Louisiana Cash Sale

Description

Key Concepts & Definitions

Cash Sale: A transaction where payment for a product or service is made in full using cash at the time of purchase. Credit Sales Management: The process of managing and collecting payments from credit sales. Cash Flow Management: The practice of tracking how much money is coming into and going out of a business to ensure financial stability. Financial Software Systems: Tools used to manage financial transactions, reporting, and audit compliance. Equity Financing Methods: Ways to raise capital through the sale of shares in the company.

Step-by-Step Guide: Managing Cash Sales

- Implement Effective Cash Handling Practices: Ensure all cash transactions are recorded immediately to prevent discrepancies.

- Utilize Financial Software Systems: Use software for accurate tracking and reporting of cash transactions.

- Train Employees: Regular training on audit compliance procedures and cash handling is essential for accuracy and prevention of theft.

- Reconcile Daily: Reconcile cash receipts with journal entries accounting at the end of each day.

Risk Analysis in Cash Sales

- Theft: Physical cash is susceptible to theft, both internal (employee) and external (burglary).

- Accounting Errors: Improper handling of cash can lead to discrepancies in financial records, affecting the business's financial health.

- Compliance Risks: Failure to adhere to audit compliance procedures can lead to fines and legal issues.

Best Practices for Cash Sale Management

- Maintain Strict Controls: Use a robust financial software system for tracking and reconciliation.

- Regular Audits: Conduct regular audits to ensure compliance with standard accounting and cash handling practices.

- Employee Training: Continuously educate employees about the importance of accurate cash handling and fraud prevention strategies.

