Louisiana Inventory, Probate

About this form

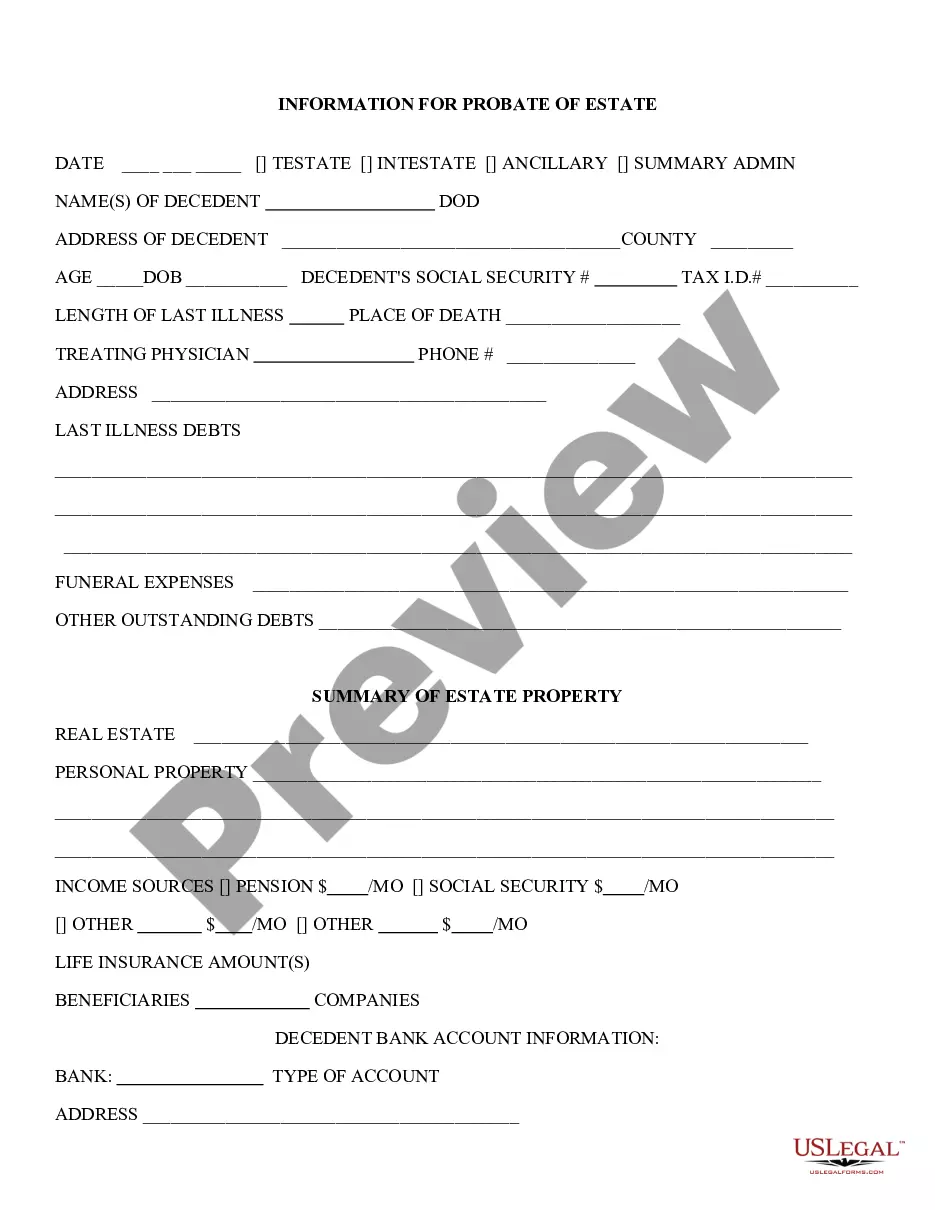

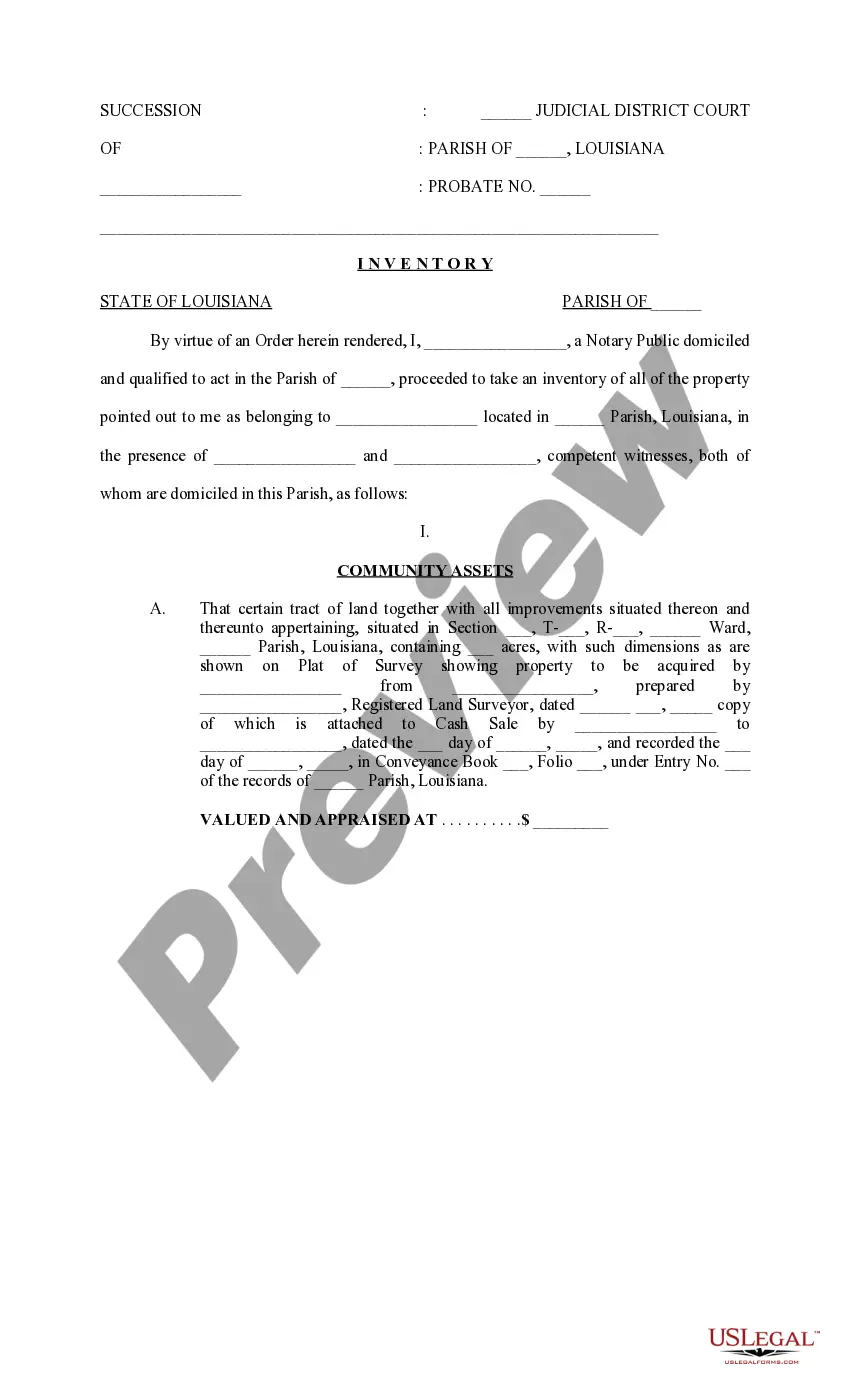

The Inventory, Probate form is a legal document used in the probate process to list and record all assets owned by a deceased individual. This inventory is crucial for assessing the total value of the estate and ensuring that the distribution of assets is conducted according to the law. Unlike other legal forms related to estate planning, such as a Last Will and Testament, the Inventory focuses specifically on detailing the assets during the probate proceedings.

Form components explained

- Location details, including the parish and address of the property.

- Identification of the decedent and the individuals present during the inventory.

- Classification of assets, including real estate and any improvements.

- Valuation of each property listed in the inventory.

- Entry specifics related to previous transactions and records in the public registry.

Common use cases

This form should be used when you are overseeing the probate process of a deceased individualâs estate. It is typically required after the court validates the decedent's will and before the distribution of assets. The inventory ensures that all assets are accounted for, which is necessary for settling debts and distributing the remaining property to heirs and beneficiaries.

Who needs this form

- Executors or administrators of a deceased person's estate.

- Beneficiaries who need to understand the full scope of the estate's assets.

- Legal representatives assisting in the probate process.

- Family members of the deceased involved in estate matters.

Completing this form step by step

- Identify the decedent and the parish where the assets are located.

- Gather all pertinent information about the decedent's properties, including addresses and legal descriptions.

- List each asset, classifying them into community assets and any other relevant categories.

- Assess and appraise the value of each property, ensuring accuracy for legal purposes.

