UCC1 - Financing Statement Addendum - Kentucky - For use after July 1, 2001. This form permits you to add an additional debtor if necessary to cover collateral as specified in the statement.

Kentucky UCC1 Financing Statement Addendum

Description

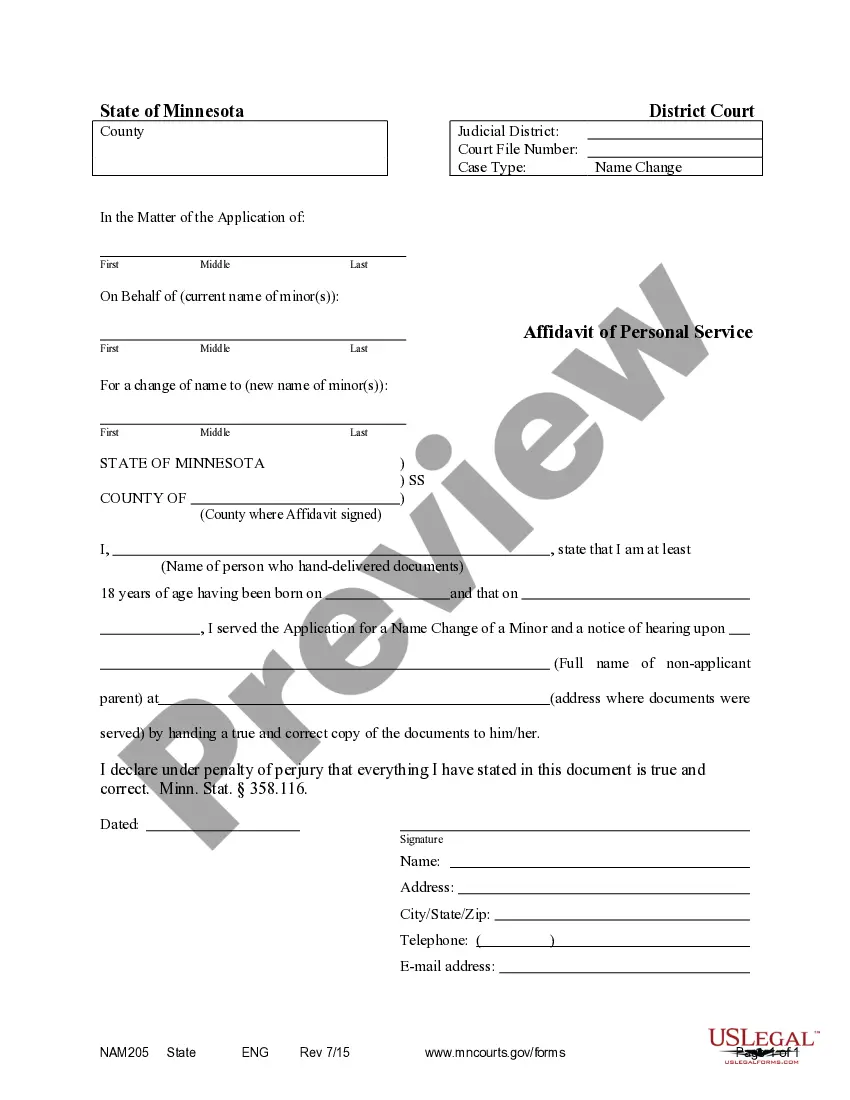

How to fill out Kentucky UCC1 Financing Statement Addendum?

Searching for Kentucky UCC1 Financing Statement Addendum sample and filling out them could be a challenge. In order to save time, costs and energy, use US Legal Forms and find the appropriate sample specifically for your state within a couple of clicks. Our attorneys draw up every document, so you just need to fill them out. It truly is that simple.

Log in to your account and come back to the form's web page and save the sample. All your saved samples are stored in My Forms and they are accessible all the time for further use later. If you haven’t subscribed yet, you have to register.

