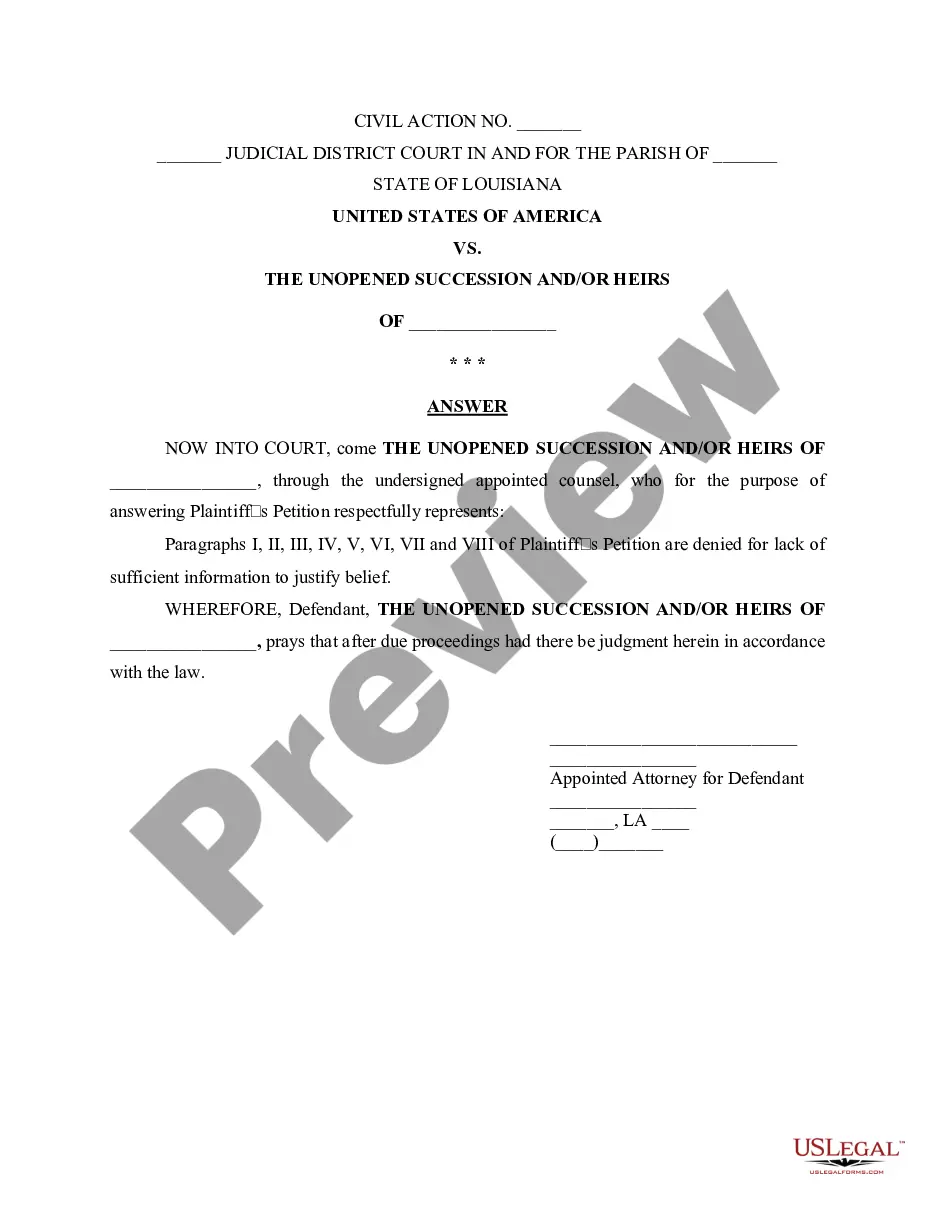

Louisiana Answer to Plaintiff's Petition for unopened succession

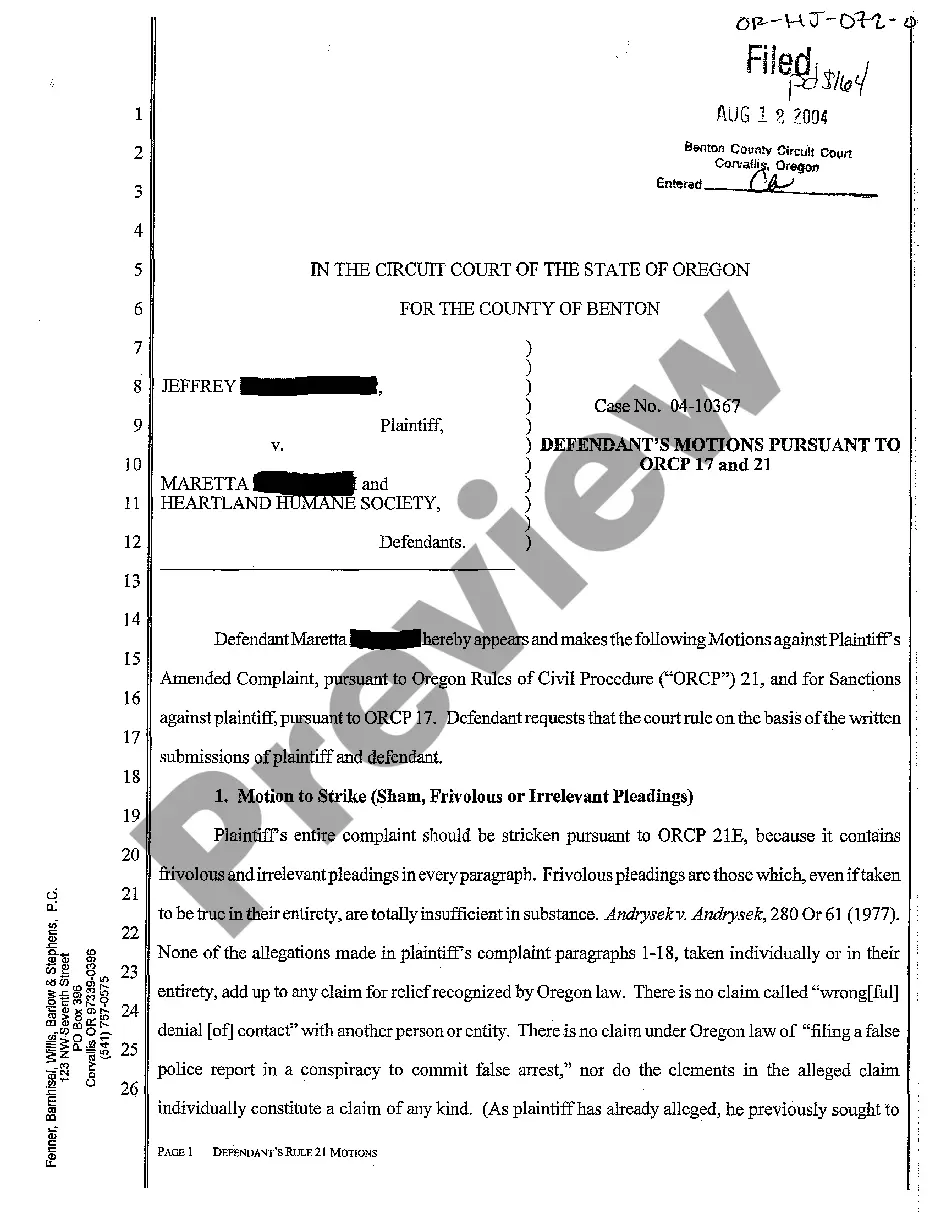

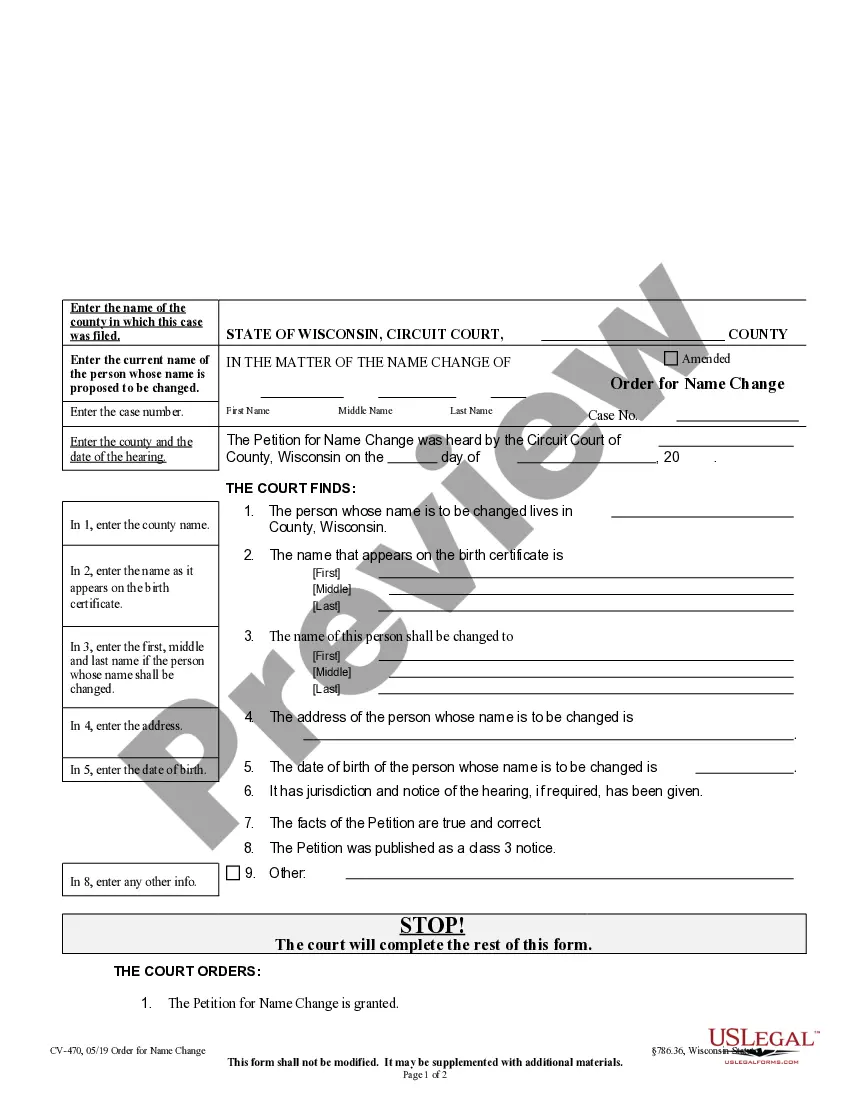

Description Plaintiff Succession File

How to fill out Louisiana Answer To Plaintiff's Petition For Unopened Succession?

Searching for Louisiana Answer to Plaintiff's Petition for unopened succession forms and completing them can be quite a problem. In order to save time, costs and energy, use US Legal Forms and find the correct template specially for your state in just a couple of clicks. Our lawyers draft all documents, so you simply need to fill them out. It really is that easy.

Log in to your account and come back to the form's page and download the sample. All your saved templates are stored in My Forms and they are available always for further use later. If you haven’t subscribed yet, you have to register.

Have a look at our thorough instructions concerning how to get the Louisiana Answer to Plaintiff's Petition for unopened succession template in a couple of minutes:

- To get an entitled sample, check its validity for your state.

- Have a look at the form using the Preview function (if it’s accessible).

- If there's a description, read through it to know the important points.

