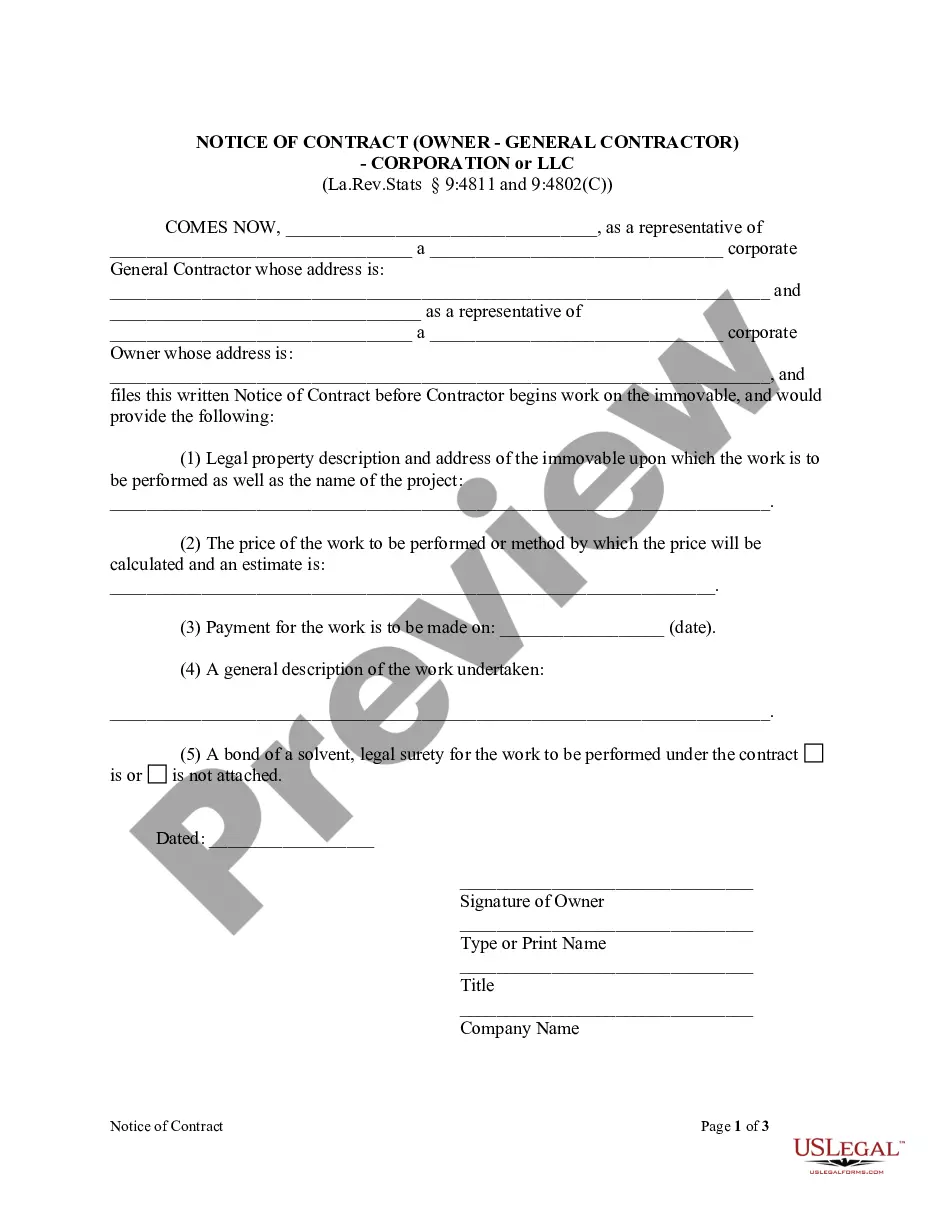

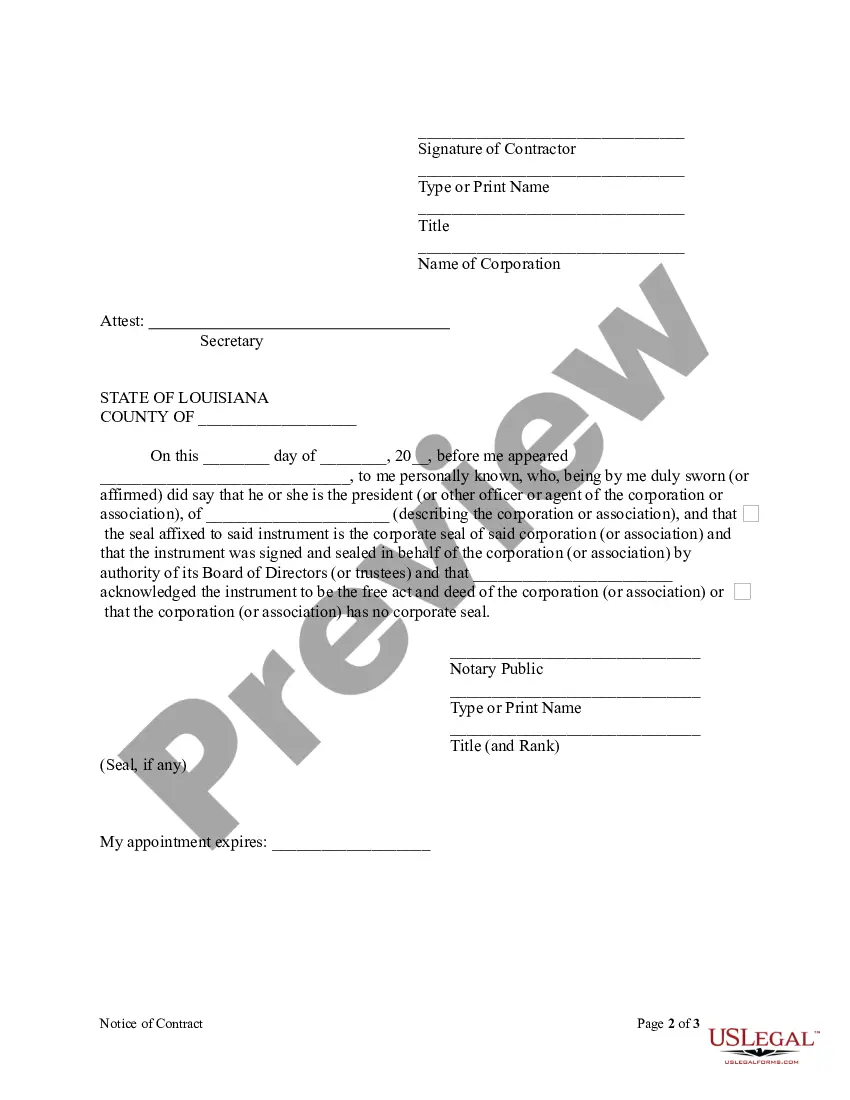

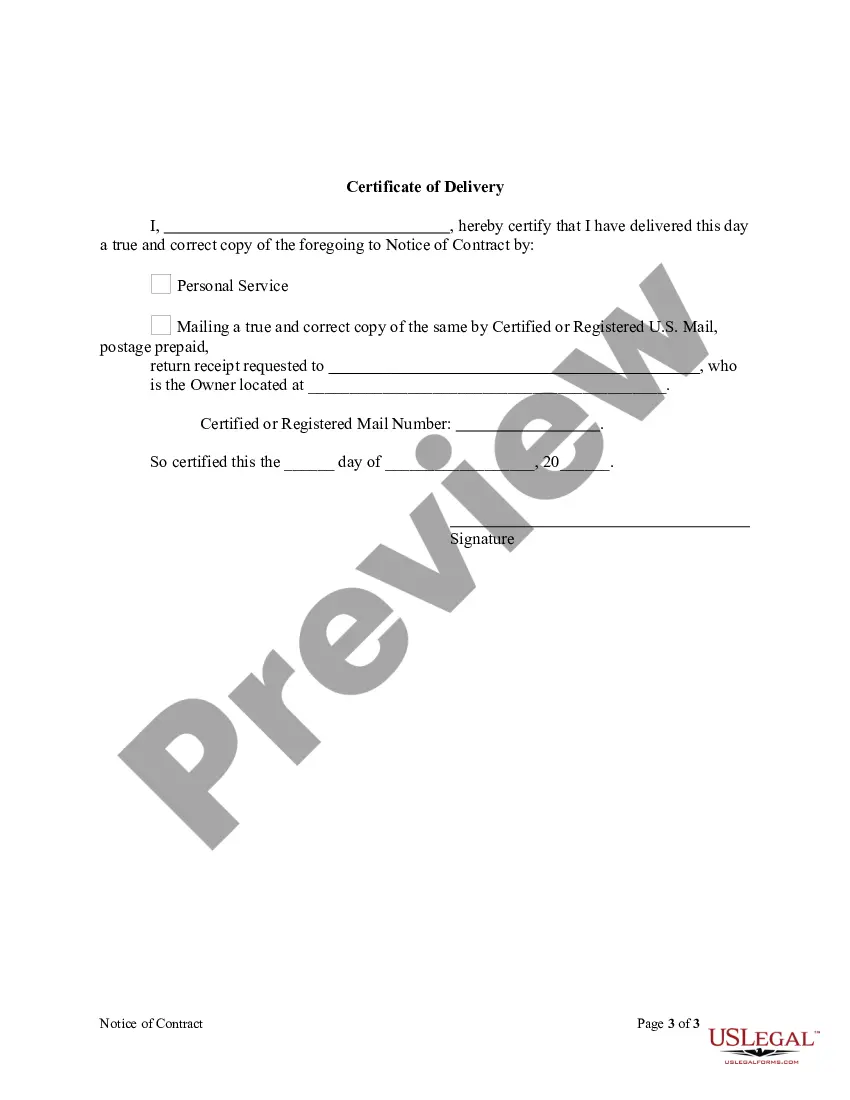

This Notice of Contract form is for use by a corporate or LLC contractor and owner to provide notice of a contract before the contractor begins work on the immovable, and includes the legal property description of the immovable upon which the work is to be performed and the name of the project, the price of the work to be performed or method by which the price will be calculated and an estimate, the date payment for the work is to be made, a general description of the work undertaken and whether a bond of a solvent, legal surety for the work to be performed under the contract is attached.

Louisiana Notice of Contract - Corporation or LLC

Description

How to fill out Louisiana Notice Of Contract - Corporation Or LLC?

Looking for Louisiana Notice of Contract - Corporation or LLC templates and completing them can be a problem. In order to save time, costs and energy, use US Legal Forms and find the appropriate sample specially for your state in a couple of clicks. Our lawyers draw up every document, so you simply need to fill them out. It really is so simple.

Log in to your account and come back to the form's web page and download the document. Your downloaded templates are kept in My Forms and are accessible all the time for further use later. If you haven’t subscribed yet, you have to register.

Have a look at our thorough recommendations concerning how to get your Louisiana Notice of Contract - Corporation or LLC template in a couple of minutes:

