Kentucky Partial Release of Mortgage / Deed of Trust For Landowner

Description

How to fill out Partial Release Of Mortgage / Deed Of Trust For Landowner?

Have you been in the placement the place you will need files for either organization or personal purposes just about every day time? There are a variety of lawful papers themes available on the net, but discovering versions you can trust isn`t easy. US Legal Forms gives a large number of develop themes, like the Kentucky Partial Release of Mortgage / Deed of Trust For Landowner, that are written in order to meet federal and state requirements.

When you are presently familiar with US Legal Forms website and have your account, just log in. Following that, you may download the Kentucky Partial Release of Mortgage / Deed of Trust For Landowner format.

Unless you have an account and would like to begin using US Legal Forms, adopt these measures:

- Discover the develop you need and make sure it is for your appropriate area/county.

- Utilize the Preview option to check the form.

- See the explanation to ensure that you have selected the appropriate develop.

- If the develop isn`t what you are seeking, use the Lookup discipline to discover the develop that fits your needs and requirements.

- When you obtain the appropriate develop, just click Purchase now.

- Choose the prices strategy you would like, fill out the necessary information to produce your money, and purchase an order making use of your PayPal or Visa or Mastercard.

- Select a practical document format and download your copy.

Find each of the papers themes you possess purchased in the My Forms menus. You can aquire a more copy of Kentucky Partial Release of Mortgage / Deed of Trust For Landowner at any time, if possible. Just select the necessary develop to download or print out the papers format.

Use US Legal Forms, probably the most extensive assortment of lawful varieties, to save time as well as steer clear of blunders. The services gives skillfully made lawful papers themes which you can use for a range of purposes. Produce your account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. In Kentucky, most conveyances of real property require a statement of consideration.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateKentuckyYYLouisianaYMaineYMarylandYY47 more rows

Kentucky has a lenient time requirement for probate. ing to the Kentucky Revised Statutes 395.010, it must be completed within 10 years after the person's death. However, it is better to file soon after the person's death and to complete the probate process as quickly as possible.

The tax is computed at the rate of $. 50 for each $500 of value or fraction thereof. A deed cannot be recorded unless the real estate transfer tax has been collected.

The type of foreclosure: If you have a deed of trust, you will usually have a nonjudicial foreclosure. On the other hand, the courts will typically be involved if you have a mortgage. Foreclosure details: When your lender forecloses with a deed of trust, the process will usually take less time and money to complete.

