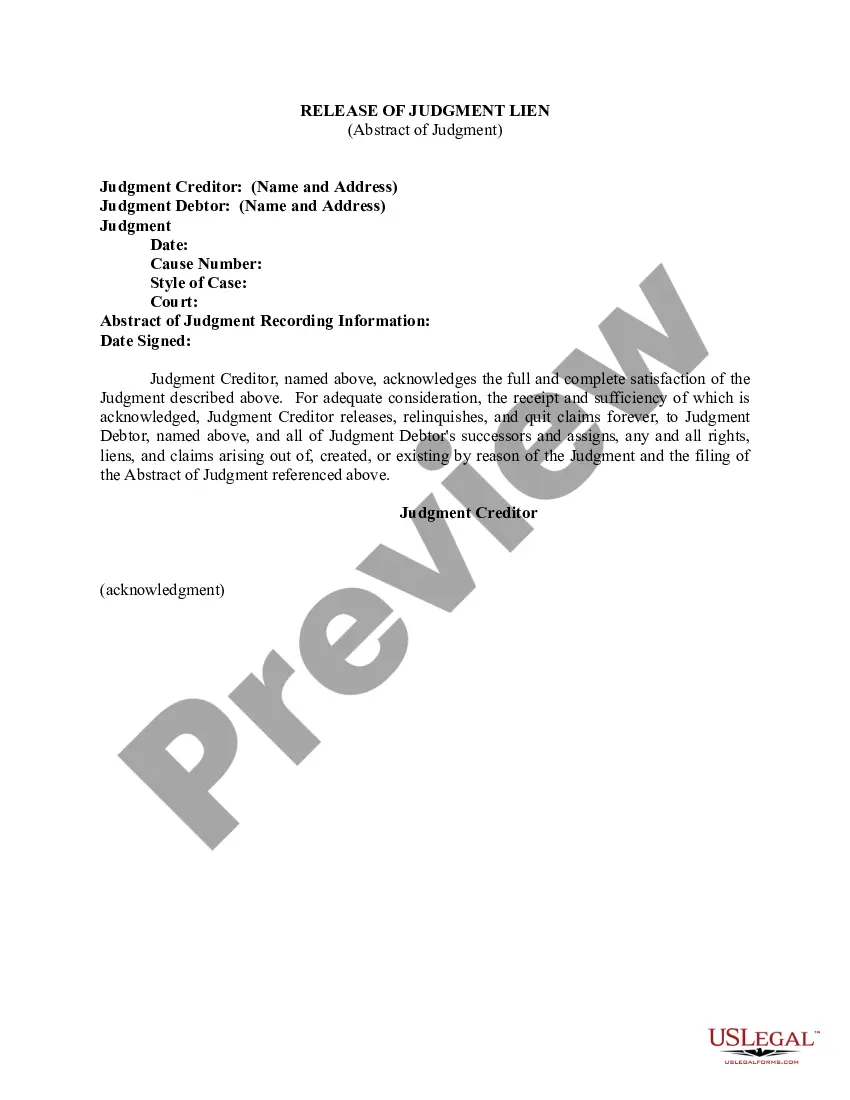

Kentucky Release of Judgment Lien - Abstract of Judgment

Description

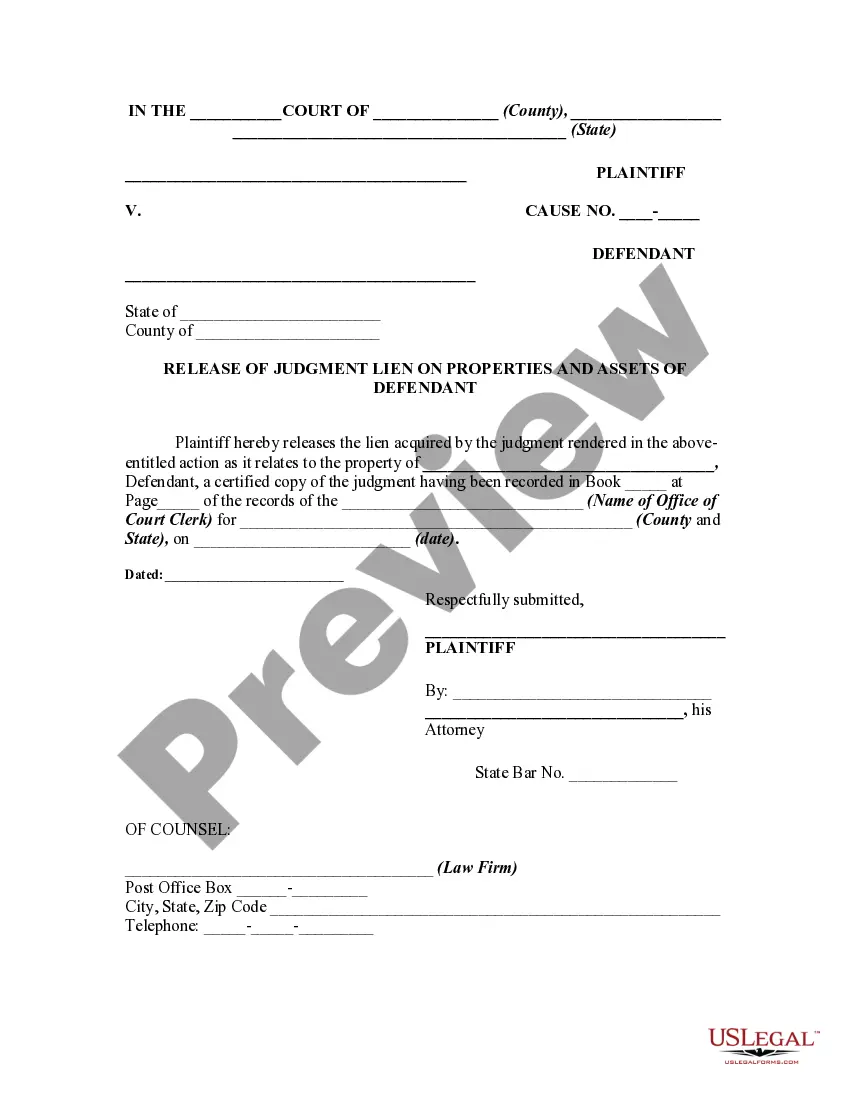

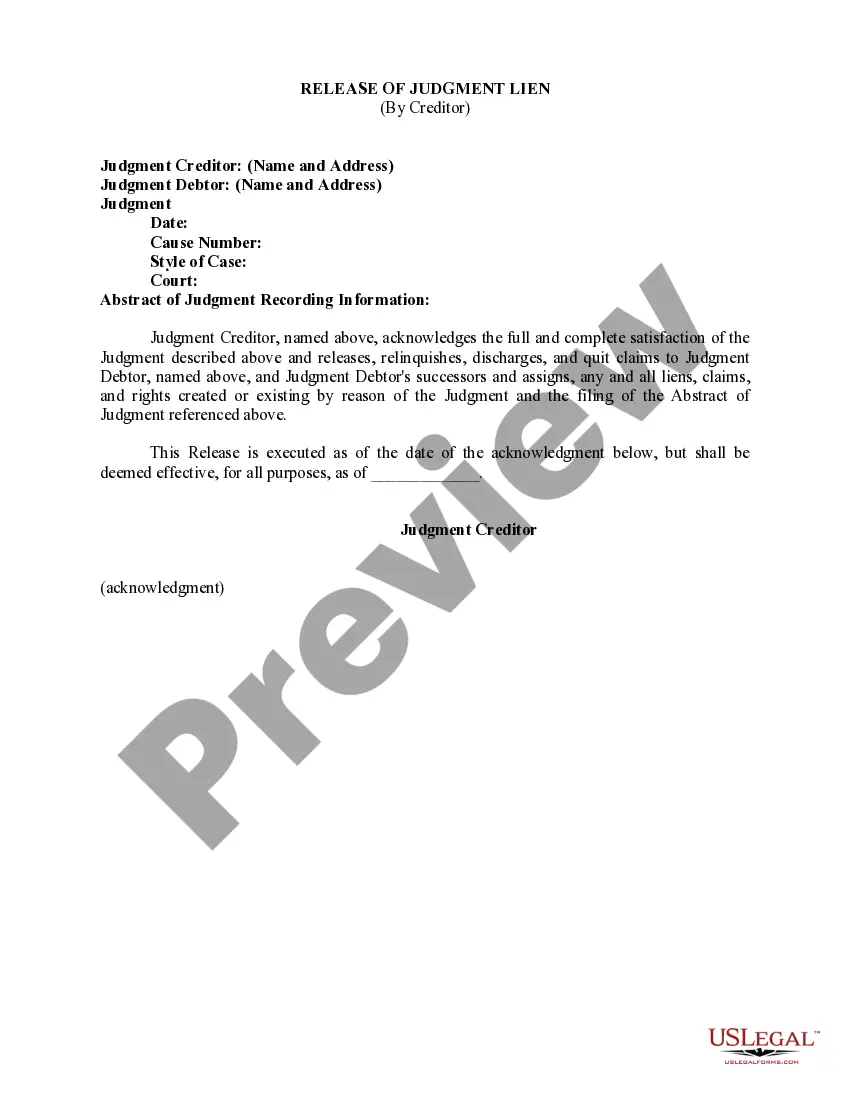

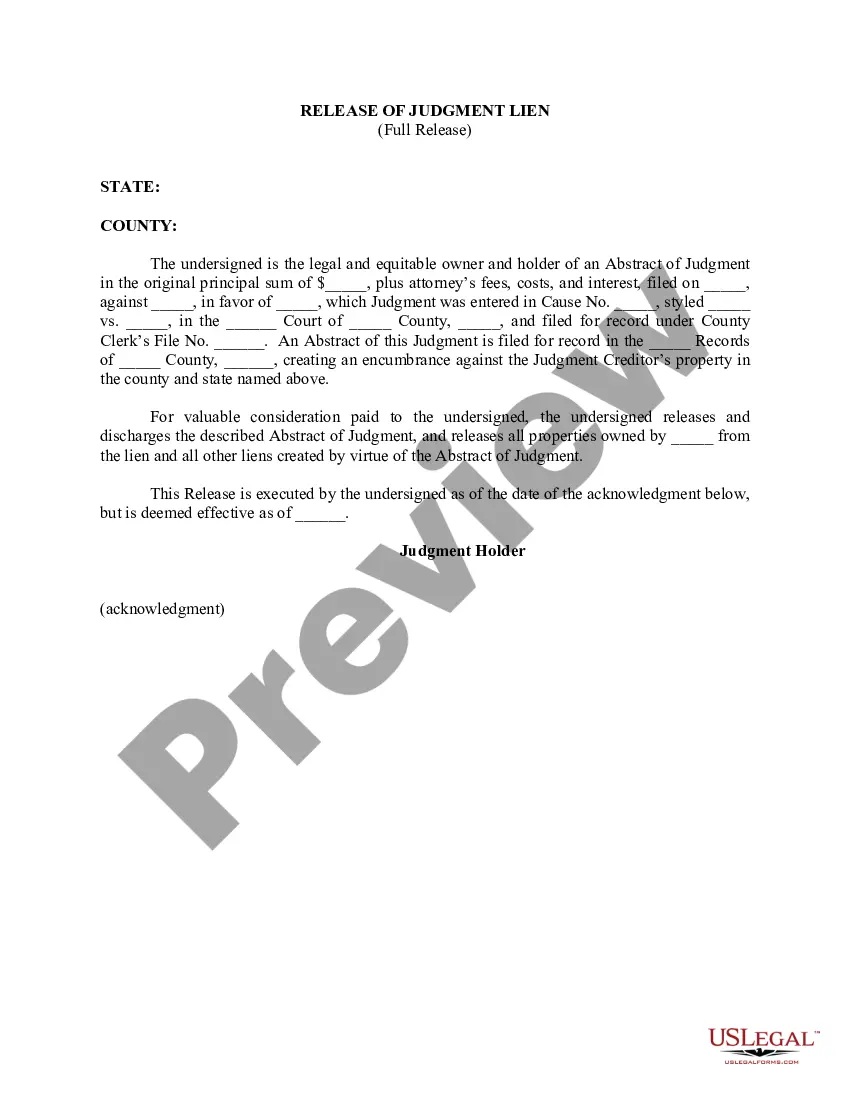

How to fill out Release Of Judgment Lien - Abstract Of Judgment?

If you wish to comprehensive, download, or printing legitimate file themes, use US Legal Forms, the biggest collection of legitimate types, that can be found on-line. Make use of the site`s simple and practical search to discover the files you will need. A variety of themes for business and person uses are sorted by classes and says, or keywords and phrases. Use US Legal Forms to discover the Kentucky Release of Judgment Lien - Abstract of Judgment within a number of mouse clicks.

When you are previously a US Legal Forms consumer, log in for your profile and click the Acquire key to find the Kentucky Release of Judgment Lien - Abstract of Judgment. Also you can gain access to types you previously acquired within the My Forms tab of your respective profile.

