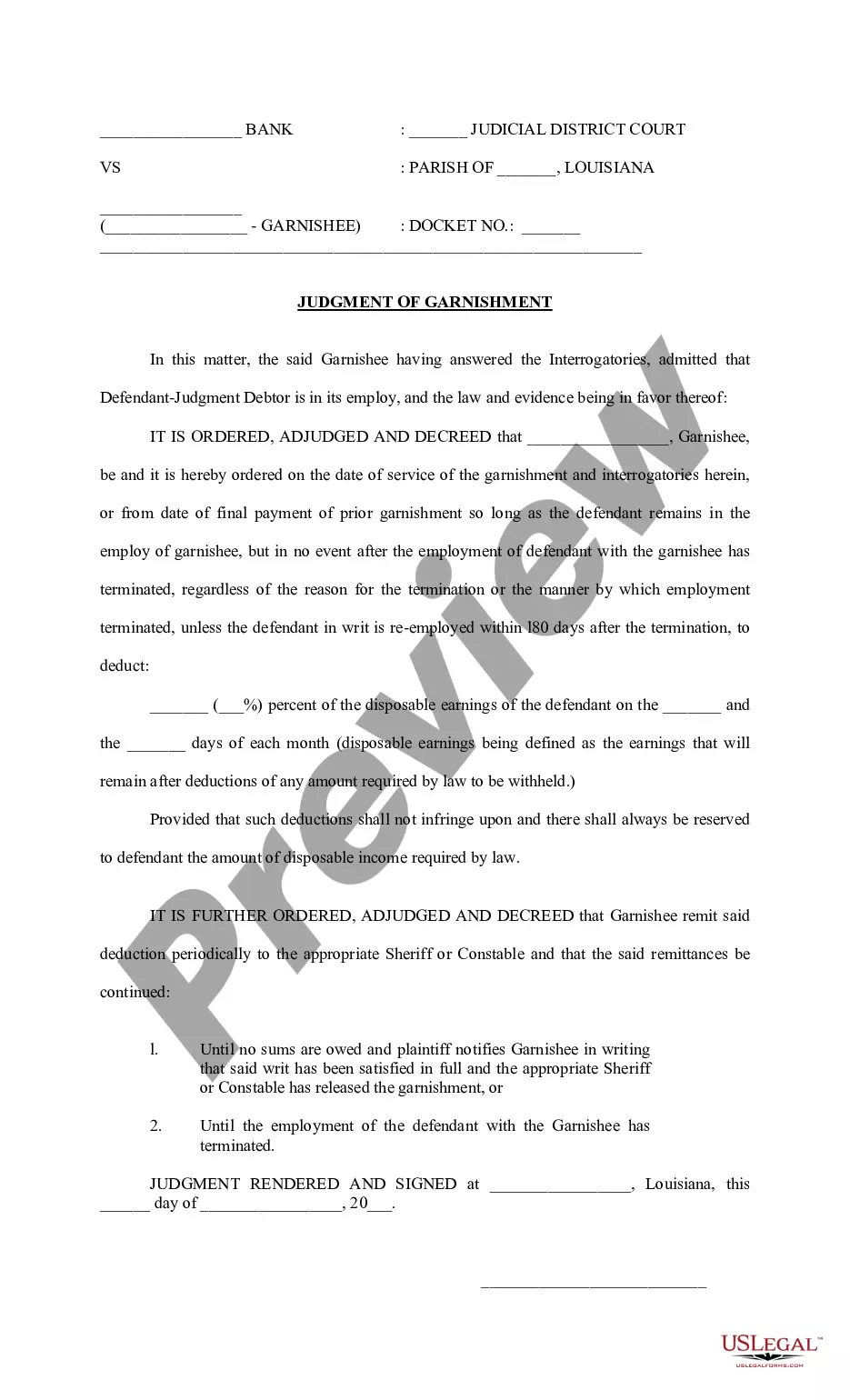

Louisiana Judgment of Garnishment

Description

Key Concepts & Definitions

Judgment of Garnishment: A legal process where a court orders a third party to withhold funds, such as wages or bank accounts, from the defendant to satisfy a debt. Common instances include child support payments and unpaid loans. Wage garnishment laws, which vary by state, regulate how much and under what conditions creditors can claim wages. A bank account levy is another form where funds are directly taken from a bank account under court order. Judgment creditor rights describe the legal entitlements creditors possess once a judgment has been made in their favor.

