Louisiana Demand Letter regarding Payment for NSF Check

What is this form?

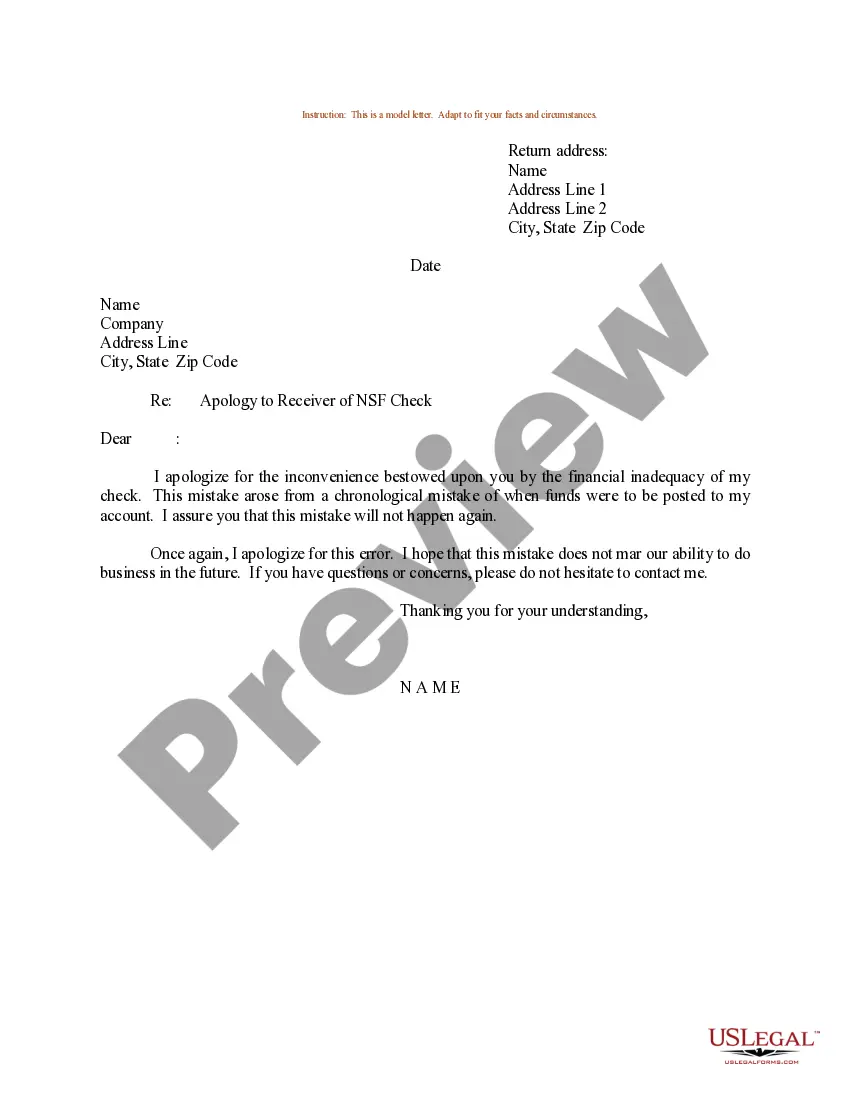

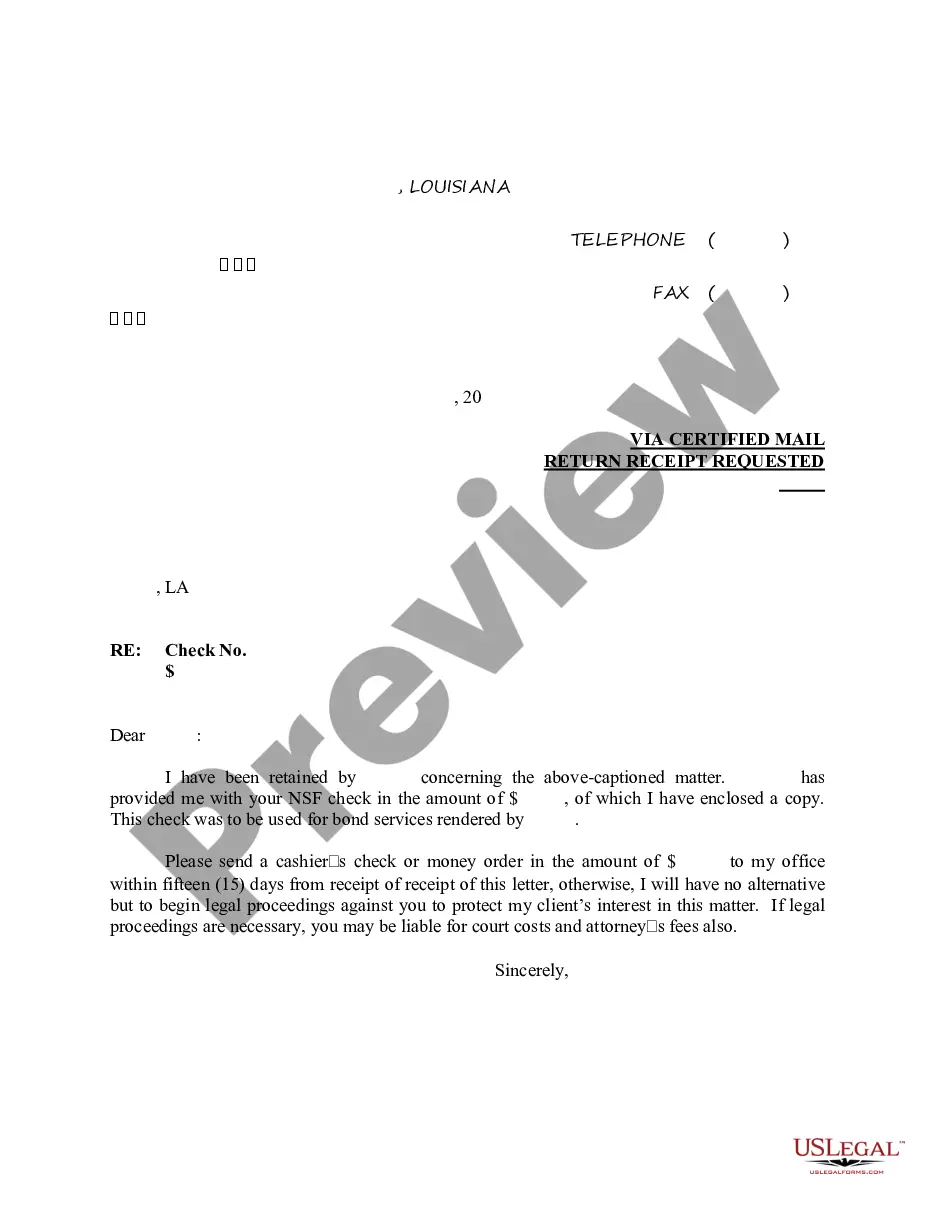

The Demand Letter regarding Payment for NSF Check is a legal document used to request payment for a check that has been returned due to insufficient funds (NSF). This letter is typically sent by the attorney representing the payee, informing the payor (the drawer of the check) of their obligation to settle the payment. By issuing this demand letter, the payee aims to resolve the matter without escalating it to legal proceedings, distinguishing it from other forms that may be used in similar situations, like a formal lawsuit or complaint.

What’s included in this form

- Identification of the parties involved (payee and payor).

- Details of the NSF check, including the amount and date.

- Deadline for payment submission.

- Payment method acceptance, specifying cashier's check or money order.

- Consequences of non-compliance, indicating potential legal action.

Situations where this form applies

This form should be used in situations where a payee has received a check that has bounced due to insufficient funds. If efforts to collect the payment informally have failed, a demand letter serves as a formal request for payment. It is often the first step before pursuing legal action and is essential for documenting attempts to resolve the matter amicably.

Intended users of this form

Individuals or businesses that have received a bounced check should consider using this form. It is intended for:

- Payees who have been issued an NSF check.

- Legal representatives acting on behalf of the payee.

- Businesses that provide services where payment by check is common.

How to prepare this document

- Identify the payee and payor, including full names and addresses.

- Clearly state the details of the NSF check, including the amount and the check date.

- Set a specific deadline for when the payment is due.

- Specify acceptable payment methods, such as cashier's check or money order.

- Include a warning about potential legal action if payment is not received.

Does this form need to be notarized?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Not including the deadline for payment, which can weaken the demand.

- Failing to specify accepted payment methods, leading to confusion.

- Using vague language regarding potential legal action.

- Omitting critical party details, such as contact information.

