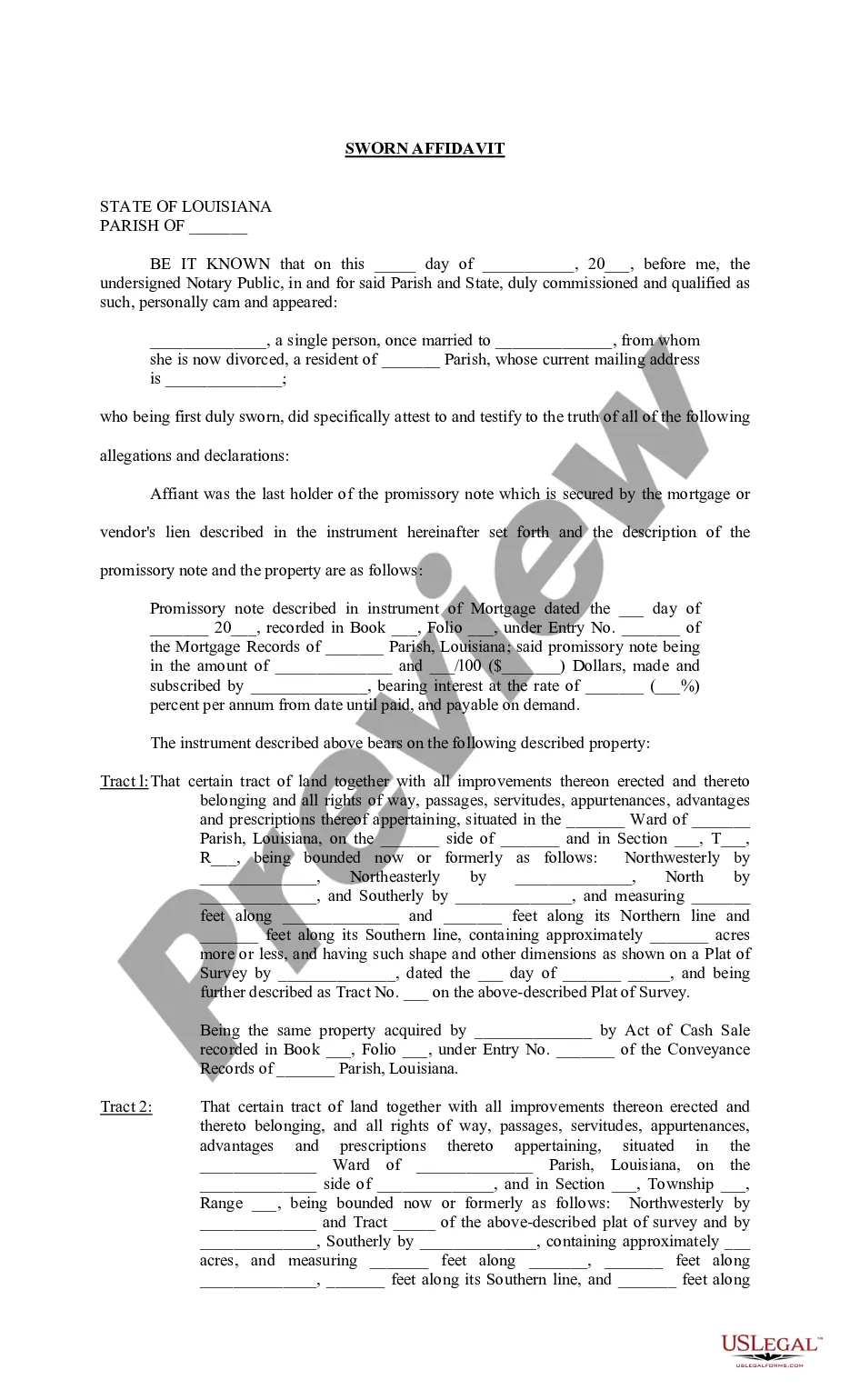

Louisiana Affidavit of Lost Promissory Note

Description

How to fill out Louisiana Affidavit Of Lost Promissory Note?

Finding a Louisiana Affidavit of Lost Promissory Note template and completing it can be difficult.

To conserve time, expenses, and effort, utilize US Legal Forms to locate the appropriate example specifically for your state within a few clicks.

Our lawyers prepare each document, so you merely need to fill them out. It is genuinely straightforward.

