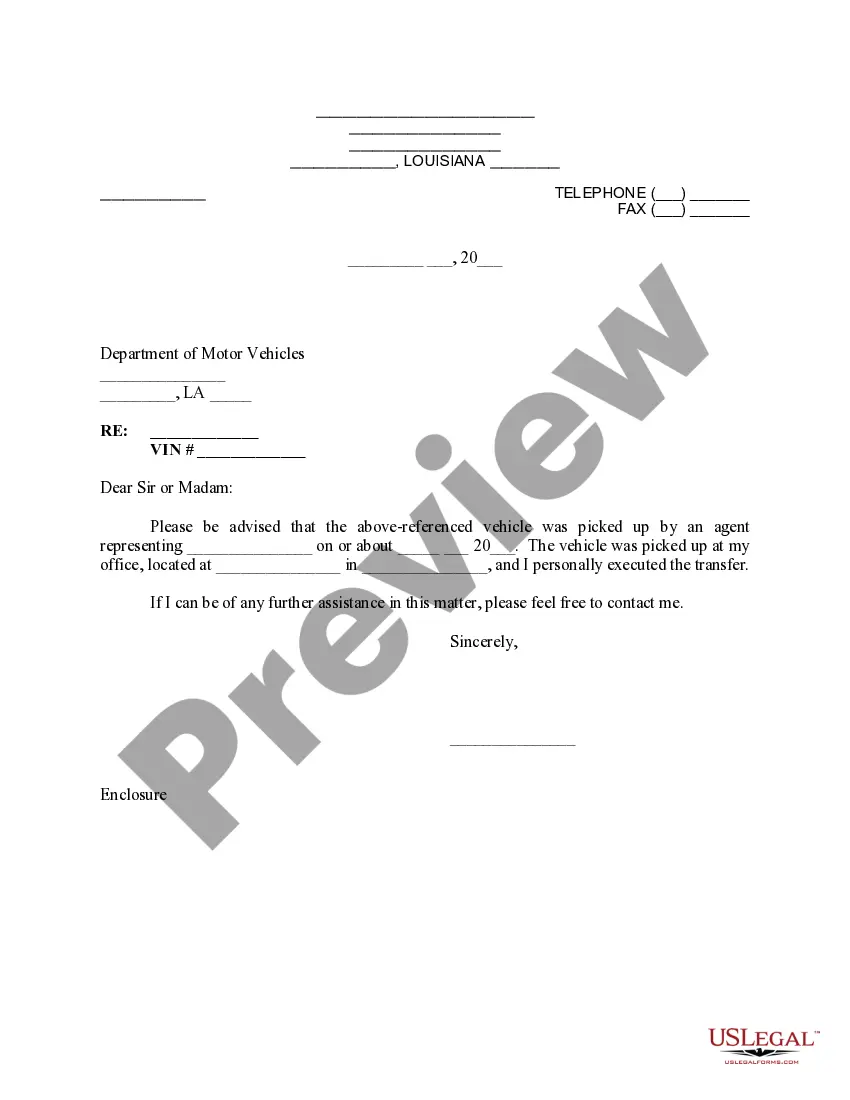

Louisiana Letter to Department of Motor Vehicles regarding Vehicle Transfer

Description

How to fill out Louisiana Letter To Department Of Motor Vehicles Regarding Vehicle Transfer?

Searching for Louisiana Letter to Department of Motor Vehicles regarding Vehicle Transfer forms and filling out them could be a challenge. To save time, costs and effort, use US Legal Forms and find the correct template specially for your state in a few clicks. Our attorneys draw up each and every document, so you simply need to fill them out. It really is so simple.

Log in to your account and return to the form's web page and save the document. Your downloaded examples are stored in My Forms and therefore are accessible always for further use later. If you haven’t subscribed yet, you have to register.

Take a look at our thorough guidelines concerning how to get your Louisiana Letter to Department of Motor Vehicles regarding Vehicle Transfer template in a couple of minutes:

- To get an entitled example, check out its validity for your state.

- Check out the sample making use of the Preview function (if it’s offered).

- If there's a description, go through it to understand the details.

- Click on Buy Now button if you found what you're seeking.

- Choose your plan on the pricing page and make an account.

- Select you want to pay by a card or by PayPal.

- Save the sample in the preferred format.

You can print the Louisiana Letter to Department of Motor Vehicles regarding Vehicle Transfer template or fill it out making use of any online editor. Don’t worry about making typos because your sample can be used and sent, and printed as often as you wish. Check out US Legal Forms and get access to more than 85,000 state-specific legal and tax documents.

Form popularity

FAQ

Out-of-state old carTo transfer an out-of-state vehicle registration to Louisiana, first you have to fill out an application. See here for the application. Along with that application, you must give the OMV: A copy of your driver's license.

Go to an LA DMV. Fill out the Vehicle Application (DPSMV 1799) Provide your information: Driver's license or ID. Proof of insurance. Provide vehicle information: Proof of purchase. Ownership documents. Pay the registration fees and taxes. Title: $68.50. Handling: Varies.

Vehicle Application form. Certificate of title. Current certificate of registration. A notarized bill of sale or Act of Donation of a Moveable. Proof of a satisfied lien, if applicable. Payment for all applicable fees. The owner's valid photo ID.

You can transfer it online if the previous owner has submitted the notice of disposal. If the notice of disposal has not been submitted by the seller you can still complete this transaction at a service centre within 14 days from the date of purchase to avoid a late transfer fee.

A completed Vehicle Application. You current driver's license. The current registration and title for the car if coming in from out of state. Proof of car insurance with at least $15.000 worth of bodily injury coverage. Inspection paperwork. Proof of sales tax payment if you are coming from out of state.

Fees necessary for issuance of a new vehicle title and registration: $68.50 title fee. $15.00 lien recordation fee for UCC-1 financing statements or $10.00 lien recordation fee for other security agreement documents, if applicable.

Get a lien release (if necessary) Get the gifter's signature on the title notarized. Complete a Vehicle Application form. Complete and notarize an Act of Donation of a Movable form.

Complete the online Notice of Transfer at the OMV website. You'll need to provide the car's license plate number and expiration date, as well as the VIN, your driver's license number, the buyer's information, the date of the sale, and the price.

After the 40th day, penalty and interest will be assessed for each 30 days or portion thereof; the penalty is assessed at the rate of 5% for 30 days or fraction thereof and 1.25% interest per month (no maximum) based on the amount of sales tax.