If you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for the proper metropolis/region.

- Step 2. Make use of the Review method to look over the form`s content material. Never overlook to see the description.

- Step 3. When you are unsatisfied with the type, take advantage of the Lookup area near the top of the screen to discover other versions from the legitimate type web template.

- Step 4. When you have identified the form you will need, click the Acquire now key. Choose the costs program you favor and put your qualifications to register to have an profile.

- Step 5. Method the transaction. You should use your charge card or PayPal profile to accomplish the transaction.

- Step 6. Pick the formatting from the legitimate type and download it in your device.

- Step 7. Complete, modify and printing or indicator the Kentucky Release of Judgment Lien - Abstract of Judgment.

Each and every legitimate file web template you acquire is your own property permanently. You have acces to each and every type you acquired inside your acccount. Select the My Forms area and choose a type to printing or download once more.

Be competitive and download, and printing the Kentucky Release of Judgment Lien - Abstract of Judgment with US Legal Forms. There are many professional and express-specific types you may use to your business or person needs.

Form popularity

FAQ

Property with a lien attached to it cannot be sold or refinanced until the taxes are paid and the lien is removed.

Generally, you won't be able to get a home equity loan if you have a tax lien. However, if the IRS agrees to subordinate its lien to the home equity lender, you may be able to get a home equity loan as long as you meet the other qualification criteria.

In short, consensual liens do not adversely affect your credit as long as repayment terms are satisfied. Statutory and judgment liens have a negative impact on your credit score and report, and they impact your ability to obtain financing in the future.

To attach a lien, the creditor records the judgment with the county clerk for the Kentucky county where the debtor has property now or may have any property in the future.

If you have a reverse mortgage, then you hold the title, and the lender has a lien. 7 You can't be foreclosed on, provided you maintain the home and stay current with your property charges?including taxes, homeowners insurance, flood insurance (if required), and any homeowners association (HOA) fees.

Releasing a Vehicle Lien To release a lien, the following documents may be mailed, e-mailed or delivered in person: Original Kentucky Title. Completed Release/Termination Statement (TC 96-187) ? we are only able to provide this form to the lien holder.

This form advises the party that a lien will be filed if payment is not received within 10 days. Since this is a non required document, you can deliver it electronically, or via mail. Sendinging documents via certified mail always adds another layer of professionalism to your payment practices.

If there is a federal tax lien on your home, you must satisfy the lien before you can sell or refinance your home. There are a number of options to satisfy the tax lien.