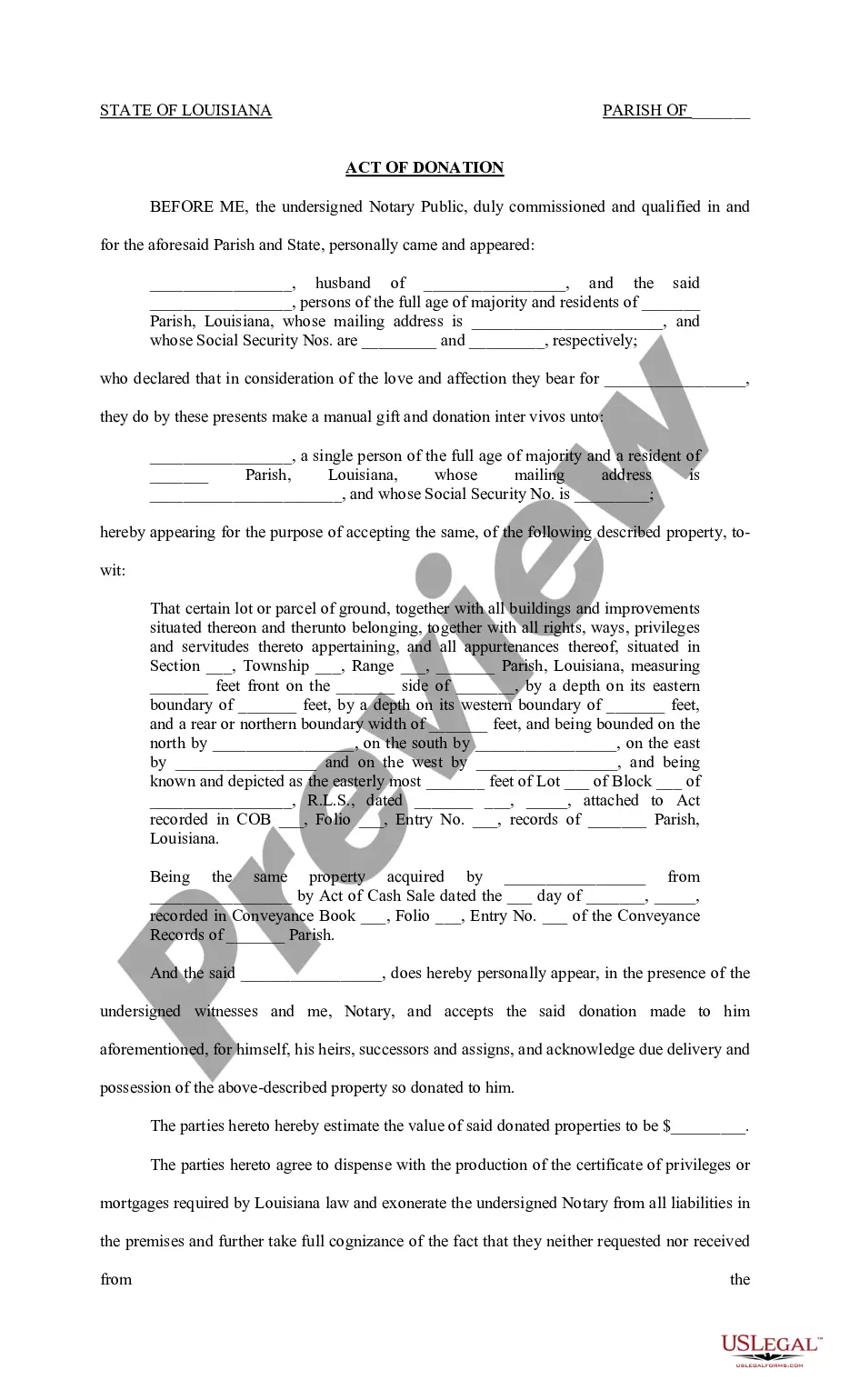

Louisiana Act of Donation Real Estate from Husband and Wife to Individual

Description

How to fill out Louisiana Act Of Donation Real Estate From Husband And Wife To Individual?

Trying to find Louisiana Act of Donation Real Estate from Husband and Wife to Individual forms and completing them could be a challenge. To save lots of time, costs and effort, use US Legal Forms and find the appropriate example specifically for your state in just a couple of clicks. Our legal professionals draw up all documents, so you just need to fill them out. It is really that easy.

Log in to your account and come back to the form's web page and download the sample. All your downloaded templates are stored in My Forms and therefore are accessible all the time for further use later. If you haven’t subscribed yet, you need to sign up.

Look at our detailed instructions concerning how to get the Louisiana Act of Donation Real Estate from Husband and Wife to Individual form in a couple of minutes:

- To get an qualified sample, check its applicability for your state.

- Take a look at the sample making use of the Preview option (if it’s offered).

- If there's a description, go through it to learn the details.

- Click on Buy Now button if you found what you're seeking.

- Pick your plan on the pricing page and make an account.

- Select you want to pay by way of a card or by PayPal.

- Download the file in the preferred format.

Now you can print the Louisiana Act of Donation Real Estate from Husband and Wife to Individual form or fill it out making use of any online editor. No need to worry about making typos because your sample may be utilized and sent away, and printed as many times as you wish. Try out US Legal Forms and access to more than 85,000 state-specific legal and tax files.

Form popularity

FAQ

In Louisiana, giving away some of your surplus to a friend, relative or charitable organization is a simple matter of completing a form called an Act of Donation and having it notarized.

In Louisiana, giving away some of your surplus to a friend, relative or charitable organization is a simple matter of completing a form called an Act of Donation and having it notarized. The process is relatively quick and easy, but it does have potential tax implications.

According to the Family Code: The prohibition shall also apply to persons living together as husband and wife without a valid marriage. Thus, generally, the husband and wife cannot donate to one another during the marriage. This includes direct or indirect giving of gifts. The reason is founded on public policy.

Yes you can sell it, it is your property now and you can do anything you deem fit. A gift deed cannot be conditional.Basically a gift deed with conditions is not valid in law. Donor cannot cancel the registered gift deed unilaterally .

The gift cannot ever be revoked nor can you later ask for financial compensation. Disadvantages of a Gift Deed? Usually a Gift Deed is used to transfer property between family members. As a result, the transaction may be subject to coercion or fraud.

Property ownership in Louisiana is voluntarily transferred by a contract through the owner and the transferee. A transfer of real (immovable) property can be made by authentic act or by an act under private signature duly acknowledged (CC1839 Art. 1839).

Act of Donation Forms LouisianaAct of Donation. To donate a thing or right to another person is to transfer such thing or right to another person without an exchange or payment. In other words it is the giving of something to another without receiving anything of value in return.