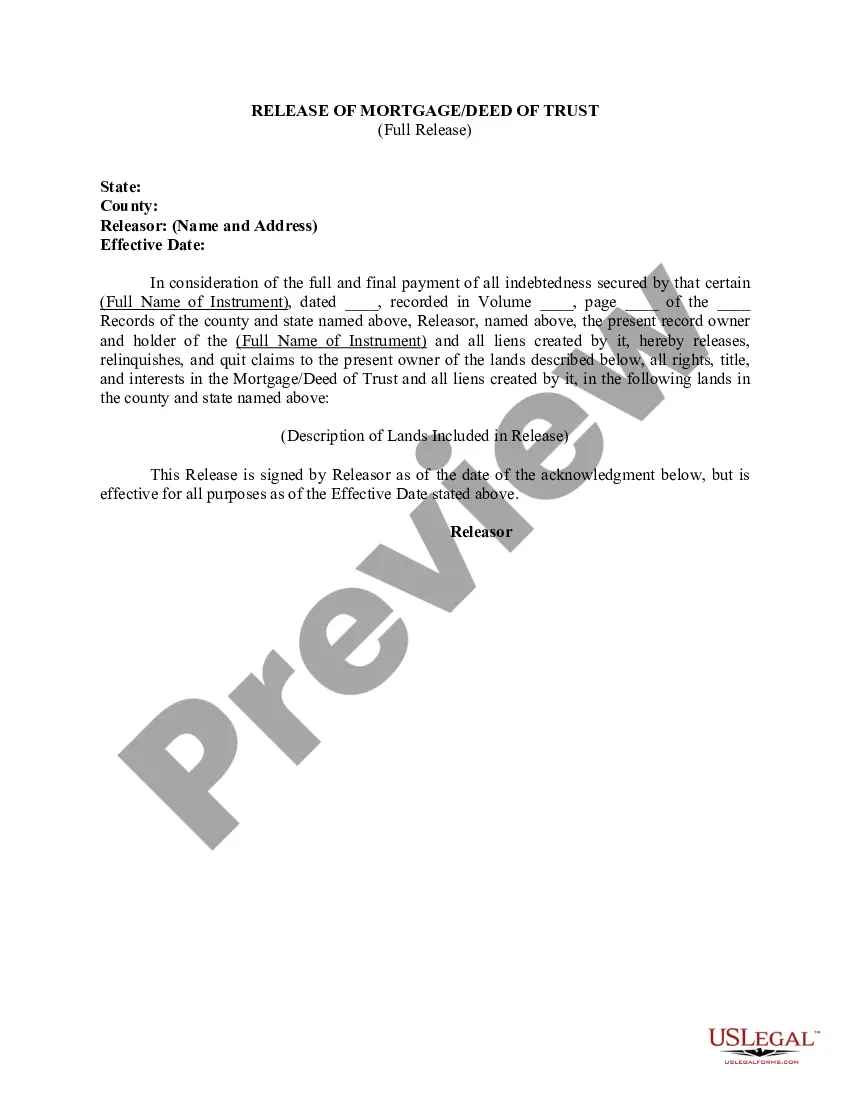

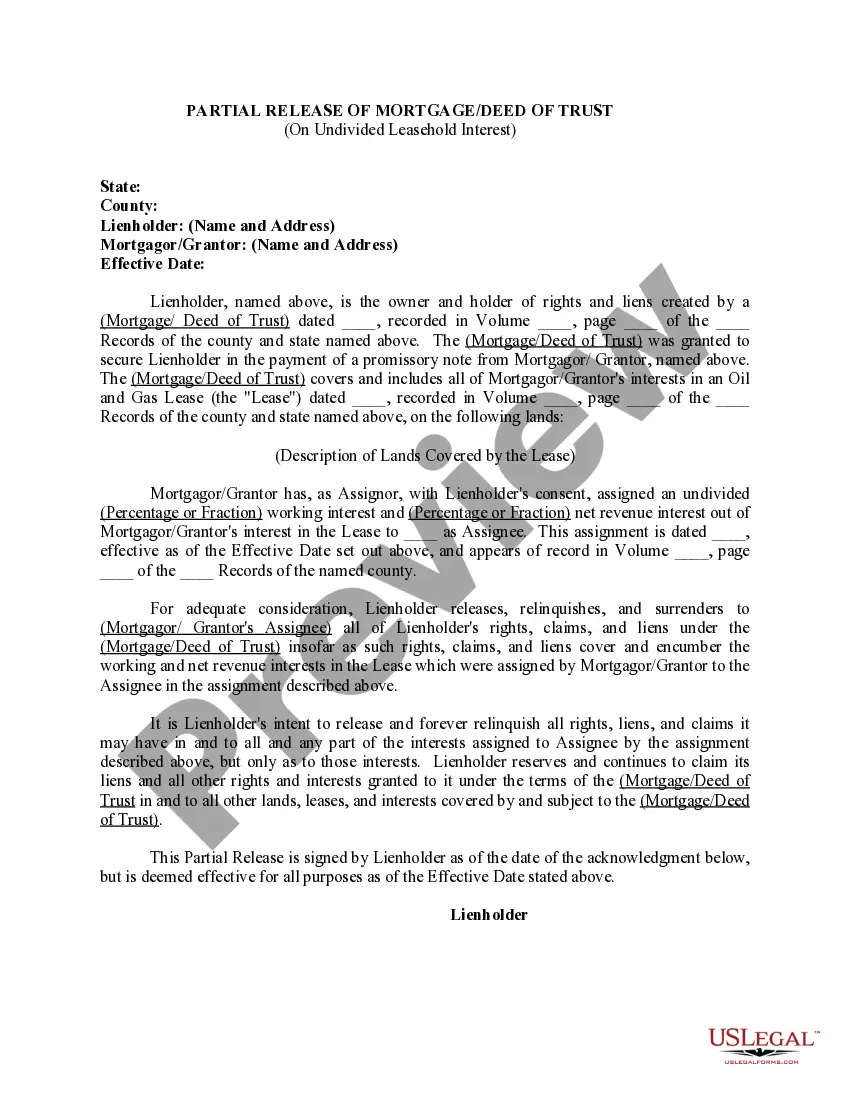

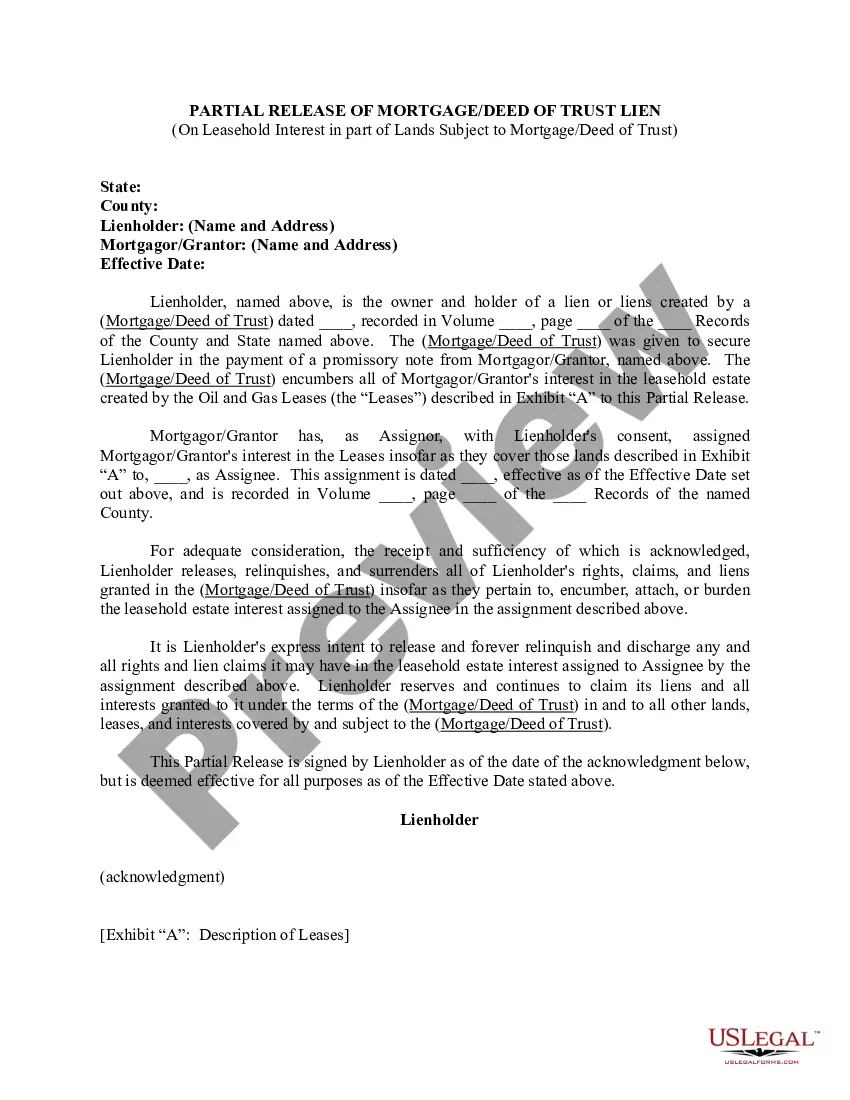

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

The grantor must sign the deed and signatures must be acknowledged (notarized). The grantor and grantee must sign the consideration statement and the signatures must be notarized. The document must be filed in the county clerk's office of the county where the property is located (or the greater part).

Kentucky charges a real estate transfer tax for recording a deed that transfers real estate. The transfer tax rate is $0.50 per $500.00 of the property's value.