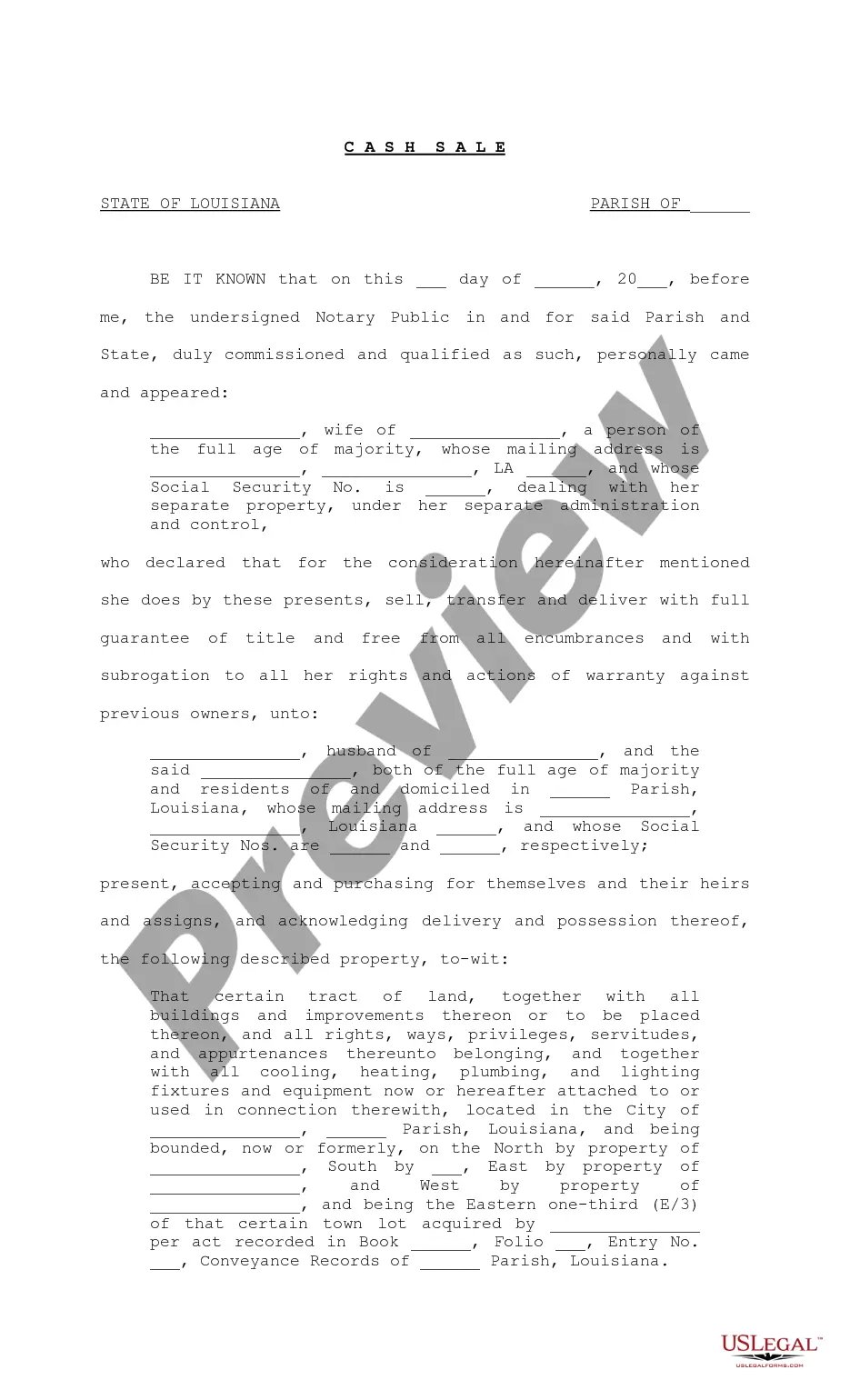

Louisiana Cash Sale property of one spouse

Description

How to fill out Louisiana Cash Sale Property Of One Spouse?

Trying to find Louisiana Cash Sale property of one spouse sample and filling out them could be a challenge. To save lots of time, costs and energy, use US Legal Forms and find the right template specially for your state within a few clicks. Our attorneys draw up all documents, so you simply need to fill them out. It really is so simple.

Log in to your account and return to the form's page and save the sample. All your downloaded templates are kept in My Forms and they are available all the time for further use later. If you haven’t subscribed yet, you should sign up.

Take a look at our thorough guidelines concerning how to get the Louisiana Cash Sale property of one spouse sample in a few minutes:

- To get an qualified form, check its validity for your state.

- Look at the form using the Preview option (if it’s accessible).

- If there's a description, go through it to understand the details.

- Click Buy Now if you identified what you're trying to find.

- Pick your plan on the pricing page and make your account.

- Pick how you want to pay by way of a card or by PayPal.

- Save the form in the favored file format.

Now you can print out the Louisiana Cash Sale property of one spouse template or fill it out making use of any online editor. Don’t concern yourself with making typos because your template may be employed and sent, and printed out as often as you want. Check out US Legal Forms and get access to above 85,000 state-specific legal and tax documents.

Form popularity

FAQ

The legal document that transfers ownership of immovable property (i.e., a home, lot, building, immobilized mobile home) can be a cash sale or a quitclaim deed. A quitclaim deed is used when there is a transfer of property ownership without being sold.

In Louisiana, a divorced spouse, or an individual going through divorce, dissolution of marriage, or legal separation, may file for periodic support, otherwise known as alimony. When periodic support is applied for, there are many circumstances that are taken into consideration by the court and judge deciding the case.

Separate property is property belongs exclusively to one of two spouses. Under Louisiana law, assets acquired by a deceased person while unmarried, or acquired during the marriage by gift, is considered to be separate property.

Marital property includes all property either spouse bought during the marriage. It does not matter whose name is on the title. For example, if a couple bought a home, but only the husband's name was on the deed, the wife would still be entitled to some of the value of the home if they were to get a divorce.

Property one spouse owned alone, before the marriage, or acquired by gift or inheritance during the marriage, is that spouse's separate property in California.California law also provides that property spouses acquire before a divorce, but after the date of separation, is separate property.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

Louisiana is a community property state. This means that spouses generally share equally in the assets, income and debt acquired by either spouse during the marriage. However, some income and some property may be separate income or separate property.

Common law marriage is based on an agreement between two legally competent persons to marry followed by a significant period of living together as husband and wife. The marriage does not rely on ceremony or the completion of specific legal procedures.

Is Louisiana a community property state? Louisiana is a community property state, which means that virtually all assets and debt acquired during the duration of a marriage are considered marital property, and are thus divided equally between the spouses in the event of a divorce.