Kentucky Clawback Guaranty

Description

How to fill out Clawback Guaranty?

If you have to full, acquire, or produce lawful file themes, use US Legal Forms, the biggest assortment of lawful kinds, which can be found on the Internet. Use the site`s simple and easy hassle-free search to find the documents you want. Different themes for company and specific functions are sorted by groups and states, or keywords and phrases. Use US Legal Forms to find the Kentucky Clawback Guaranty with a couple of clicks.

When you are already a US Legal Forms customer, log in in your accounts and click on the Down load button to get the Kentucky Clawback Guaranty. You may also accessibility kinds you formerly acquired in the My Forms tab of your respective accounts.

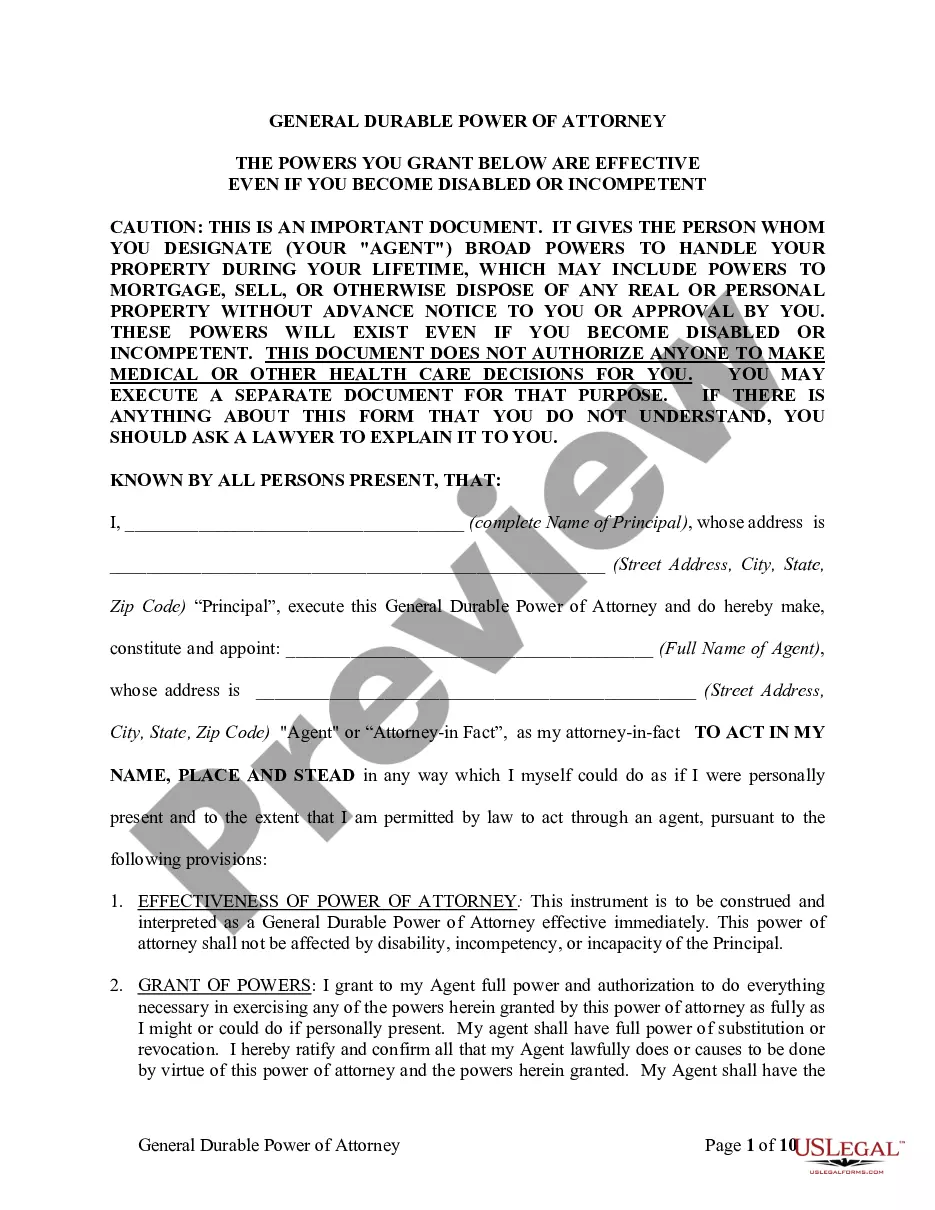

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form to the appropriate area/region.

- Step 2. Use the Review method to look through the form`s information. Do not neglect to read the description.

- Step 3. When you are not satisfied with the develop, take advantage of the Look for field at the top of the display screen to find other versions from the lawful develop design.

- Step 4. Upon having identified the form you want, go through the Purchase now button. Opt for the pricing program you choose and add your accreditations to sign up for the accounts.

- Step 5. Process the purchase. You can use your credit card or PayPal accounts to complete the purchase.

- Step 6. Choose the structure from the lawful develop and acquire it on the device.

- Step 7. Total, revise and produce or indication the Kentucky Clawback Guaranty.

Each lawful file design you purchase is your own property eternally. You possess acces to every single develop you acquired with your acccount. Go through the My Forms area and choose a develop to produce or acquire yet again.

Remain competitive and acquire, and produce the Kentucky Clawback Guaranty with US Legal Forms. There are millions of expert and express-specific kinds you may use for your company or specific requires.

Form popularity

FAQ

The SEC Clawback Rules require that a committee composed of independent directors charged with oversight of executive compensation, or the independent members of the board of directors, must make any determination that the recovery of erroneously awarded compensation would be impracticable.

Employee agrees that the Company shall have the right to require Employee to repay the value of the shares received by Employee pursuant to this Agreement, as may be required by law (including, without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act and implementing rules and regulations ...

For example, a company might initiate a clawback if they offer a bonus to an employee based on their job performance but later discover their assessment of the performance was incorrect. Clawbacks often refer to money, but they might also apply to legal documents and other significant nonmonetary items.

This is a common term of the private equity agreement. To the extent that the general partner receives more than its fair share of profits, as determined by the carried interest, the general partner clawback holds the individual partners responsible for paying back the limited partners what they are owed.

A clawback is a contractual provision whereby money already paid to an employee must be returned to an employer or benefactor, sometimes with a penalty. Many companies use clawback policies in employee contracts for incentive-based pay like bonuses.

Employee agrees that the Company shall have the right to require Employee to repay the value of the shares received by Employee pursuant to this Agreement, as may be required by law (including, without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act and implementing rules and regulations ...

A clawback is a contractual provision that requires an employee to return money already paid by an employer, sometimes with a penalty. Clawbacks act as insurance policies in the event of fraud or misconduct, a drop in company profits, or for poor employee performance.

For example, if fund targeted a 10% annual return but only returned 7% for a period of time, investors known as limited partners may be entitled under the terms of their investment agreement to "claw back" a portion of the carry paid to the general partner to cover the shortfall when the fund closes.