Louisiana Judgment for Child Support

What this document covers

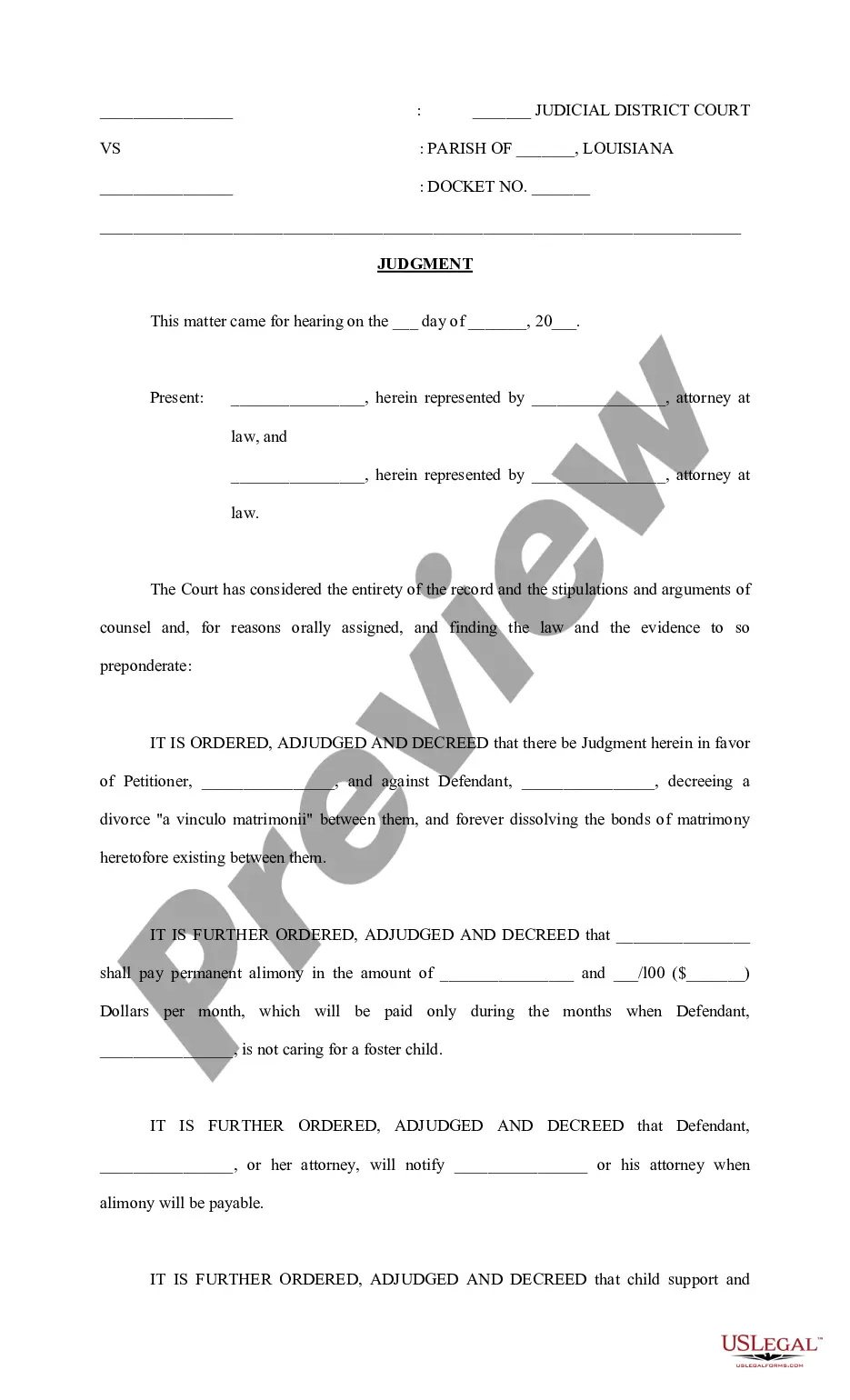

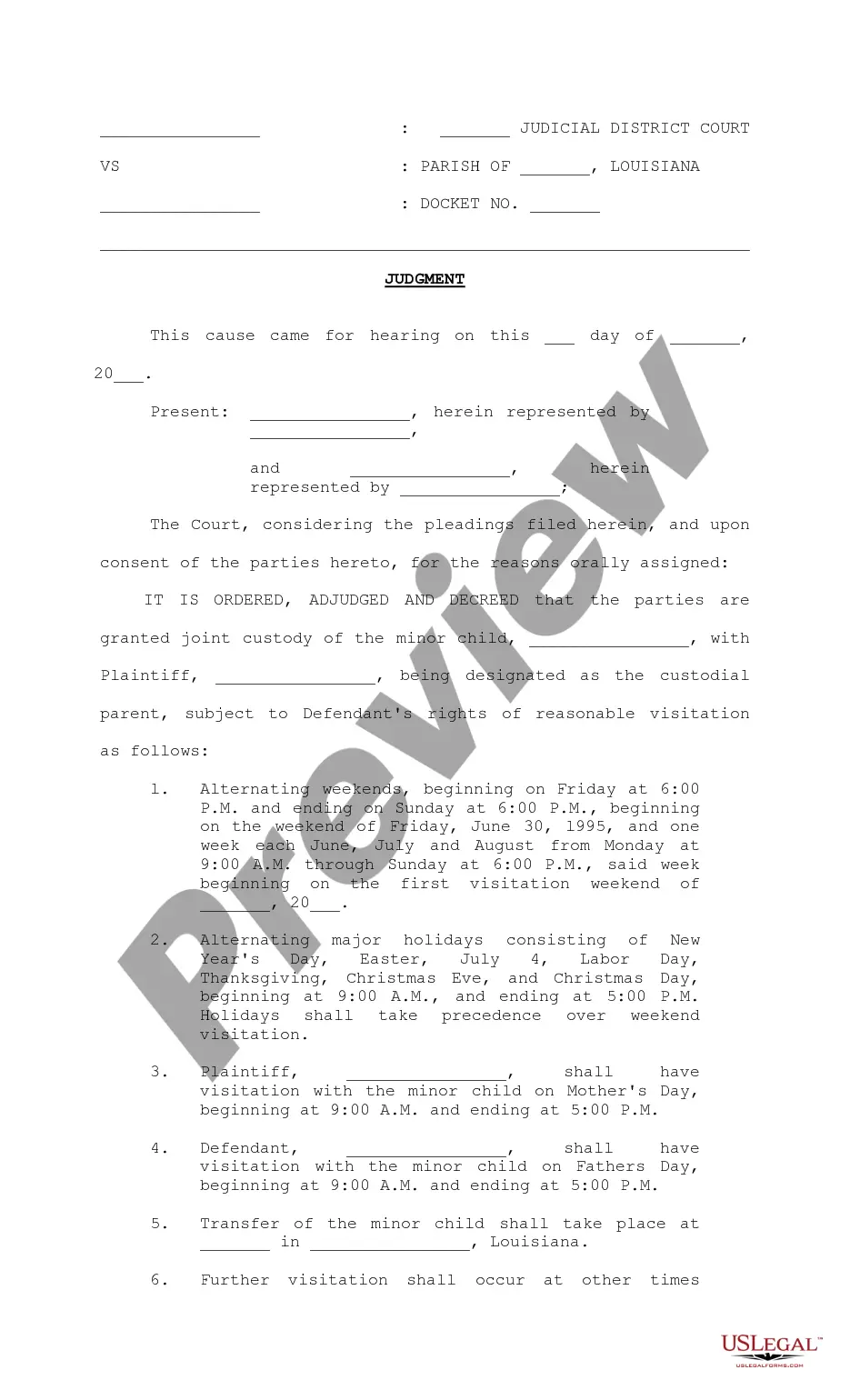

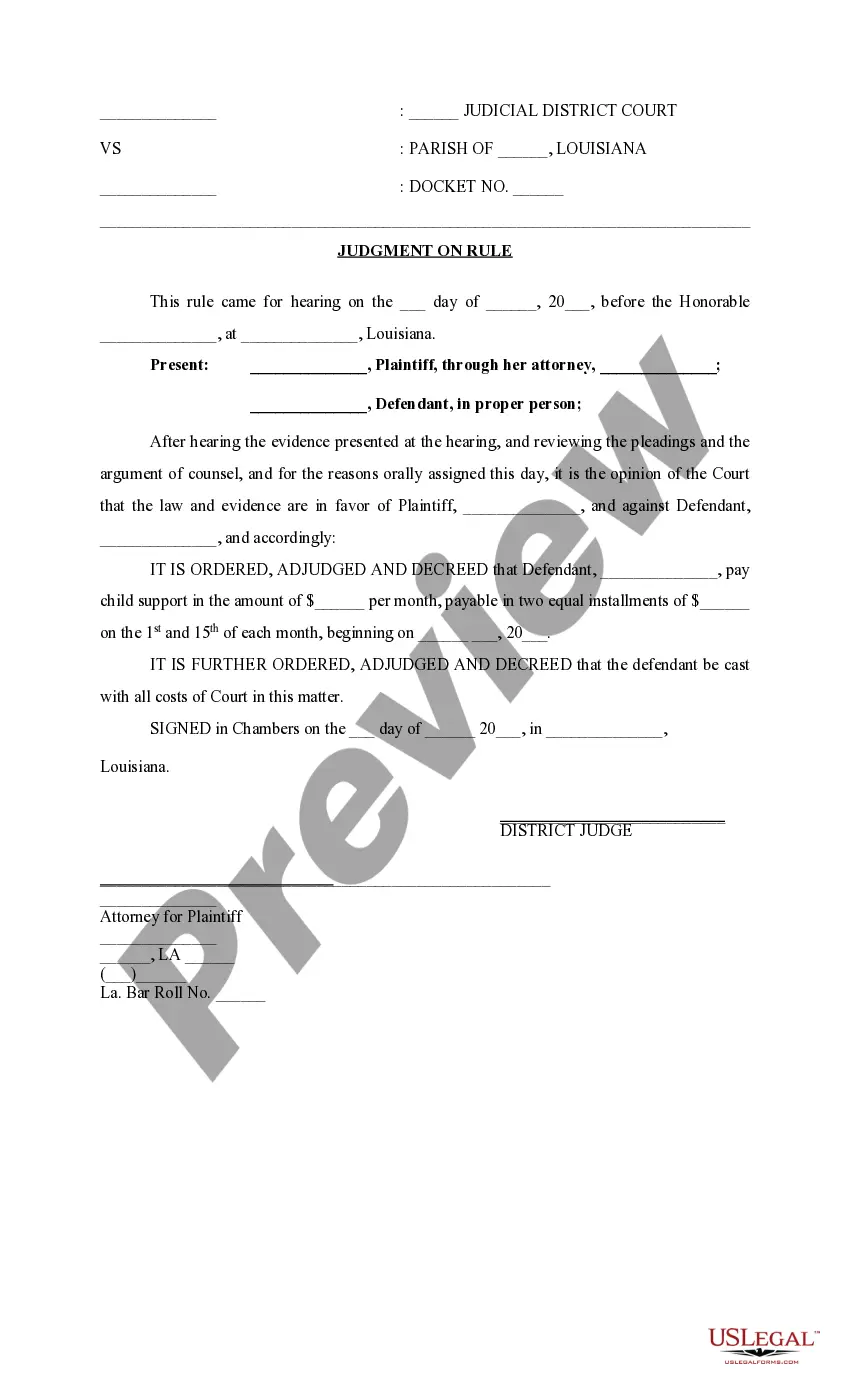

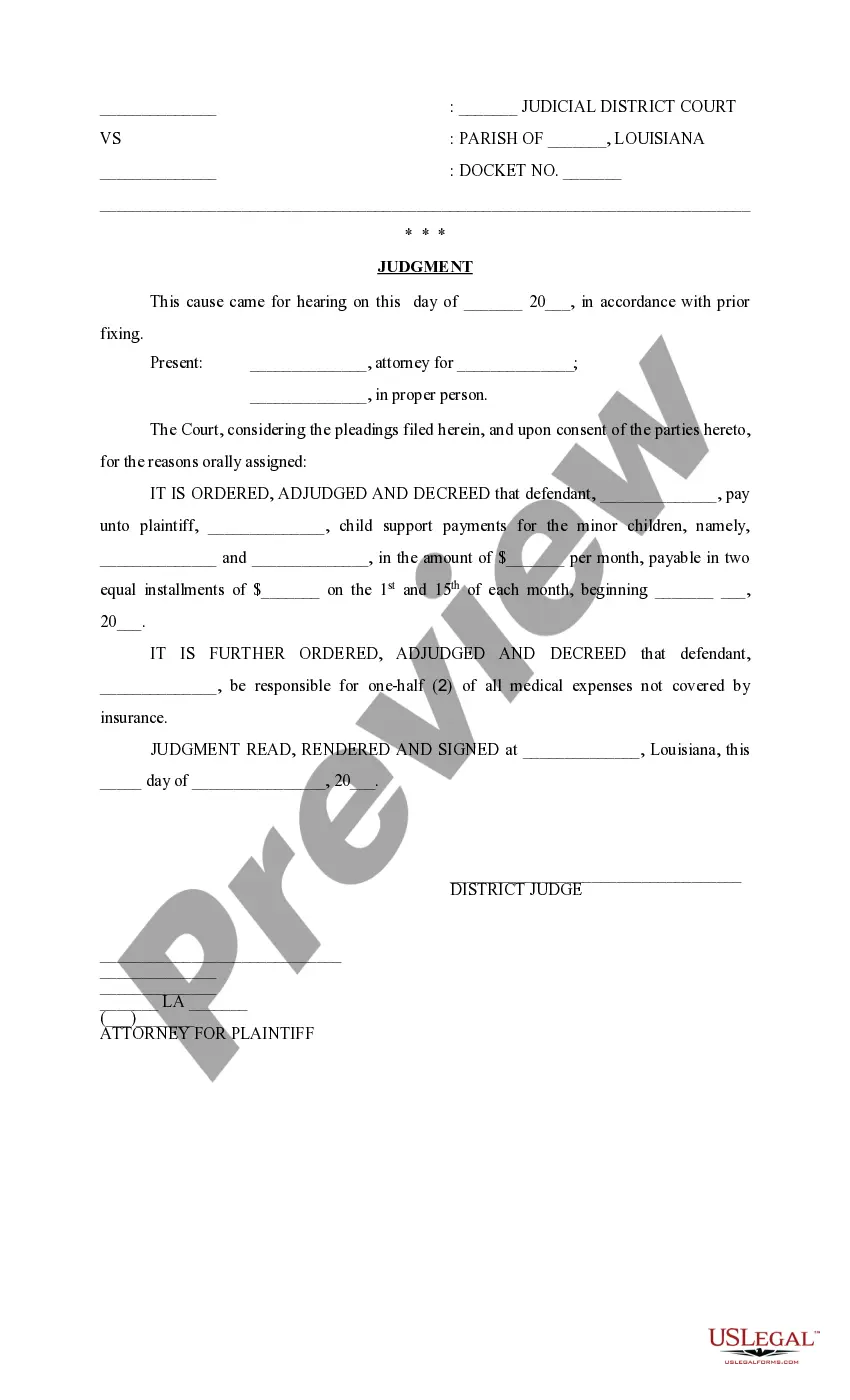

The Judgment for Child Support is a legal document that outlines the court's decision regarding child support payments. This form is used to formalize the obligations of a non-custodial parent (defendant) to provide financial support for their minor children. It specifically dictates the monthly payment amount and the division of medical expenses not covered by insurance, differentiating it from other forms related to child custody or visitation rights.

What’s included in this form

- Case details, including the date of the hearing and docket number.

- The names of the parties involved (plaintiff and defendant).

- Specific amount of monthly child support payments and payment schedule.

- Division of uninsured medical expenses associated with the children.

- Judgment's date and the signature of the district judge.

Common use cases