- Click Buy Now if you identified what you're searching for.

- Choose your plan on the pricing page and make an account.

- Choose you want to pay out by way of a credit card or by PayPal.

- Save the form in the favored file format.

Now you can print the Louisiana Answer to Plaintiff's Petition for unopened succession form or fill it out making use of any web-based editor. Don’t concern yourself with making typos because your sample can be employed and sent, and printed out as many times as you want. Check out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Louisiana Unopened Form popularity

Unopened Succession Other Form Names

FAQ

Maximum $125,000 (CCP 3421 Small Successions Defined) Laws CCP 3432. Step 1 Write in the full name of the person who died. Step 2 Write in the State and County or Parish in which the decedent resided at the time of death. Step 3 Write in the names of the two people signing the petition.

If someone who owns real estate in Louisiana dies while domiciled in another state, a succession will have to be opened to transfer the Louisiana property to the heirs.Assets in the decedent's name become unavailable to anyone after death until the succession is opened.

As a practical matter, it typically takes two to six months to complete a succession. Some successions remain open for years due to complexity, litigation between the heirs, or a number of other reasons.

Succession costs for smaller estates with cooperative heirs will typically range from $1,500.00 to $3,000.00. Succession costs for larger estates that require administration will typically range from $5,000.00 up to $15,000.00 depending on what needs to be done.

Maximum $125,000 (CCP 3421 Small Successions Defined) Laws CCP 3432. Step 1 Write in the full name of the person who died. Step 2 Write in the State and County or Parish in which the decedent resided at the time of death. Step 3 Write in the names of the two people signing the petition.

Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.

Inheritance Laws in Louisiana. Louisiana does not impose any state inheritance or estate taxes. It's also a community property estate, meaning it considers all the assets of a married couple jointly owned.

If all heirs agree and the property is easy to find; you could be looking at a rate of $1,250-$3,500 plus court costs. Court costs for Louisiana successions can range from $250 to $500 depending on parish. If any issues are apparent or litigation is necessary, the cost could easily go higher.