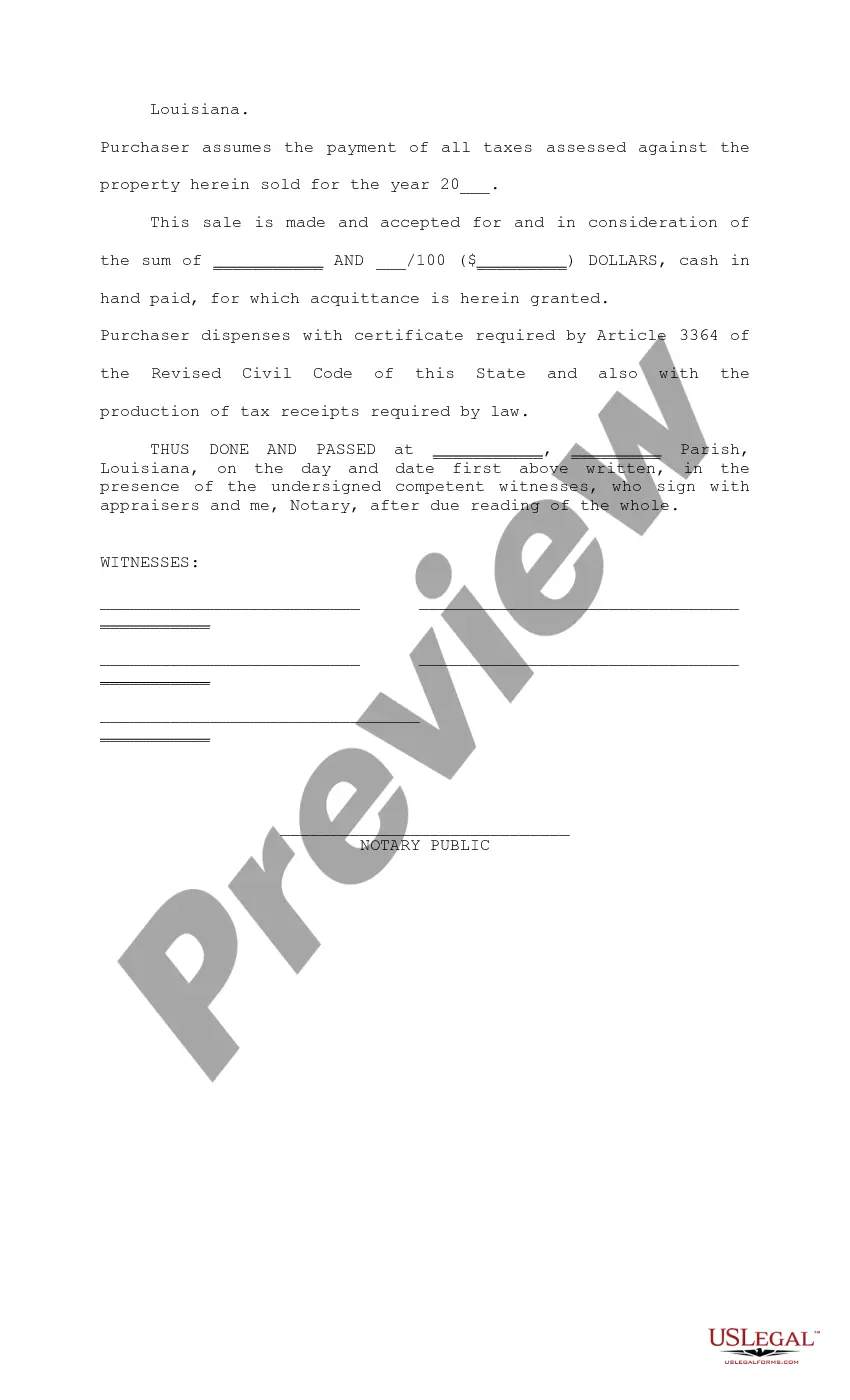

How to fill out Louisiana Cash Sale?

Trying to find Louisiana Cash Sale templates and completing them might be a problem. To save lots of time, costs and energy, use US Legal Forms and find the correct template specifically for your state in just a couple of clicks. Our lawyers draft all documents, so you simply need to fill them out. It truly is that simple.

Log in to your account and return to the form's page and download the document. All your saved templates are kept in My Forms and therefore are available all the time for further use later. If you haven’t subscribed yet, you should register.

Check out our detailed instructions regarding how to get your Louisiana Cash Sale sample in a couple of minutes:

- To get an eligible sample, check its applicability for your state.

- Look at the form utilizing the Preview option (if it’s accessible).

- If there's a description, read it to learn the details.

- Click on Buy Now button if you identified what you're searching for.

- Choose your plan on the pricing page and create an account.

- Select you want to pay out with a card or by PayPal.

- Download the form in the favored file format.

You can print out the Louisiana Cash Sale form or fill it out using any online editor. No need to concern yourself with making typos because your form may be applied and sent away, and printed out as many times as you would like. Try out US Legal Forms and get access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

Property ownership in Louisiana is voluntarily transferred by a contract through the owner and the transferee. A transfer of real (immovable) property can be made by authentic act or by an act under private signature duly acknowledged (CC1839 Art. 1839).

The Louisiana quitclaim deed is used to transfer real estate in Louisiana from one person to another. A quitclaim has no guarantee or warranty attached to it.Signing A quitclaim deed must be authorized with the Grantor(s) (the Sellers) in front of two (2) witnesses and a notary public.

Three basic types of deeds commonly used are the grant deed, the quitclaim deed, and the warranty deed. A sample grant deed. the property he or she is transferring is implied from such language.

A cash deed is involves the sale of a property for cash. Usually, the process is between two parties and doesn't involve a mortgage lender or line of credit. It is, as the name implies, a cash sale. The deed must be signed in the presence of a notary so that it can be recorded.

The legal document that transfers ownership of immovable property (i.e., a home, lot, building, immobilized mobile home) can be a cash sale or a quitclaim deed. A quitclaim deed is used when there is a transfer of property ownership without being sold.

A warranty deed is a document often used in real estate that provides the greatest amount of protection to the purchaser of a property. It pledges or warrants that the owner owns the property free and clear of any outstanding liens, mortgages, or other encumbrances against it.

Act of Cash Sale means an act of cash sale or other transfer/deed of land to be delivered at the Closing by the applicable Seller conveying to the Purchaser the Transferred Owned Real Property owned by such Seller, substantially in the form set forth in Exhibit B.

A warranty deed is a customary form for the conveyance of real estate in Louisiana. Deeds in this state may be referred to as Acts of Sales or Cash Sales.The seller also warrants that the property being sold is fit for its intended use (CC 2475).