This form should be used when a court has made a decision regarding child support payments post-hearing. It is necessary when establishing legal requirements for one parent to provide financial support for their children, especially after a divorce or separation. Additionally, it sets clear expectations for the payment of medical expenses, ensuring that both parents share responsibility for their children's health care costs.

Who needs this form

This form is intended for:

- Parents involved in child support cases where a court hearing has already taken place.

- Non-custodial parents required to make child support payments.

- Custodial parents seeking to formalize support agreements through the court.

- Attorneys representing parties in child support matters.

Steps to complete this form

Follow these steps to accurately complete the Judgment for Child Support:

- Enter the pertinent court details, including the date and docket number.

- Clearly state the names of both the plaintiff and defendant.

- Specify the monthly child support payment amount and the due dates.

- Indicate the division of any medical expenses not covered by insurance.

- Ensure the judgment is signed and dated by the district judge.

Notarization guidance

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to include both parties' names accurately.

- Not specifying the exact monthly payment amount or payment schedule.

- Omitting the necessary details about uninsured medical expenses.

- Incorrectly filling out court information, such as docket numbers.

- Neglecting to secure the signature from the district judge.

Advantages of online completion

- Accessibility: Download and complete the form at your convenience.

- Editability: Make necessary changes easily before finalizing.

- Reliability: Forms are drafted by licensed attorneys to ensure legal compliance.

- Time-efficient: Eliminate the need for legal office visits and consultations.

Looking for another form?

Form popularity

FAQ

The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66.6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

Child support back pay cannot be totally forgiven or waived, but there are a few situations that can help you handle it. Double-check the amount the court states you are in arrears. You can always ask the court to recalculate this amount to make sure it is correct.You can request a manageable payment schedule.

As with other types of government debt, the consequences can be severe if you don't pay. The Child Support Agency (CSA) or Child Maintenance Service (CMS) have the powers to deduct arrears and ongoing payments straight from your earnings or bank account.

Yes, because the law requires a non-custodial parent (that is, a parent who does not live with the child) pay a minimum amount of child support. That minimum amount is $100.00 a month for any number of children.

Louisiana law requires both parents to pay child support based on the needs of the child and the ability of the parents to provide support. Both parents are expected to provide basic financial support for things like food, housing, and clothing.

The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66.6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

For certain outstanding debts -- including past-due child support and unpaid student loans -- the IRS can withhold some or all of your unpaid stimulus payment issued as a Recovery Rebate Credit when you file your taxes.

The statute of limitations for child support enforcement in Louisiana is 10 years.

A custodial parent can waive or forgive all arrears owed to him or her directly. Use the Account Summary from the SCU to determine what arrears are owed to the parent, and what arrears are owed to the state (if the custodial parent ever received Public Assistance).