Advantages of online completion

- Convenience of filling out and customizing the form from home.

- Immediate access to the document, enabling quicker resolution.

- Ability to easily edit the content as needed.

- Prepared by licensed attorneys to ensure legal compliance.

Summary of main points

- The Demand Letter regarding Payment for NSF Check serves as a formal request for payment for bounced checks.

- Ensure the document includes all necessary details to avoid future disputes.

- Using the form correctly can help establish a legal basis for further action if needed.

Looking for another form?

Form popularity

FAQ

Request for payment of a debt that you believe you might. owe. While most of the amount that is demanded may. be owing, a portion may not be owing. It's important.

LETTER OF DEMAND BACKGROUND A demand generally amounts to a request for payment or a request to perform in terms of a legal obligation. A letter of demand is generally an initial step in the litigation process. In certain instances, a letter of demand is necessary to place the debtor in mora.

After you've sent your demand letter, which is a letter telling the insurance company how much you believe you're owed for a settlement, the insurer has control of the clock. However, you should receive a settlement check within two weeks to two months, roughly.

After you send a demand letter, one of several things can happen: The insurance company accepts your demand, and the settlement goes forward. You'll receive the compensation you asked for and sign a release of liability in exchange.

A demand generally amounts to a request for payment or a request to perform in terms of a legal obligation.The letter of demand must provide a clear indication of what is expected from the defaulting party, e.g payment of a liquidated amount, delivery of a certain thing, or to refrain from taking certain action.

Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

An attorney is usually not necessary at this point and you can write a demand letter on your own. To write one, gather necessary documents, draft your letter, and send the letter to your opposing party.

Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.

Your company name and address. recipient's name and address. today's date. a clear reference and/or any account reference numbers. the amount outstanding. original payment due date. a brief explanation that no payment has been received.