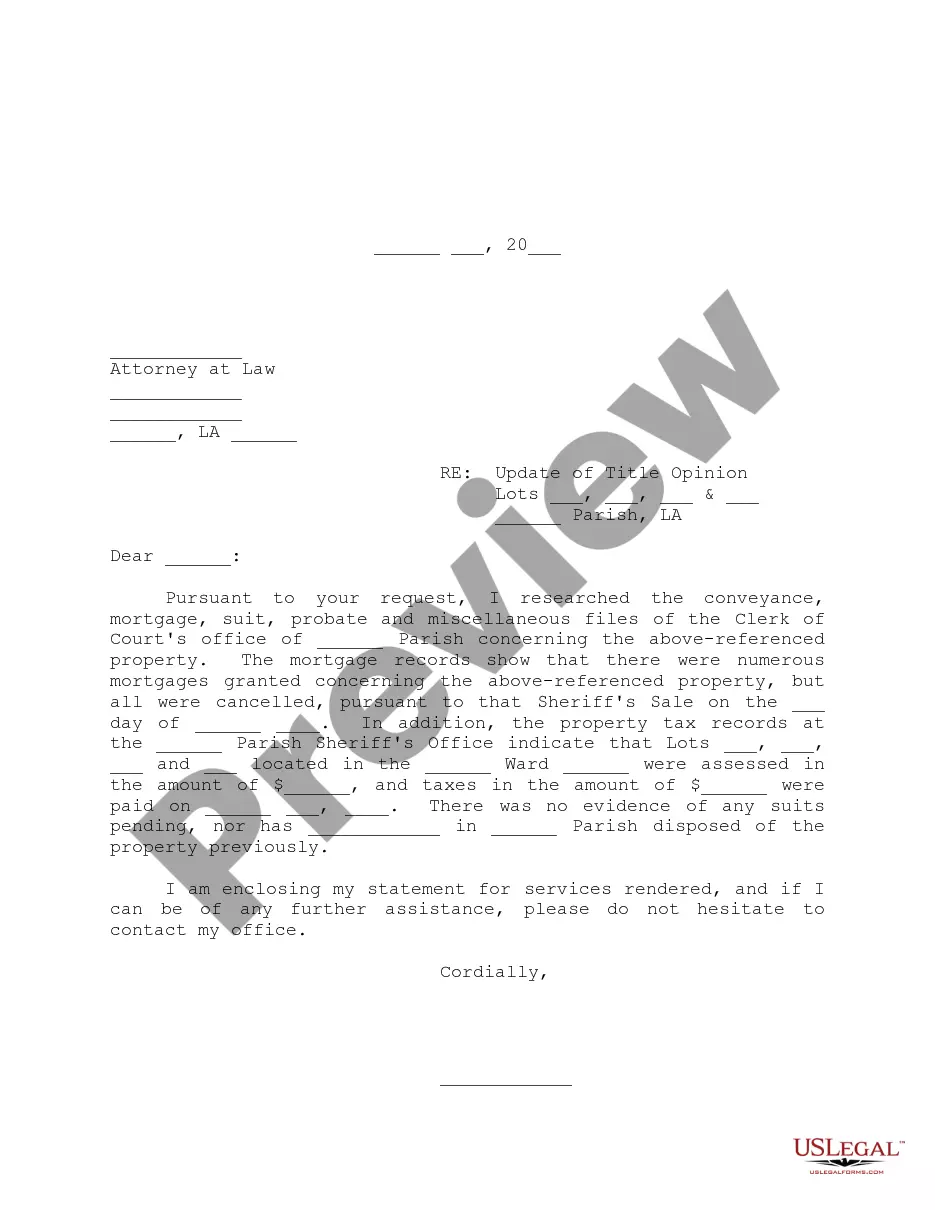

Louisiana Update of Title Opinion

Description Letter Of Opinion Real Estate

How to fill out What Is A Title Opinion Letter?

In search of Louisiana Update of Title Opinion sample and completing them can be a challenge. To save lots of time, costs and energy, use US Legal Forms and find the correct sample specially for your state in just a couple of clicks. Our attorneys draft every document, so you simply need to fill them out. It really is that simple.

Log in to your account and come back to the form's web page and download the document. All of your saved examples are stored in My Forms and are accessible always for further use later. If you haven’t subscribed yet, you should sign up.

Check out our comprehensive instructions on how to get your Louisiana Update of Title Opinion sample in a few minutes:

- To get an qualified sample, check its applicability for your state.

- Look at the form utilizing the Preview option (if it’s accessible).

- If there's a description, read through it to learn the specifics.

- Click Buy Now if you identified what you're seeking.

- Choose your plan on the pricing page and make an account.

- Select you want to pay by a credit card or by PayPal.

- Save the sample in the preferred file format.

Now you can print out the Louisiana Update of Title Opinion template or fill it out utilizing any online editor. No need to concern yourself with making typos because your template may be utilized and sent away, and published as often as you wish. Check out US Legal Forms and access to over 85,000 state-specific legal and tax documents.