- Obtain signatures from competent witnesses present during the inventory process.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all assets, resulting in incomplete inventory.

- Incorrectly valuing properties, which can lead to legal disputes.

- Not having the required witnesses or notary present during the inventory process.

- Omitting necessary legal descriptions of properties.

Benefits of completing this form online

- Convenience of accessing and completing the form at any time.

- Editable templates allow for easy customization to fit specific circumstances.

- Access to forms directly drafted by licensed attorneys ensuring legal compliance.

Quick recap

- The Inventory, Probate form is essential for documenting all assets in a deceased's estate.

- It is used during the probate process to establish asset value and prepare for distribution.

- Complete the form accurately to avoid legal complications and ensure fair asset distribution.

Looking for another form?

Form popularity

FAQ

Real Estate, Bank Accounts, and Vehicles. Stocks and Bonds. Life Insurance and Retirement Plans. Wages and Business Interests. Intellectual Property. Debts and Judgments.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

When assets are being valued for probate, the valuation should be as at the date of death. For property, this will be what the market value at that time is; for personal possessions, it will be what they will fetch on the open market at the date of your death, and so on.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Beneficiaries are entitled to receive a financial accounting of the trust, including bank statements, regularly. When statements are not received as requested, a beneficiary must submit a written demand to the trustee.The court will review the trust account for any discrepancies or irregular activity.

Beneficiaries often must sign off on the inheritance they receive to acknowledge receipt of the distribution. For example, if you inherit a portion of real estate from the decedent, you must sign a deed accepting that real estate.