It is not uncommon to encounter a situation where a mineral owner owns all the mineral estate in a tract of land, but the royalty interest in that tract has been divided and conveyed to a number of parties; i.e., the royalty ownership is not common in the entire tract. If a lease is granted by the mineral owner on the entire tract, and the lessee intends to develop the entire tract as a producing unit, the royalty owners may desire to enter into an agreement providing for all royalty owners in the tract to participate in production royalty, regardless of where the well is actually located on the tract. This form of agreement accomplishes this objective.

Kentucky Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common

Description

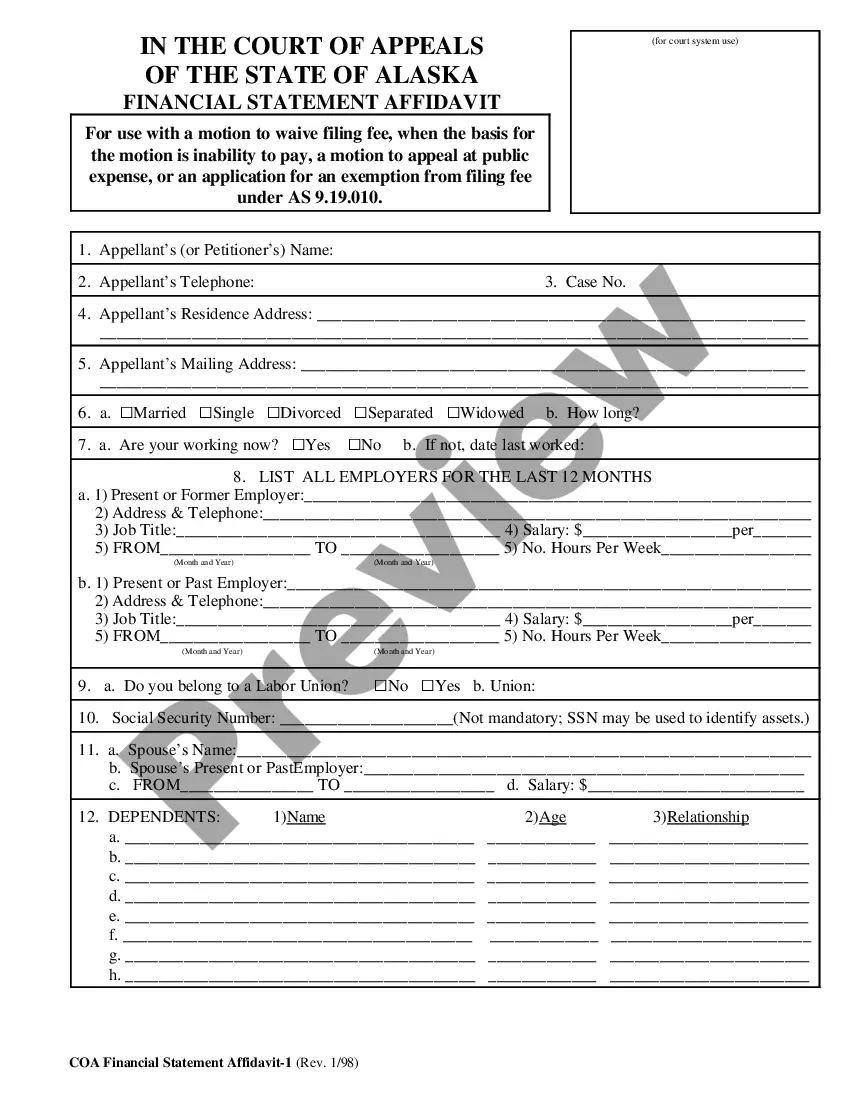

How to fill out Commingling And Entirety Agreement By Royalty Owners Where The Royalty Ownership Is Not Common?

If you want to full, obtain, or print out legal record layouts, use US Legal Forms, the most important variety of legal forms, which can be found on the web. Utilize the site`s easy and handy search to obtain the documents you need. Various layouts for business and personal functions are categorized by types and states, or search phrases. Use US Legal Forms to obtain the Kentucky Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common in a few click throughs.

In case you are presently a US Legal Forms buyer, log in in your accounts and click on the Obtain button to get the Kentucky Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common. Also you can accessibility forms you in the past saved from the My Forms tab of your accounts.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for your right area/region.

- Step 2. Utilize the Review solution to examine the form`s information. Never forget about to see the outline.

- Step 3. In case you are not happy with the kind, utilize the Look for discipline near the top of the display screen to find other models from the legal kind design.

- Step 4. After you have found the form you need, click on the Purchase now button. Choose the costs strategy you favor and add your accreditations to sign up for an accounts.

- Step 5. Procedure the purchase. You may use your bank card or PayPal accounts to finish the purchase.

- Step 6. Select the structure from the legal kind and obtain it on the gadget.

- Step 7. Comprehensive, edit and print out or indicator the Kentucky Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common.

Each and every legal record design you purchase is your own forever. You have acces to each kind you saved with your acccount. Click the My Forms portion and select a kind to print out or obtain once again.

Contend and obtain, and print out the Kentucky Commingling and Entirety Agreement by Royalty Owners Where the Royalty Ownership Is Not Common with US Legal Forms. There are thousands of skilled and express-particular forms you can utilize for the business or personal requirements.