Title: Kentucky Complaint Regarding Insurer's Failure to Pay Claim: Understanding the Legal Recourse and Resolving Disputes Keywords: Kentucky, complaint, insurer, failure to pay-claim, legal recourse, unresolved claims, disputes, insurance regulations, insurance commissioner, bad faith, denied claims. Introduction: In Kentucky, a complaint regarding an insurer's failure to pay a claim is a legally recognized action taken by policyholders to address unresolved claim disputes with their insurance companies. When policyholders face challenges in securing their deserved insurance benefits, filing a complaint can be a crucial step towards seeking resolution. This article aims to provide a detailed description of the Kentucky complaint process, different types of complaints, and steps insured individuals can take to address insurer failure to pay claims. 1. Understanding the Kentucky Complaint Process: — Kentucky Division of Insurance: The Kentucky Department of Insurance oversees the regulation of insurance in the state. The division provides resources, guidance, and a formal process for filing complaints against insurance companies. — Initiating a Complaint: To initiate a complaint, an insured individual needs to fill out a complaint form, provide relevant documentation, and submit it to the Kentucky Department of Insurance. — Investigation and Review: Once a complaint is filed, the department reviews the case and conducts an investigation to determine if the insurer has violated any state insurance regulations. — Legal Action: If the insurer fails to resolve the dispute or pay the claim, pursuing legal action may be necessary to seek justice and compensation for the policyholder. 2. Different Types of Kentucky Complaints: — Delayed Payment Complaints: When an insurer unreasonably delays the payment of a valid claim, policyholders can file a complaint regarding the undue delay and seek appropriate action. — Wrongful Denial Complaints: If an insurer wrongfully denies a valid claim without providing adequate justification or valid reasons, policyholders can file a complaint to challenge the denial. — Unfair Settlement Practices Complaints: These complaints address situations where insurers offer inadequate settlement amounts or engage in unfair practices during the claim settlement process. — Bad Faith Complaints: Policyholders can file complaints against insurers who act in bad faith by intentionally disregarding their obligations under the insurance policy. 3. Steps to Address Insurer's Failure to Pay Claim: — Documenting the Claim: Maintain a detailed record of all communication, policies, evidence of damages, and any other relevant documents related to the claim. — Internal Appeals: Follow the insurer's internal appeal process to address the issue internally before escalating it externally. — Filing a Complaint: Complete the complaint form provided by the Kentucky Division of Insurance, providing accurate and comprehensive information about the claim and the insurer's failure to pay. — Cooperation: Cooperate with the investigation process initiated by the Kentucky Department of Insurance, providing any additional documentation or information required. — Seeking Legal Advice: Consult with an attorney experienced in insurance law to explore your legal rights and options, especially if negotiations with the insurer have been unsuccessful. Conclusion: Kentucky policyholders facing an insurer's failure to pay-claim have legal recourse through the complaint process. Whether dealing with delayed payment, wrongful denial, unfair settlement practices, or bad faith, understanding the steps to address such issues and seeking appropriate legal advice can help policyholders navigate the complexities of insurance disputes and potentially obtain the compensation they deserve. By resorting to the Kentucky complaint process, individuals can strive for a fair resolution to their claim-related predicaments.

