Louisiana Affidavit of Lost Promissory Note

Understanding this form

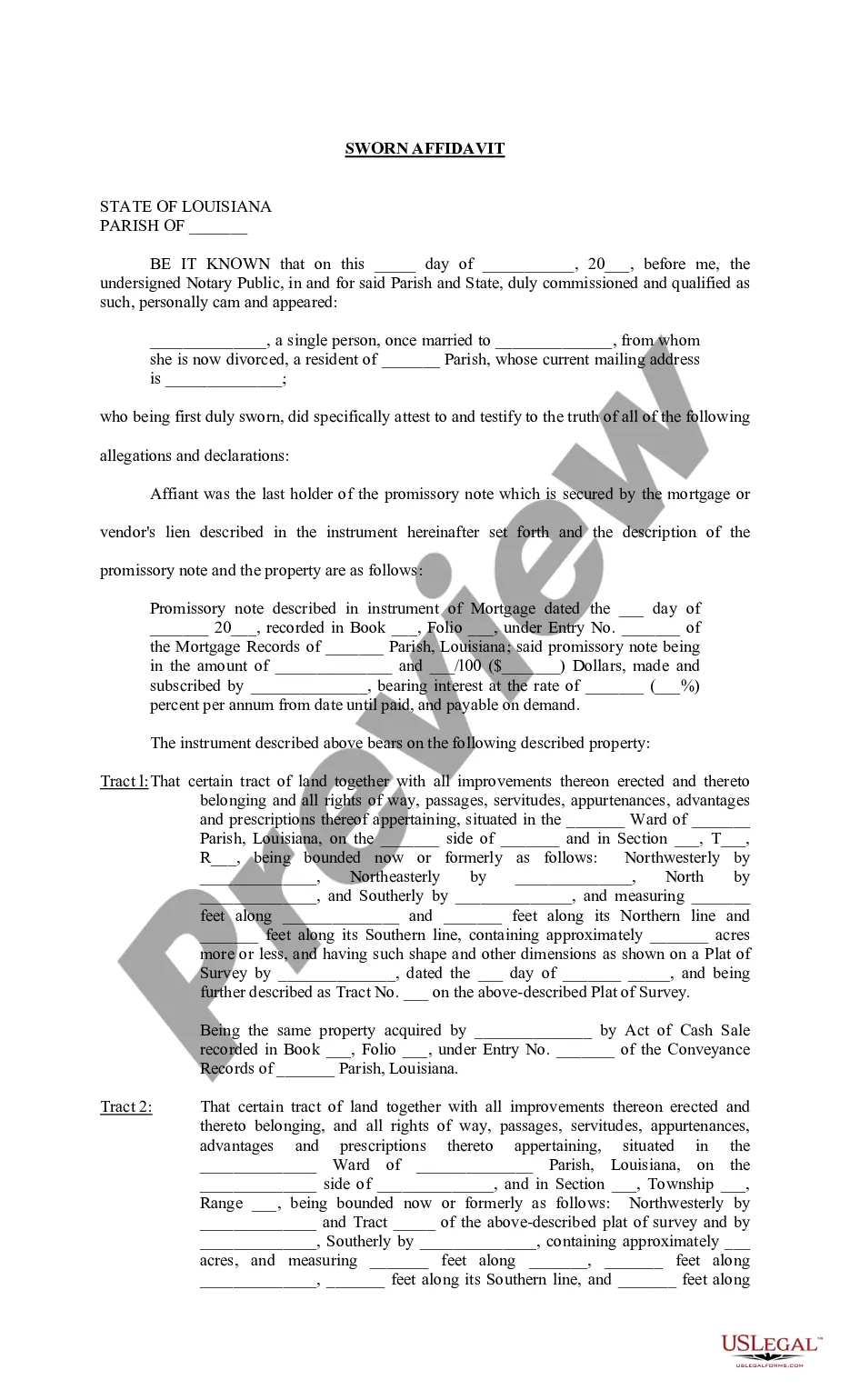

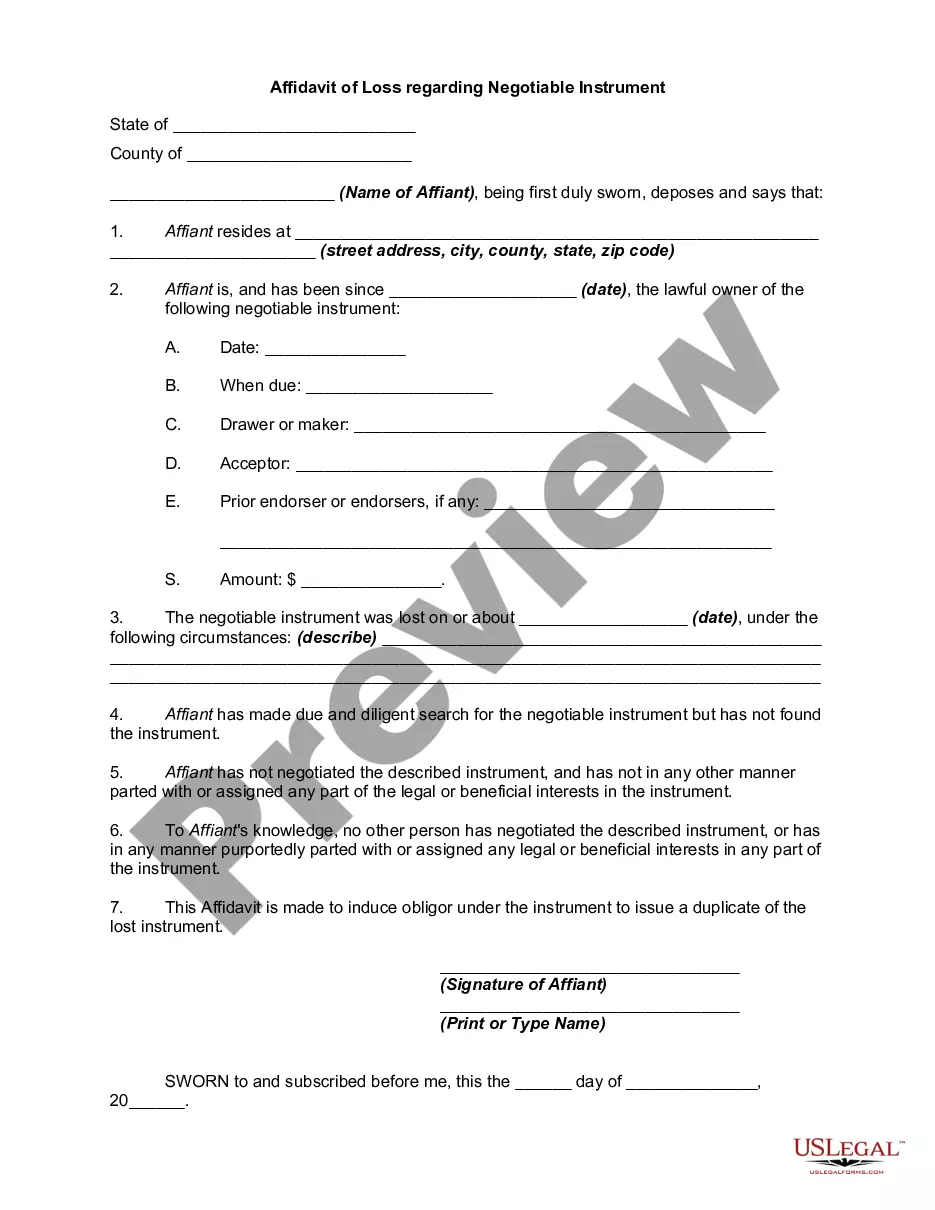

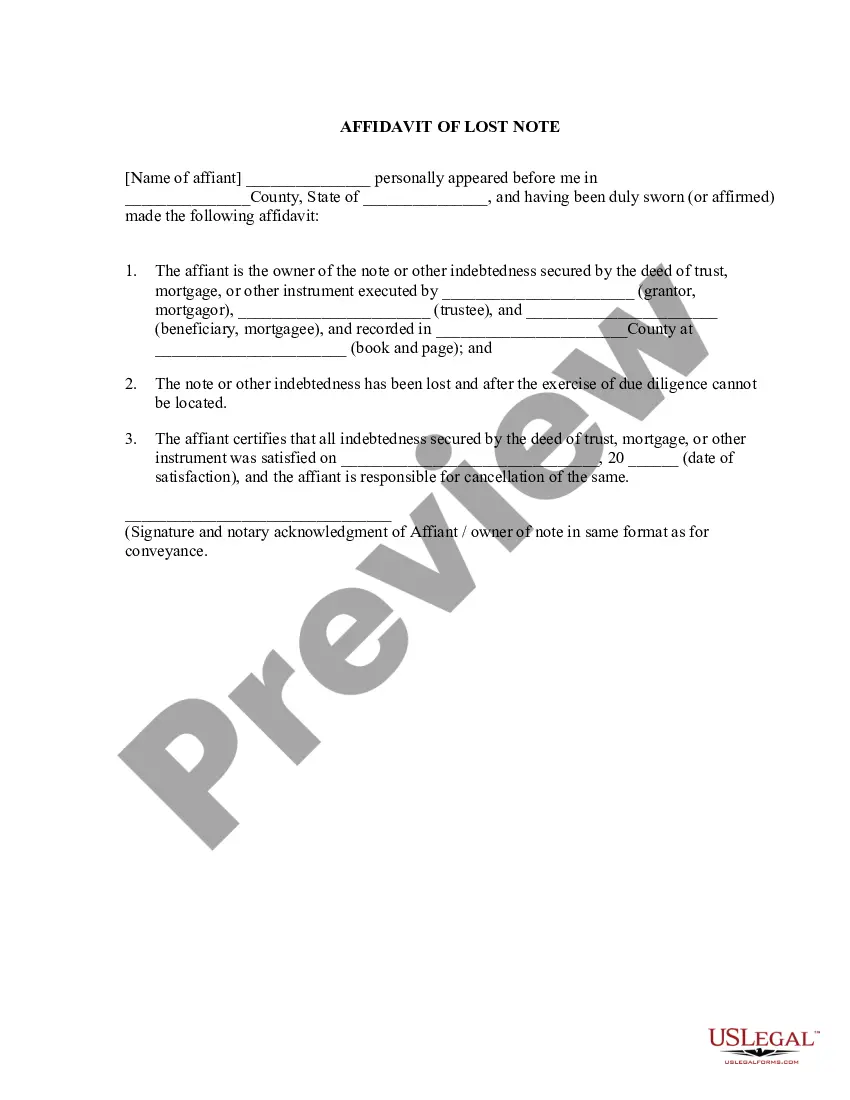

The Affidavit of Lost Promissory Note is a legal document in which the affiant declares that they were the holder of a promissory note that has been lost but has been fully paid. This affidavit serves the purpose of authorizing the Clerk of Court and recorder of mortgages to cancel the associated mortgage or vendor's lien. It clarifies that the affiant has not sold, transferred, or assigned the note to another party, distinguishing it from other types of affidavits that may focus on different legal claims or agreements.

Form components explained

- Details about the affiant, including name, address, and relationship status.

- Description of the lost promissory note including amount and interest rate.

- Identification of the mortgage or vendor's lien being canceled.

