Louisiana Seller's Information for Appraiser provided to Buyer

Description

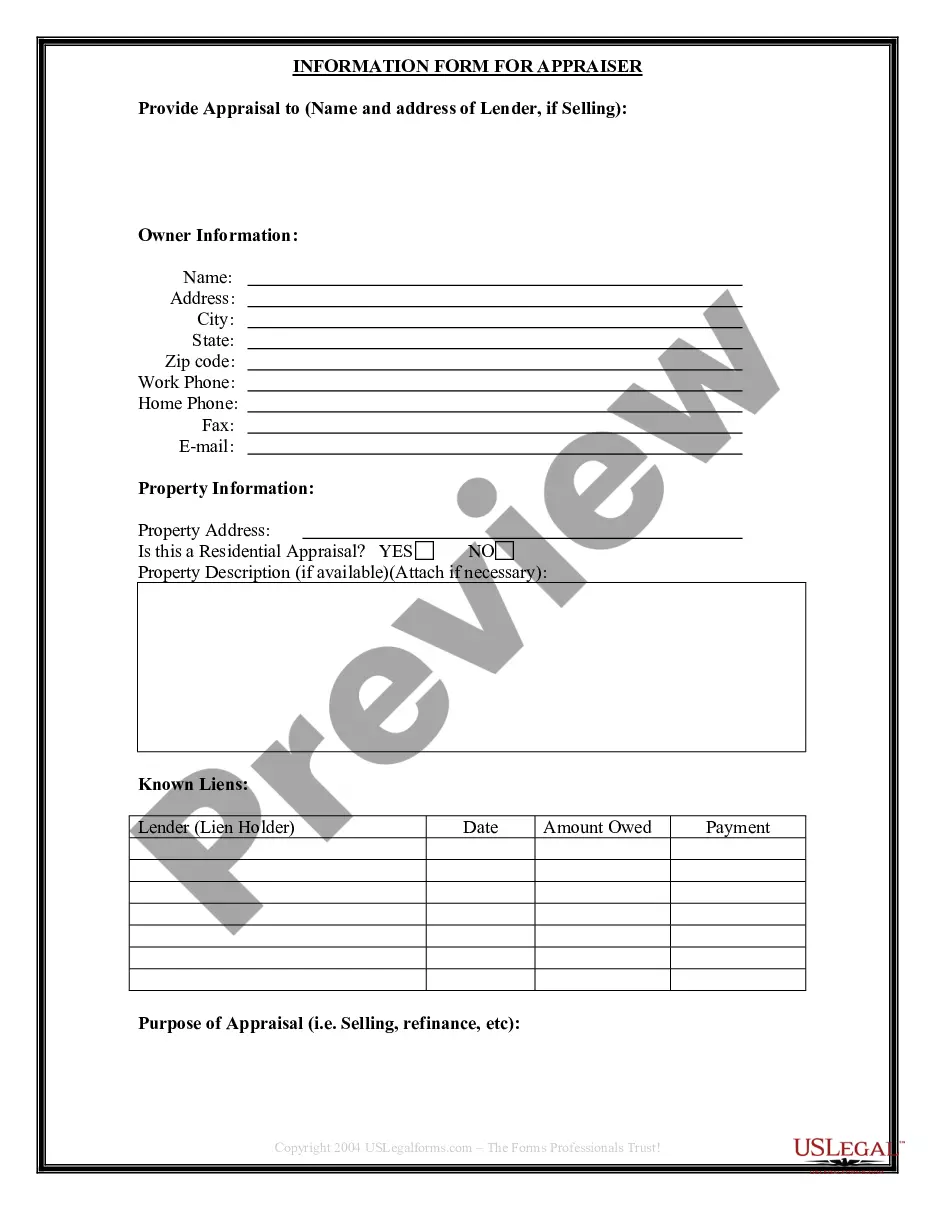

How to fill out Louisiana Seller's Information For Appraiser Provided To Buyer?

Among lots of paid and free examples that you can get on the web, you can't be sure about their accuracy and reliability. For example, who created them or if they are skilled enough to deal with the thing you need those to. Always keep relaxed and make use of US Legal Forms! Get Louisiana Seller's Information for Appraiser provided to Buyer templates made by professional legal representatives and get away from the high-priced and time-consuming process of looking for an lawyer or attorney and then paying them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the form you are seeking. You'll also be able to access all your earlier acquired examples in the My Forms menu.

If you are making use of our website the very first time, follow the guidelines listed below to get your Louisiana Seller's Information for Appraiser provided to Buyer quick:

- Make sure that the document you see applies where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or find another template using the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

As soon as you have signed up and purchased your subscription, you can utilize your Louisiana Seller's Information for Appraiser provided to Buyer as often as you need or for as long as it continues to be valid in your state. Change it with your preferred editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

The most widely-used and accepted in residential practice is the sales comparison approach. This approach bases its opinion of value on what similar properties in the vicinity have sold for recently, with appropriate adjustments for time, acreage, living area, amenities and so on.

A home that appraises for higher than the purchase price is a benefit to buyers as it means instant equity. Its impact on sellers is subject to how motivated they are. Still, offering something for sale only to find out that it's worth much more may be enough to make a seller reconsider.

Sometimes a seller won't budge off the contract price, even after an appraisal comes in below contract.That means if you are under contract to purchase a $100,000 home, and the lender will loan up to 80% of the appraised value, you'll have to come up with $20,000 as a down payment.

Will the homebuyer receive a copy of the appraisal? A. Yes! Regulations allow real estate agents, or other persons with an interest in the real estate transaction, to communicate with the appraiser and provide additional property information, including a copy of the sales contract.

If a buyer finds something they're unhappy with during the inspection process and can't make amends with the seller, they can walk away with no consequences. If the appraisal comes in low and negotiations fall apart, the buyer has the option of backing out of the contract.

If you're a seller, you almost never see the appraisal, unless the buyer wants to show it to you. If the home appraised for more than sale price, the buyer might be a little reluctant to show the appraisal to you!

The income approach discounts the future value of rents by the capitalization rate. When using the income approach for purchasing a rental property, an investor considers the amount of income generated and other factors to determine how much the property may sell for under current market conditions.

Home sellers aren't entitled to copies of the appraisals mortgage lenders conduct on behalf of their borrowers. If a home seller wants a copy of an appraisal, she should consider asking for a copy from the buyer.However, a copy may come in handy if the appraisal comes in low and price negotiations must ensue.

A: An appraisal is generally considered a professional opinion of the market value of a property, not a fact. Although it's both legally and ethically necessary to disclose a material fact, the same requirement doesn't apply to an opinion.