Louisiana Sale and Mortgage

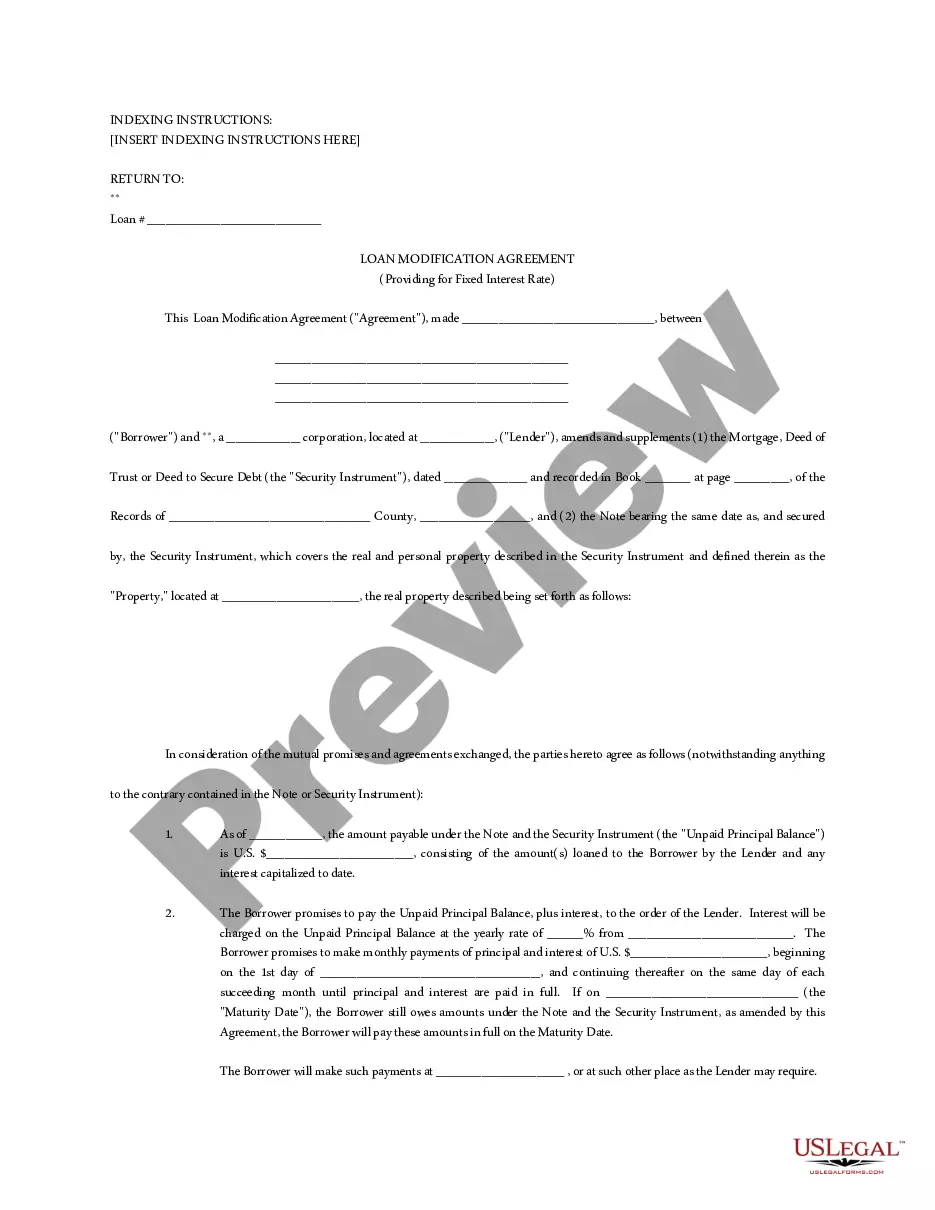

Description

How to fill out Louisiana Sale And Mortgage?

You are welcome to the most significant legal documents library, US Legal Forms. Right here you will find any example such as Louisiana Sale and Mortgage forms and download them (as many of them as you wish/need). Make official documents within a few hours, instead of days or even weeks, without spending an arm and a leg with an attorney. Get the state-specific example in a couple of clicks and feel confident understanding that it was drafted by our state-certified legal professionals.

If you’re already a subscribed customer, just log in to your account and click Download next to the Louisiana Sale and Mortgage you want. Because US Legal Forms is online solution, you’ll always have access to your saved forms, regardless of the device you’re using. See them within the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check our instructions below to start:

- If this is a state-specific sample, check its applicability in the state where you live.

- View the description (if available) to learn if it’s the right example.

- See much more content with the Preview option.

- If the example fulfills all your requirements, just click Buy Now.

- To create your account, choose a pricing plan.

- Use a credit card or PayPal account to sign up.

- Download the template in the format you require (Word or PDF).

- Print the file and fill it with your/your business’s information.

As soon as you’ve completed the Louisiana Sale and Mortgage, send it to your legal professional for verification. It’s an additional step but an essential one for being certain you’re totally covered. Become a member of US Legal Forms now and get access to a mass amount of reusable samples.

Form popularity

FAQ

Title fees (or attorney fees) Pre-paids and escrow (property taxes and homeowner's insurance) Mortgage insurance. Loan-related fees (lender fees) Property-related fees (may also be found in lender fees)

At the top of the page, you should center the title between the left- and right-hand margins. Title your document something like Purchase and Sale Agreement or Agreement to Purchase Real Estate. Identify the parties to the sale. You need to identify the purchaser and the seller at the start of your agreement.

The real estate commission is usually the biggest fee a seller pays 5 percent to 6 percent of the sale price. If you sell your house for $250,000, say, you could end up paying $15,000 in commissions. The commission is split between the seller's real estate agent and the buyer's agent.

Scope Out the Competition (Be A Nosey Neighbor) Give Louisiana Buyers What They Want. Analyze Louisiana's Real Estate Market Data for a Correct Listing Price. Make Sure Your Real Estate Photographs Don't Suck.

Closing costs: ~1-3% While the buyers will typically be responsible for the lion's share, sellers should expect to pay between 1-3% of the home's final sale price at closing. Based on the average home value in Louisiana of $178,000, that roughly translates to $2,000 to $5,000.

A real estate deal can take a turn for the worst if the contract is not carefully written to include all the legal stipulations for both the buyer and seller.You can write your own real estate purchase agreement without paying any money as long as you include certain specifics about your home.

A seller can often expect to pay some significant closing costs, including real estate agent commissions, transfer taxes and recording fees.But then come all of the closing costs you're responsible for. Unlike buyers, sellers are usually on the hook for real estate agent commissions and title insurance.

According to lines 235 to 237 of the Louisiana Residential Agreement to Buy or Sell, SELLER's title shall be merchantable and free of all liens and encumbrances except those that can be satisfied at Act of Sale. All costs and fees required to make title merchantable shall be paid by SELLER.

Your Buyer pays for your house. The Buyer wires funds for down payment and closing costs to the Escrow Company. Then, if the Buyer is taking out a mortgage, the Buyer's Lender wires loan funds to the Title Company. If you sell your home to a cash buyer, the Buyer wires all the funds to the Escrow Company.