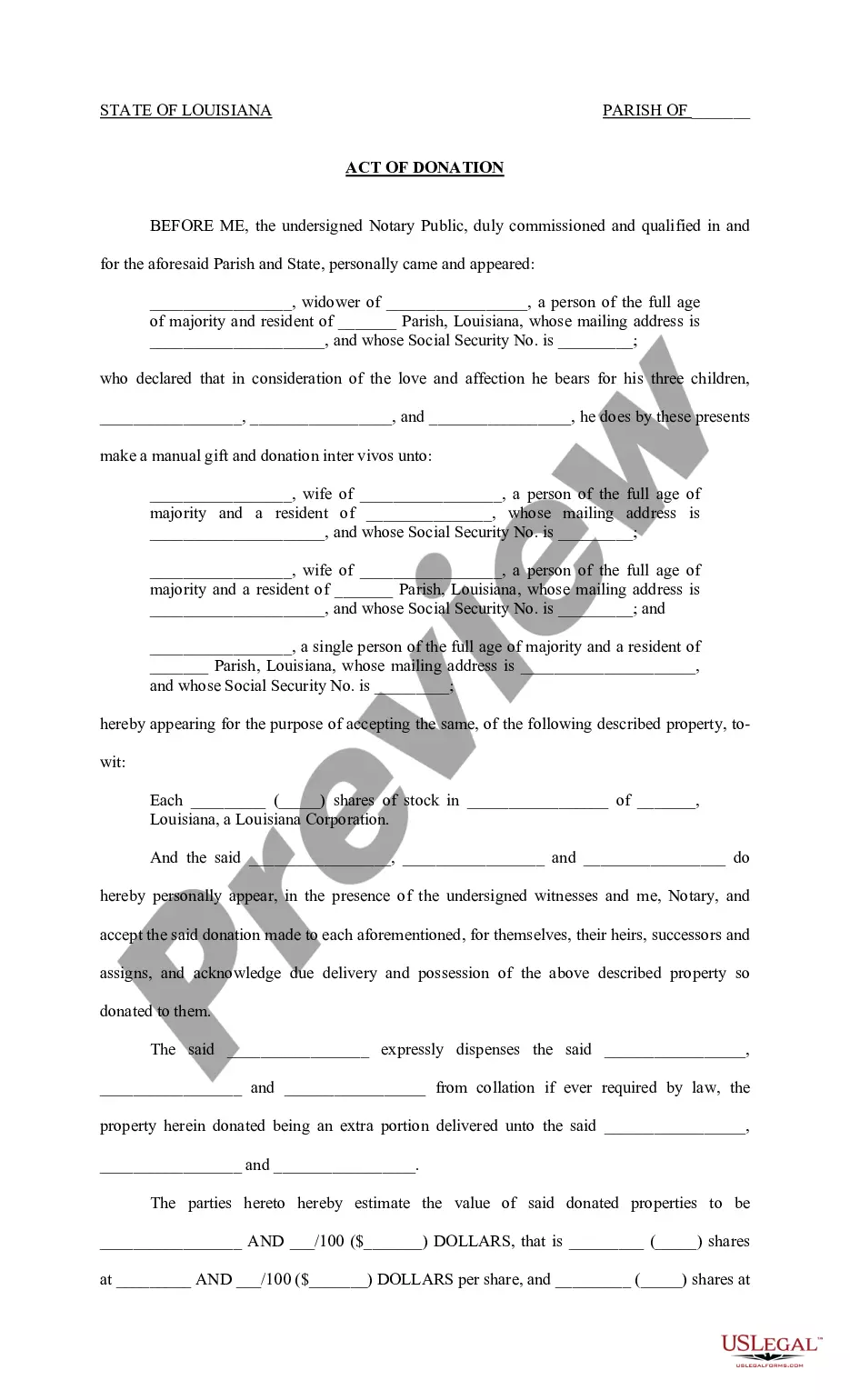

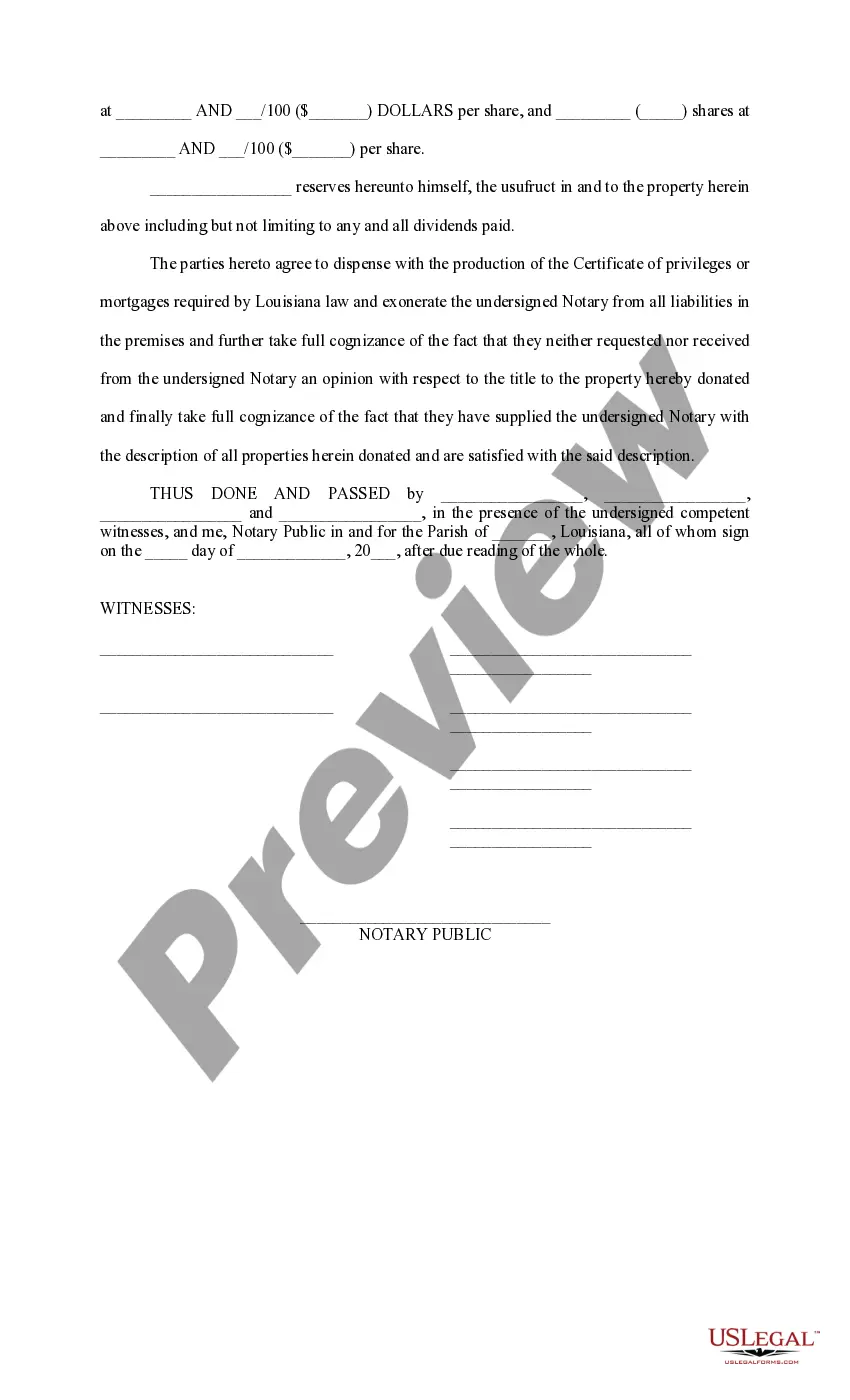

Louisiana Act of Donation Stock - Parent to Children

Description La Act Donation

How to fill out Sample Act Of Donation Letter?

Trying to find Louisiana Act of Donation Stock - Parent to Children templates and filling out them can be quite a problem. To save time, costs and energy, use US Legal Forms and find the appropriate example specifically for your state within a few clicks. Our legal professionals draw up each and every document, so you just need to fill them out. It really is so easy.

Log in to your account and return to the form's web page and save the document. All your downloaded templates are stored in My Forms and are available always for further use later. If you haven’t subscribed yet, you have to sign up.

Check out our thorough guidelines concerning how to get your Louisiana Act of Donation Stock - Parent to Children form in a few minutes:

- To get an qualified example, check out its applicability for your state.

