Louisiana Demand Letter - Repayment of Loan

Description

How to fill out Louisiana Demand Letter - Repayment Of Loan?

Looking for Louisiana Demand Letter - Repayment of Loan templates and completing them could be a challenge. To save lots of time, costs and effort, use US Legal Forms and choose the right template specially for your state within a few clicks. Our lawyers draw up each and every document, so you just have to fill them out. It truly is that simple.

Log in to your account and come back to the form's web page and save the document. All your saved templates are kept in My Forms and therefore are accessible always for further use later. If you haven’t subscribed yet, you have to sign up.

Look at our detailed guidelines on how to get the Louisiana Demand Letter - Repayment of Loan template in a couple of minutes:

- To get an qualified form, check out its applicability for your state.

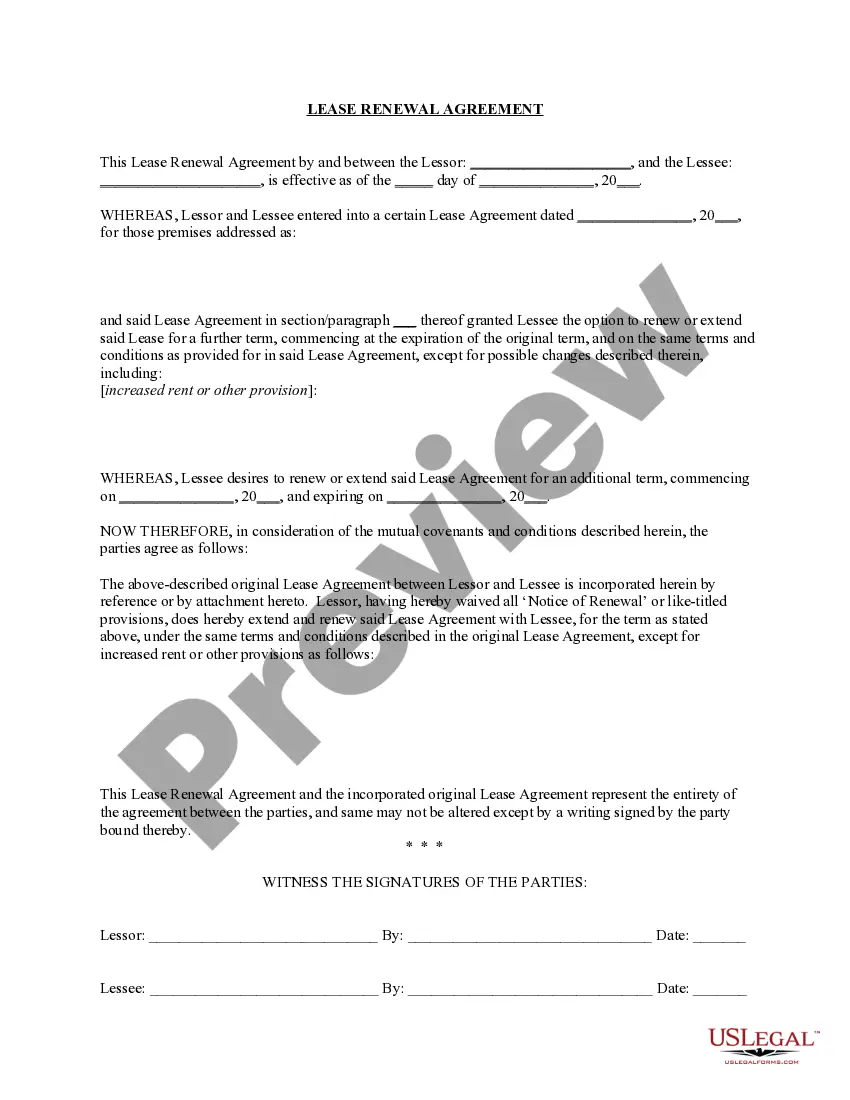

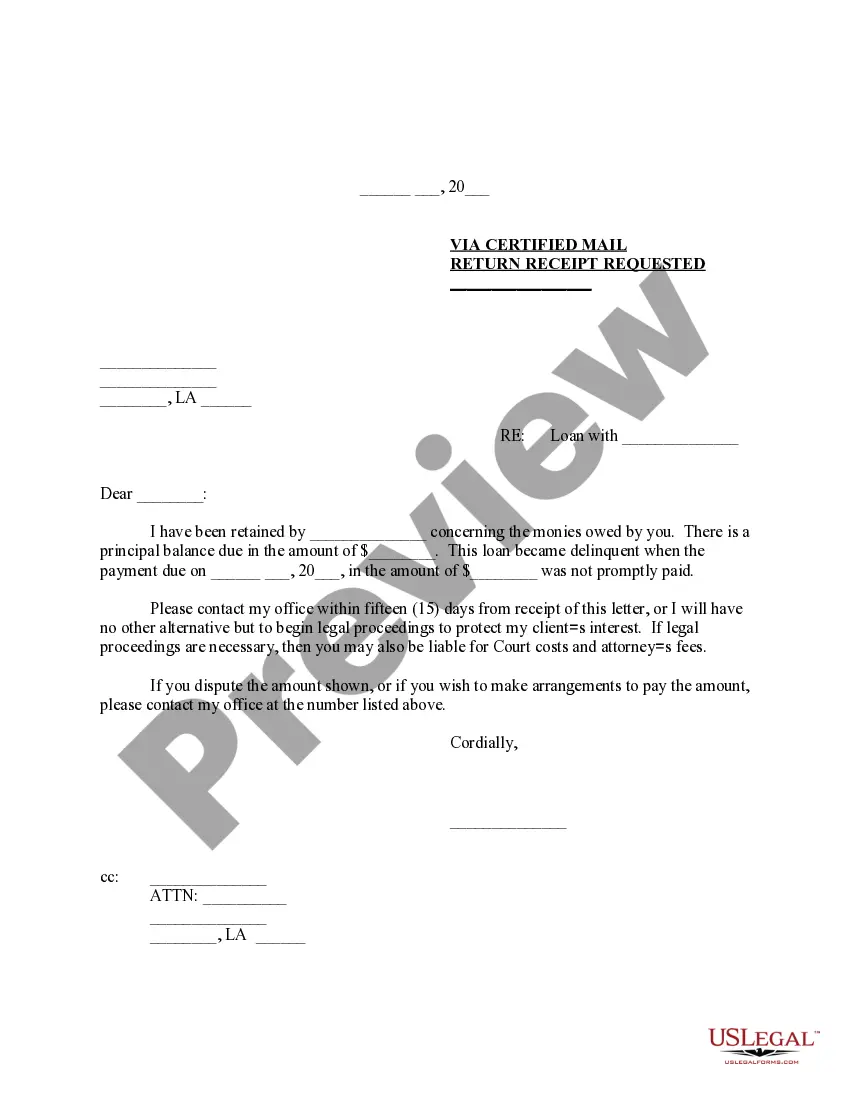

- Take a look at the example using the Preview option (if it’s accessible).

- If there's a description, go through it to learn the details.

- Click on Buy Now button if you identified what you're trying to find.

- Select your plan on the pricing page and create your account.

- Select you would like to pay by a card or by PayPal.

- Save the sample in the favored format.

You can print the Louisiana Demand Letter - Repayment of Loan template or fill it out using any online editor. Don’t concern yourself with making typos because your template may be employed and sent away, and published as many times as you wish. Try out US Legal Forms and access to above 85,000 state-specific legal and tax files.

Form popularity

FAQ

LETTER OF DEMAND BACKGROUND A demand generally amounts to a request for payment or a request to perform in terms of a legal obligation. A letter of demand is generally an initial step in the litigation process. In certain instances, a letter of demand is necessary to place the debtor in mora.