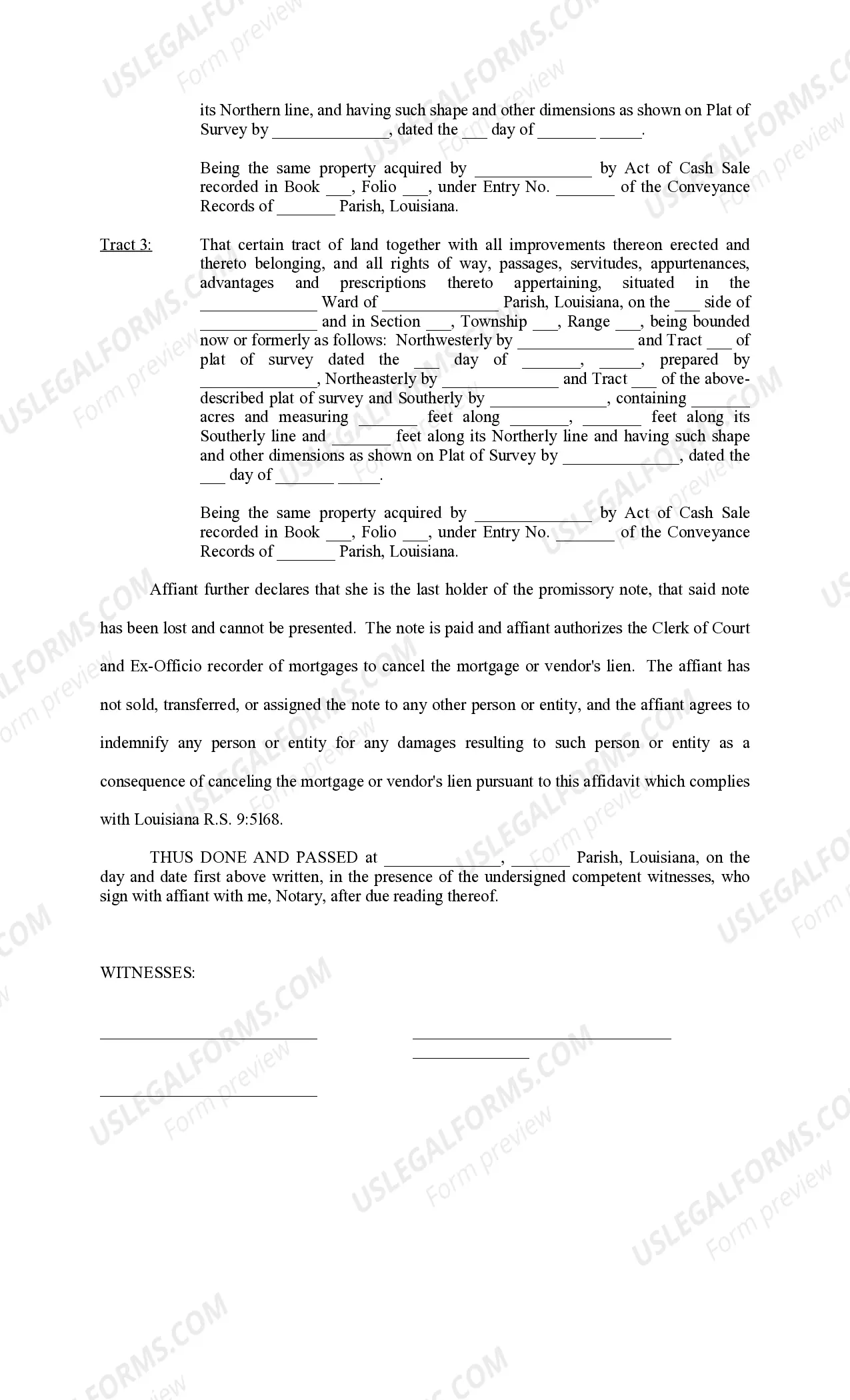

- Affiant's declaration regarding the status of the note and indemnification agreement.

- Signatures of the affiant and witnesses, along with a notary public certification.

Common use cases

This form is used when an individual has lost a promissory note they were holding, which is secured by a mortgage or vendor's lien. It is necessary when the individual wishes to cancel or release the mortgage or lien and ensure that their legal rights to the property are maintained. This document is particularly relevant in situations where the note has been paid off but cannot be presented for cancellation.

Who should use this form

- Individuals who were the lawful holders of a promissory note that has been lost.

- Homeowners seeking to release a mortgage or lien tied to a paid-off loan.

- Affiants who have not assigned their notes to another party.

- Persons who need to clear up their property records due to lost documentation.

How to complete this form

- Identify the affiant and provide their personal information, including marital status and current address.

- Describe the lost promissory note with its amount, interest rate, and other relevant details.

- Specify the mortgage or vendor's lien being canceled and provide a description of the secured property.

- Include a declaration stating that the note is lost, paid, and not assigned to anyone else.

- Obtain signatures from the affiant, witnesses, and a notary public to finalize the document.

