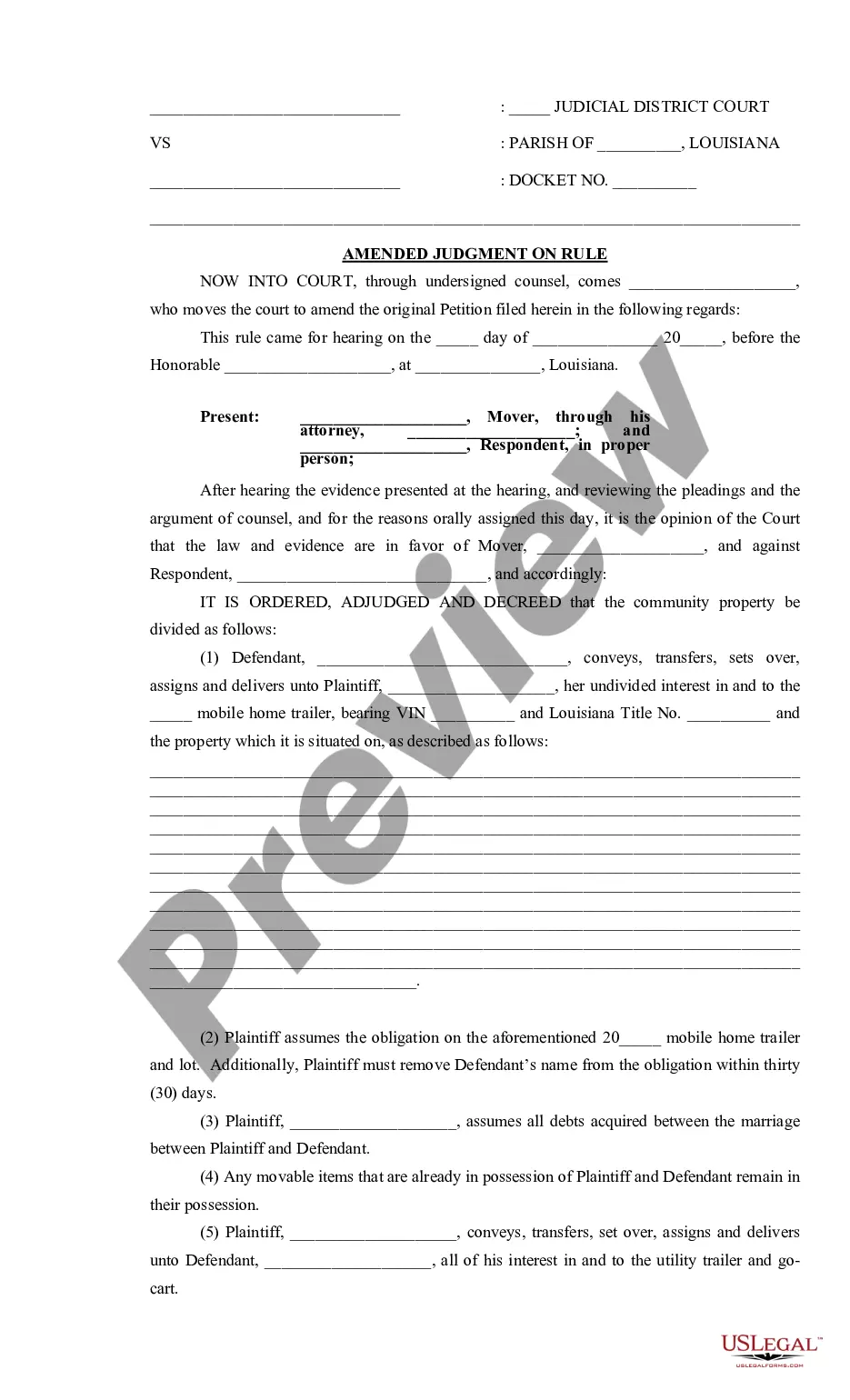

Louisiana Amended Judgment on Rule with Community Property in Divorce

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Louisiana Amended Judgment On Rule With Community Property In Divorce?

Looking for Louisiana Revised Judgment on Rule with Joint Property in Divorce documents and completing them can be somewhat challenging.

To conserve a lot of time, expenses, and effort, utilize US Legal Forms and discover the appropriate template specifically for your jurisdiction in just a few clicks.

Our lawyers prepare every document, so you only need to complete them. It's that straightforward.

- Log in to your account and return to the form's webpage to download the document.

- All your downloaded templates are stored in My documents and are available at all times for future use.

- If you haven’t signed up yet, you should create an account.

- Check our comprehensive directions on how to obtain the Louisiana Revised Judgment on Rule with Joint Property in Divorce form in no time.

- To access a valid document, verify its relevance for your state.

- Use the Preview feature (if available) to inspect the form.

- If a description exists, review it to comprehend the specifics.

- Click on the Buy Now button if you found what you are looking for.

- Select your plan on the pricing page and establish your account.

- Choose whether you wish to pay by card or via PayPal.

- Download the template in your desired format.

- You can print the Louisiana Revised Judgment on Rule with Joint Property in Divorce template or complete it using any online editor.

- Don't worry about making errors as your template can be utilized and submitted, and printed as many times as you like.

- Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

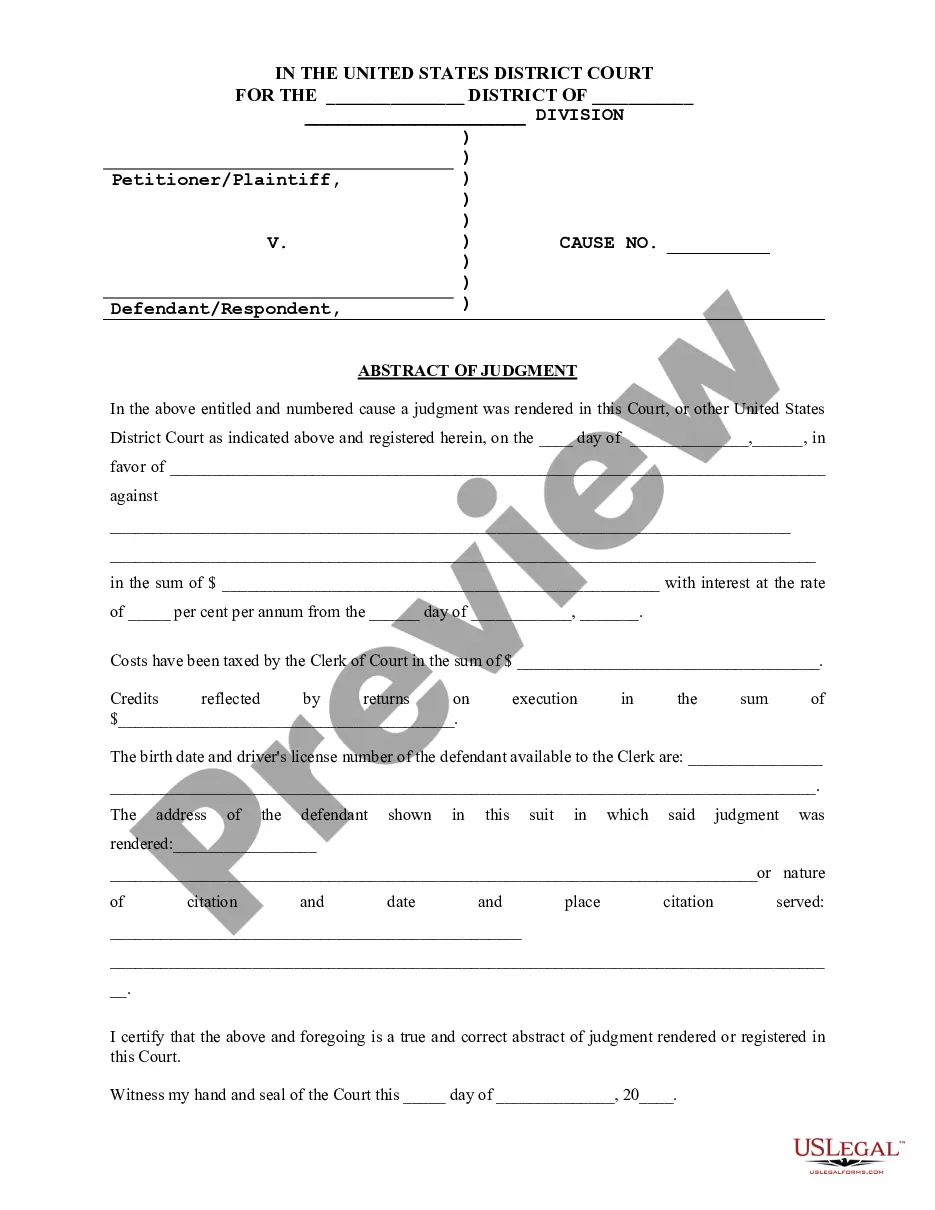

In Louisiana, certain personal property can be seized to satisfy a judgment, such as bank accounts, vehicles, and other assets that can be readily liquidated. However, certain exemptions apply, protecting essential properties from seizure. Knowing which personal property can be affected is crucial, especially concerning a Louisiana Amended Judgment on Rule with Community Property in Divorce.

A motion to amend a judgment in Louisiana allows a party to request changes to the existing judgment. This may be necessary if new evidence arises or if there were errors in the original judgment. Filing a motion can be particularly important when dealing with a Louisiana Amended Judgment on Rule with Community Property in Divorce, as it ensures that the judgment accurately reflects all relevant factors.

In Louisiana, a judgment is generally valid for ten years from the date it is rendered. After this period, you may need to take specific legal actions to renew or enforce the judgment. This timeframe is crucial if you are dealing with a Louisiana Amended Judgment on Rule with Community Property in Divorce, as timing can significantly impact the division of assets.

To make a judgment executory in Louisiana, you must first obtain the judgment from the court. Once you have the final judgment, you can file it with the clerk of court. This process allows the judgment to be enforced through various means, ensuring that your Louisiana Amended Judgment on Rule with Community Property in Divorce can be enacted effectively.

What Is Community Property? Community property refers to a U.S. state-level legal distinction that designates a married individual's assets. Any income and any real or personal property acquired by either spouse during a marriage are considered community property and thus belong to both partners of the marriage.

Regardless of your state's property division laws, a prenuptial agreement lets you decide how marital property will be divided in the event of a divorce.In this sense, a prenuptial agreement can "override" community property or equitable distribution laws.

There's no restriction on being married and filing jointly with different state residences. As long as you and your spouse are married on the last day of the year, the IRS counts you as married for all 12 months. If, say, your divorce becomes final December 31, you file as single for the entire year.

Louisiana is a community property state. This means that spouses generally share equally in the assets, income and debt acquired by either spouse during the marriage. However, some income and some property may be separate income or separate property.

Community property states as of 2020 include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin.That means spouses can divide their property by community property standards, but they don't have to.

Key Takeaways. Community property law requires that a divorcing couple split their assets 50/50, but only assets acquired while they were domiciled in the state. Property owned by either spouse prior to the marriage or after the legal separation may not be considered or divided as community property.