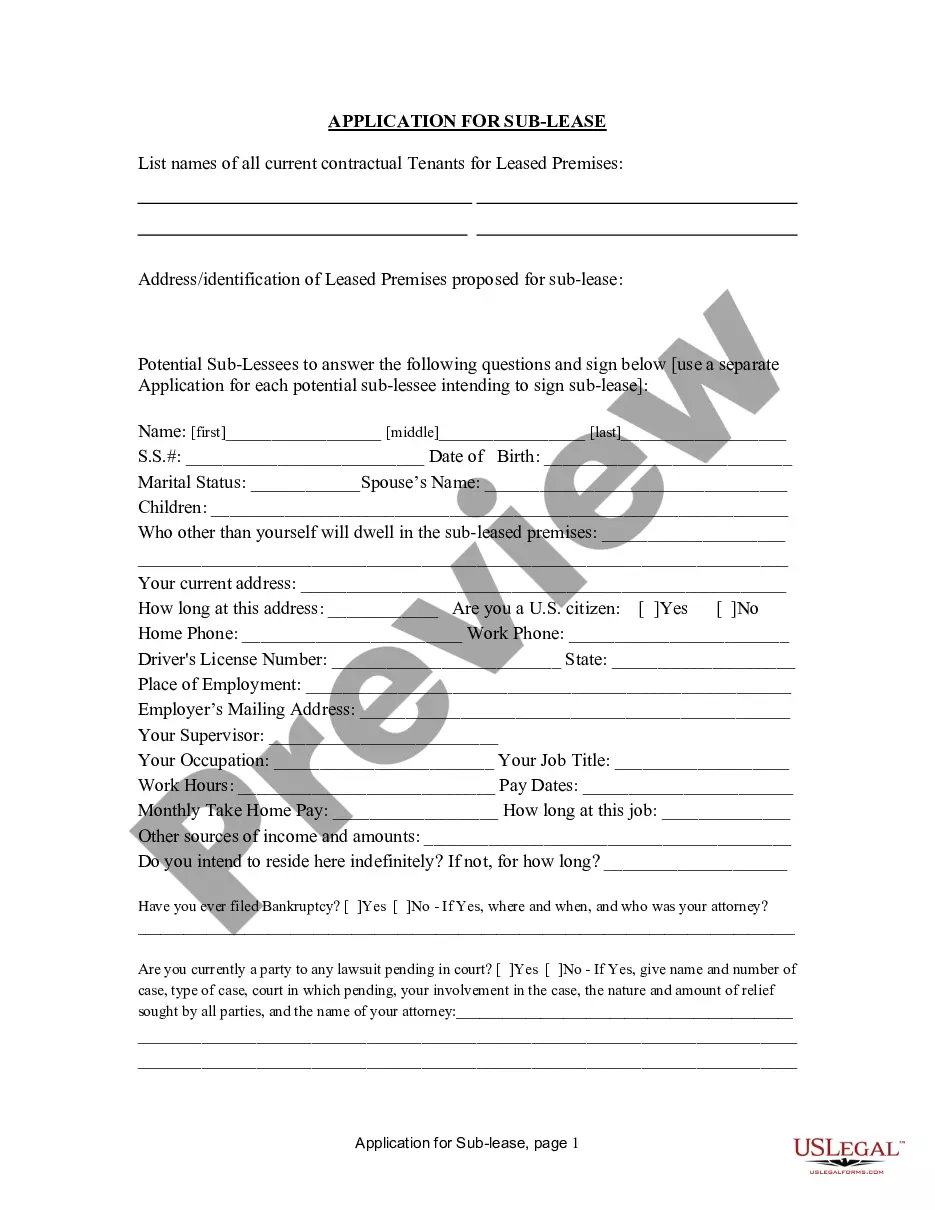

How to fill out Putting It All Together - Indemnification Provisions?

You can commit time on the Internet looking for the lawful papers template that fits the state and federal needs you require. US Legal Forms offers a large number of lawful kinds that are examined by experts. It is possible to down load or print out the Kentucky Putting It All Together - Indemnification Provisions from my assistance.

If you have a US Legal Forms profile, it is possible to log in and click the Obtain key. Afterward, it is possible to full, change, print out, or indicator the Kentucky Putting It All Together - Indemnification Provisions. Each and every lawful papers template you acquire is your own permanently. To have an additional version for any purchased form, go to the My Forms tab and click the corresponding key.

If you use the US Legal Forms web site the very first time, keep to the simple directions beneath:

- Initial, make certain you have chosen the right papers template for that state/metropolis that you pick. Browse the form information to ensure you have picked out the correct form. If offered, take advantage of the Review key to appear from the papers template too.

- In order to get an additional version in the form, take advantage of the Search area to obtain the template that meets your requirements and needs.

- After you have identified the template you want, click Get now to carry on.

- Pick the prices plan you want, key in your credentials, and register for a free account on US Legal Forms.

- Total the transaction. You may use your bank card or PayPal profile to cover the lawful form.