- To get an entitled form, check out its applicability for your state.

- Check out the form utilizing the Preview option (if it’s accessible).

- If there's a description, read it to know the important points.

- Click Buy Now if you identified what you're seeking.

- Choose your plan on the pricing page and create an account.

- Pick how you want to pay out with a credit card or by PayPal.

- Save the sample in the preferred format.

Now you can print out the Louisiana Notice of Contract - Corporation or LLC template or fill it out using any web-based editor. Don’t concern yourself with making typos because your sample can be utilized and sent away, and printed out as often as you would like. Check out US Legal Forms and get access to more than 85,000 state-specific legal and tax files.

Form popularity

FAQ

The State of Louisiana requires you to file an annual report for your LLC. You can file your annual report online at the SOS website. You also can go online to print out a paper annual report to file by mail. The annual report is due on or before the anniversary date of your LLC's formation.

The State of Louisiana requires you to file an annual report for your LLC. You can file your annual report online at the SOS website. You also can go online to print out a paper annual report to file by mail. The annual report is due on or before the anniversary date of your LLC's formation.

After a certain amount of time past the due date, if the report still isn't filed, the jurisdiction will revoke your company's good standing or put it into a forfeited status.Most states require the past due annual report as well as an additional certificate of reinstatement and more fees.

STEP 1: Name your Louisiana LLC. STEP 2: Choose a Registered Agent in Louisiana. STEP 3: File the Louisiana LLC Articles of Organization. STEP 4: Create a Louisiana LLC Operating Agreement. STEP 5: Get an EIN.

How to File Your Annual Report. If you do need to file an annual report for your LLC or corporation, you can normally do so online, through your state's website. In addition to filing your annual report, you will also need to pay a fee These fees do vary from state to state and could range between $50 and $400.

LLC Taxes in CaliforniaCalifornia LLCs must pay an annual $800 LLC tax. California LLC taxes are due by April 15th, just like federal taxes, and should be paid to the California Franchise Tax Board. You must pay this tax even if your LLC doesn't earn any income.

Step 1: Name Your LLC. Step 2: Choose Your Louisiana Registered Agent. Step 3: File the Louisiana LLC Articles of Organization. Step 4: Create an LLC Operating Agreement. Step 5: Get an EIN and Complete Form 2553 on the IRS Website.

SuBCHAPTER s CORPORATIONs Louisiana law does not recognize Subchapter S corporation status, and an S corporation is required to file in the same manner as a C corporation. However, in certain instances, all or part of the corporation income can be excluded from Louisiana tax.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Obtain an EIN. File Annual Reports.