Title Opinion Example Form popularity

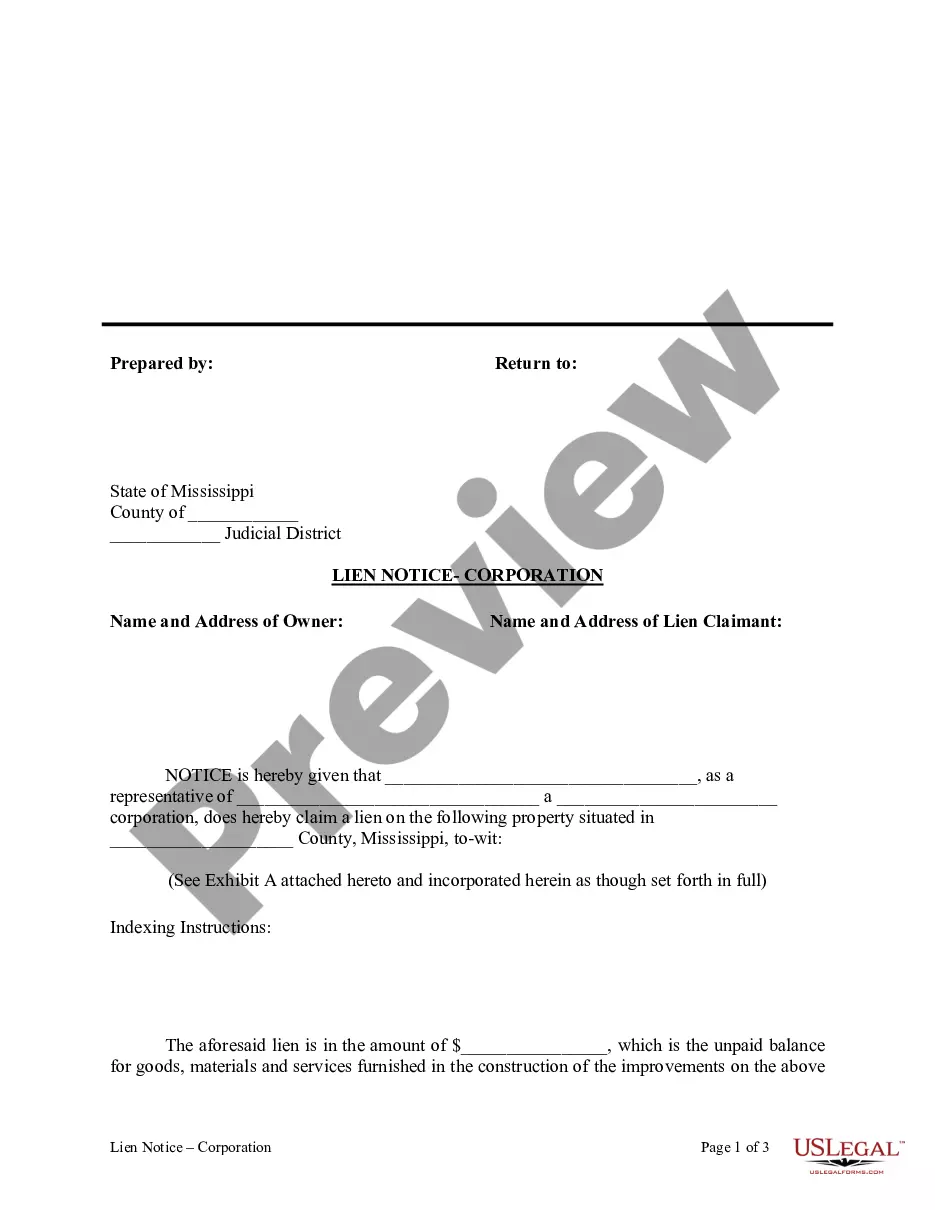

Final Title Opinion Other Form Names

Marketable Title Opinion Letter FAQ

As with many other types of insurance, an owner's title insurance policy can feel like a waste of money if you never need to use it. But it's a small price to pay to protect your interests in case anyone challenges your title after you close on your home.

A search report is usually prepared by an advocate, who after visiting the registrar's office and inspecting the property documents, issues a title certificate. A title certificate states whether the property is unencumbered and has a clear marketable title.

Title Insurance and Title Policy are the same; it is the same contract, same protection, and coverage. However, the term insurance and policy are different by definition but are often time used and are commonly interchanged.

A title opinion is the written opinion of an attorney, based on the attorney's title search into a property, describing the current ownership rights in the property, as well as the actions that must be taken to make the stated ownership rights marketable.

Title Insurance: The new alternative However, it is important to note that, unlike a title opinion, which attempts to assure good title and/or security, title insurance is meant to insure against the risks specified in the subject policy. In other words, title insurance only insures covered risks.

Two basic types of title insurance policies are available to owners of real property in California: (1) a standard coverage policy and (2) an extended coverage policy. A standard policy insures primarily against defects in title which are discoverable through an examination of the public record.

The opinion of title is the legal opinion which attests to the validity of the title deed to a parcel of property. The opinion is sometimes issued in conjunction with an insuring title agency.

To put it simply, title insurance is a way to protect yourself from financial loss and related legal expenses in the event there is a defect in title to your property that is covered by the policy.Title insurance also differs in that it comes with no monthly payment. It's just a one-time premium paid at closing.