Notarization requirements for this form

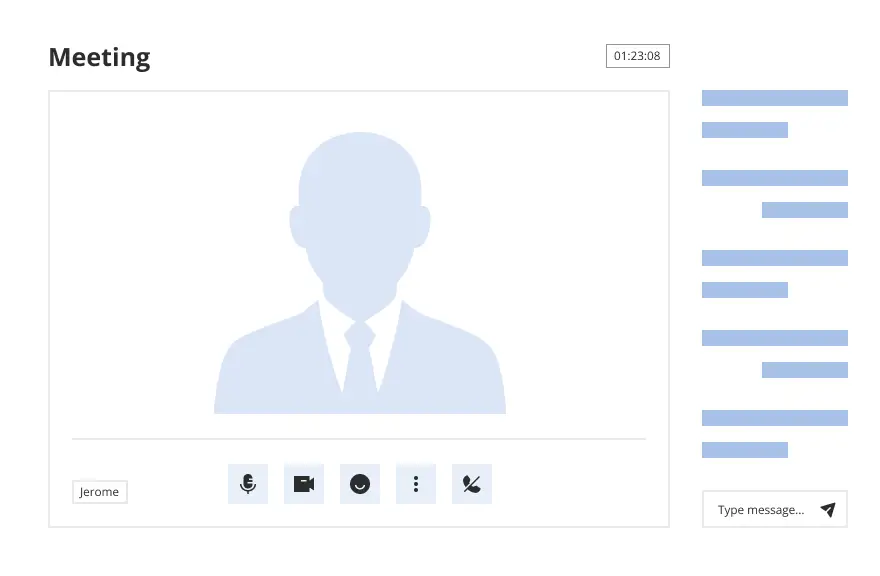

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

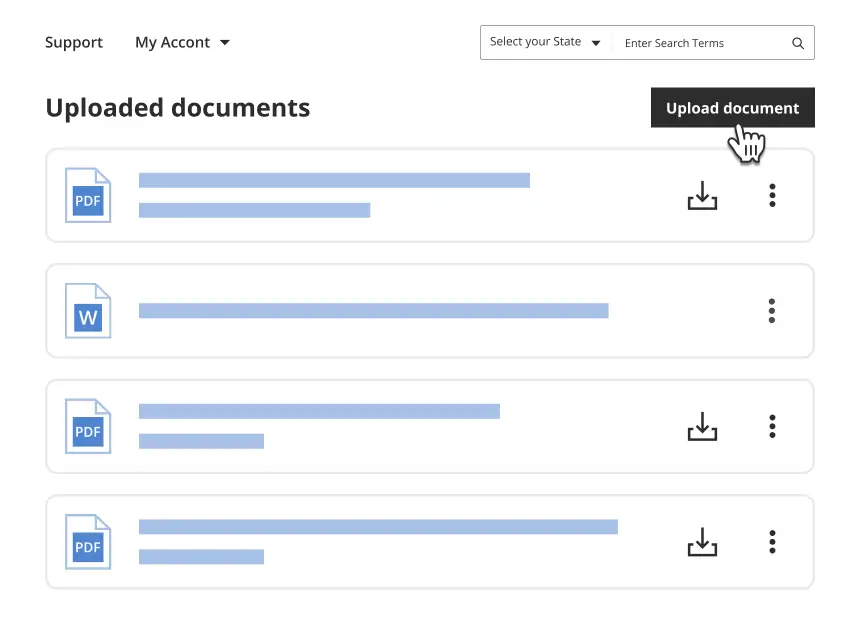

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to provide accurate details about the promissory note or property.

- Not having the document notarized if required by local regulations.

- Omitting witness signatures, which may invalidate the affidavit.

- Incorrectly stating whether the note has been sold or transferred.

Why use this form online

- Convenience of immediate download and accessibility from anywhere.

- Editability allows for personalization to meet specific needs.

- Reliability of having templates drafted by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

Who must sign the promissory note? A loan agreement is signed by both parties but only the borrowing party needs to sign a promissory note. A witness need not sign but the note can be notarized as evidence that the borrower did sign the document.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

The buyer of the note becomes what is called a holder because they hold your note as the owner of it. A holder has a special right to collect from you right away if you don't pay. But only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.

A promissory note, in simplest terms, is the acknowledgment of a debt.Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents. A lender is required under the Federal Servicer Act to provide you copies of your loan documents if you submit a written request.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.