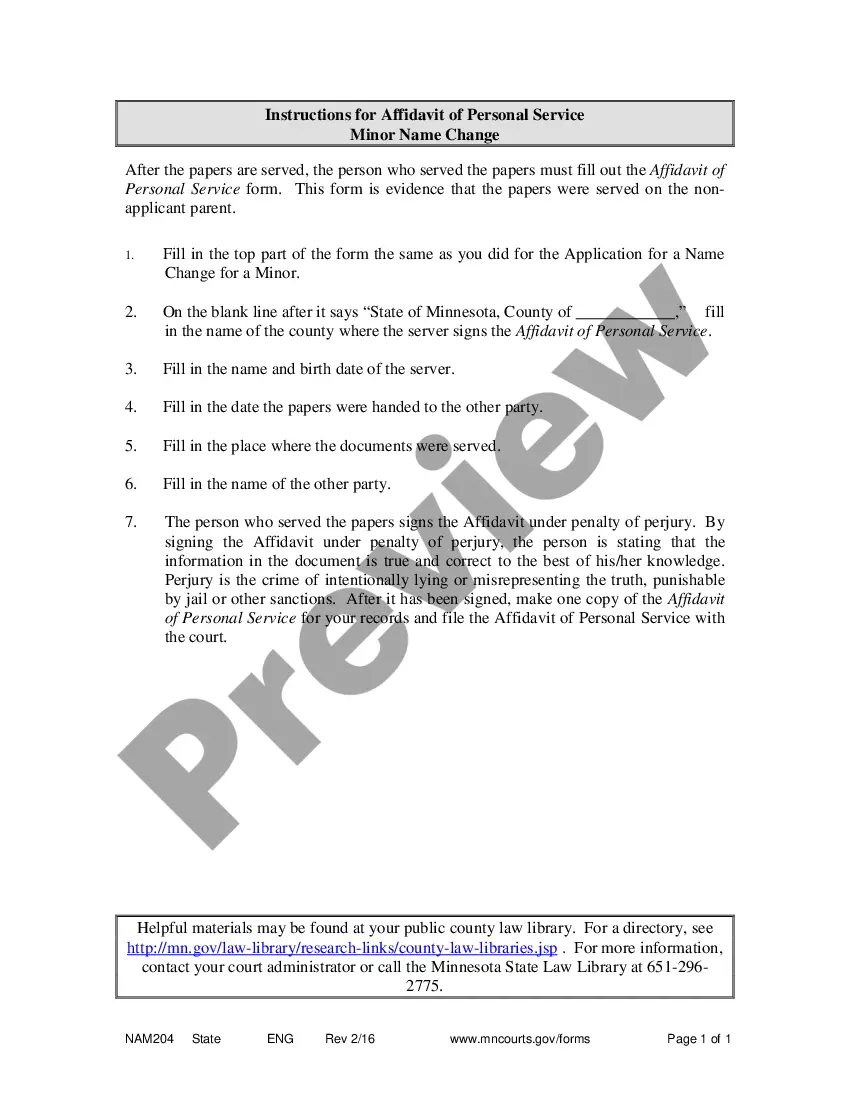

Look at our detailed recommendations on how to get your Kentucky UCC1 Financing Statement Addendum form in a few minutes:

- To get an qualified sample, check out its validity for your state.

- Look at the form utilizing the Preview function (if it’s available).

- If there's a description, go through it to understand the important points.

- Click Buy Now if you identified what you're searching for.

- Choose your plan on the pricing page and create your account.

- Pick how you want to pay by a credit card or by PayPal.

- Save the form in the favored file format.

Now you can print out the Kentucky UCC1 Financing Statement Addendum form or fill it out making use of any web-based editor. Don’t worry about making typos because your sample may be applied and sent away, and printed as often as you would like. Try out US Legal Forms and access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

Section 9-503 of the UCC provides various, more specific rules regarding the sufficiency of a debtor's name on a financing statement.However, unlike with a security agreement, on a financing statement it is acceptable to use a supergeneric description of collateral.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

It should be noted that UCC financing statements filed now generally do not contain a grant of the security interest and generally are not signed or otherwise authenticated by the Debtor and therefore would not satisfy the requirement of a security agreement.

If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

Form UCC3 is used to amend (make changes to) a UCC1 filing.However, it is important to note that for a UCC1 filing a termination is only an amendment and that the UCC1 filing may be amended further, even after a termination has been filed. Box 3 Continuation A UCC1 filing is good for five years.