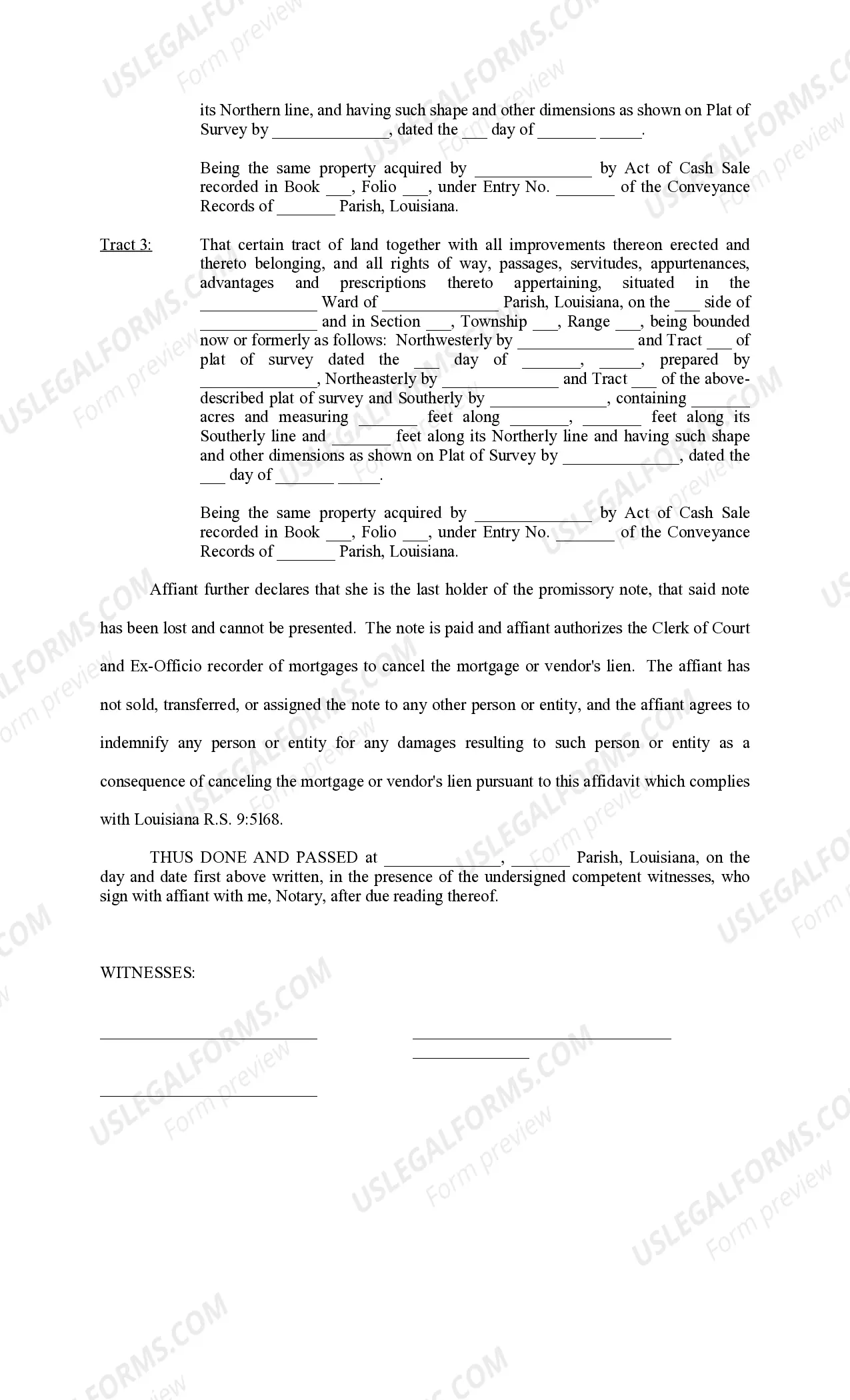

Choose your plan on the pricing page and create your account. Indicate whether you prefer to pay by card or through PayPal. Save the template in your preferred file format. You can now print the Louisiana Affidavit of Lost Promissory Note form or fill it out using any online editor. Don’t worry about making errors since your template can be utilized and submitted as many times as needed. Try US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account to revisit the form's webpage and download the template.

- Your saved templates are stored in My documents and can be accessed at any time for later use.

- If you haven’t registered yet, you should create an account.

- Review our detailed instructions on how to obtain your Louisiana Affidavit of Lost Promissory Note template in no time.

- To acquire a relevant sample, confirm its suitability for your state.

- Use the Preview feature to review the sample (if available).

