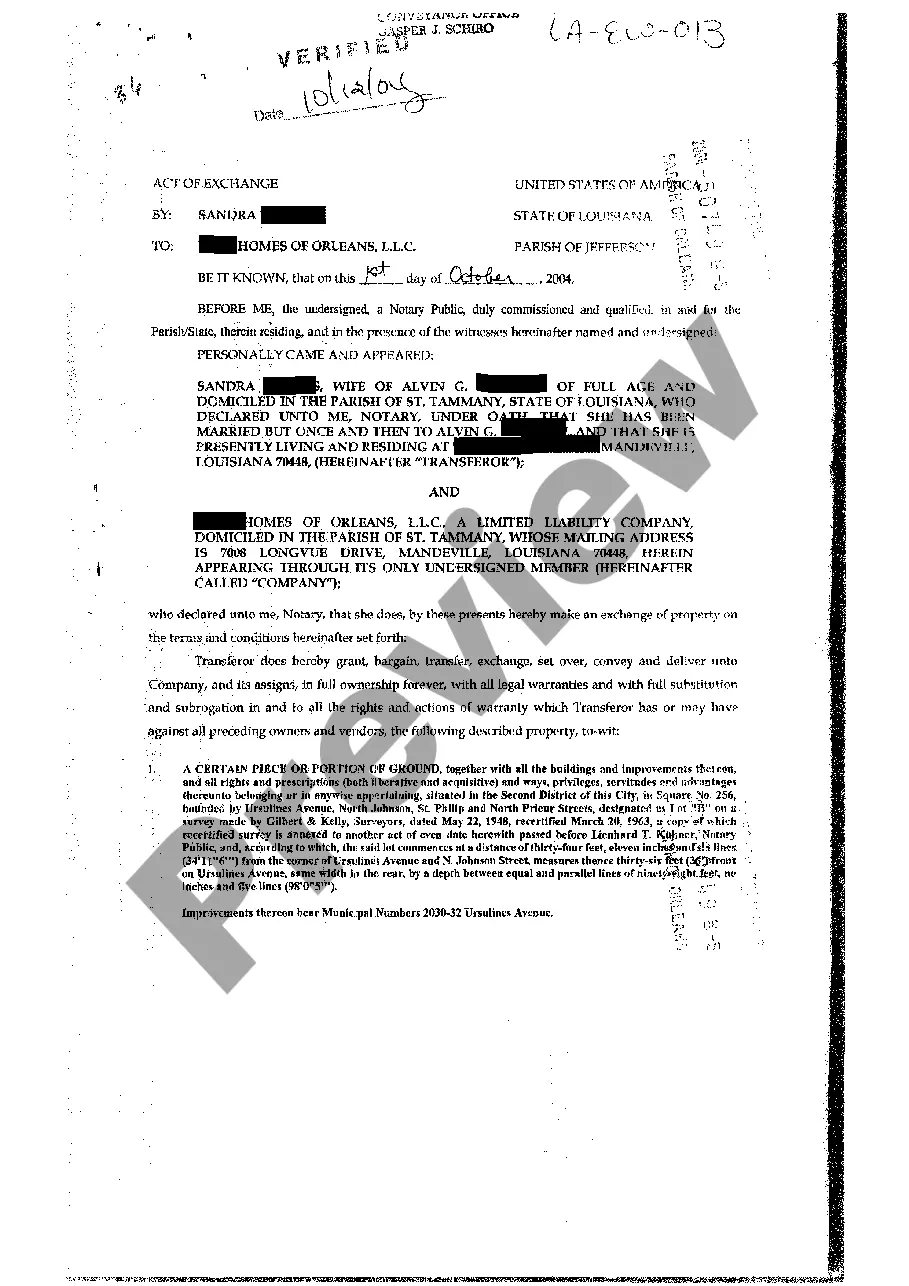

Louisiana Act of Exchange

Overview of this form

The Act of Exchange is a legal document used to facilitate the exchange of immovable property between parties, where both parties receive properties of equal value. This form differs from other property transfer documents as it specifically records an exchange without any additional consideration or payments beyond the value of the properties exchanged. Typically used by married couples and corporations in Louisiana, this document streamlines the exchange process by outlining the terms and conditions agreed upon by both parties.