Step-by-Step Guide to Responding to a Judgment of Garnishment

- Review the Garnishment Notice: Understand the details, including the amount and source of garnishment.

- Seek Legal Advice: Consult a debt collection lawyer to explore your legal options.

- Assess Financial Impact: Determine how the garnishment affects your finances, particularly if it involves child support payments or income garnishments details.

- Filing for Bankruptcy: If appropriate, consider filing for bankruptcy to Invoke bankruptcy protection information.

- Appeal the Garnishment: If you believe the garnishment was wrongly issued, discuss appealing the decision with your lawyer.

Risk Analysis of Garnishment

- Financial Strain: Garnishment can significantly reduce disposable income, impacting daily living and ability to pay other debts.

- Credit Score Impact: Garnishments are recorded and can negatively affect your credit score.

- Employment Concerns: Some employers view garnishment negatively, potentially impacting job security.

- Increased Legal Costs: Fighting a garnishment can involve substantial legal fees and time.

Common Mistakes & How to Avoid Them

- Ignoring Garnishment Notifications: Always respond promptly to avoid additional penalties or fees.

- Not Updating Court Documents: Keep all records current, especially if your financial situation changes.

- Failing to Secure Personal Information: Employ online security solutions, like a website firewall such as Sucuri, to protect personal financial information from data breaches.

- Omitting Professional Help: Consider hiring a debt collection lawyer early in the process to navigate the complexities of garnishment laws and creditor rights effectively.

How to fill out Louisiana Judgment Of Garnishment?

Trying to find Louisiana Judgment of Garnishment sample and completing them can be a problem. To save lots of time, costs and effort, use US Legal Forms and find the correct example specially for your state in a few clicks. Our lawyers draw up each and every document, so you just have to fill them out. It truly is so easy.

Log in to your account and return to the form's web page and save the sample. Your saved templates are saved in My Forms and are available always for further use later. If you haven’t subscribed yet, you need to register.

Check out our detailed guidelines on how to get your Louisiana Judgment of Garnishment template in a few minutes:

- To get an qualified example, check its applicability for your state.

- Take a look at the sample using the Preview function (if it’s available).

- If there's a description, read it to learn the details.

- Click on Buy Now button if you found what you're looking for.

- Choose your plan on the pricing page and create your account.

- Choose you wish to pay out by a credit card or by PayPal.

- Download the form in the favored format.

You can print out the Louisiana Judgment of Garnishment template or fill it out making use of any web-based editor. No need to concern yourself with making typos because your template can be used and sent away, and printed as many times as you want. Try out US Legal Forms and get access to more than 85,000 state-specific legal and tax documents.

Form popularity

FAQ

This current liability account reports the amount a company must remit to a court or other agencies for amounts withheld from its employees' salaries and wages.

The journal entry will be Debit Gross Wages, and Credit "Child Support Liability account." When you write the check to pay the garnishment, on the Expenses tab, you list the Child Support Liability account.

Go to Employees, then choose the Employee's name. In the Deductions and Contributions section, select Edit. Select Add a Garnishment. Select a garnishment type, then enter the required information. Field. Select Save, then OK.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Wage Garnishments Only Apply to the Employment Relationship In most situations, the creditor must first file a lawsuit, overcome any defenses the debtor may assert (many debtors simply default), and then obtain a Monetary Judgment in the exact amount of the debt due plus interest (both past and ongoing).

You do this by filing a Claim of Exemption with the court and mailing it to the judgment creditor, the sheriff or constable who served the collection paperwork, and any third party involved (such as your employer or bank). f063 Fill out the Claim of Exemption form completely.

In many situations, one of the best ways to collect a judgment after winning a case is to put a lien on the debtor's property. This gives you a claim to the property and, in some cases, the property will be sold at public auction in order to satisfy the debt that is owed.

There is no wage garnishment tax deduction that can automatically reduce your income tax if you have wages garnished. However, if your wages are being garnished to pay a tax-deductible expense, like medical debt, you may be able to deduct those payments.

Record the Judgment. File motion for judgment debtor examination and obtain personal service. File petition for garnishment under writ of fifa. If the garnishee does not timely provide answers, you may file a motion for judgment against garnish.