- If there is a description, read it to grasp the key points.

- Click Buy Now if you have found what you are looking for.

Form popularity

FAQ

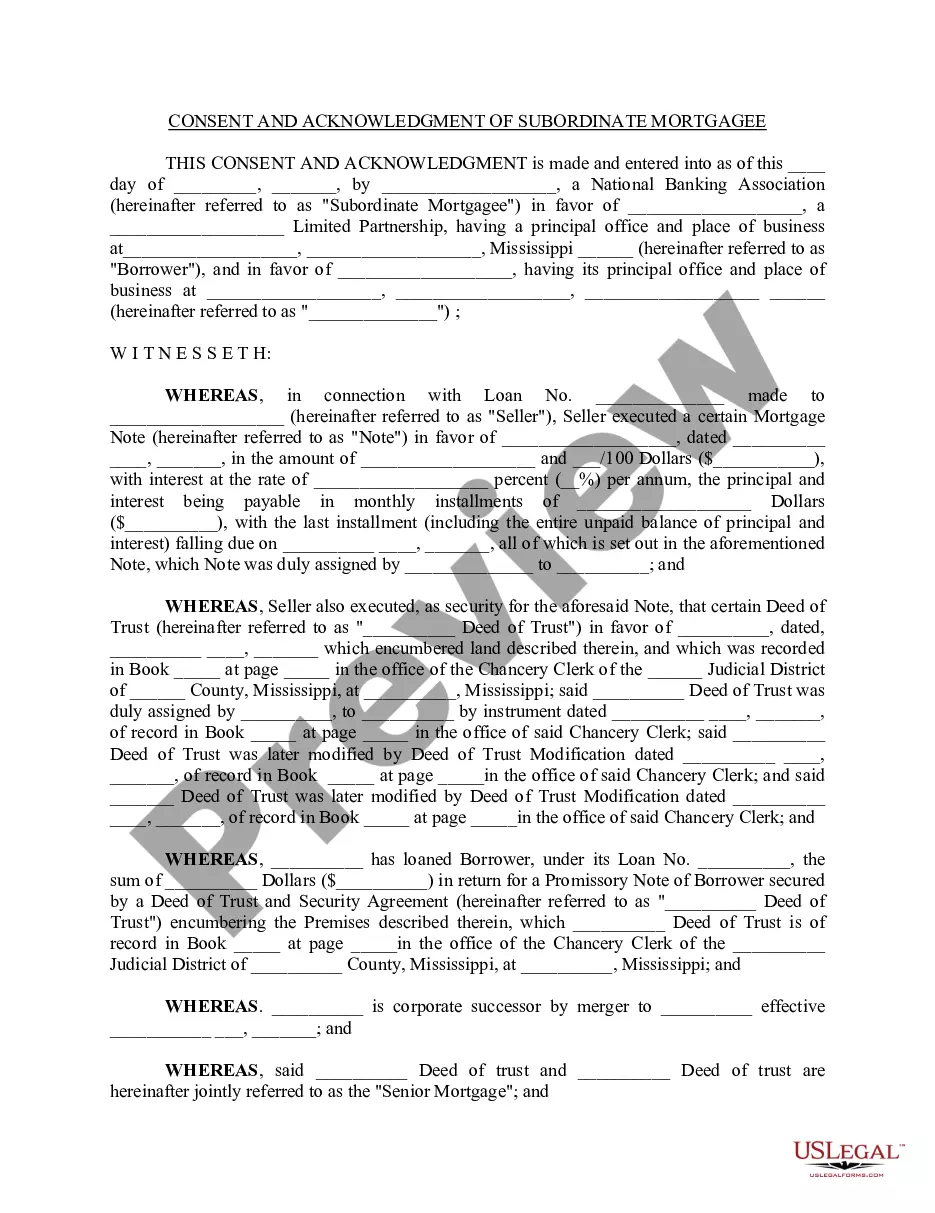

Who must sign the promissory note? A loan agreement is signed by both parties but only the borrowing party needs to sign a promissory note. A witness need not sign but the note can be notarized as evidence that the borrower did sign the document.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

The buyer of the note becomes what is called a holder because they hold your note as the owner of it. A holder has a special right to collect from you right away if you don't pay. But only the holder of an original promissory note can collect from you. A promissory note can change many hands as it is bought and sold.

A promissory note, in simplest terms, is the acknowledgment of a debt.Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents. A lender is required under the Federal Servicer Act to provide you copies of your loan documents if you submit a written request.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.