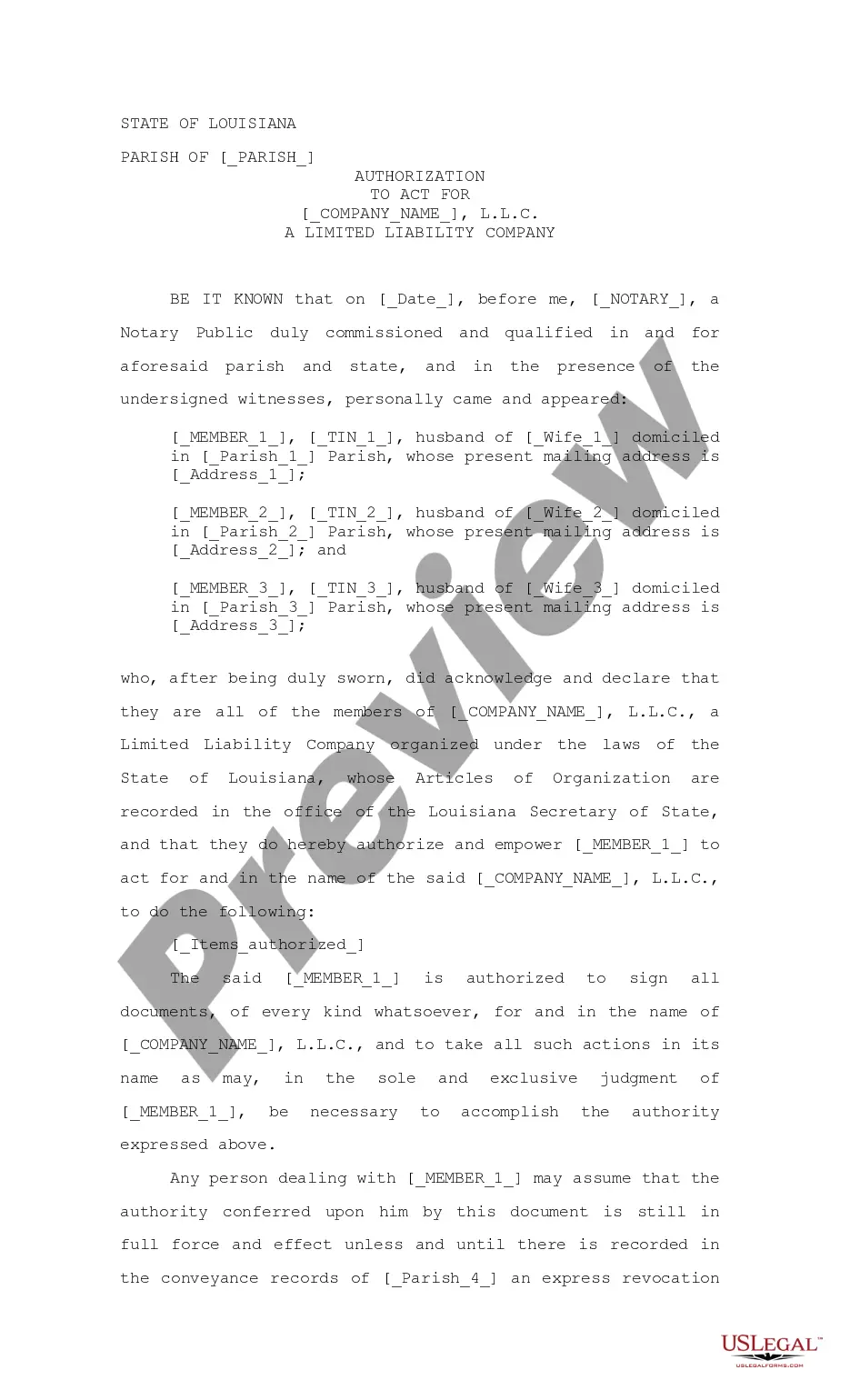

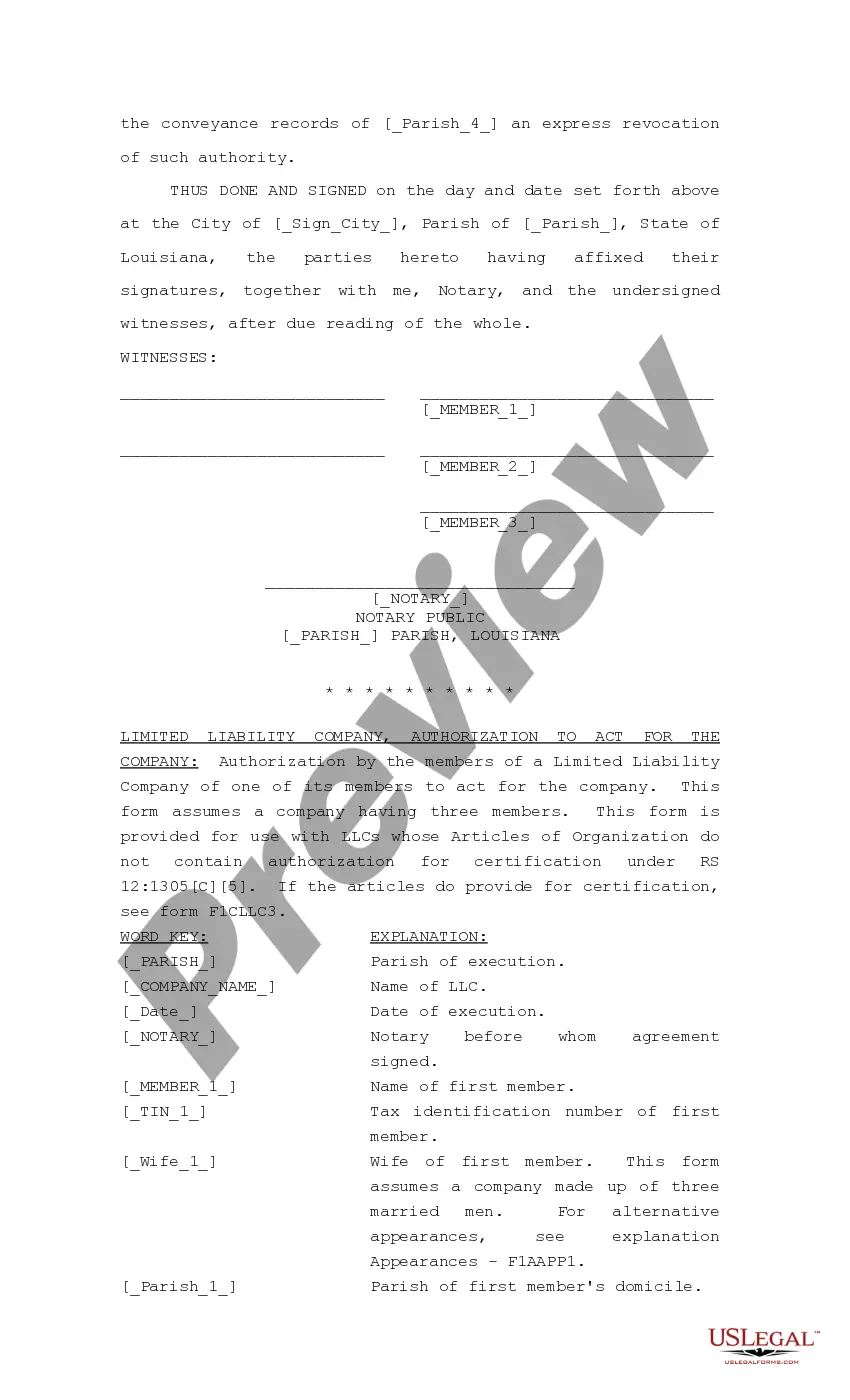

Louisiana Authorization to Act for a Limited Liability Company LLC

Description Sample Articles Of Organization Llc Louisiana

How to fill out How To Start An Llc In Louisiana?

Welcome to the biggest legal documents library, US Legal Forms. Here you will find any example including Louisiana Authorization to Act for a Limited Liability Company LLC forms and download them (as many of them as you wish/need to have). Prepare official papers with a couple of hours, rather than days or weeks, without having to spend an arm and a leg with an lawyer. Get the state-specific form in clicks and be assured understanding that it was drafted by our state-certified attorneys.

If you’re already a subscribed user, just log in to your account and click Download near the Louisiana Authorization to Act for a Limited Liability Company LLC you want. Due to the fact US Legal Forms is online solution, you’ll always get access to your downloaded templates, no matter what device you’re using. Locate them inside the My Forms tab.

If you don't come with an account yet, just what are you waiting for? Check out our guidelines listed below to get started:

- If this is a state-specific sample, check its applicability in the state where you live.

- See the description (if accessible) to learn if it’s the right example.

- See much more content with the Preview option.

- If the sample fulfills your needs, click Buy Now.

- To make your account, select a pricing plan.

- Use a card or PayPal account to sign up.

- Save the file in the format you require (Word or PDF).

- Print out the document and complete it with your/your business’s info.

As soon as you’ve completed the Louisiana Authorization to Act for a Limited Liability Company LLC, send out it to your legal professional for confirmation. It’s an additional step but an essential one for making confident you’re entirely covered. Join US Legal Forms now and access a mass amount of reusable samples.

Louisiana Limited Liability Corporation Form popularity

Louisiana Limited Liability Company Law Other Form Names

Llc In Louisiana FAQ

