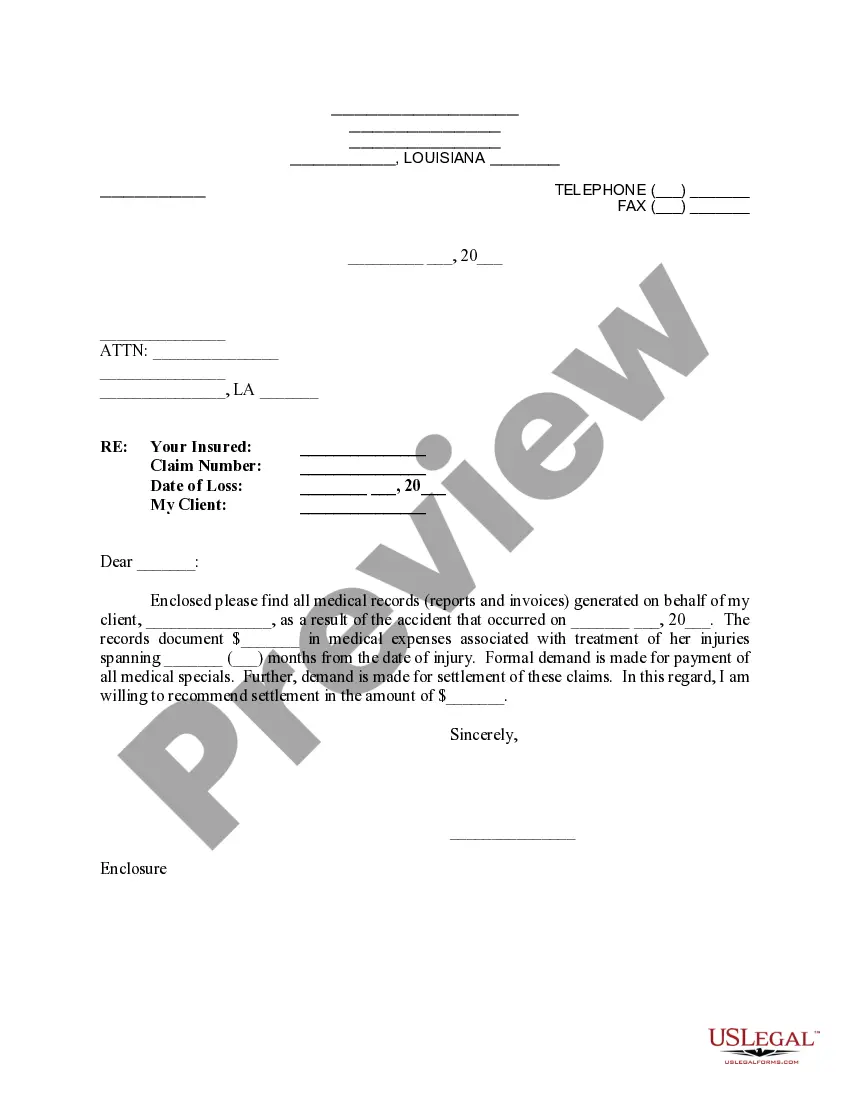

Louisiana Letter to Opposing Counsel regarding Insurance Settlement Demand

Description

How to fill out Louisiana Letter To Opposing Counsel Regarding Insurance Settlement Demand?

Looking for Louisiana Letter to Opposing Counsel regarding Insurance Settlement Demand forms and completing them could be a problem. To save time, costs and energy, use US Legal Forms and find the right sample specially for your state within a few clicks. Our attorneys draw up every document, so you just have to fill them out. It truly is that easy.

Log in to your account and return to the form's page and save the document. Your downloaded samples are kept in My Forms and therefore are available all the time for further use later. If you haven’t subscribed yet, you have to sign up.

Have a look at our detailed recommendations concerning how to get the Louisiana Letter to Opposing Counsel regarding Insurance Settlement Demand form in a couple of minutes:

- To get an qualified form, check out its applicability for your state.

- Have a look at the example making use of the Preview function (if it’s offered).

- If there's a description, read through it to understand the details.

- Click on Buy Now button if you identified what you're trying to find.

- Choose your plan on the pricing page and make your account.

- Pick how you want to pay out by way of a card or by PayPal.

- Download the file in the favored format.

Now you can print out the Louisiana Letter to Opposing Counsel regarding Insurance Settlement Demand template or fill it out utilizing any web-based editor. Don’t concern yourself with making typos because your template can be utilized and sent, and printed as many times as you wish. Try out US Legal Forms and get access to over 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Step 1 Complete the Initial Letter. Enter the reason for the demand (referencing a settlement agreement, medical bills, etc.) Step 2 Send to the Insurance Company. The demand letter should be sent with appropriate details. Step 3 Wait for Payment. Step 4 Get an Attorney. Step 5 File Legal Action.

Demand letters are often the precursor to filing a lawsuit. But they can also be an effective tool in resolving disputes before going to court.Having your attorney draft a demand letter can be a wise move because it gives the recipient a chance to rectify the situation without facing a lawsuit.

An attorney is usually not necessary at this point and you can write a demand letter on your own. To write one, gather necessary documents, draft your letter, and send the letter to your opposing party.

After you've sent your demand letter, which is a letter telling the insurance company how much you believe you're owed for a settlement, the insurer has control of the clock. However, you should receive a settlement check within two weeks to two months, roughly.

Timeline After the Demand Letter Is Sent The most common route is that, after your demand letter has been sent, the insurance company will reject your settlement amount and come back with a different value. Once that has been sent, you and your attorney will either accept or refuse the amount.

The most common route is that, after your demand letter has been sent, the insurance company will reject your settlement amount and come back with a different value. Once that has been sent, you and your attorney will either accept or refuse the amount.

Outline The Incident. You will need to start by outlining the details of the accident. Detail Your Injuries. The next section you will want to talk about the resulting injuries. Explain All Of Your Damages. Calculate Your Settlement Demand. Attach Relevant Documents. Get Help From An Attorney.

Type your letter. Concisely review the main facts. Be polite. Write with your goal in mind. Ask for exactly what you want. Set a deadline. End the letter by stating you will promptly pursue legal remedies if the other party does not meet your demand. Make and keep copies.