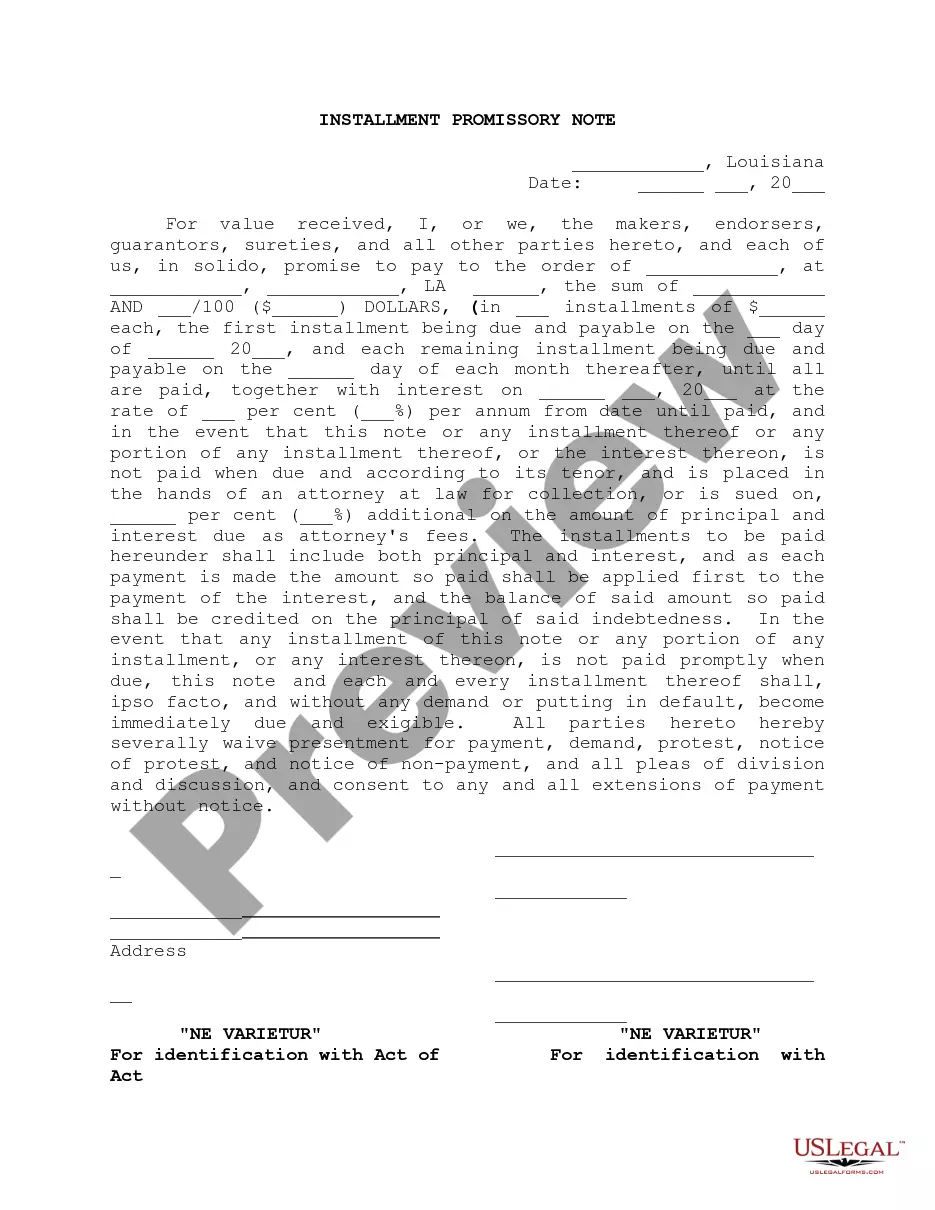

Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination

Description Promissory Note Vs Mortgage

How to fill out Installment Note Example?

In search of Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination templates and filling out them could be a challenge. To save lots of time, costs and energy, use US Legal Forms and find the correct template specifically for your state within a few clicks. Our lawyers draft each and every document, so you simply need to fill them out. It truly is so simple.

Log in to your account and come back to the form's page and save the document. Your saved templates are stored in My Forms and are available always for further use later. If you haven’t subscribed yet, you have to register.

Have a look at our detailed guidelines concerning how to get the Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination form in a couple of minutes:

- To get an eligible sample, check its applicability for your state.

- Look at the form using the Preview option (if it’s offered).

- If there's a description, go through it to know the specifics.

- Click on Buy Now button if you found what you're searching for.

- Pick your plan on the pricing page and create your account.

- Choose you would like to pay by a card or by PayPal.

- Save the file in the favored format.

You can print out the Louisiana Installment Promissory Note Ne Varietur, for Identification with Act of Collateral Mortgage and with Act of Subordination template or fill it out utilizing any online editor. No need to worry about making typos because your sample may be utilized and sent, and printed out as many times as you wish. Try out US Legal Forms and access to more than 85,000 state-specific legal and tax documents.

Mortgage Promissory Note Example Form popularity

Installment Note Other Form Names

Promissory Note With Collateral FAQ

Personal real estate. Home equity. Personal vehicles. Paychecks. Cash or savings accounts. Investment accounts. Paper investments. Fine art, jewelry or collectibles.

Property or assets that are committed by an individual in order to guarantee a loan. Upon default, the collateral becomes subject to seizure by the lender and may be sold to satisfy the debt. EXAMPLE. In securing a mortgage, the borrower may offer the house as collateral.

Collateral is an asset pledged to a lender until a loan is repaid. If the loan isn't repaid, the lender may seize the collateral and sell it to pay off the loan. Obvious forms of collateral include houses, cars, stocks, bonds and cash -- all things that are readily convertible into cash to repay the loan.

These include checking accounts, savings accounts, mortgages, debit cards, credit cards, and personal loans., he may use his car or the title of a piece of property as collateral. If he fails to repay the loan, the collateral may be seized by the bank, based on the two parties' agreement.

The term collateral refers to an asset that a lender accepts as security for a loan.The collateral acts as a form of protection for the lender. That is, if the borrower defaults on their loan payments, the lender can seize the collateral and sell it to recoup some or all of its losses.

These include checking accounts, savings accounts, mortgages, debit cards, credit cards, and personal loans., he may use his car or the title of a piece of property as collateral. If he fails to repay the loan, the collateral may be seized by the bank, based on the two parties' agreement.

The term collateral refers to an asset that a lender accepts as security for a loan.The collateral acts as a form of protection for the lender. That is, if the borrower defaults on their loan payments, the lender can seize the collateral and sell it to recoup some or all of its losses.

Personal loans are typically unsecured, meaning they don't require collateral, but lenders require some personal loans to be backed by something that holds monetary value. Collateral on a secured personal loan can include things like cash in a savings account, a car or even a home.

The term collateral refers to an asset that a lender accepts as security for a loan. Collateral may take the form of real estate or other kinds of assets, depending on the purpose of the loan. The collateral acts as a form of protection for the lender.