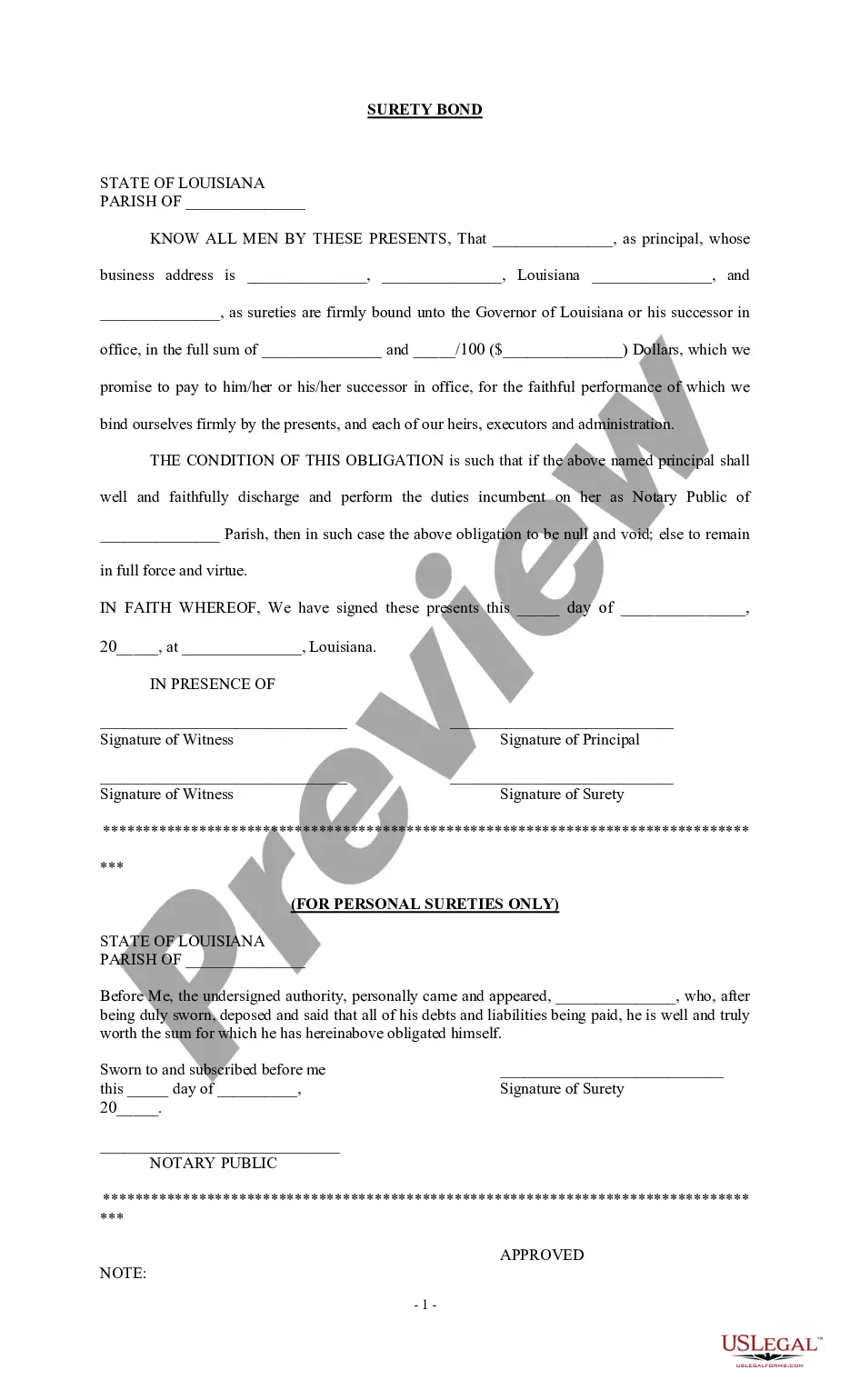

Louisiana Surety Bond

Description

How to fill out Louisiana Surety Bond?

In search of Louisiana Surety Bond forms and filling out them could be a problem. To save lots of time, costs and effort, use US Legal Forms and find the right sample specifically for your state in just a few clicks. Our lawyers draft all documents, so you just have to fill them out. It truly is so easy.

Log in to your account and come back to the form's page and save the sample. All your downloaded examples are kept in My Forms and they are available at all times for further use later. If you haven’t subscribed yet, you need to register.

Check out our thorough recommendations concerning how to get your Louisiana Surety Bond template in a couple of minutes:

- To get an entitled example, check its validity for your state.

- Look at the example making use of the Preview function (if it’s available).

- If there's a description, go through it to learn the important points.

- Click on Buy Now button if you identified what you're trying to find.

- Select your plan on the pricing page and create an account.

- Select you want to pay by a credit card or by PayPal.

- Download the file in the preferred format.

You can print the Louisiana Surety Bond template or fill it out making use of any web-based editor. No need to worry about making typos because your form can be utilized and sent, and printed as often as you wish. Check out US Legal Forms and get access to over 85,000 state-specific legal and tax files.

Form popularity

FAQ

Name of the lender and the borrower. Address of the lender and the borrower. The amount being lent/borrowed. The purpose for which the amount is being borrowed. The time period for which the amount is being lent. The interest to be levied on the amount.

Your Louisiana Notary Surety Bond. Louisiana law requires all Notaries to purchase and maintain a $10,000 Notary surety bond or errors & omissions insurance (E&O) every five years. The Notary bond protects the general public of Louisiana against any financial loss due to improper conduct by an Louisiana Notary.

How long will it take to get my bond? In most instances, surety experts can issue a bond within 24 hours of the initial application. The turnaround time can take longer for riskier bonds that require more complicated underwriting processes, such as contract bonds for construction projects.

Examples of these bonds include construction and environmental performance, payment, supply, maintenance, and warranty bonds. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs.International surety examines the unique surety requirements internationally.

Examples of these bonds include construction and environmental performance, payment, supply, maintenance, and warranty bonds. Commercial surety helps obtain capacity at the lowest cost for all corporate surety needs.International surety examines the unique surety requirements internationally.

Write the name of the obligor, or project owner, on the line preceded or followed by are held and firmly bonded to. Write the amount of money at issue in the bond on the line designated for the bond amount. Sign the bond in the presence of a notary public and have the bond notarized.

A surety bond application is a form required by the surety carrier. It provides the basic information needed about the bond and the principal for the approval process. It also often serves as the legal contract between the surety carrier and the principal.

Gather the information required to apply for your surety bond. Common necessary details include your business name and address, license number (if you are renewing your bond), and ownership information.