The Kentucky State of Delaware Limited Partnership Tax Notice is an official document that outlines the tax obligations, rules, and regulations for limited partnerships established in and operating within the state of Kentucky. This notice serves as an essential resource for limited partnership businesses and individuals involved in such entities, providing important information on taxation requirements and procedures. Kentucky operates under a specific set of tax laws and guidelines for limited partnerships, which are governed by the Delaware state regulations due to the partnership's establishment in Delaware. Therefore, understanding the Kentucky State of Delaware Limited Partnership Tax Notice is crucial to ensure compliance with both Kentucky and Delaware tax obligations. The notice covers various aspects related to limited partnership taxation, including reporting requirements, deadlines, filing procedures, and types of taxes applicable to these entities. The primary types of Kentucky State of Delaware Limited Partnership Tax Notices may include: 1. Kentucky State of Delaware Limited Partnership Income Tax Notice: This notice specifically covers income tax obligations for limited partnerships operating in Kentucky. It highlights the requirements for reporting income, deductions, exemptions, and credits, along with guidelines for completing the necessary tax returns. 2. Kentucky State of Delaware Limited Partnership Sales and Use Tax Notice: This notice focuses on the sales and use tax obligations for limited partnerships engaged in selling taxable goods or services within Kentucky. It provides information on tax rates, taxable sales, exemptions, reporting mechanisms, and payment procedures for sales and use taxes. 3. Kentucky State of Delaware Limited Partnership Withholding Tax Notice: For limited partnerships having employees, this notice details the requirements for withholding and submitting state income taxes from employees' wages. It outlines the rules for calculating withholding amounts, reporting employee earnings, and remitting taxes to the appropriate state agencies. 4. Kentucky State of Delaware Limited Partnership Franchise Tax Notice: The franchise tax notice pertains to the annual franchise tax obligations imposed on limited partnerships by the state of Delaware. It explains the calculation methods, filing procedures, payment deadlines, and consequences of non-compliance with franchise tax requirements. 5. Kentucky State of Delaware Limited Partnership Excise Tax Notice: This notice explains the excise tax obligations applicable to certain limited partnership activities or industries in Kentucky. It provides detailed guidelines on the determination of excise tax liability, reporting procedures, and payment methods. It is important for Kentucky State of Delaware Limited Partnerships to thoroughly review and understand the relevant tax notices to ensure proper compliance and avoid penalties or legal implications. Seeking guidance from tax professionals or legal advisors specializing in partnership taxation is highly recommended navigating these complex tax obligations effectively.