As noted above, demand letters are generally written by a lawyer on behalf of an individual or corporation, although the sender may sometimes write it themselves.Although they are not legally required, demand letters are frequently used in contract law, tort law, and commercial law cases.

A demand generally amounts to a request for payment or a request to perform in terms of a legal obligation.The letter of demand must provide a clear indication of what is expected from the defaulting party, e.g payment of a liquidated amount, delivery of a certain thing, or to refrain from taking certain action.

Someone owes you money. There are various reasons that one party may owe money to another. Someone owes you an obligation in some way. For insurance claims after an injury.

Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

Many courts require you to make a formal demand for payment before filing your lawsuit. But even if writing a formal demand letter isn't legally necessary, there are two reasons why sending one makes sense: In as many as one-third of all disputes, your demand letter will catalyze settlement.

Understand the Costs and Impact of Your Injuries In short, it's best to send a demand letter only after you (and/or your attorney) have taken a thorough look at the impact of your injury on all aspects of your life, and made a reasonable valuation of your injury claim.

After you've sent your demand letter, which is a letter telling the insurance company how much you believe you're owed for a settlement, the insurer has control of the clock. However, you should receive a settlement check within two weeks to two months, roughly.

After you send a demand letter, one of several things can happen: The insurance company accepts your demand, and the settlement goes forward. You'll receive the compensation you asked for and sign a release of liability in exchange.