Kentucky Affidavit As to Changes and Alterations Appearing in Oil and Gas Lease

Description

How to fill out Affidavit As To Changes And Alterations Appearing In Oil And Gas Lease?

If you want to comprehensive, obtain, or print legal record themes, use US Legal Forms, the most important collection of legal types, that can be found online. Utilize the site`s simple and convenient look for to discover the documents you require. Various themes for business and individual purposes are sorted by groups and claims, or keywords and phrases. Use US Legal Forms to discover the Kentucky Affidavit As to Changes and Alterations Appearing in Oil and Gas Lease within a few mouse clicks.

If you are currently a US Legal Forms client, log in to the account and click the Acquire key to obtain the Kentucky Affidavit As to Changes and Alterations Appearing in Oil and Gas Lease. You may also accessibility types you formerly downloaded inside the My Forms tab of the account.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form for the appropriate metropolis/nation.

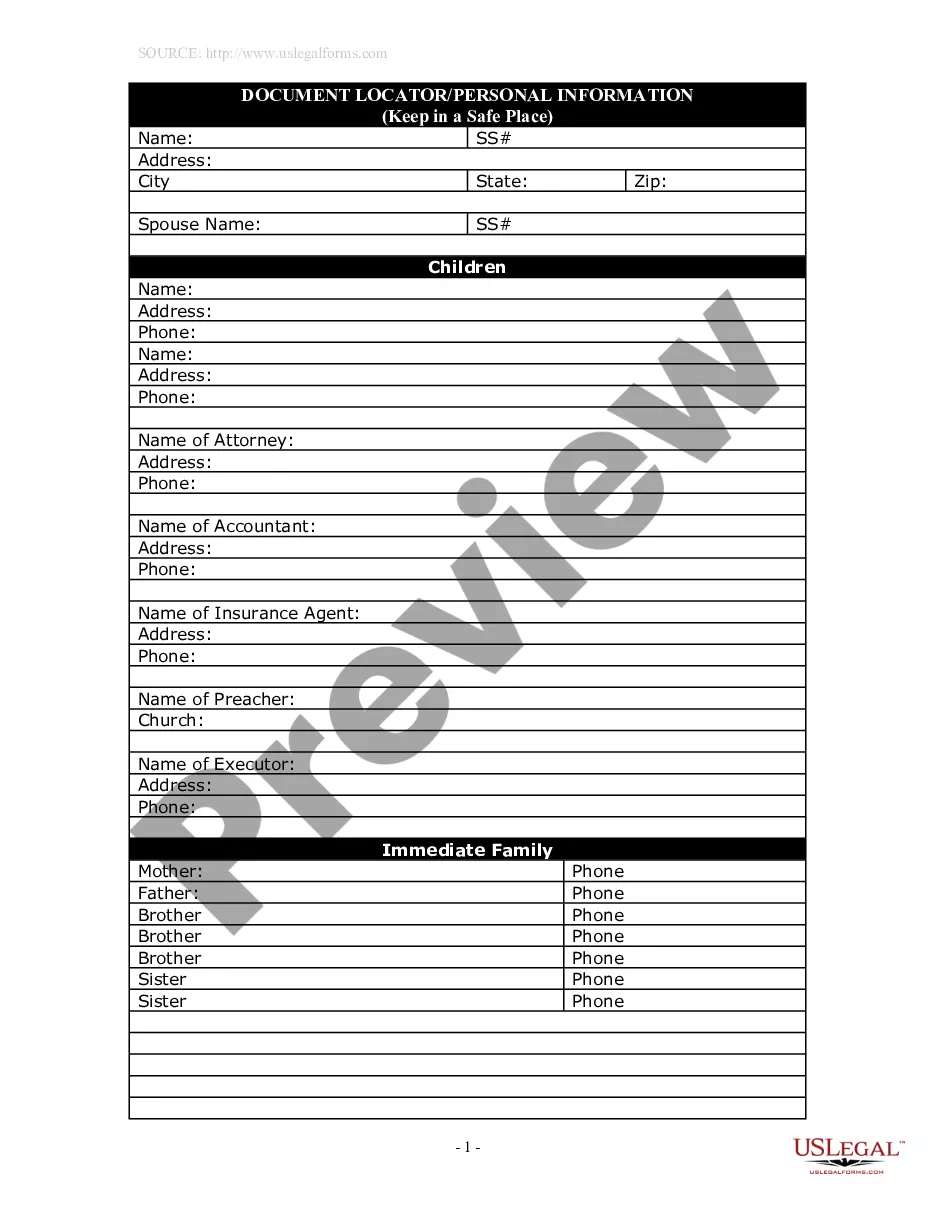

- Step 2. Make use of the Preview method to look over the form`s content material. Don`t overlook to read through the explanation.

- Step 3. If you are not happy together with the kind, use the Lookup field on top of the display to locate other variations in the legal kind web template.

- Step 4. After you have located the form you require, click the Purchase now key. Pick the costs plan you prefer and put your accreditations to register for the account.

- Step 5. Approach the deal. You can utilize your bank card or PayPal account to accomplish the deal.

- Step 6. Find the formatting in the legal kind and obtain it on your device.

- Step 7. Comprehensive, revise and print or indicator the Kentucky Affidavit As to Changes and Alterations Appearing in Oil and Gas Lease.

Each legal record web template you purchase is your own property permanently. You possess acces to each kind you downloaded within your acccount. Select the My Forms segment and select a kind to print or obtain again.

Be competitive and obtain, and print the Kentucky Affidavit As to Changes and Alterations Appearing in Oil and Gas Lease with US Legal Forms. There are thousands of specialist and status-particular types you can use for the business or individual demands.

Form popularity

FAQ

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.