Situations where this form applies

This form is useful when individuals or entities wish to exchange immovable properties without financial transactions beyond the properties' values. Common scenarios include homeowners swapping properties for various reasons, or couples looking to consolidate their real estate under mutual agreements. It is particularly pertinent in transactions involving parties in Louisiana, ensuring that all legal obligations and property descriptions are documented correctly.

Who should use this form

This form is intended for:

- Married couples who wish to exchange real estate.

- Corporations involved in property exchanges with individuals or other corporations.

- Individuals looking for a straightforward method to swap properties valued equally without monetary exchange.

- Real estate professionals and attorneys requiring a template for property exchanges.

Completing this form step by step

- Identify and enter the names and tax identification numbers of both parties involved in the exchange.

- Provide the description and address of each property being exchanged.

- Specify the value of the properties being exchanged to ensure they are equal.

- Include the date of execution and the parish where the document will be notarized.

- Collect signatures from both parties in the presence of a notary public and witnesses.

Notarization requirements for this form

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes

- Failing to ensure both properties are valued equally.

- Omitting tax identification numbers which are essential for legal documentation.

- Not having the form notarized, which could render it invalid.

- Leaving sections incomplete, particularly property descriptions and addresses.

- Neglecting to collect necessary signatures from witnesses.

Why complete this form online

- Convenience of downloading and filling out the form at any time.

- Editable templates allow for easy adjustments to meet specific needs.

- Access to reliable legal forms crafted by licensed attorneys.

- Instant availability, which can speed up the property exchange process.

Form popularity

FAQ

The actalso known as the "Truth in Securities" law, the 1933 Act, and the Federal Securities Actrequires that investors receive financial information from securities being offered for public sale. This means that prior to going public, companies have to submit information that is readily available to investors.

SEC Form N-1A is the required registration form for establishing open-end management companies. The form can be used for registering both open-end mutual funds and open-end exchange traded funds (ETFs).

SEC Form S-1 is the initial registration form for new securities required by the SEC for public companies that are based in the U.S. Any security that meets the criteria must have an S-1 filing before shares can be listed on a national exchange, such as the New York Stock Exchange.

The Securities and Exchange Commission (SEC) requires public companies, certain company insiders, and broker-dealers to file periodic financial statements and other disclosures. Finance professionals and investors rely on SEC filings to make informed decisions when evaluating whether to invest in a company.

What Is SEC Form N-2? SEC Form N-2 is a filing with the Securities and Exchange Commission (SEC) that must be submitted by closed-end management investment companies to register under the Investment Company Act of 1940 and to offer their shares under the Securities Act of 1933.

SEC Form S-3 is a regulatory filing that provides simplified reporting for issuers of registered securities. An S-3 filing is utilized when a company wishes to raise capital, usually as a secondary offering after an initial public offering has already occurred.

Among the most common SEC filings are: Form 10-K, Form 10-Q, Form 8-K, the proxy statement, Forms 3,4, and 5, Schedule 13, Form 114, and Foreign Investment Disclosures.

SEC Form 3: Initial Statement of Beneficial Ownership of Securities is a document filed by a company insider or major shareholder with the Securities and Exchange Commission (SEC).Filing Form 3 helps disclose who these insiders are and track any suspicious behaviors.

This SEC Form 17-A shall be used for annual reports filed pursuant to Section 17 of the Securities Regulation Code (SRC) and paragraph (1)(A) of SRC Rule 17.1 thereunder.Reports filed on this Form shall be deemed to satisfy Section 141 of the Corporation Code of the Philippines.