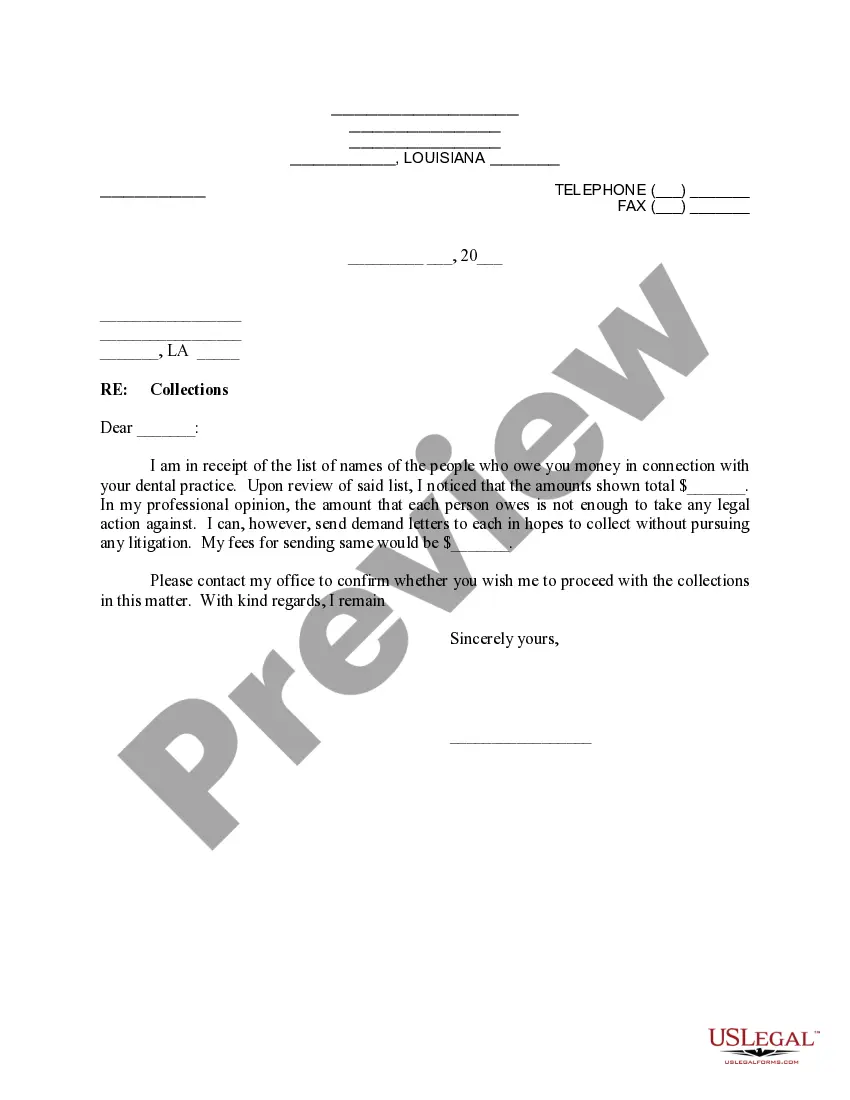

Louisiana Letter to Client regarding Collections Advice

Description Letter Collections Template

How to fill out Louisiana Letter To Client Regarding Collections Advice?

Looking for Louisiana Letter to Client regarding Collections Advice templates and completing them can be a challenge. To save lots of time, costs and energy, use US Legal Forms and find the correct sample specially for your state within a few clicks. Our lawyers draw up each and every document, so you just have to fill them out. It truly is so simple.

Log in to your account and come back to the form's page and download the document. Your downloaded samples are saved in My Forms and therefore are available all the time for further use later. If you haven’t subscribed yet, you have to sign up.

Have a look at our comprehensive guidelines on how to get the Louisiana Letter to Client regarding Collections Advice sample in a couple of minutes:

- To get an eligible example, check out its applicability for your state.

- Take a look at the example using the Preview option (if it’s offered).

- If there's a description, read it to understand the important points.

- Click Buy Now if you identified what you're trying to find.

- Pick your plan on the pricing page and make an account.

- Select you would like to pay by way of a card or by PayPal.

- Save the sample in the preferred format.

You can print the Louisiana Letter to Client regarding Collections Advice template or fill it out using any web-based editor. Don’t concern yourself with making typos because your template can be used and sent, and printed as many times as you wish. Check out US Legal Forms and access to around 85,000 state-specific legal and tax documents.

Letter Collections Form Form popularity

Louisiana Client Form Other Form Names

FAQ

A debt validation letter can be an effective tool for dealing with debt collectors.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.

Verify that it's your debt. Understand your rights. Consider the kind of debt you owe. Consider hardship programs. Offer a lump sum. Mention bankruptcy. Speak calmly and logically. Be mindful of the statute of limitations.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.

You have the right to force the debt collector to prove you owe the money. Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

The amount of debt owed. The name of the creditor to whom the debt is owed. A statement of notice that the debt will be considered valid by the debt collector unless the consumer disputes it within 30 days of notice.

It is the purpose of this subchapter to eliminate abusive debt collection practices by debt collectors, to insure that those debt collectors who refrain from using abusive debt collection practices are not competitively disadvantaged, and to promote consistent State action to protect consumers against debt collection

Fair Debt Collection Practices Act (FDCPA) Validation Letter The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies.

I am responding to your contact about a debt you are attempting to collect. You contacted me by phone/mail, on date. You identified the debt as any information they gave you about the debt. Please stop all communication with me and with this address about this debt.