Louisiana Pretrial Memorandum requesting reimbursement of real estate upkeep costs for redeemed property

Overview of this form

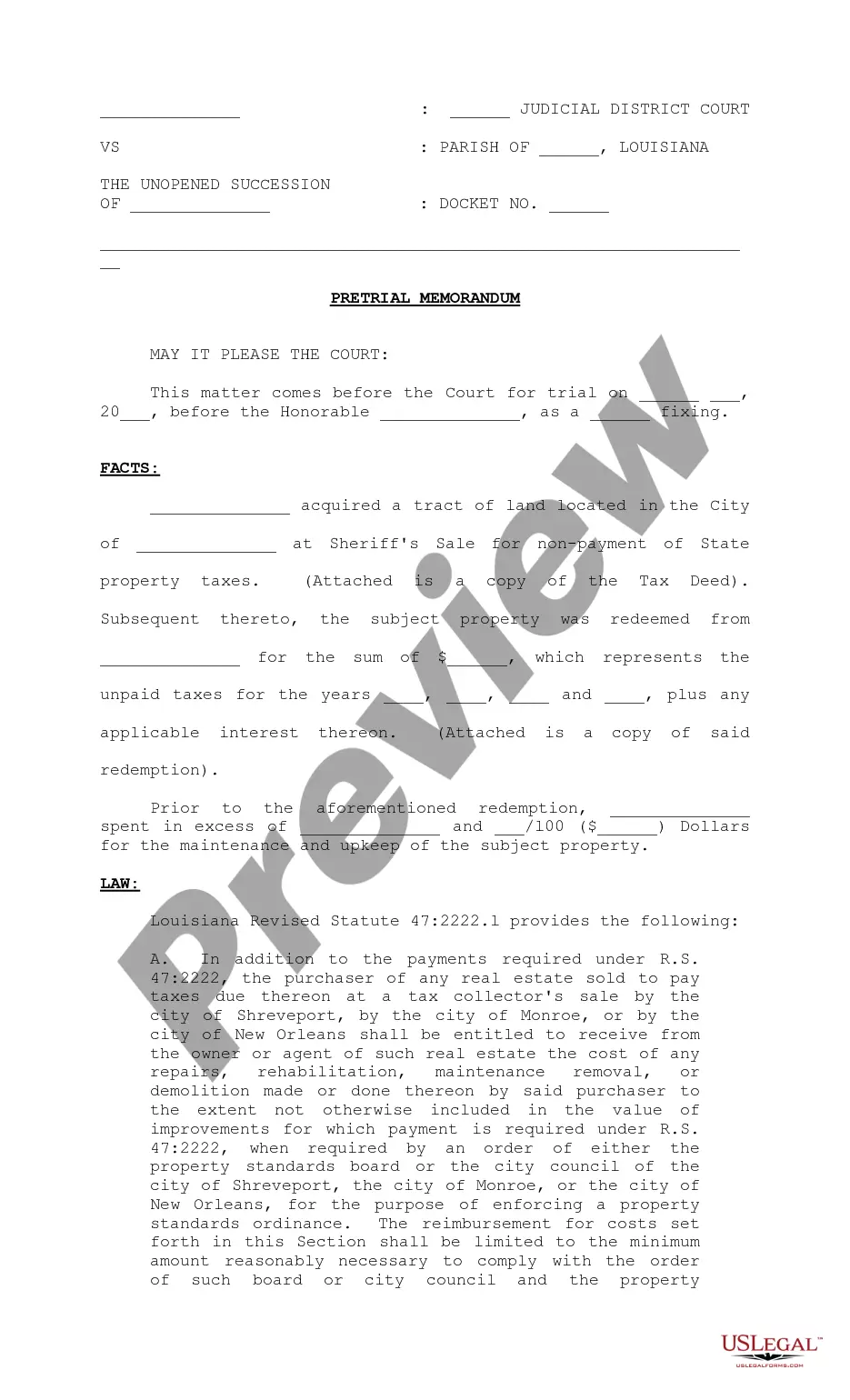

The pretrial memorandum requesting reimbursement of real estate upkeep costs for redeemed property is a legal document used in Louisiana to outline a plaintiff's case for recovering maintenance costs incurred on a property that was redeemed after the defendant purchased it at a Sheriff's Sale. This form clarifies the reimbursement rights under Louisiana Revised Statute 47:2222, setting it apart from other real estate forms by specifically addressing costs related to property upkeep and maintenance during the period before its redemption.

