Louisiana Promissory Note - Unsecured - No Interest

Description Promissory No Interest

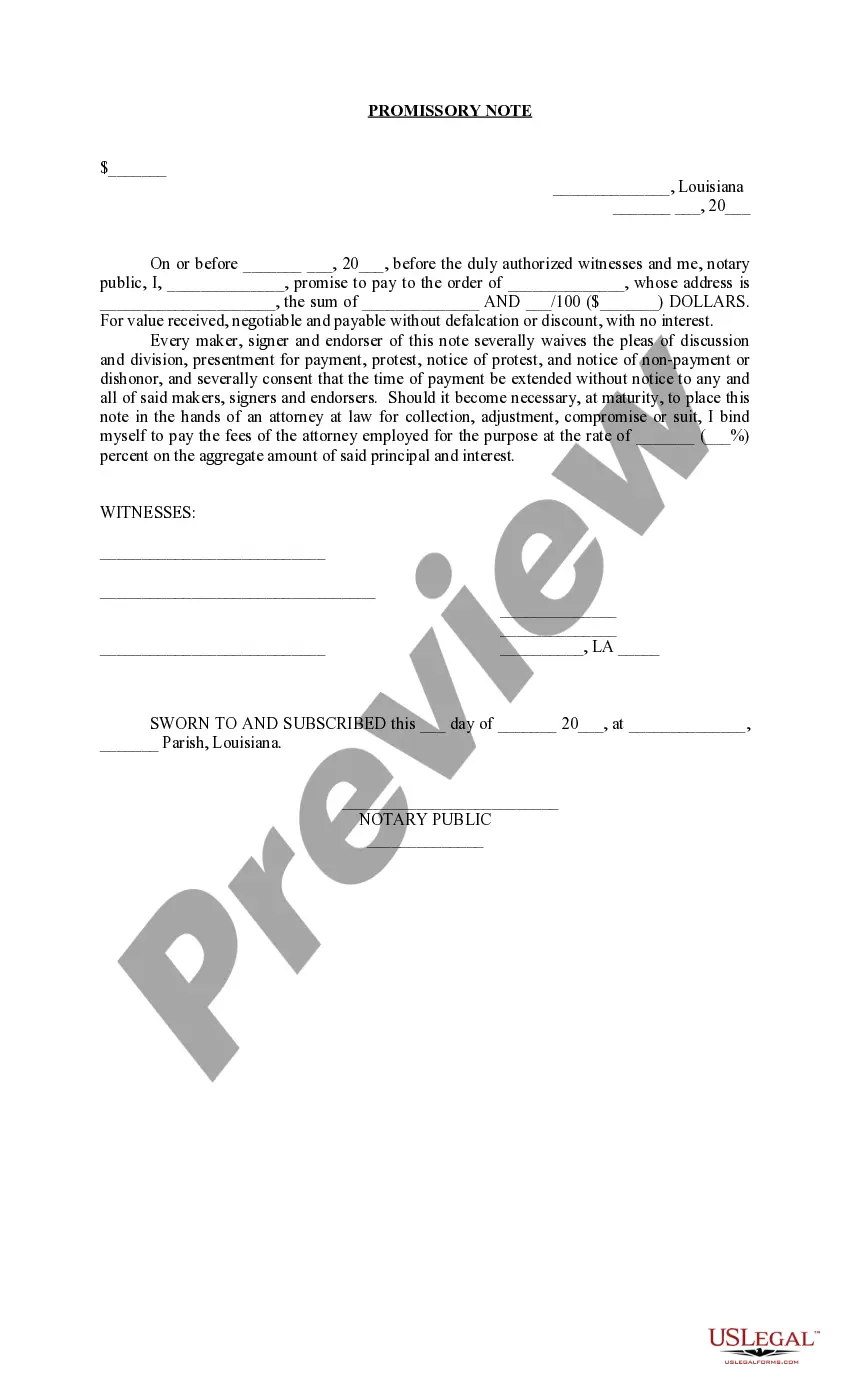

How to fill out Louisiana Promissory La?

In search of Louisiana Promissory Note - Unsecured - No Interest sample and completing them can be a challenge. To save time, costs and effort, use US Legal Forms and find the right template specifically for your state in just a couple of clicks. Our legal professionals draw up each and every document, so you just have to fill them out. It really is so simple.

Log in to your account and come back to the form's web page and save the document. Your downloaded examples are kept in My Forms and they are accessible at all times for further use later. If you haven’t subscribed yet, you need to sign up.

Take a look at our detailed guidelines regarding how to get your Louisiana Promissory Note - Unsecured - No Interest template in a couple of minutes:

- To get an qualified sample, check its validity for your state.

- Look at the sample making use of the Preview function (if it’s accessible).

- If there's a description, read it to learn the details.

- Click Buy Now if you found what you're searching for.

- Choose your plan on the pricing page and make your account.

- Pick how you would like to pay by a card or by PayPal.

- Download the file in the favored format.

You can print out the Louisiana Promissory Note - Unsecured - No Interest form or fill it out using any online editor. Don’t concern yourself with making typos because your sample can be utilized and sent, and printed out as often as you want. Try out US Legal Forms and access to over 85,000 state-specific legal and tax files.

Promissory Note Form Form popularity

Promissory Note Louisiana Other Form Names

Louisiana Promissory FAQ

In general, under the Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.The US Supreme Court in Reves recognizes that most notes are, in fact, not securities.

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

Use our promissory note if you prefer a standard basic contract. Do I have to charge the Borrower interest? No, the Lender can choose whether or not to charge interest. If the Lender decides to charge interest, they can pick how much interest to charge.

Although this case relates to state securities law claims, in applying the Reves test and holding that the Notes are not securities, the court has ruled squarely in favor of the long-held view in the loan industry that loans are not securities.

A promissory note is a written promise, basically an IOU, to pay money to someone. The note document serves as written evidence of the amount of the debt. To start, decide how much money you'll lend, the amount of interest you'll charge, if any, and the type of repayment schedule.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Lenders, whether banks or individual sellers, typically require the persons who are borrowing money in order to finance the purchase of real estate to sign a "note" and a "security instrument." A note is a written, unconditional promise to pay a certain sum of money at a certain time or within a certain period of time.

A note is a debt security obligating repayment of a loan, at a predetermined interest rate, within a defined time frame.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.