Kentucky Exhibit C Accounting Procedure Joint Operations refers to the accounting practices and procedures followed in joint operations in the state of Kentucky. Joint operations typically occur when two or more parties collaborate to carry out a specific project or business venture, such as oil and gas exploration, mining, or real estate development. In Kentucky, Exhibit C Accounting Procedure Joint Operations serve as guidelines that govern the financial aspects of these collaborations, ensuring accuracy, transparency, and accountability amongst the participating parties. These procedures outline the methodologies and principles used to record, report, and distribute financial information related to joint operations. Key components of Kentucky Exhibit C Accounting Procedure Joint Operations may include: 1. Revenue Recognition: The guidelines determine how revenue generated from the joint operation is recognized and allocated to each participating party. This involves determining the agreed-upon allocation percentages or ratios and ensuring proper documentation of revenue streams. 2. Cost Allocation: The procedures outline how costs incurred during the joint operation are allocated amongst the participants. This includes both direct costs related to the project and indirect costs such as administrative expenses or depreciation. 3. Record-Keeping: The procedures establish record-keeping requirements to ensure all financial transactions, including income, expenses, assets, and liabilities, are accurately documented and reported. This ensures accountability and transparency amongst the participating parties. 4. Financial Reporting: The guidelines govern the preparation and presentation of financial statements for the joint operation. This may involve the use of standardized reporting templates or formats to facilitate consistent reporting across different joint operations. 5. Audit and Review: The procedures may outline the requirements for audits or reviews of the joint operations' financial statements. This can involve engaging external auditors to provide independent verification and assurance of the financial information presented. Different types of Kentucky Exhibit C Accounting Procedure Joint Operations may exist depending on the specific industry or sector involved. For example: 1. Oil and Gas Joint Operations: These procedures are specifically designed for joint ventures or partnerships engaged in oil and gas exploration, drilling, and production activities within Kentucky. 2. Mining Joint Operations: These procedures cater to joint ventures involved in mining operations, including coal mining, mineral extraction, or aggregate production in Kentucky. 3. Real Estate Development Joint Operations: These procedures govern joint ventures focused on real estate development projects, such as residential or commercial property development, construction, and sales within Kentucky. 4. Infrastructure and Energy Joint Operations: These procedures pertain to collaborative projects focused on large-scale infrastructure development, including transportation networks, energy infrastructure, or public utilities within Kentucky. By following Kentucky Exhibit C Accounting Procedure Joint Operations, participants in joint operations can ensure accurate financial reporting, transparent distribution of revenue and costs, and enhanced collaboration and trust amongst the participating parties.

Kentucky Exhibit C Accounting Procedure Joint Operations

Description

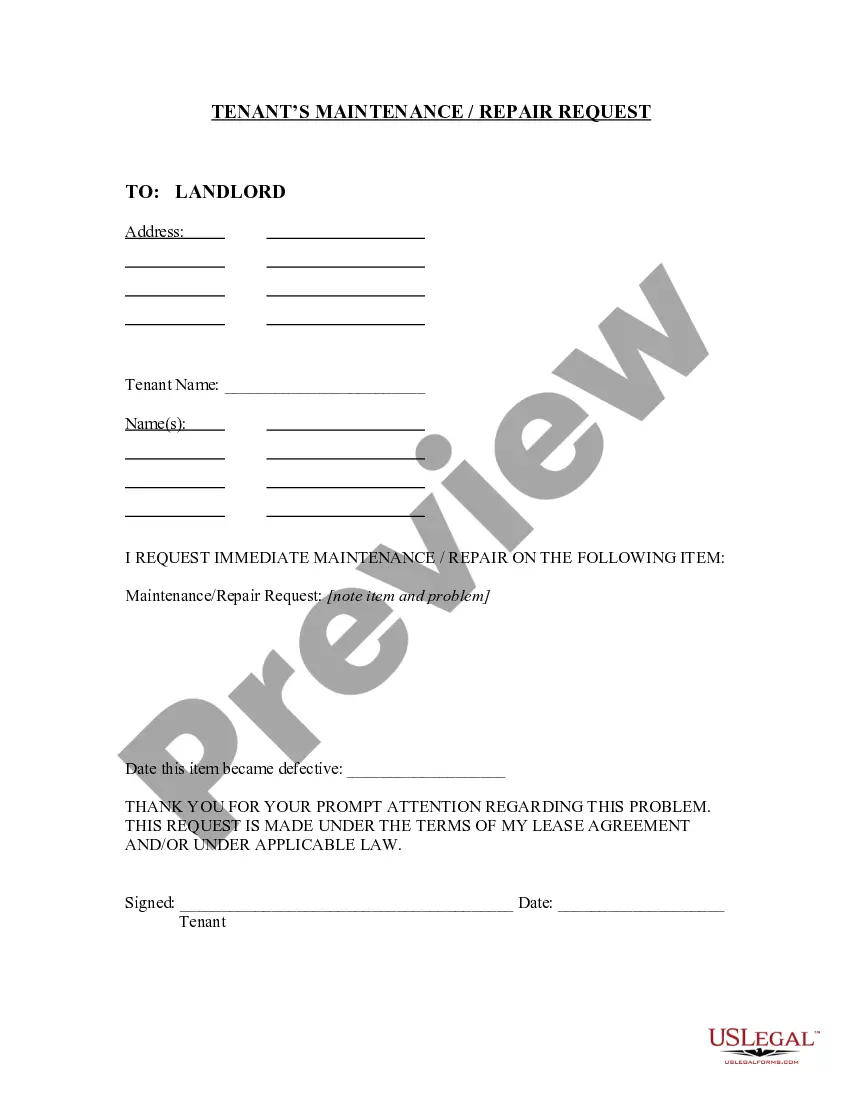

How to fill out Kentucky Exhibit C Accounting Procedure Joint Operations?

Choosing the best lawful papers design might be a struggle. Needless to say, there are tons of web templates available on the net, but how do you discover the lawful develop you need? Take advantage of the US Legal Forms web site. The services offers a huge number of web templates, including the Kentucky Exhibit C Accounting Procedure Joint Operations, that you can use for organization and personal demands. All the forms are checked by specialists and meet federal and state specifications.

If you are currently listed, log in in your accounts and click the Download button to find the Kentucky Exhibit C Accounting Procedure Joint Operations. Use your accounts to appear with the lawful forms you might have purchased in the past. Visit the My Forms tab of your own accounts and get one more copy of your papers you need.

If you are a new customer of US Legal Forms, here are straightforward guidelines that you should follow:

- First, make certain you have selected the appropriate develop for your personal city/county. You are able to look over the form making use of the Preview button and study the form description to make sure it will be the best for you.

- In case the develop fails to meet your needs, make use of the Seach industry to obtain the proper develop.

- When you are certain that the form would work, click on the Acquire now button to find the develop.

- Choose the rates strategy you need and enter the needed details. Build your accounts and pay for the transaction utilizing your PayPal accounts or bank card.

- Choose the data file formatting and download the lawful papers design in your product.

- Total, modify and printing and indicator the received Kentucky Exhibit C Accounting Procedure Joint Operations.

US Legal Forms is the biggest collection of lawful forms that you can see various papers web templates. Take advantage of the service to download skillfully-created documents that follow state specifications.