Form components explained

- Case details including the docket number and court information

- Facts surrounding the property acquisition and redemption, including financial details

- Citation of relevant state law pertaining to reimbursement of upkeep costs

- Evidence of expenses incurred for maintenance, including required receipts

- Conclusion stating the amount sought for reimbursement

- Certification of service to the defendant's attorney

When this form is needed

This form is necessary when a plaintiff seeks to recover maintenance costs incurred on a property that has been redeemed after a tax sale. It is relevant in cases where the owner of the property had previously failed to pay property taxes, resulting in a sale, which the owner later redeemed. The plaintiff must demonstrate that they have incurred expenses for the property's upkeep during this interim period and are entitled to reimbursement under state law.

Who can use this document

This form is intended for:

- Property owners who have redeemed their property after a tax sale

- Individuals or entities who maintained the property during the redemption period

- Attorneys representing plaintiffs in real estate disputes in Louisiana

How to prepare this document

- Begin by filling in the docket number and court information at the top of the form.

- Provide factual details regarding the acquisition and subsequent redemption of the property, including financial figures.

- Cite the relevant Louisiana statutes that pertain to your reimbursement claim.

- Attach necessary receipts that validate the expenses incurred for maintenance.

- Conclude with a clear statement of the amount being claimed for reimbursement.

- Ensure that a copy of the memorandum is served to the defendant's attorney.

Is notarization required?

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to attach receipts or documentation proving maintenance expenses.

- Neglecting to provide complete property and case information.

- Incomplete citation of the applicable Louisiana statutes.

- Not serving the memorandum correctly to the defendant's attorney.

Benefits of completing this form online

- Convenience of downloading and completing the form at your own pace.

- Access to attorney-drafted templates ensuring legal compliance.

- Editable format allows for easy updates and modifications as needed.

Looking for another form?

Form popularity

FAQ

Five U.S. states (New Hampshire, Oregon, Montana, Alaska and Delaware) do not impose any general, statewide sales tax on goods or services. Of the 45 states remaining, four (Hawaii, South Dakota, New Mexico and West Virginia) tax services by default, with exceptions only for services specifically exempted in the law.

In the case of service transactions, only the particular transactions enumerated in the law are taxable. What is the sales tax rate in Louisiana? Sales and use taxes levied by political subdivisions of the state are in addition to the sales and use taxes levied by the state.

In Louisiana, failing to pay your property taxes will lead to a tax sale.But you'll eventually lose ownership of the property permanently if you don't pay off the debt during what's called a redemption period after the sale.

Louisiana is classified as a Redemption Deed State. The municipal or parish tax collector oversees the sale which is an oral public auction. Tax deeds are sold with a 3 year right of redemption. Investors receive a rate of return of 1% per month, or 12% annually.

The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

A tax sale gives the original property owner three years to redeem their property. To redeem the property, the owner has to pay the purchaser of the tax title the price paid at the tax sale; all taxes paid on the property since the tax sale; a 5% penalty; and 1% interest per month.

Louisiana is classified as a Redemption Deed State. The municipal or parish tax collector oversees the sale which is an oral public auction. Tax deeds are sold with a 3 year right of redemption.The state also mandates a flat penalty rate of 5% due to the deed holder upon property redemption.

Labor Only for Repairs Charges for repairs of tangible personal property needing only labor or service are not subject to sales tax or surtax. The dealer must keep documentation to prove no tangible personal property was joined with, or attached to, the repaired item.

Louisiana sales tax details The Louisiana (LA) state sales tax rate is currently 4.45%. Depending on local municipalities, the total tax rate can be as high as 11.45%.