Kentucky Complaint regarding Insurer's Failure to Pay Claim

Description

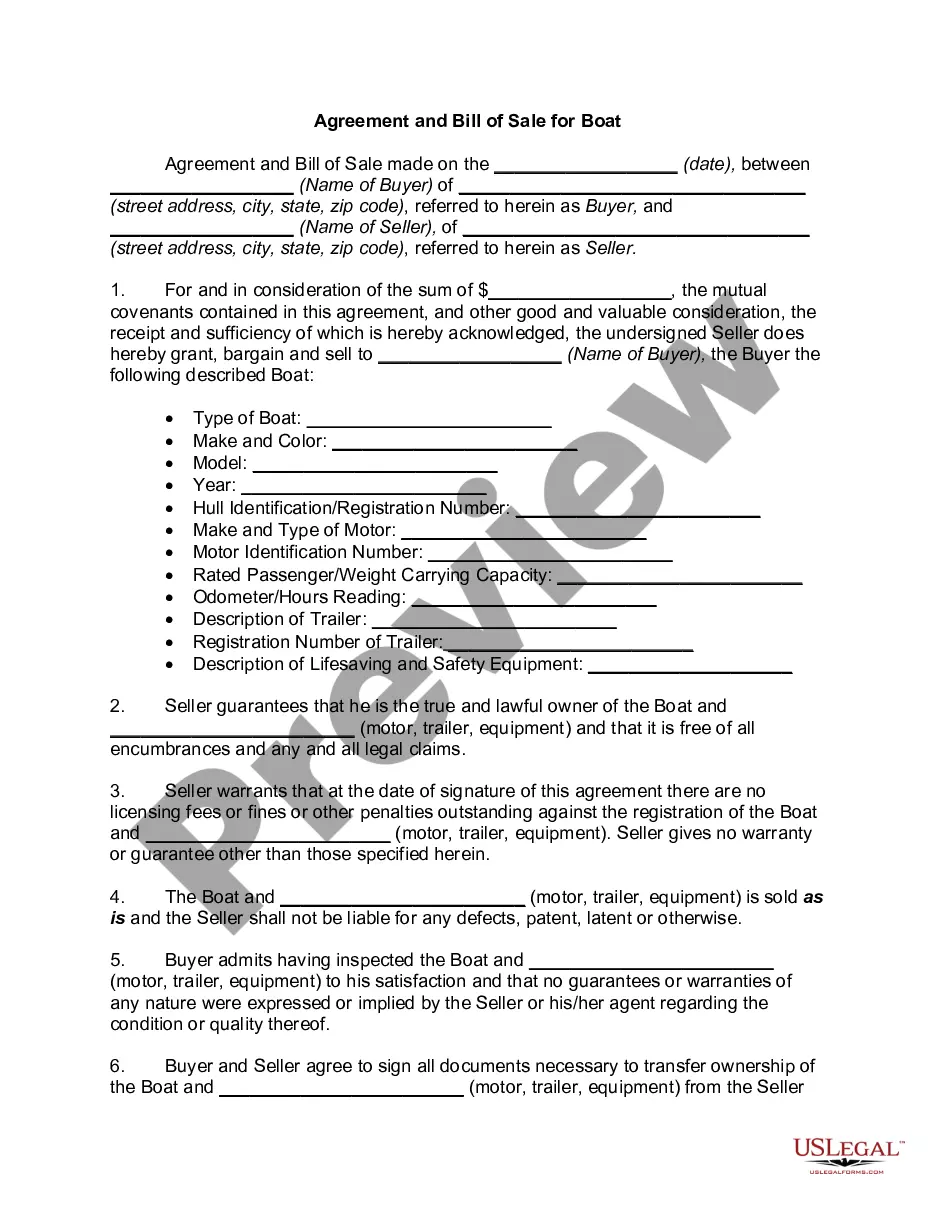

How to fill out Kentucky Complaint Regarding Insurer's Failure To Pay Claim?

Are you presently within a place that you need to have papers for possibly company or personal uses just about every working day? There are plenty of legal file layouts available online, but discovering ones you can rely on is not easy. US Legal Forms provides 1000s of kind layouts, just like the Kentucky Complaint regarding Insurer's Failure to Pay Claim, that happen to be created to fulfill state and federal requirements.

If you are previously familiar with US Legal Forms site and also have your account, simply log in. After that, you are able to download the Kentucky Complaint regarding Insurer's Failure to Pay Claim design.

Should you not offer an bank account and need to start using US Legal Forms, abide by these steps:

- Find the kind you need and ensure it is for your proper metropolis/state.

- Use the Preview button to review the form.

- See the description to ensure that you have selected the appropriate kind.

- When the kind is not what you are searching for, use the Look for discipline to discover the kind that meets your requirements and requirements.

- When you get the proper kind, simply click Buy now.

- Select the rates prepare you need, submit the required information and facts to create your money, and purchase the transaction using your PayPal or bank card.

- Choose a practical paper structure and download your copy.

Get every one of the file layouts you might have purchased in the My Forms menus. You can obtain a more copy of Kentucky Complaint regarding Insurer's Failure to Pay Claim any time, if possible. Just go through the essential kind to download or printing the file design.

Use US Legal Forms, by far the most considerable variety of legal forms, to save some time and stay away from errors. The services provides appropriately manufactured legal file layouts that you can use for a range of uses. Produce your account on US Legal Forms and begin making your lifestyle a little easier.