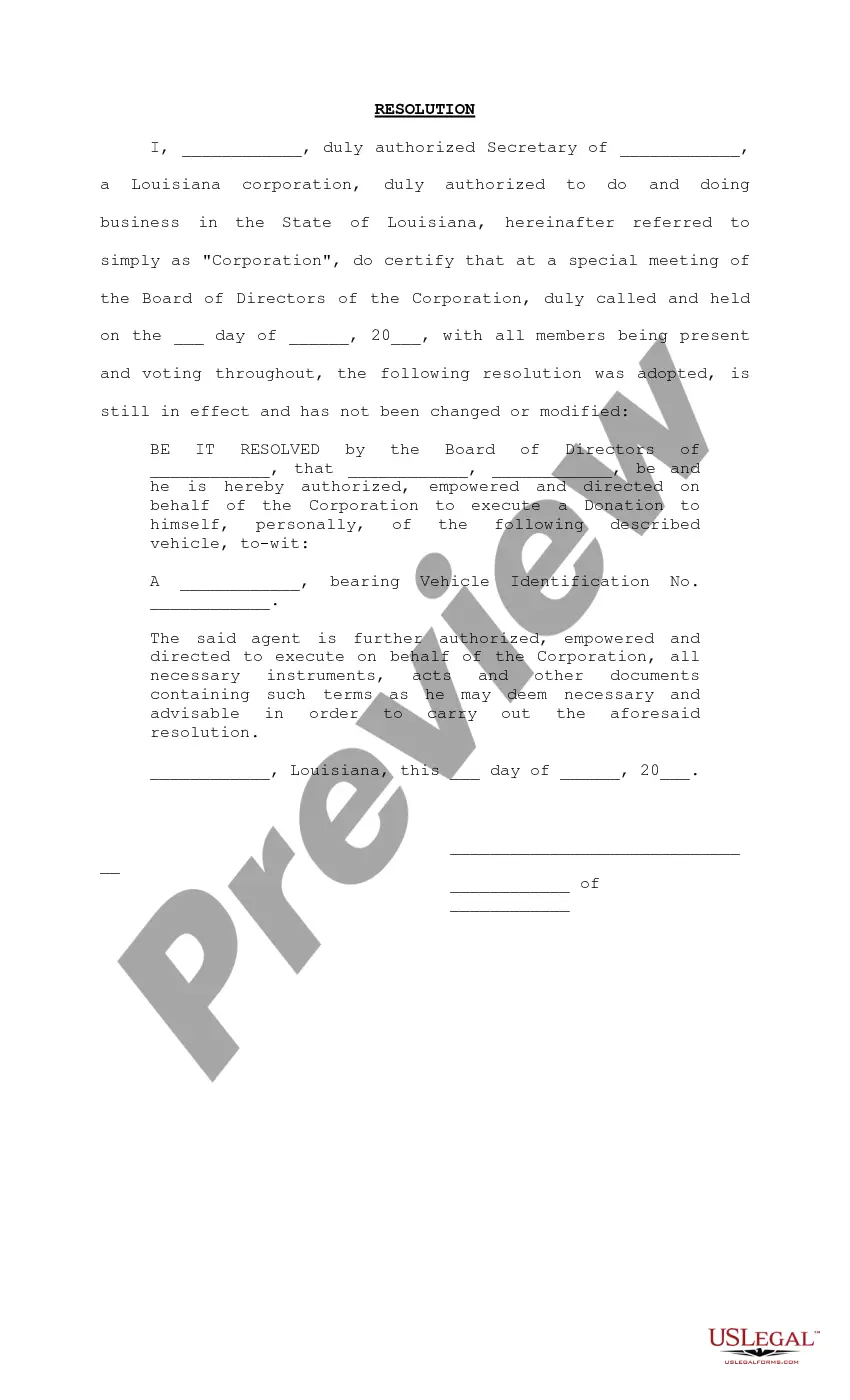

Louisiana Resolution Authorizing Donation of Vehicle to Corporate Officer

Description

How to fill out Louisiana Resolution Authorizing Donation Of Vehicle To Corporate Officer?

Searching for Louisiana Resolution Permitting Contribution of Vehicle to Corporate Officer template may be challenging.

To conserve significant time, expenses, and effort, utilize US Legal Forms and locate the appropriate template specifically for your state in just a few clicks.

Our attorneys prepare each document, so you only need to complete them. It is truly that easy.

Choose your package on the pricing page and create your account. Select whether you want to pay by credit card or PayPal. Save the form in your preferred file format. Now you can print the Louisiana Resolution Permitting Contribution of Vehicle to Corporate Officer template or complete it using any online editor. Don’t worry about making errors because your form can be utilized and submitted, and printed as many times as you desire. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Sign in to your account and navigate back to the form's page to save the document.

- Your downloaded templates are kept in My documents and are always accessible for future use.

- If you are not a subscriber yet, you must register.

- Review our comprehensive instructions on how to obtain your Louisiana Resolution Permitting Contribution of Vehicle to Corporate Officer template in a few minutes.

- Ensure the form is suitable for your state.

- Examine the sample by using the Preview option (if available).

- If there’s a description, read it to learn the specifics.

- Click Purchase Now if you have found what you are looking for.

Form popularity

FAQ

2) Vehicle Donation ABC Title can assist you with gifting (donating) a vehicle to a friend or family member (Donee). A donation is an Authentic Act executed before a Notary in the presence of two witnesses transferring the ownership of a vehicle with no monetary exchange.

The good news? Gifting a vehicle means no sales tax. But the person receiving the gifted vehicle to may have to pay a federal gift tax. As of 2019, a gift tax payment is required if the fair market value of the vehicle is more than $15,000 for a single individual or $30,000 for a married couple.

Get a lien release (if necessary) Get the gifter's signature on the title notarized. Complete a Vehicle Application form. Complete and notarize an Act of Donation of a Movable form.

Transferring the Title In the field where it asks for the sales price, you may simply fill in gift. In Louisiana, you will also need to:Get the gifter's signature on the title notarized. Complete a Vehicle Application form. Complete and notarize an Act of Donation of a Movable form.

Acceptable identification. proof of ownership of the new vehicle. proof of valid insurance pink card

To officially release ownership of your car to the person you're gifting it to, you must transfer your title. You can do this by heading over to your local DMV, paying a fee, and filling out some paperwork. Check your state's laws to learn about title transfer laws and fees.

If your intent is to gift the car to this person, give them the money so they can pay the tab at the counter. The authorities will still accept cash for the transaction along with the title fee. No need for both of you to go to the county offices. The buyer can take care of the transaction in a normal manner this way.

If the charity sells your car sells for $500 or less, you can deduct $500 or your car's fair market value, whichever is less. For example, if your car is valued at $650 but sells for $350, you can deduct $500. Most charities will report the sales price of your car to you on Form 1098-C.

If the recipient of the car has a different last name than you, the state will require proof that you're related. As you're filling out the title, you should list your name as the seller and your relative's name as the buyer. You'll also need to state the odometer reading. You should list the price of the car as gift.