As for the legality of ownership, an LLC is allowed to be an owner of another LLC. LLC owners are known as members. LLC laws don't place many restrictions on who can be an LLC member. LLC members can therefore be individuals or business entities such as corporations or other LLCs.

Instead of shareholders or partners, a Limited Liability Company has its own term for owners, calling them members. The business structure of an LLC is known for its flexibility, and the role of LLC members is flexible as well.

In the absence of an Operating Agreement, state law provides the rules under which the business is conducted.In the typical LLC, managers are also members, having both the ownership interest and the business authority. However, members can employ managers who have no ownership interests.

Unlike a corporation, an LLC is not considered separate from its owners for tax purposes. Instead, it is what the IRS calls a "pass-through entity," like a partnership or sole proprietorship.While an LLC itself doesn't pay taxes, co-owned LLCs must file Form 1065, an informational return, with the IRS each year.

A Limited Liability Company (LLC) is an entity created by state statute.A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832 and elects to be treated as a corporation.

Can an LLC Own Another LLC? Yes. There are two ways in which an LLC may own another LLC: An LLC may own multiple, single-member LLCsthis is called a holding company structure; or.

The owners of a limited liability company (LLC) are called members. Each member is an owner of the company; there are no owner shares, as in a corporation. An LLC is formed in a state by filing Articles of Organization or similar document in some states.

The members are the owners of an LLC, like shareholders are the owners of a corporation. Members do not own the LLC's property. They may or may not manage the business and affairs. Initial members are admitted at the time of formation.

The main reason people form LLCs is to avoid personal liability for the debts of a business they own or are involved in. By forming an LLC, only the LLC is liable for the debts and liabilities incurred by the businessnot the owners or managers.