- Pick the formatting in the papers and down load it in your gadget.

- Make modifications in your papers if necessary. You can full, change and indicator and print out Kentucky Putting It All Together - Indemnification Provisions.

Obtain and print out a large number of papers layouts using the US Legal Forms Internet site, that offers the greatest assortment of lawful kinds. Use professional and state-distinct layouts to deal with your organization or specific requires.

Form popularity

FAQ

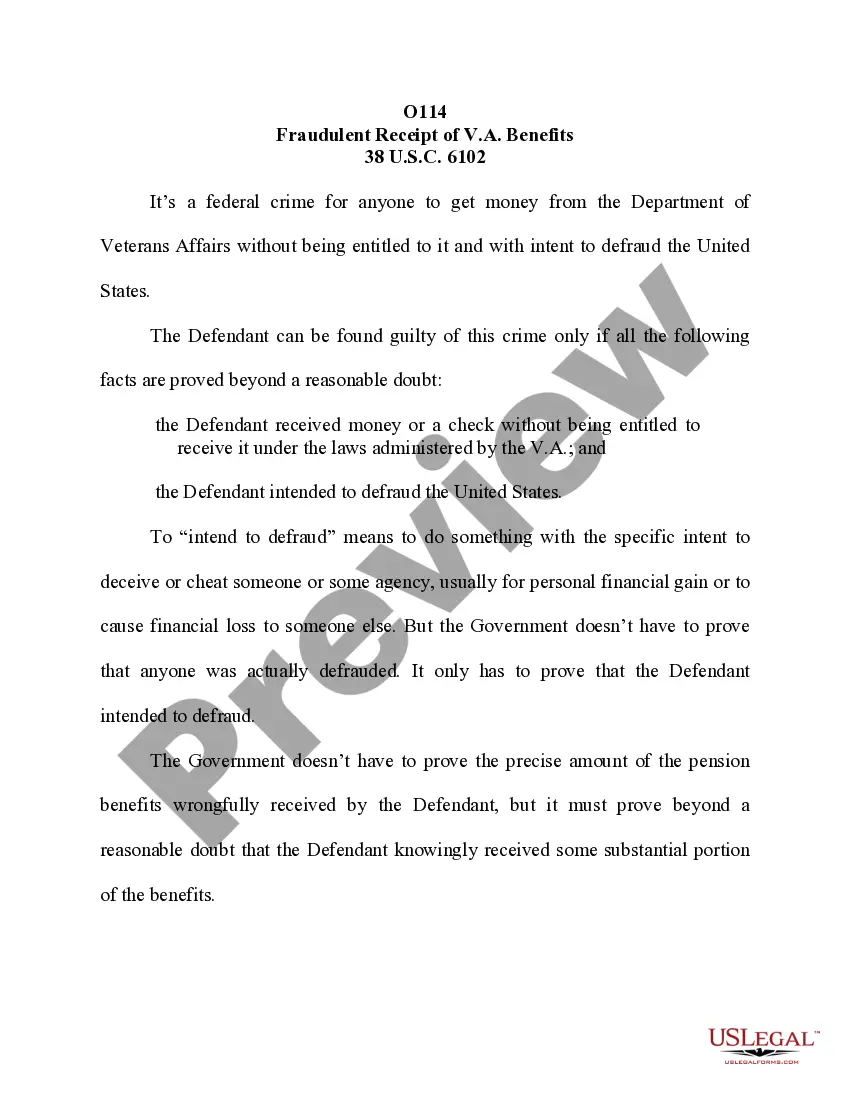

Most indemnification provisions require the indemnifying party to "indemnify and hold harmless" the indemnified party for specified liabilities. In practice, these terms are typically paired and interpreted as a unit to mean "indemnity."

Example 1: A service provider asking their customer to indemnify them to protect against misuse of their work product. Example 2: A rental car company, as the rightful owner of the car, having their customer indemnify them from any damage caused by the customer during the course of the retnal. Indemnification Clause: Meaning & Samples (2022) - Contracts Counsel contractscounsel.com ? indemnification-clause contractscounsel.com ? indemnification-clause

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

In a business transaction, a letter of indemnity (LOI) is a contractual document guaranteeing that specific provisions will be met between two parties in the event of a mishap leading to financial loss or damage to goods. An LOI is drafted by third-party institutions such as banks or insurance companies. What is Letter of Indemnity?| Meaning, Sample, Importance & More dripcapital.com ? en-us ? resources ? blog dripcapital.com ? en-us ? resources ? blog

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

For example, in the case of home insurance, the homeowner pays insurance premiums to the insurance company in exchange for the assurance that the homeowner will be indemnified if the house sustains damage from fire, natural disasters, or other perils specified in the insurance agreement. Indemnity: What It Means in Insurance and the Law - Investopedia investopedia.com ? terms ? indemnity investopedia.com ? terms ? indemnity

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution. What Is a Letter of Indemnity (LOI)? Definition and Example - Investopedia investopedia.com ? terms ? letterofindemnity investopedia.com ? terms ? letterofindemnity