Kentucky State of Delaware Limited Partnership Tax Notice

Description

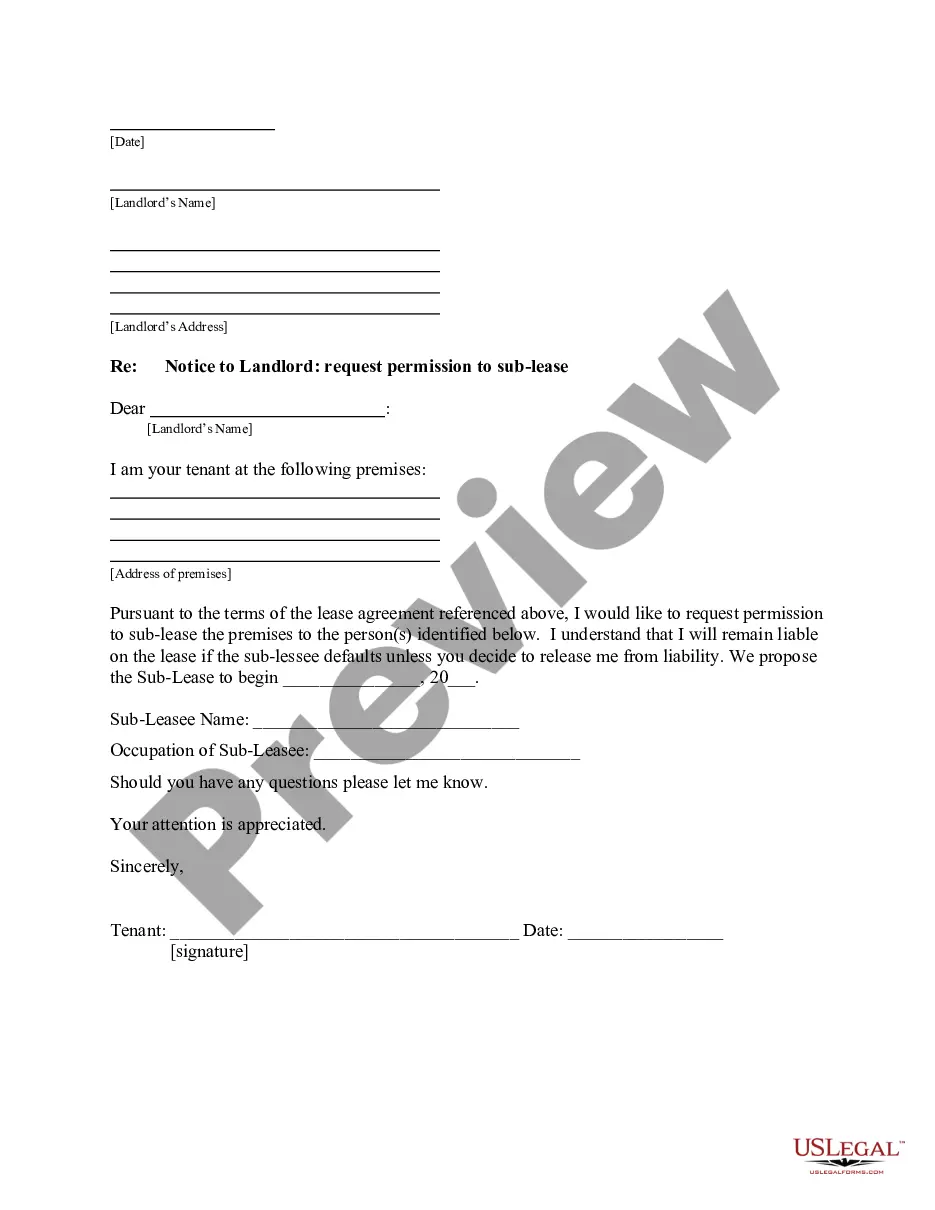

How to fill out Kentucky State Of Delaware Limited Partnership Tax Notice?

It is possible to devote time online looking for the legal record design that meets the state and federal needs you need. US Legal Forms gives thousands of legal varieties which are reviewed by experts. You can easily download or produce the Kentucky State of Delaware Limited Partnership Tax Notice from the assistance.

If you already possess a US Legal Forms profile, you are able to log in and click on the Down load button. Next, you are able to total, edit, produce, or signal the Kentucky State of Delaware Limited Partnership Tax Notice. Every single legal record design you get is your own property permanently. To acquire another copy for any purchased develop, proceed to the My Forms tab and click on the corresponding button.

If you use the US Legal Forms site for the first time, follow the simple instructions listed below:

- First, ensure that you have selected the best record design to the area/area of your choice. Look at the develop description to make sure you have chosen the correct develop. If offered, utilize the Review button to appear throughout the record design at the same time.

- If you wish to discover another version from the develop, utilize the Search field to discover the design that fits your needs and needs.

- Once you have identified the design you want, just click Buy now to move forward.

- Find the prices plan you want, enter your references, and register for your account on US Legal Forms.

- Complete the financial transaction. You should use your credit card or PayPal profile to pay for the legal develop.

- Find the structure from the record and download it in your device.

- Make alterations in your record if required. It is possible to total, edit and signal and produce Kentucky State of Delaware Limited Partnership Tax Notice.

Down load and produce thousands of record templates utilizing the US Legal Forms site, which offers the greatest assortment of legal varieties. Use skilled and condition-distinct templates to take on your company or personal requirements.

Form popularity

FAQ

Qualified dividends are taxed at a maximum rate of 20%. Ordinary dividends are taxed at the same rate as federal income taxes, or between 10% and 37%. State income taxes also may apply. Be cautious when considering investments that pay a high dividend.

Kentucky has a flat income tax of 5%. That rate ranks slightly below the national average. At the same time, cities and counties may impose their own occupational taxes directly on wages, bringing the total tax rates in some areas to up to 8.75%. Both sales and property taxes are below the national average.

Note: While most partnerships in Delaware are not subject to income taxes, they are required to file yearly state income tax returns and are required to pay an annual tax to the Secretary of State.

§6654(a) and 6655(a)]. There is no maximum or minimum for this penalty. Underpayment or Late Payment of Estimated Income Tax or LLET (for tax years beginning before January 1, 2019)- 10 percent for failure to pay any installment of estimated income tax by the time prescribed by law.

The LLET may be calculated using the lesser of $0.095/$100 of Kentucky gross receipts or $0.75/$100 of Kentucky gross profits. A minimum tax of $175 applies regardless of the method used. Sole proprietorships and pass-through entities are exempt from state corporate income taxes.

To obtain your valid Kentucky Corporation/LLET account number, please contact the Department of Revenue at (502) 564-3306. To submit payment online, visit .

Yes, Kentucky requires an addback for: the increase in the limits under IRC Sec. 163(j) for the federal business interest expense deduction; and. expenses from exempt or nonapportionable income.

These partnerships are required by law to file a Kentucky Partnership Income and LLET Return (Form 765). Form 765 is complementary to the federal form 1065. HOW TO OBTAIN ADDITIONAL FORMS. Forms and instructions are available at all Kentucky Taxpayer Service Centers (see page 19).