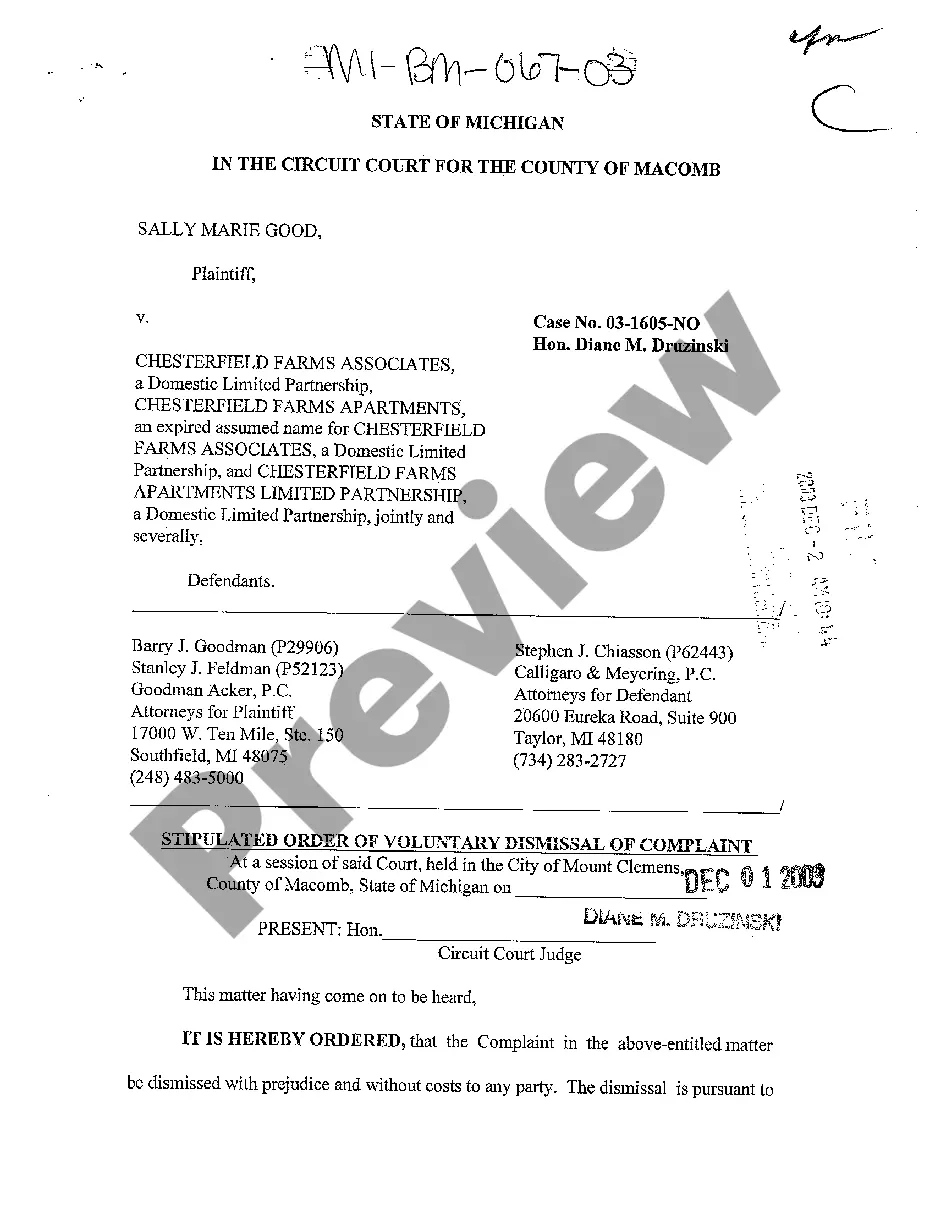

- Check out the example using the Preview option (if it’s offered).

- If there's a description, read through it to learn the important points.

- Click Buy Now if you identified what you're searching for.

- Select your plan on the pricing page and make an account.

- Pick how you would like to pay by way of a card or by PayPal.

- Save the sample in the favored file format.

Now you can print the Louisiana Act of Donation Stock - Parent to Children template or fill it out utilizing any web-based editor. Don’t worry about making typos because your template may be employed and sent, and published as many times as you would like. Check out US Legal Forms and access to over 85,000 state-specific legal and tax documents.

Louisiana Act Donation Pdf Form popularity

Act Of Donation Other Form Names

Louisiana Donation Pdf FAQ

Act of Donation Forms LouisianaAct of Donation. To donate a thing or right to another person is to transfer such thing or right to another person without an exchange or payment. In other words it is the giving of something to another without receiving anything of value in return.

Monetary Donations Text REDCROSS to 90999 to give $10 to American Red Cross Disaster Relief. Please make your check or money order payable to the "American Red Cross, Southeast Louisiana Chapter" and mail to: American Red Cross of Louisiana, 2640 Canal Street, New Orleans, LA 70119.

Kids Wish Network. Cancer Fund of America. Children's Wish Foundation International. American Breast Cancer Foundation. Firefighters Charitable Foundation. Breast Cancer Relief Foundation. International Union of Police Associations, AFL-CIO. National Veterans Service Fund.

So, on average, about 67 percent of the funds raised went to the charity, and 33 percent went to the fundraisers. The numbers are a slight improvement from 2015, when 35 percent of the money raised went to the professional fundraisers' costs.

Charity Navigator, a watchdog group that grades charities on their financial health, transparency and fundraising costs, estimated the Red Cross spends almost 90% of its total expenses spent on the programs and services it delivers.

The gift cannot ever be revoked nor can you later ask for financial compensation. Disadvantages of a Gift Deed? Usually a Gift Deed is used to transfer property between family members. As a result, the transaction may be subject to coercion or fraud.

82 cents of every dollar donated to The Salvation Army goes toward program services. The average charity spends 75 percent of their budget on programs, while the remaining money goes to cover overhead costs like fundraising, Sandra Miniutti, with Charity Navigator, told NBC News.

The Red Cross is proud that an average of 90 cents of every dollar we spend is invested in delivering care and comfort to those in need. The Red Cross is proud that an average of 90 cents of every dollar we spend is invested in delivering care and comfort to those in need.

You can make sure that your donation is to a charity and tax-deductible by looking up the organization in the IRS's Tax Exempt Organization Search. Check to see if the fundraiser and charity are registered with your state's charity regulator (if that's required in your state).